Download Adp Pay Stub Template

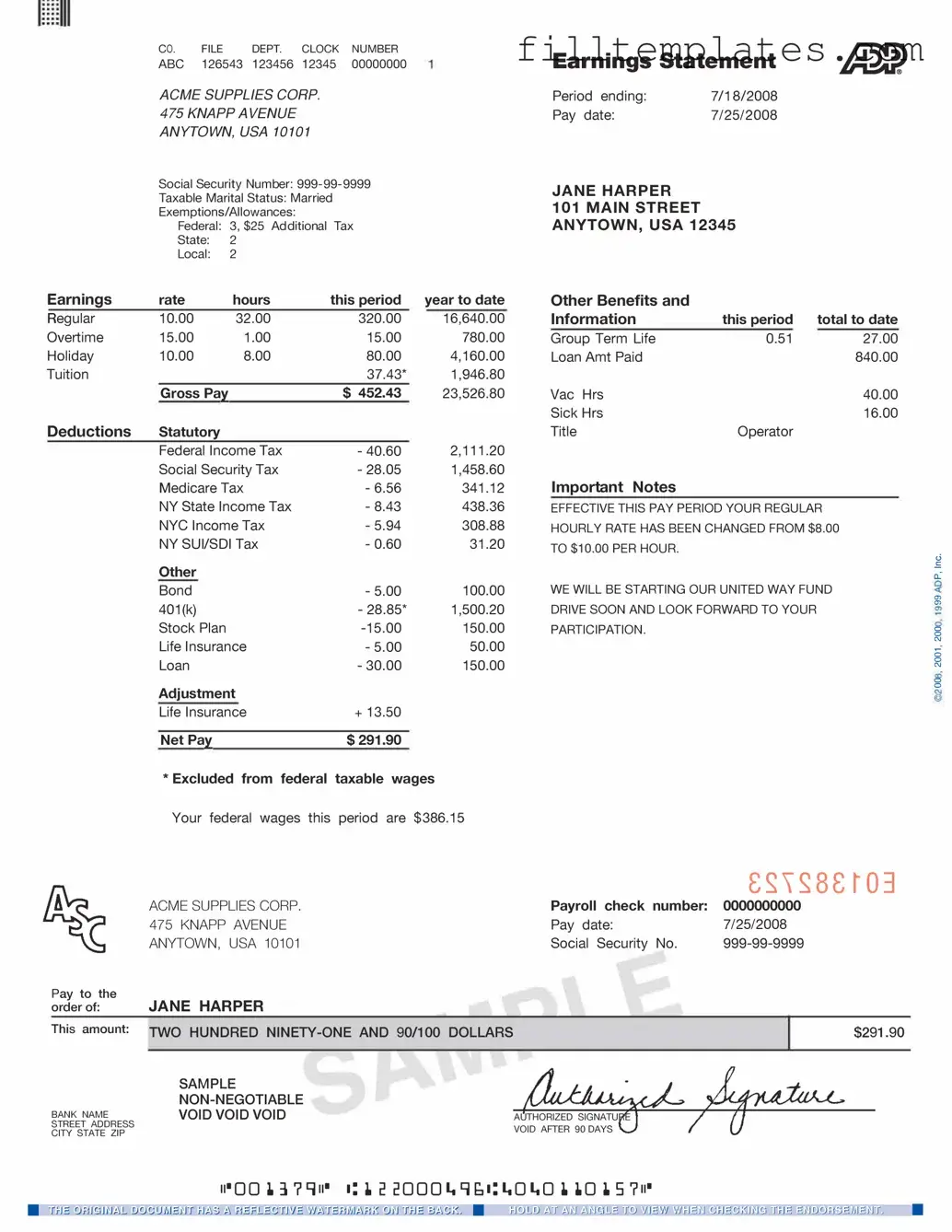

The ADP Pay Stub form serves as a vital document for employees, providing a detailed breakdown of their earnings and deductions for each pay period. This form includes essential information such as gross wages, net pay, and various withholdings like taxes, health insurance, and retirement contributions. Understanding the components of the pay stub is crucial for employees to track their earnings accurately and ensure that all deductions are correct. Additionally, the pay stub often features year-to-date earnings, allowing individuals to monitor their financial progress throughout the year. For those who may have questions about their compensation or deductions, the ADP Pay Stub form acts as a transparent resource, enabling employees to verify their pay and address any discrepancies with their employer. Overall, this document not only serves as proof of income but also plays a significant role in personal financial management.

Key takeaways

Understanding the ADP Pay Stub form is crucial for both employees and employers. Here are five key takeaways to keep in mind:

- Accurate Information: Ensure that all personal and employment details are filled out correctly. This includes your name, address, and Social Security number.

- Review Earnings: Check the earnings section carefully. It should reflect your gross pay, deductions, and net pay accurately.

- Understand Deductions: Familiarize yourself with the various deductions listed. These may include taxes, health insurance, and retirement contributions.

- Accessing Pay Stubs: You can access your pay stubs online through the ADP portal. Make sure to create an account if you haven't already.

- Keep Records: Save copies of your pay stubs for your records. They can be useful for tax purposes or when applying for loans.

Guide to Writing Adp Pay Stub

Filling out the ADP Pay Stub form requires careful attention to detail to ensure all necessary information is accurately recorded. Below are the steps to guide you through the process.

- Start with the employee's name. Write the full name as it appears on official documents.

- Next, enter the employee's identification number. This number is usually assigned by the employer.

- Fill in the pay period dates. Clearly indicate the start and end dates of the pay period.

- Record the total hours worked during the pay period. Be precise with the number of hours.

- Indicate the hourly wage or salary. Ensure this amount matches what is agreed upon in the employment contract.

- Calculate the gross pay. This is the total earnings before any deductions.

- List any deductions. Common deductions include taxes, health insurance, and retirement contributions.

- Calculate the net pay. This is the amount the employee will take home after all deductions.

- Finally, review the completed form for accuracy. Make any necessary corrections before submission.

Browse Other PDFs

Va Form 10-2850c - It ensures compliance with federal employment regulations for healthcare professionals.

Free Time Sheet Template - Helps to streamline the payroll process.

To ensure a smooth transaction when selling an all-terrain vehicle in Arizona, it's important to complete the Arizona ATV Bill of Sale form. This legal document, which records the sale and transfer of ownership, includes vital details about the buyer, seller, and the vehicle. For a reliable source to obtain this form, you can visit My PDF Forms, which offers a user-friendly experience for your documentation needs.

Printable Direction of Payment Form - Your timely completion of this form can speed up the repair process after an accident.

Form Preview Example

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Documents used along the form

The ADP Pay Stub form is a crucial document for employees, providing a detailed breakdown of earnings, deductions, and net pay. However, it is often accompanied by other forms and documents that serve various purposes in the employment and payroll processes. Below is a list of commonly used documents that complement the ADP Pay Stub.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld from their paycheck. Employers must provide this document to employees by January 31 each year for tax filing purposes.

- W-4 Form: Employees use this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from each paycheck.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account. It streamlines the payment process and ensures timely access to funds.

- Pay Rate Change Form: When an employee’s pay rate changes, this form documents the new rate and the effective date. It serves as a record for both the employer and the employee.

- Aaa International Driving Permit Application: When traveling abroad, the essential Aaa International Driving Permit Application guide can help ensure you have the necessary documentation to drive legally in foreign countries.

- Time Sheet: Employees use this document to record their hours worked, including overtime. It helps ensure accurate pay calculations and compliance with labor laws.

- Leave Request Form: This form is used by employees to formally request time off from work. It provides a record of the request and helps employers manage staffing needs.

- Employee Handbook Acknowledgment: Employees sign this document to confirm they have received and understood the company's policies and procedures outlined in the employee handbook.

- Benefits Enrollment Form: This form allows employees to enroll in company-sponsored benefits, such as health insurance or retirement plans. It is essential for managing employee benefits.

- Separation Notice: When an employee leaves a company, this document outlines the terms of their departure. It may include information about final paychecks, benefits, and return of company property.

Each of these documents plays a vital role in the employment relationship, ensuring clarity and compliance for both employers and employees. Familiarity with these forms can help employees navigate their rights and responsibilities in the workplace more effectively.