Free Business Bill of Sale Template

When it comes to transferring ownership of a business, a Business Bill of Sale form serves as a crucial document that formalizes the sale and outlines the terms agreed upon by both the buyer and the seller. This form typically includes essential details such as the names and addresses of both parties, a description of the business being sold, and the purchase price. Additionally, it may specify any included assets, such as equipment, inventory, or intellectual property, which are vital to the business's operation. By detailing these elements, the Business Bill of Sale not only protects the interests of both parties but also provides a clear record of the transaction for future reference. This document can help prevent misunderstandings and disputes that may arise after the sale, making it an indispensable tool in the business transfer process. Furthermore, it may include clauses related to warranties, liabilities, and any conditions that must be met before the sale is finalized, ensuring that both parties are fully aware of their rights and responsibilities.

Key takeaways

When engaging in the sale or transfer of a business, understanding the Business Bill of Sale form is essential. Here are some key takeaways to consider:

- Clear Identification: Ensure that both the buyer and seller are clearly identified in the document. This includes full names and addresses to avoid any confusion.

- Accurate Description: Provide a detailed description of the business being sold. This should include any assets, inventory, and intellectual property involved in the transaction.

- Purchase Price: Clearly state the purchase price of the business. This figure should be agreed upon by both parties and documented to prevent disputes later.

- Conditions of Sale: Outline any specific conditions or terms related to the sale. This may include payment terms, contingencies, or warranties that both parties need to adhere to.

- Signatures: Ensure that both parties sign and date the document. This step is crucial for the legal validity of the sale and confirms that both parties agree to the terms laid out in the Bill of Sale.

Using the Business Bill of Sale form effectively can help facilitate a smooth transition and protect the interests of both the buyer and the seller. Properly documenting the sale is a vital step in ensuring clarity and legal compliance.

Guide to Writing Business Bill of Sale

Filling out the Business Bill of Sale form is an important step in the process of transferring ownership of a business. This document serves as a record of the sale and protects both the buyer and the seller by outlining the terms of the transaction. Completing the form accurately ensures that all necessary details are captured for future reference.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. This should include any business name if applicable.

- Next, fill in the buyer's full name and address, ensuring that all information is accurate.

- In the designated section, describe the business being sold. Include details such as the business name, location, and any relevant identifying information.

- Specify the purchase price of the business. Clearly state the amount in both numbers and words to avoid any confusion.

- If applicable, outline any items or assets included in the sale, such as equipment or inventory.

- Both parties should sign and date the form at the bottom. This confirms their agreement to the terms outlined in the document.

- Make copies of the completed form for both the buyer and the seller for their records.

Create Popular Types of Business Bill of Sale Templates

Who Buys Art Prints - A document to transfer ownership of artwork.

For anyone involved in personal property transactions, the "simple yet effective General Bill of Sale form" is a crucial tool to ensure that ownership is transferred correctly. This document not only serves as proof of the sale but also safeguards the interests of both the buyer and seller by providing a clear record of the agreement. For details on how to create this important document, check out the resource available at simple yet effective General Bill of Sale form.

Camper Bill of Sale - Facilitates communication between buyer and seller post-sale.

Form Preview Example

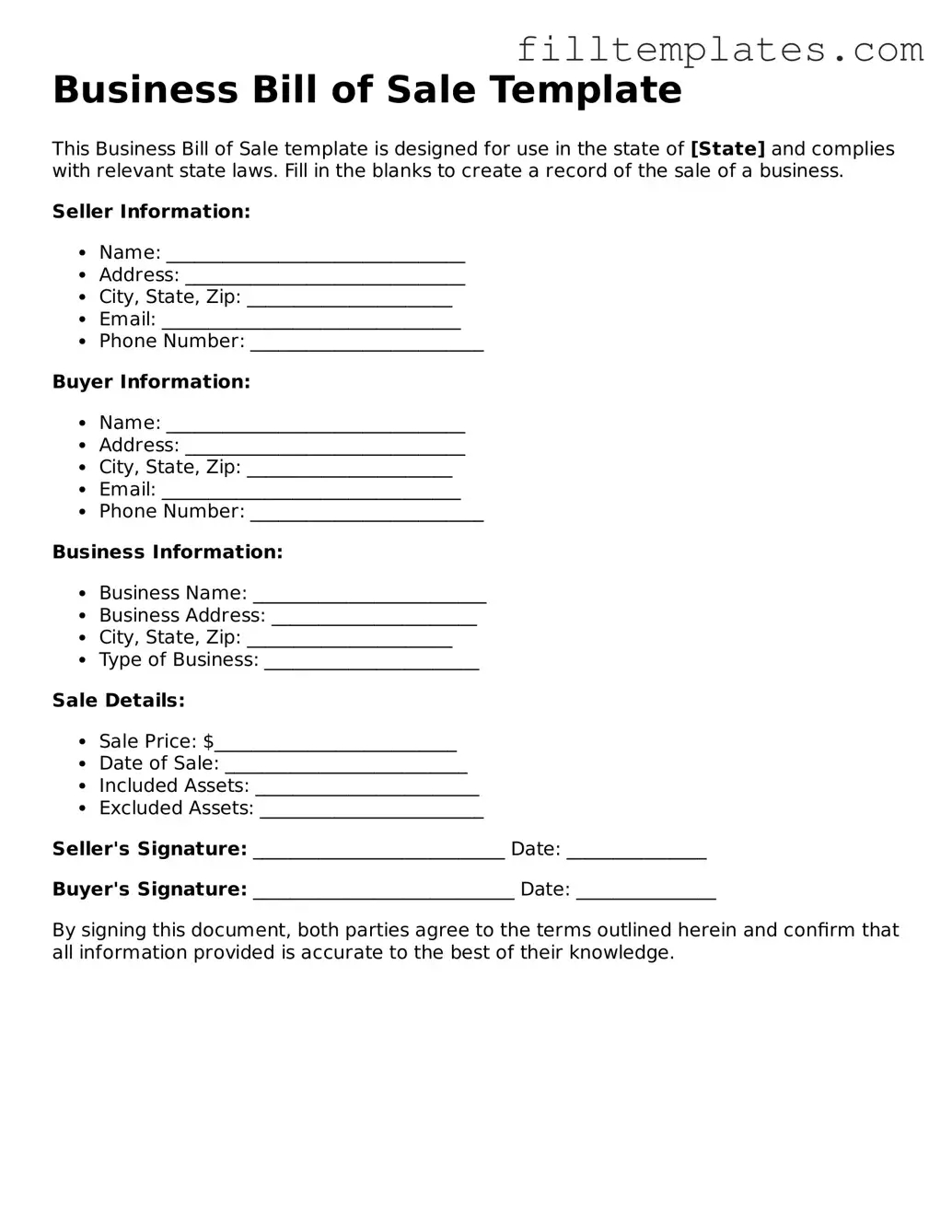

Business Bill of Sale Template

This Business Bill of Sale template is designed for use in the state of [State] and complies with relevant state laws. Fill in the blanks to create a record of the sale of a business.

Seller Information:

- Name: ________________________________

- Address: ______________________________

- City, State, Zip: ______________________

- Email: ________________________________

- Phone Number: _________________________

Buyer Information:

- Name: ________________________________

- Address: ______________________________

- City, State, Zip: ______________________

- Email: ________________________________

- Phone Number: _________________________

Business Information:

- Business Name: _________________________

- Business Address: ______________________

- City, State, Zip: ______________________

- Type of Business: _______________________

Sale Details:

- Sale Price: $__________________________

- Date of Sale: __________________________

- Included Assets: ________________________

- Excluded Assets: ________________________

Seller's Signature: ___________________________ Date: _______________

Buyer's Signature: ____________________________ Date: _______________

By signing this document, both parties agree to the terms outlined herein and confirm that all information provided is accurate to the best of their knowledge.

Documents used along the form

A Business Bill of Sale form is an essential document for transferring ownership of a business. However, several other forms and documents often accompany it to ensure a smooth transaction. Below is a list of these important documents.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price, payment method, and any contingencies that must be met before the sale is finalized.

- Asset List: A detailed inventory of all assets included in the sale, such as equipment, inventory, and intellectual property, helps both parties understand what is being transferred.

- Non-Disclosure Agreement (NDA): This agreement protects sensitive business information from being disclosed to third parties during the negotiation process.

- Transfer of Ownership Form: This form officially documents the change of ownership for legal and tax purposes, ensuring that the new owner is recognized by relevant authorities.

- Tax Clearance Certificate: This certificate verifies that the business has paid all its taxes, providing peace of mind to the buyer regarding any outstanding tax liabilities.

- Employment Agreements: If employees are part of the business sale, these agreements outline the terms of their continued employment under the new ownership.

- Florida Motor Vehicle Bill of Sale: This form is essential for documenting the sale of a vehicle in Florida, serving as proof of the transaction and detailing critical information about the vehicle and the parties involved. For more information, visit OnlineLawDocs.com.

- Liabilities Disclosure Statement: This document details any outstanding debts or liabilities associated with the business, ensuring that the buyer is fully informed before completing the sale.

- Closing Statement: This final document summarizes the transaction, including the final sale price, any adjustments, and the distribution of funds, ensuring transparency in the closing process.

Having these documents prepared and organized can help facilitate a smoother business sale process. It’s important to ensure all parties understand their rights and responsibilities throughout the transaction.