Download Acord 50 WM Template

The Acord 50 WM form plays a crucial role in the insurance industry, particularly for those involved in workers' compensation. This form serves as a comprehensive application for insurance coverage, detailing essential information about the business seeking protection. It captures vital data, including the nature of the business, its location, and the number of employees. By providing this information, businesses can help insurers assess risk and determine appropriate coverage options. Additionally, the Acord 50 WM form includes sections for listing previous insurance coverage and claims history, which can significantly influence underwriting decisions. Understanding the nuances of this form is essential for business owners looking to secure the right workers' compensation insurance, as it not only facilitates the application process but also ensures that all necessary information is disclosed to the insurer. Overall, the Acord 50 WM form is a fundamental document that streamlines the path to obtaining crucial coverage for employees and protects businesses from potential liabilities.

Key takeaways

The Acord 50 WM form is essential for insurance professionals. Here are key takeaways for filling it out and using it effectively:

- Ensure all fields are completed accurately to avoid processing delays.

- Use clear and concise language when providing descriptions and information.

- Double-check the contact information for all parties involved.

- Be aware of the specific requirements for the type of coverage being requested.

- Retain a copy of the completed form for your records and future reference.

Guide to Writing Acord 50 WM

Filling out the Acord 50 WM form is a straightforward process. It requires specific information about the insurance policy and the insured party. Following these steps will help ensure that the form is completed accurately and efficiently.

- Start by entering the policyholder's name in the designated field. Make sure to use the full legal name.

- Provide the address of the policyholder. Include the street address, city, state, and zip code.

- In the section for contact information, fill in the phone number and email address of the policyholder.

- Next, enter the policy number. This should be the unique identifier for the insurance policy.

- Fill out the effective date of the policy. This is the date when the coverage begins.

- Indicate the expiration date of the policy, marking when the coverage will end.

- In the section for coverage details, specify the type of coverage being requested.

- Lastly, review all the entered information for accuracy before signing the form. Ensure that all fields are completed as required.

Once the form is filled out, it will need to be submitted to the appropriate insurance company or agency for processing. Be sure to keep a copy for your records.

Browse Other PDFs

Correction Deed California - The scrivener's declaration is subject to penalties for false statements made under oath.

The Texas Motor Vehicle Bill of Sale form is instrumental in facilitating the sale of a vehicle, offering clarity and protection for both parties involved. This document not only serves as proof of the transaction but is also vital for the legal transfer of ownership, ensuring that all necessary details are meticulously recorded. For further assistance in preparing this important paperwork, you may consider visiting smarttemplates.net.

Qdro Definition - The model language provided is intended to aid parties in specifying their individual needs and circumstances.

Download D1 Form Pdf - The form includes provisions for organ donation registration if desired.

Form Preview Example

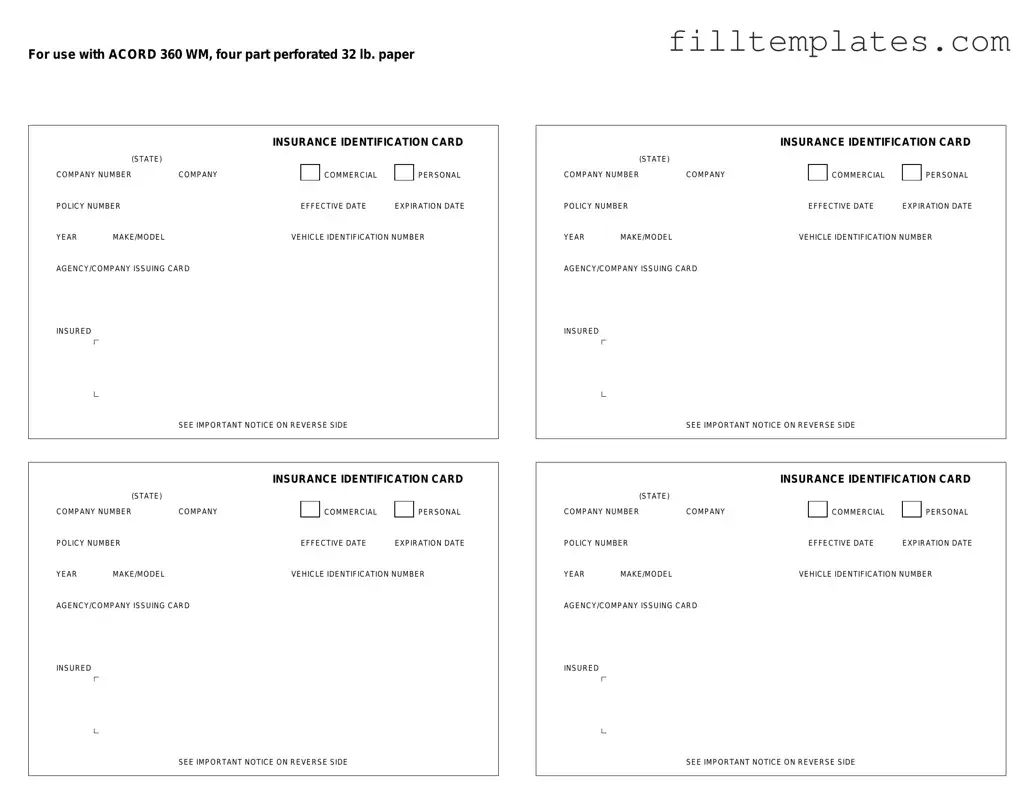

For use with ACORD 360 WM, four part perforated 32 lb. paper

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

Documents used along the form

The Acord 50 WM form is commonly used in the insurance industry, particularly for workers' compensation. When dealing with this form, several other documents often accompany it to ensure comprehensive coverage and compliance. Below is a list of related forms and documents that are frequently utilized alongside the Acord 50 WM form.

- Acord 25: This is the Certificate of Liability Insurance. It provides proof of insurance coverage and details the types of coverage and limits available.

- Acord 130: This is the Commercial General Liability Application. It gathers information about the business seeking insurance and assesses its risk profile.

- Acord 130S: This is the Supplemental Application for Commercial General Liability. It is used for specific situations or additional coverage needs not addressed in the standard application.

- California Motorcycle Bill of Sale - This essential document verifies the transfer of ownership when purchasing a motorcycle in California, providing detailed information about the transaction and the motorcycle. For more information, visit https://toptemplates.info/bill-of-sale/motorcycle-bill-of-sale/california-motorcycle-bill-of-sale/.

- Acord 2: This is the General Information Form. It collects essential information about the insured party and the type of insurance being requested.

- Acord 27: This is the Additional Insured Endorsement. It adds other parties to the insurance policy, providing them with coverage under the primary policy.

- Acord 51: This is the Workers' Compensation Application. It provides detailed information about the business's employees and job classifications to determine appropriate coverage.

- Acord 4: This is the Property Application. It is used to provide information about the property being insured, including its value and any special considerations.

These forms and documents play a vital role in the insurance process, helping to clarify coverage needs and ensure that all parties are adequately protected. Understanding each of these documents can facilitate smoother transactions and better communication between clients and insurance providers.