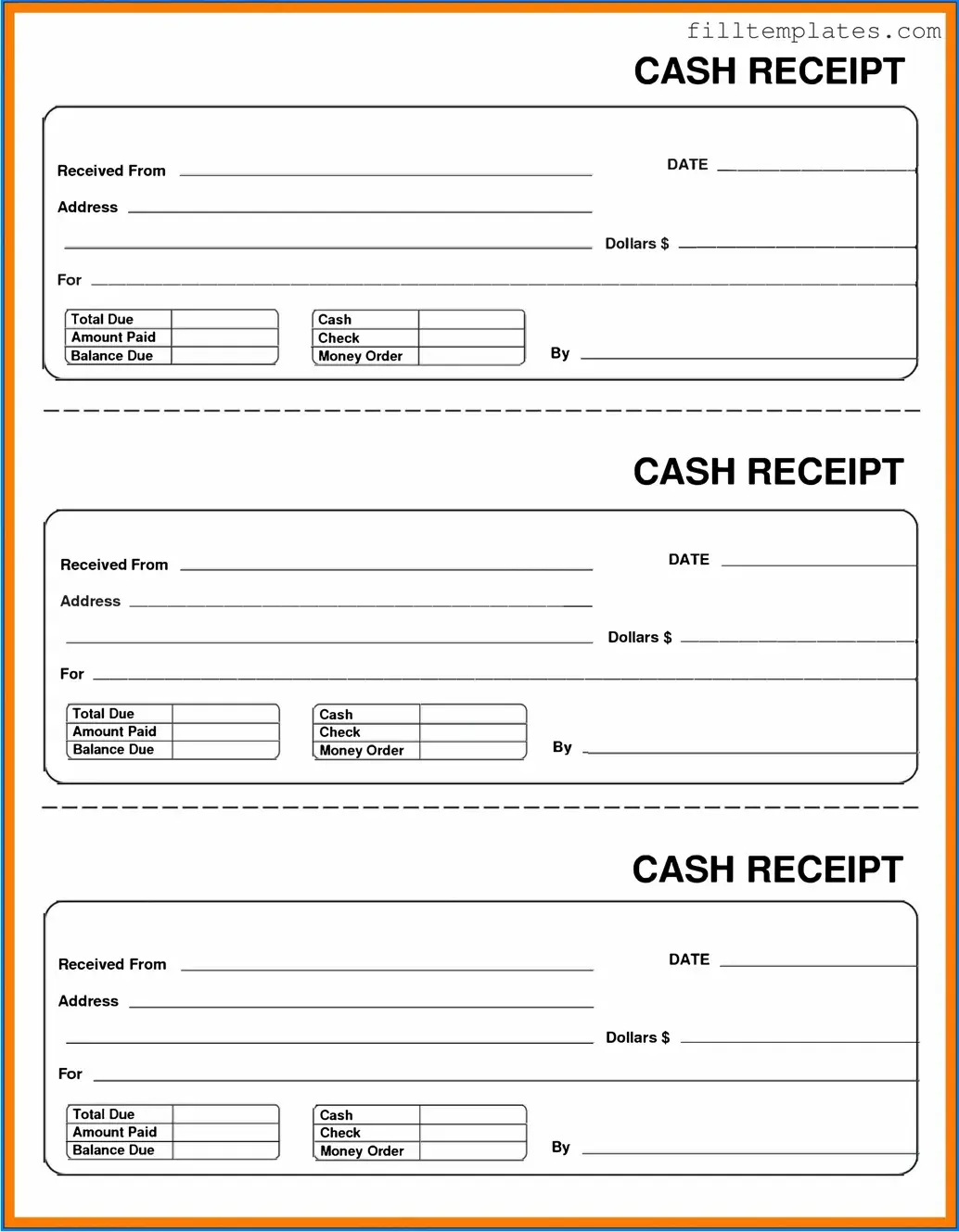

Download Cash Receipt Template

The Cash Receipt form serves as a vital tool for businesses and organizations, facilitating the accurate tracking and documentation of cash transactions. This form typically includes essential details such as the date of the transaction, the amount received, and the method of payment, whether cash, check, or electronic transfer. Additionally, it often captures information about the payer, ensuring that all parties involved are clearly identified. By maintaining a well-organized record of cash inflows, businesses can enhance their financial accountability and streamline their accounting processes. Not only does this form help in reconciling cash balances, but it also plays a crucial role in safeguarding against discrepancies and potential fraud. Overall, the Cash Receipt form is an indispensable component of effective financial management, promoting transparency and accuracy in every transaction.

Key takeaways

When filling out and using the Cash Receipt form, keep these key points in mind:

- Accuracy is crucial. Ensure all information is entered correctly to avoid issues with record-keeping.

- Document all transactions. Each cash receipt should reflect a specific transaction to maintain transparency and accountability.

- Keep copies. Always retain a copy of the completed Cash Receipt form for your records and for future reference.

- Use clear descriptions. Provide detailed descriptions of the transaction to clarify the purpose of the payment.

- Follow internal procedures. Adhere to your organization's policies for processing cash receipts to ensure compliance and consistency.

Guide to Writing Cash Receipt

Once you have the Cash Receipt form in front of you, it’s time to fill it out accurately. Completing this form is essential for maintaining clear financial records. Follow the steps below to ensure that you provide all the necessary information.

- Begin by entering the date on which the cash receipt is being issued. This should be the current date or the date of the transaction.

- Next, fill in the name of the person or organization that is making the payment. Ensure that the name is spelled correctly to avoid any confusion.

- In the next section, specify the amount of cash received. Write the amount clearly, using numbers and words to confirm accuracy.

- Indicate the purpose of the payment. This could be for a service rendered, a product sold, or any other reason for the transaction.

- If applicable, include any reference number related to the transaction. This could be an invoice number or a customer ID.

- Finally, sign the form to validate the receipt. Your signature confirms that the transaction has been completed.

After filling out the Cash Receipt form, keep a copy for your records and provide the original to the payer. This ensures both parties have documentation of the transaction.

Browse Other PDFs

Bathroom Sign Out Sheet Pdf - Facilitate transparency with a review sign-off from management.

When engaging in a motorcycle sale, obtaining a Texas Motorcycle Bill of Sale form is vital. This form not only solidifies the terms of the sale but also ensures that both the seller and buyer maintain clear records of the transaction. For a streamlined process, you can visit smarttemplates.net to access easily fillable templates that comply with state requirements.

Cancel Melaleuca - Make sure to use the appropriate mailing address for submissions.

Form Preview Example

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Documents used along the form

The Cash Receipt form is an essential document for recording cash transactions. However, it often works in conjunction with various other forms and documents that help ensure accurate record-keeping and financial management. Below is a list of commonly used documents that complement the Cash Receipt form.

- Invoice: This document details the goods or services provided to a customer, along with the amount owed. It serves as a request for payment and is often issued before the cash receipt is created.

- Payment Voucher: A payment voucher is used to authorize a payment. It includes details about the transaction and helps ensure that funds are disbursed correctly.

- ATV Bill of Sale Form: When transferring ownership of an ATV, it's essential to utilize the official ATV Bill of Sale documentation to ensure legality and accuracy in the transaction.

- Bank Deposit Slip: This slip is used when depositing cash or checks into a bank account. It provides a record of the transaction and is essential for reconciling bank statements.

- Sales Receipt: A sales receipt is provided to customers as proof of purchase. It includes details about the transaction and can be used for returns or exchanges.

- Credit Memo: This document is issued to reduce the amount owed by a customer, typically due to returns or discounts. It helps maintain accurate accounts receivable records.

- Expense Report: An expense report outlines costs incurred by employees on behalf of the company. It is often submitted for reimbursement and must be supported by receipts.

- Cash Disbursement Journal: This journal records all cash payments made by a business. It helps track cash flow and is essential for financial reporting.

- Accounts Receivable Aging Report: This report categorizes outstanding invoices based on how long they have been due. It helps businesses manage collections effectively.

- Petty Cash Log: A petty cash log tracks small, incidental expenses paid in cash. It helps ensure that petty cash funds are accounted for and replenished as needed.

Understanding these documents can significantly enhance financial accuracy and transparency within an organization. Each plays a vital role in the overall financial ecosystem, ensuring that every transaction is properly documented and accounted for.