Free Articles of Incorporation Template

The Articles of Incorporation form serves as a foundational document for establishing a corporation in the United States. This form typically outlines essential details such as the corporation's name, the purpose of its existence, and the location of its principal office. Additionally, it includes information about the registered agent, who acts as the corporation's official point of contact for legal matters. Shareholder structure is also addressed, detailing the types and number of shares the corporation is authorized to issue. Furthermore, the form may stipulate the duration of the corporation, which can be perpetual or for a specified term. By completing and filing the Articles of Incorporation, founders not only comply with state requirements but also lay the groundwork for their business's legal identity and operational framework. Understanding each component of this form is crucial for anyone looking to successfully navigate the incorporation process.

Articles of Incorporation - Adapted for State

Key takeaways

When filling out and using the Articles of Incorporation form, several important factors should be considered to ensure compliance and clarity. Here are key takeaways:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for a corporation, establishing its existence and outlining its structure.

- Identify the Corporation Type: Clearly specify whether the corporation is for profit, non-profit, or another classification, as this affects legal obligations and tax status.

- Provide Accurate Information: Include the legal name of the corporation, which must be unique and comply with state naming requirements.

- Designate a Registered Agent: Appoint a registered agent who will receive legal documents on behalf of the corporation. This agent must have a physical address in the state of incorporation.

- Outline the Purpose: Describe the business activities the corporation will engage in. This can be a general statement but should reflect the corporation's intent.

- Include the Number of Shares: Specify the total number of shares the corporation is authorized to issue. This information is crucial for ownership and investment purposes.

- Review State Requirements: Each state has specific requirements for the Articles of Incorporation. Ensure compliance with local regulations to avoid delays or rejections.

- File with the Appropriate Authority: Submit the completed form to the designated state agency, typically the Secretary of State, along with any required fees.

Completing the Articles of Incorporation accurately is essential for establishing a corporation and ensuring legal protection for its owners.

Guide to Writing Articles of Incorporation

Once you have your Articles of Incorporation form ready, you will need to fill it out carefully. This form is essential for establishing your business entity. Follow these steps to ensure you complete it correctly.

- Obtain the form: Download the Articles of Incorporation form from your state’s Secretary of State website or request a hard copy from their office.

- Provide the name of your corporation: Enter the proposed name of your corporation. Ensure it complies with state naming rules and is unique.

- State the purpose: Clearly describe the purpose of your corporation. This can be a general statement about business activities.

- List the registered agent: Include the name and address of your registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Include the address of the corporation: Provide the physical address where your corporation will be located. This cannot be a P.O. Box.

- Detail the incorporators: List the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Specify the number of shares: Indicate how many shares of stock the corporation is authorized to issue and their par value, if applicable.

- Sign and date the form: Ensure that all incorporators sign and date the form. This indicates their agreement to the information provided.

- Check for accuracy: Review the completed form for any errors or missing information before submission.

- Submit the form: Send the completed Articles of Incorporation form to the appropriate state office, along with any required filing fees.

After submitting your Articles of Incorporation, keep a copy for your records. You will receive confirmation from the state once your corporation is officially recognized. This process may take some time, so be patient as you await your confirmation.

Other Forms:

Correction Deed California - This affidavit must be filled out accurately to fulfill legal requirements.

The Chick Fil A Job Application form serves as the initial step for individuals seeking employment at one of the many Chick-fil-A restaurant locations. By completing this form, applicants communicate their interest in joining the team, along with their qualifications and availability. For those looking to streamline their application process, more information can be found at smarttemplates.net/fillable-chick-fil-a-job-application/. It's a critical document in the hiring process, ensuring candidates are fairly evaluated.

How to Get a Firearm License - Applicants need to specify the country of origin and destination for the firearms.

Form Preview Example

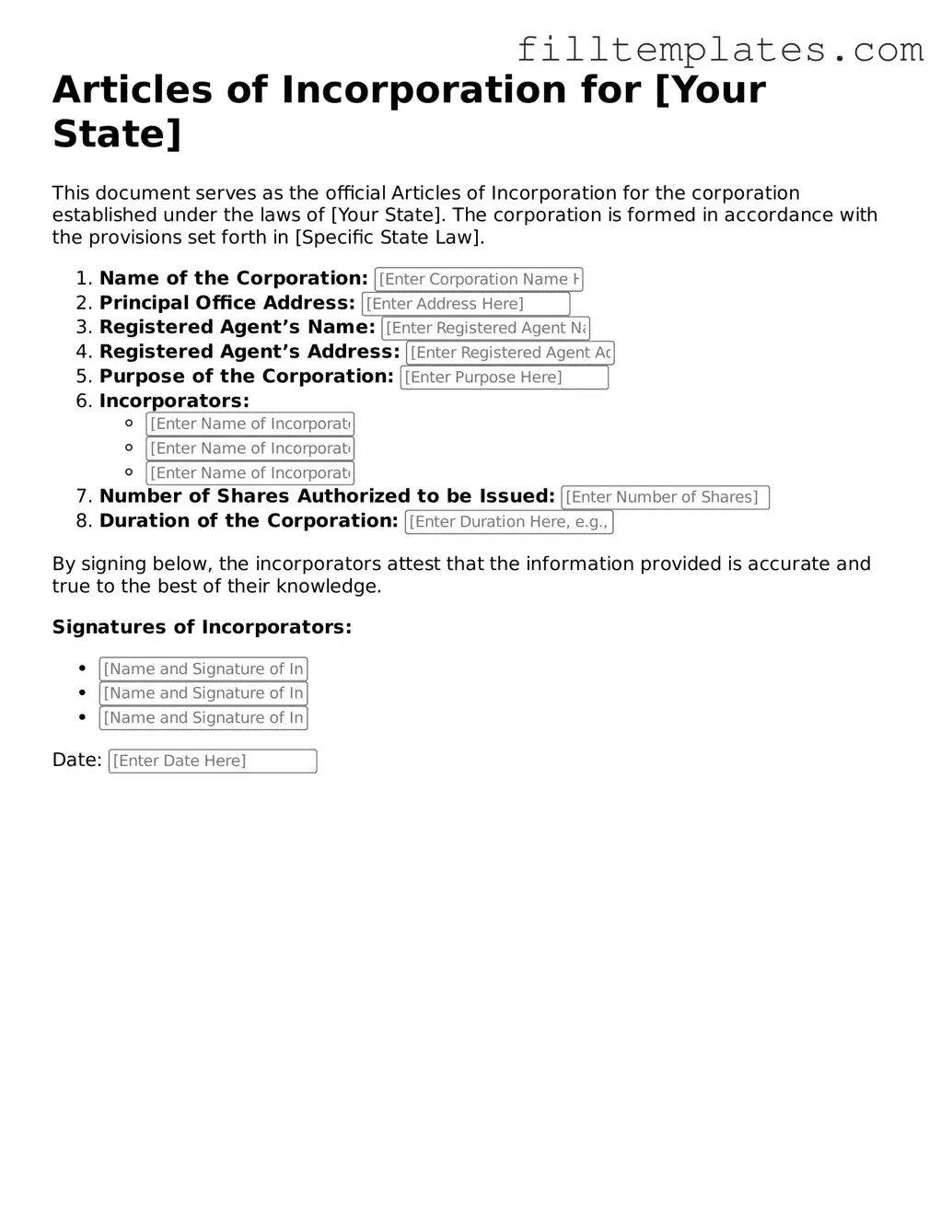

Articles of Incorporation for [Your State]

This document serves as the official Articles of Incorporation for the corporation established under the laws of [Your State]. The corporation is formed in accordance with the provisions set forth in [Specific State Law].

- Name of the Corporation:

- Principal Office Address:

- Registered Agent’s Name:

- Registered Agent’s Address:

- Purpose of the Corporation:

-

Incorporators:

- Number of Shares Authorized to be Issued:

- Duration of the Corporation:

By signing below, the incorporators attest that the information provided is accurate and true to the best of their knowledge.

Signatures of Incorporators:

Date:

Documents used along the form

When forming a corporation, the Articles of Incorporation is a key document. However, several other forms and documents are typically required to complete the incorporation process. Here’s a list of some important ones:

- Bylaws: These are the rules that govern the internal management of the corporation. Bylaws outline the roles of directors and officers, how meetings are conducted, and how decisions are made.

- Initial Report: Some states require an initial report shortly after incorporation. This document provides basic information about the corporation, including its address and the names of its officers and directors.

- Employer Identification Number (EIN) Application: An EIN is necessary for tax purposes. This application, often submitted to the IRS, helps identify the corporation for tax filings and employee payroll.

- State Business License: Depending on the business type and location, a state business license may be needed. This license allows the corporation to legally operate within that state.

- Trader Joe's Application Form: This document is crucial for those seeking employment with Trader Joe's, as it collects personal details, availability, and relevant skills for the retail sector. For more information, you can visit TopTemplates.info.

- Operating Agreement: While more common for LLCs, some corporations may choose to create an operating agreement. This document outlines the management structure and operational procedures of the corporation.

Each of these documents plays a vital role in ensuring that the corporation is set up properly and operates within the legal framework. It’s important to gather and prepare all necessary documents to avoid any potential issues down the line.