Download Business Credit Application Template

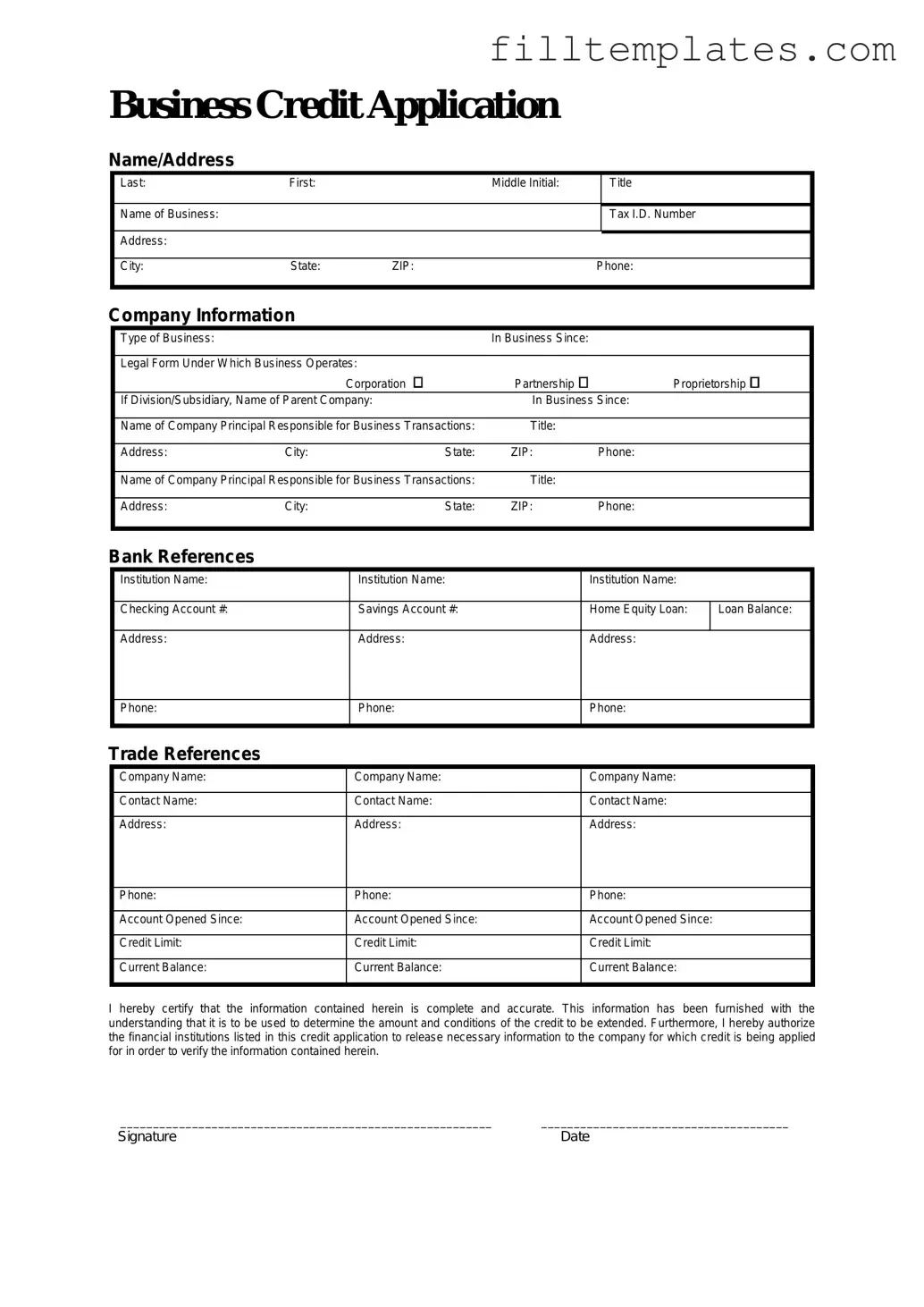

The Business Credit Application form serves as a vital tool for companies seeking to establish credit relationships with suppliers, lenders, or other financial institutions. This form typically gathers essential information about the business, including its legal structure, ownership details, and financial history. By requesting specifics such as the business's tax identification number, bank references, and trade references, the form aims to provide a comprehensive overview of the applicant's creditworthiness. Additionally, it often includes sections for the applicant to disclose any outstanding debts or previous credit issues, allowing lenders to assess risk more accurately. Furthermore, the form may require signatures from authorized representatives, ensuring that the information provided is verified and binding. Overall, this document plays a crucial role in facilitating the credit evaluation process, enabling both parties to enter into a mutually beneficial financial relationship with a clear understanding of the associated risks and responsibilities.

Key takeaways

Filling out a Business Credit Application form is a crucial step for businesses seeking credit from suppliers or financial institutions. Here are some key takeaways to keep in mind:

- Accuracy is essential: Ensure that all information provided is correct and up-to-date. Inaccuracies can lead to delays or denials.

- Complete all sections: Fill out every section of the application. Incomplete forms may be rejected or require additional follow-up.

- Provide financial details: Include relevant financial information, such as annual revenue and existing debts. This helps the lender assess your creditworthiness.

- Business structure matters: Clearly indicate your business structure (e.g., LLC, corporation, sole proprietorship). Different structures may affect credit decisions.

- Personal guarantees: Be prepared to provide personal guarantees if required. This means you may be personally liable for the business’s debts.

- Credit history: Be honest about your business’s credit history. Lenders will likely check your credit report, so transparency is important.

- References can help: Providing references from other suppliers or lenders can strengthen your application and build trust.

- Review before submission: Double-check the form for any errors or omissions before sending it in. A thorough review can prevent issues later on.

- Follow up: After submission, follow up with the lender to confirm receipt and inquire about the timeline for a decision.

By keeping these points in mind, businesses can improve their chances of successfully obtaining credit and establishing strong relationships with lenders.

Guide to Writing Business Credit Application

After obtaining the Business Credit Application form, you are ready to provide the necessary information that will help facilitate the credit assessment process. Completing this form accurately is crucial for a smooth review. Follow the steps below to ensure you fill it out correctly.

- Begin by entering your business name in the designated field.

- Provide your business address, including city, state, and ZIP code.

- Fill in the contact information for the primary business representative, including name, phone number, and email address.

- Indicate the type of business (e.g., corporation, partnership, sole proprietorship).

- List your business structure and the date of establishment.

- Include your tax identification number or Social Security number, as applicable.

- Detail your banking information, including bank name and account number.

- Provide a brief description of your business and its primary products or services.

- List any trade references with contact information, including names and phone numbers.

- Sign and date the application to confirm the accuracy of the information provided.

Browse Other PDFs

I9 Verification - This verification aids in determining eligibility for loans.

In addition to its legal significance, a Bill of Sale can simplify the process of transferring ownership, ensuring that both parties have a clear record of the transaction. For those looking to create their own document, resources such as PDF Documents Hub offer convenient options to generate a Bill of Sale form tailored to specific needs.

Geico Vendor Online Services - Please fill out all required fields to ensure your request is processed smoothly.

Form Preview Example

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Documents used along the form

When applying for credit for a business, the Business Credit Application form is just the beginning. Several other documents may be required to support your application and provide the lender with a complete picture of your financial health and business operations. Below is a list of common forms and documents that often accompany a Business Credit Application.

- Personal Guarantee: This document is a promise from an individual, usually a business owner, to repay the debt if the business cannot. It adds an extra layer of security for the lender.

- International Driving Permit: For those planning to travel abroad, obtaining an Aaa International Driving Permit Application form can be essential for driving legally overseas.

- Financial Statements: These include balance sheets, income statements, and cash flow statements. They give lenders insight into the financial status of your business and its ability to repay loans.

- Tax Returns: Typically, lenders will request the last two or three years of business tax returns. These documents help verify income and provide a historical view of your business’s financial performance.

- Business Plan: A well-crafted business plan outlines your business’s goals, strategies, and financial projections. It demonstrates to lenders that you have a clear vision for the future.

- Bank Statements: Recent bank statements can show cash flow and help lenders assess the day-to-day financial health of your business.

- Credit Report: A copy of your business credit report offers lenders a snapshot of your credit history and helps them evaluate your creditworthiness.

- Operating Agreement or Bylaws: For LLCs or corporations, these documents outline the management structure and operational procedures. They help lenders understand how your business is organized and governed.

Gathering these documents not only strengthens your Business Credit Application but also prepares you for potential questions from lenders. Being thorough and organized can make a significant difference in securing the credit your business needs to grow and thrive.