Free Affidavit of Gift Template

The Affidavit of Gift form serves as a vital document in the transfer of ownership of property or assets without an exchange of money. Often used in situations involving family members or friends, this form provides a clear record of the intent to gift, ensuring that both the giver and the recipient understand the nature of the transaction. Key elements typically included in the form are the names and addresses of both the donor and the recipient, a detailed description of the item or property being gifted, and the date of the transfer. Additionally, the form usually requires the donor’s signature, affirming their intention to give the gift freely and without any expectation of compensation. This document can be particularly important for tax purposes, as it helps establish the legitimacy of the gift and may have implications for gift tax reporting. By formalizing the gift process, the Affidavit of Gift helps to prevent misunderstandings and provides a legal safeguard for both parties involved.

Key takeaways

Filling out the Affidavit of Gift form can seem daunting, but understanding its key elements can simplify the process. Here are ten important takeaways:

- Purpose: The Affidavit of Gift is used to document the transfer of property or assets as a gift.

- Eligibility: Anyone can give a gift, but the recipient must be aware of and accept the gift.

- Details Required: You will need to provide information about both the giver and the recipient, including names and addresses.

- Description of Gift: Clearly describe the item or asset being gifted. This helps avoid confusion later.

- Value Declaration: State the fair market value of the gift. This is important for tax purposes.

- Signature: The giver must sign the affidavit, affirming the gift is made voluntarily and without expectation of return.

- Notarization: In some cases, notarizing the affidavit adds an extra layer of authenticity.

- Tax Implications: Be aware that large gifts may have tax implications for the giver, so consulting a tax professional is wise.

- Record Keeping: Keep a copy of the completed affidavit for your records. This can be useful for future reference.

- State Requirements: Check if your state has specific requirements for the Affidavit of Gift, as they can vary.

Understanding these key points can make filling out the Affidavit of Gift form more straightforward and ensure that the process goes smoothly.

Guide to Writing Affidavit of Gift

After obtaining the Affidavit of Gift form, you will need to complete it accurately to ensure it serves its intended purpose. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Fill in the full name of the donor in the designated section.

- Provide the donor's address, including city, state, and zip code.

- Identify the recipient by entering their full name.

- Include the recipient's address in the appropriate fields.

- Describe the gift being given. Be specific about the item or amount.

- Indicate the date the gift was given.

- Sign the form where indicated, confirming the information is accurate.

- Have a witness sign the form, if required, to validate the gift.

Once you have completed the form, review it for accuracy. Ensure all signatures are in place before submitting it as needed.

Create Popular Types of Affidavit of Gift Templates

Single Status Certificate Usa - This form can help prevent misunderstandings regarding marital status during the marriage process.

The Employment Application PDF form is an essential tool for candidates to present their personal, educational, and professional details when pursuing job opportunities. By utilizing this standardized document, employers can easily gather and compare applicant information, thereby streamlining the hiring process. For additional resources, candidates can visit OnlineLawDocs.com to access the form and ensure they meet all necessary application requirements.

Affidavit Letter of Support Sample - Support letters help provide a fuller picture of the couple's life together.

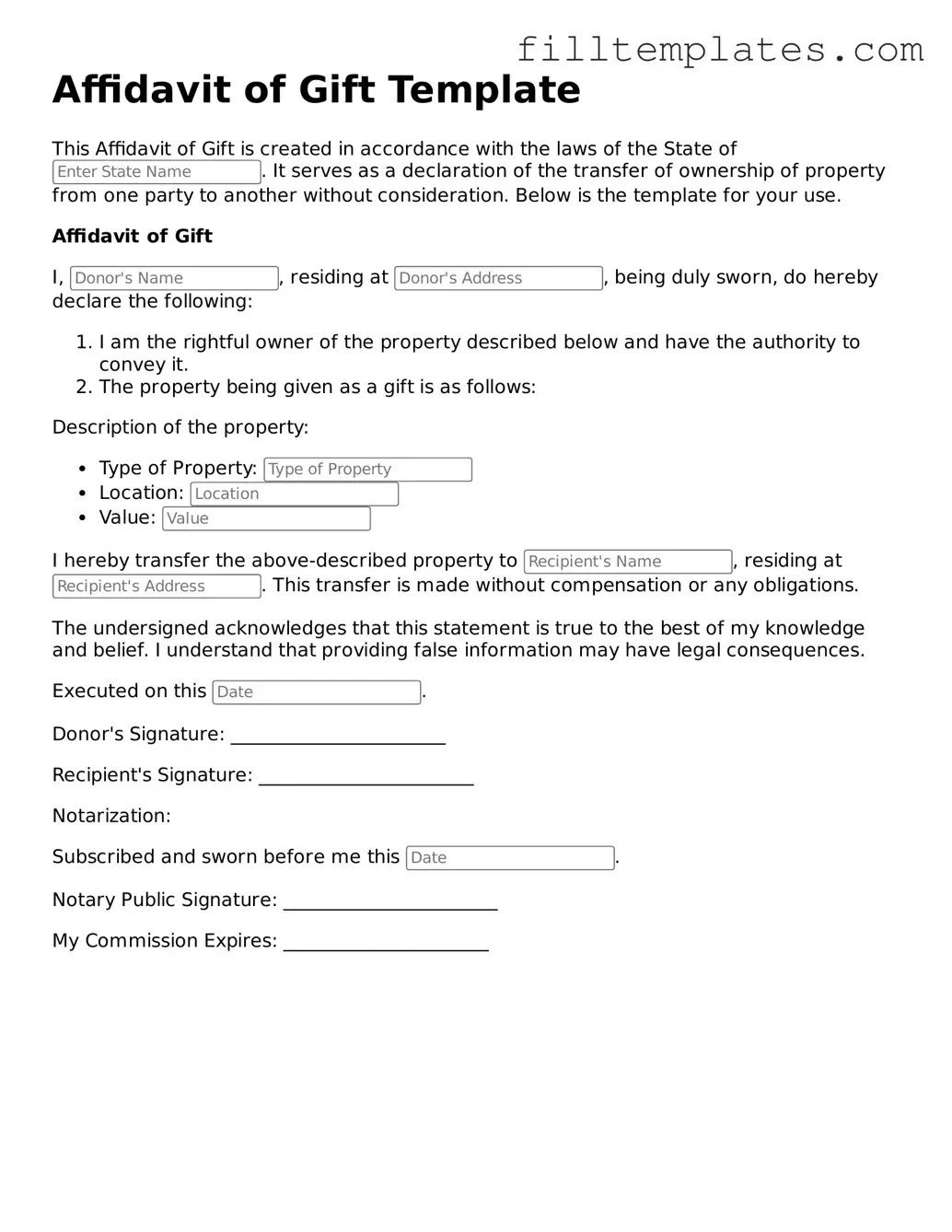

Form Preview Example

Affidavit of Gift Template

This Affidavit of Gift is created in accordance with the laws of the State of . It serves as a declaration of the transfer of ownership of property from one party to another without consideration. Below is the template for your use.

Affidavit of Gift

I, , residing at , being duly sworn, do hereby declare the following:

- I am the rightful owner of the property described below and have the authority to convey it.

- The property being given as a gift is as follows:

Description of the property:

- Type of Property:

- Location:

- Value:

I hereby transfer the above-described property to , residing at . This transfer is made without compensation or any obligations.

The undersigned acknowledges that this statement is true to the best of my knowledge and belief. I understand that providing false information may have legal consequences.

Executed on this .

Donor's Signature: _______________________

Recipient's Signature: _______________________

Notarization:

Subscribed and sworn before me this .

Notary Public Signature: _______________________

My Commission Expires: ______________________

Documents used along the form

The Affidavit of Gift form serves as an important document in the process of transferring ownership of property or assets without compensation. However, several other forms and documents are often utilized in conjunction with it to ensure a smooth and legally sound transfer. Below is a list of these additional documents, each serving a specific purpose in the gifting process.

- Gift Tax Return (Form 709): This form is required by the IRS for reporting gifts that exceed the annual exclusion limit. It helps ensure compliance with federal tax regulations.

- New York Motorcycle Bill of Sale Form: For those engaged in motorcycle transactions, our essential motorcycle bill of sale guidelines provide the necessary documentation for a secure transfer.

- Deed of Gift: This legal document formally transfers ownership of real property from one party to another. It is often used when real estate is involved in the gift.

- Bill of Sale: This document provides proof of the transfer of personal property. It includes details about the item being gifted and the parties involved in the transaction.

- Trust Agreement: When a gift is placed into a trust, this document outlines the terms of the trust, including the responsibilities of the trustee and the rights of the beneficiaries.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. It can be useful if the donor is unable to complete the gifting process personally.

- Letter of Intent: While not a legally binding document, this letter expresses the donor's wishes regarding the gift and can provide clarity on the intent behind the transfer.

- Beneficiary Designation Forms: For gifts involving financial accounts or insurance policies, these forms specify who will receive the assets upon the donor's passing.

- Tax Identification Number (TIN) Application (Form SS-4): If the gift involves a business entity or requires a TIN for tax purposes, this form is necessary to apply for one.

In summary, while the Affidavit of Gift is a crucial document in the gifting process, it often works in tandem with various other forms and agreements. Each document plays a vital role in ensuring that the gift is transferred legally and in accordance with the wishes of the donor. Understanding these documents can help facilitate a smoother transition and provide peace of mind for all parties involved.