Download Cash Drawer Count Sheet Template

Managing cash flow is a vital aspect of running a successful business, and the Cash Drawer Count Sheet plays a crucial role in this process. This simple yet effective tool helps businesses track the amount of cash in their drawers at the end of each shift or day. By providing a structured format for recording cash counts, the form not only ensures accuracy but also aids in identifying discrepancies that may arise. The Cash Drawer Count Sheet typically includes sections for listing the denominations of bills and coins, as well as spaces for noting any discrepancies between expected and actual cash amounts. Additionally, it often features areas for employee signatures and timestamps, promoting accountability and transparency. Using this form can streamline cash management practices, making it easier for businesses to maintain financial integrity and foster trust with both employees and customers.

Key takeaways

When filling out and using the Cash Drawer Count Sheet form, it is important to keep a few key points in mind. Here are some takeaways that can help ensure accuracy and efficiency.

- Accuracy is crucial. Double-check all amounts entered to avoid discrepancies.

- Use clear handwriting. This helps prevent misunderstandings and ensures that others can read the information easily.

- Record the date and time. This provides context for the cash count and helps with tracking over time.

- Include all denominations. Make sure to list each type of bill and coin to get a complete picture of the cash drawer.

- Count cash in a quiet environment. Reducing distractions can help improve focus and accuracy during the counting process.

- Have a second person verify the count. A second set of eyes can catch mistakes and ensure that the count is correct.

- Keep the form organized. Use a clean and tidy format to make it easier to review and reference later.

- Store the completed form securely. Protect sensitive information by keeping the form in a safe place.

- Review regularly. Regular checks can help identify patterns or issues that may need addressing.

By following these guidelines, individuals can use the Cash Drawer Count Sheet effectively, leading to better cash management and accountability.

Guide to Writing Cash Drawer Count Sheet

Completing the Cash Drawer Count Sheet is essential for maintaining accurate financial records. Follow these steps carefully to ensure that all necessary information is recorded correctly. This will help in reconciling cash transactions and preparing for audits.

- Gather all necessary cash and coin from the cash drawer.

- Open the Cash Drawer Count Sheet form on your computer or print a physical copy.

- In the first section, enter the date of the count.

- Write down your name or the name of the person performing the count in the designated field.

- Count the total amount of cash and coins in the drawer.

- Record the total cash amount in the appropriate box on the form.

- List the denominations of the coins and bills separately, filling in the corresponding fields.

- Double-check your calculations to ensure accuracy.

- Sign and date the form to confirm that the count is complete.

- Submit the completed Cash Drawer Count Sheet to the designated supervisor or manager.

Browse Other PDFs

Contracts for Owner Operators - The agreement restricts the Owner Operator from assigning the contract without written consent from the Carrier.

The importance of having a proper documentation when buying or selling a vehicle cannot be overlooked. The Texas Motor Vehicle Bill of Sale form ensures that all necessary details are recorded, helping to prevent disputes between parties involved in the transaction. For those looking for a reliable template, you can visit toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/texas-motor-vehicle-bill-of-sale/ for assistance in completing this essential paperwork.

Make My Own March Madness Bracket - Users can input their predictions for the Final Four.

How to Check How Many College Credits You Have - This process ensures your educational history is accurately recorded.

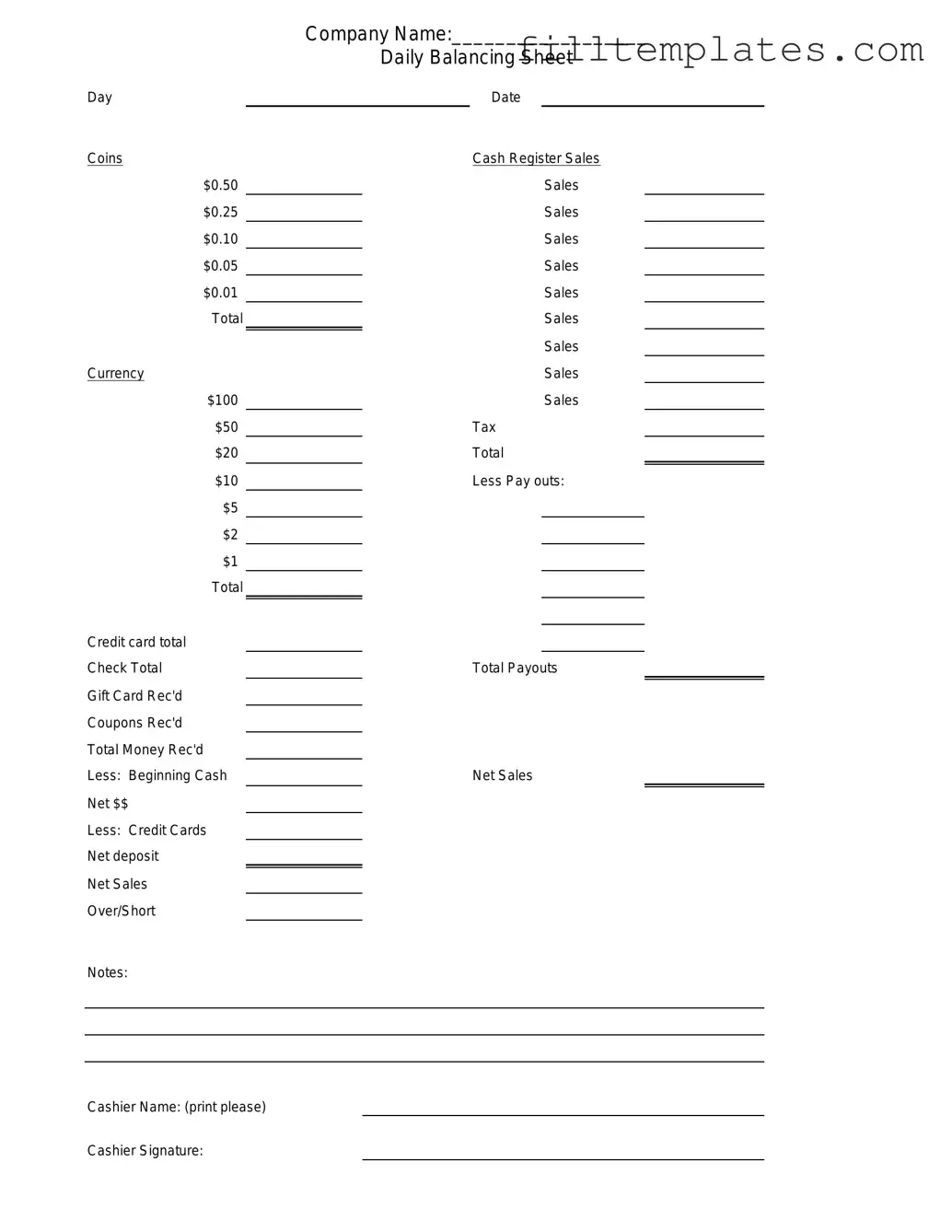

Form Preview Example

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Documents used along the form

The Cash Drawer Count Sheet form is a vital document for businesses that manage cash transactions. It helps track the amount of cash in a register at the beginning and end of a shift. Several other forms and documents are commonly used alongside it to ensure accurate financial management and reporting. Below is a list of these related documents.

- Cash Register Z Report: This report summarizes the total sales and cash collected during a specific period, typically at the end of a business day.

- Sales Receipt: A record provided to customers after a transaction, detailing the items purchased and the total amount paid.

- Deposit Slip: A form used to deposit cash and checks into a bank account, detailing the amount being deposited.

- Petty Cash Log: A record that tracks small cash expenses, ensuring that petty cash funds are accounted for and replenished as needed.

- Texas Motorcycle Bill of Sale: This document acts as a legal receipt for the sale and purchase of a motorcycle in Texas, ensuring the transfer of ownership is properly documented and verifiable, making it essential for both buyers and sellers. For more information, visit smarttemplates.net.

- Cash Disbursement Journal: A document that records all cash payments made by the business, providing a clear audit trail.

- Daily Sales Report: A summary of total sales for the day, often used for performance tracking and inventory management.

- End-of-Day Summary: A comprehensive report that includes cash drawer totals, sales figures, and any discrepancies noted during the cash count.

- Employee Shift Report: A form that details employee hours worked, cash transactions handled, and any issues encountered during the shift.

These documents collectively support the financial operations of a business. They help maintain accountability, track sales, and ensure that cash handling procedures are followed correctly.