Free Business Purchase and Sale Agreement Template

When considering the transfer of ownership in a business, a Business Purchase and Sale Agreement (BPSA) serves as a vital document that outlines the terms and conditions of the sale. This agreement encompasses essential elements, such as the purchase price, payment terms, and the specific assets being sold, which can include inventory, equipment, or intellectual property. It also addresses the responsibilities of both the buyer and the seller, ensuring that both parties understand their obligations throughout the transaction. Additionally, the BPSA often includes contingencies that may affect the sale, such as financing conditions or due diligence requirements. By clearly defining the terms of the sale, this agreement helps to minimize misunderstandings and disputes, paving the way for a smoother transition of ownership. Ultimately, a well-crafted Business Purchase and Sale Agreement not only protects the interests of both parties but also lays the groundwork for a successful business relationship moving forward.

Key takeaways

When dealing with a Business Purchase and Sale Agreement, it’s essential to understand the key components that ensure a smooth transaction. Here are some important takeaways to consider:

- Clarity is Crucial: Clearly outline the terms of the sale, including the purchase price, payment terms, and any contingencies. This reduces the chances of misunderstandings later.

- Due Diligence: Conduct thorough research on the business being purchased. This includes reviewing financial statements, contracts, and any potential liabilities.

- Legal Review: It’s wise to have a legal professional review the agreement. They can provide insights and ensure that all legal requirements are met.

- Confidentiality Matters: Include a confidentiality clause to protect sensitive information about the business during and after the sale process.

- Signatures are Essential: Ensure that all parties involved sign the agreement. This formalizes the transaction and makes it legally binding.

By keeping these points in mind, you can navigate the process of completing a Business Purchase and Sale Agreement with greater confidence.

Guide to Writing Business Purchase and Sale Agreement

Completing a Business Purchase and Sale Agreement form is a critical step in finalizing the sale of a business. Properly filling out this form ensures that all parties involved understand their rights and obligations. Below are the steps to guide you through the process.

- Begin by entering the date at the top of the form.

- Identify the parties involved in the transaction. Clearly state the names and addresses of both the seller and the buyer.

- Provide a detailed description of the business being sold. Include the business name, location, and any relevant identification numbers.

- Specify the purchase price. Clearly outline the total amount being paid for the business.

- Outline the payment terms. Indicate how the buyer will pay the seller, including any deposits, installment payments, or financing arrangements.

- Detail any included assets. List all tangible and intangible assets that are part of the sale, such as inventory, equipment, and intellectual property.

- Address any liabilities. Clearly state any debts or obligations that the buyer will assume as part of the sale.

- Include contingencies, if applicable. Specify any conditions that must be met before the sale can be finalized.

- Provide space for signatures. Ensure both parties sign and date the agreement to make it legally binding.

After completing the form, review it carefully for accuracy and completeness. Both parties should retain a copy for their records. It is advisable to consult with a legal professional to ensure that all aspects of the agreement are compliant with relevant laws and regulations.

Other Forms:

Puppy Health Record - This form is a great way to share your puppy's health history with your vet.

For anyone seeking to navigate the complexities of vehicle transactions, a solid understanding of the ATV Bill of Sale template is vital. This document provides essential details and serves as a legal proof of the sale, ensuring both parties are protected during the transfer. For more information, check out this essential guide to the ATV Bill of Sale.

Loan Note Template - Reinforces the borrower's understanding of the loan's terms and conditions.

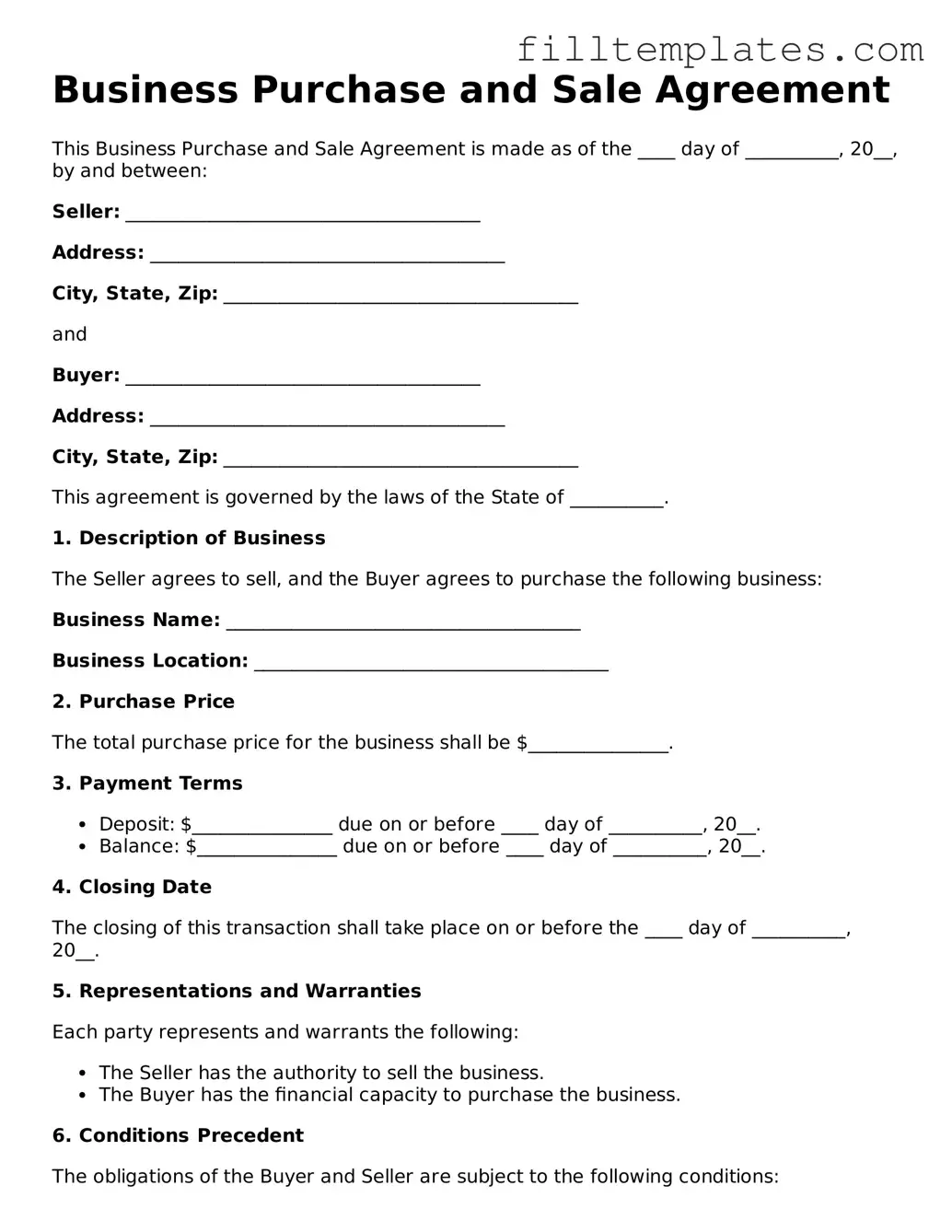

Form Preview Example

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement is made as of the ____ day of __________, 20__, by and between:

Seller: ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________________

and

Buyer: ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________________

This agreement is governed by the laws of the State of __________.

1. Description of Business

The Seller agrees to sell, and the Buyer agrees to purchase the following business:

Business Name: ______________________________________

Business Location: ______________________________________

2. Purchase Price

The total purchase price for the business shall be $_______________.

3. Payment Terms

- Deposit: $_______________ due on or before ____ day of __________, 20__.

- Balance: $_______________ due on or before ____ day of __________, 20__.

4. Closing Date

The closing of this transaction shall take place on or before the ____ day of __________, 20__.

5. Representations and Warranties

Each party represents and warrants the following:

- The Seller has the authority to sell the business.

- The Buyer has the financial capacity to purchase the business.

6. Conditions Precedent

The obligations of the Buyer and Seller are subject to the following conditions:

- Completion of due diligence by the Buyer.

- Obtainment of necessary approvals and consents.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of __________.

8. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Business Purchase and Sale Agreement as of the date first above written.

Seller:

______________________________________

Date: _______________________________

Buyer:

______________________________________

Date: _______________________________

Documents used along the form

When engaging in a business transaction, particularly when purchasing or selling a business, several important documents accompany the Business Purchase and Sale Agreement. Each document serves a distinct purpose and contributes to the overall clarity and legality of the transaction.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller. It typically includes key terms of the deal, such as purchase price and conditions, but is not legally binding.

- Employment Verification Form - This document is essential for confirming the employment status of individuals and may include their job title, employment dates, and salary information, crucial for processes such as loan applications and background checks. For more information, visit OnlineLawDocs.com.

- Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document ensures that sensitive information shared during negotiations remains confidential. It protects both parties from potential misuse of proprietary information.

- Due Diligence Checklist: This is a comprehensive list of items that the buyer needs to review before finalizing the purchase. It often includes financial statements, contracts, and operational documents, helping the buyer assess the business's value and risks.

- Asset Purchase Agreement: If the transaction involves purchasing specific assets rather than the entire business, this agreement details which assets are included in the sale. It specifies the terms and conditions related to the transfer of ownership.

- Bill of Sale: This document serves as proof of the transfer of ownership of tangible assets. It typically includes a description of the assets being sold and the purchase price, formalizing the transaction.

- Non-Compete Agreement: Often included in business sales, this agreement restricts the seller from starting a competing business for a specified period and within a certain geographic area. It helps protect the buyer's investment.

- Closing Statement: This document summarizes the financial aspects of the transaction at closing. It outlines the final amounts due, including any adjustments, and is signed by both parties to confirm their agreement on the terms.

Each of these documents plays a crucial role in the business purchase process. Understanding their purposes can help both buyers and sellers navigate the complexities of the transaction more effectively.