Download Citibank Direct Deposit Template

For individuals seeking a seamless banking experience, the Citibank Direct Deposit form serves as an essential tool for managing income efficiently. This form simplifies the process of having funds, such as paychecks or government benefits, deposited directly into a Citibank account. By utilizing this service, customers can enjoy the convenience of immediate access to their money without the need to visit a bank or ATM. The form typically requires key information, including the account holder’s name, account number, and the bank's routing number, ensuring that deposits are accurately directed. Additionally, it often includes sections for authorization, allowing employers or payers to verify that they have permission to deposit funds into the designated account. As a result, the Citibank Direct Deposit form not only enhances financial management but also promotes security and reliability in the handling of personal finances.

Key takeaways

When filling out the Citibank Direct Deposit form, keep these key takeaways in mind:

- Ensure you have your bank account number and routing number readily available.

- Complete all required fields accurately to avoid processing delays.

- Double-check the account type, whether it’s checking or savings.

- Provide your employer or payer’s information in the designated section.

- Sign and date the form to validate your request.

- Submit the form to your employer or the organization responsible for the deposit.

- Keep a copy of the completed form for your records.

- Monitor your bank account to confirm that deposits are being made correctly.

Guide to Writing Citibank Direct Deposit

After obtaining the Citibank Direct Deposit form, you are ready to begin the process of filling it out. This form allows you to set up direct deposit for your paycheck or other payments directly into your Citibank account. Follow these steps carefully to ensure that all necessary information is provided accurately.

- Begin by entering your personal information at the top of the form. This typically includes your full name, address, and contact number.

- Locate the section for account information. Here, you will need to provide your Citibank account number. Double-check this number to avoid any errors.

- Next, find the routing number section. You can usually find your Citibank routing number on your checks or by contacting customer service. Enter this number accurately.

- Indicate the type of account you are using for direct deposit. You will typically choose between a checking or savings account.

- If applicable, include any additional instructions or details requested on the form. This might involve specifying the percentage or amount of your deposit.

- Sign and date the form at the bottom. Your signature is essential for authorization.

- Finally, review the entire form for any mistakes before submitting it to your employer or the relevant payroll department.

Browse Other PDFs

Official Girlfriend Application - Looking for a like-minded individual who enjoys fitness classes.

When engaging in the sale or purchase of a Recreational Vehicle (RV) in Arizona, it is essential to have the proper documentation in place. The Arizona RV Bill of Sale form plays a significant role in this process, acting as a legal record of the transaction between buyer and seller. Without this form, the transfer of ownership may not be recognized, leading to potential complications down the line. For detailed guidance on how to complete this important document, refer to the RV Bill of Sale form which provides the necessary structure and information for a smooth sale.

Payroll Status Change Form - Facilitate seamless transitions in employment categories.

Form Preview Example

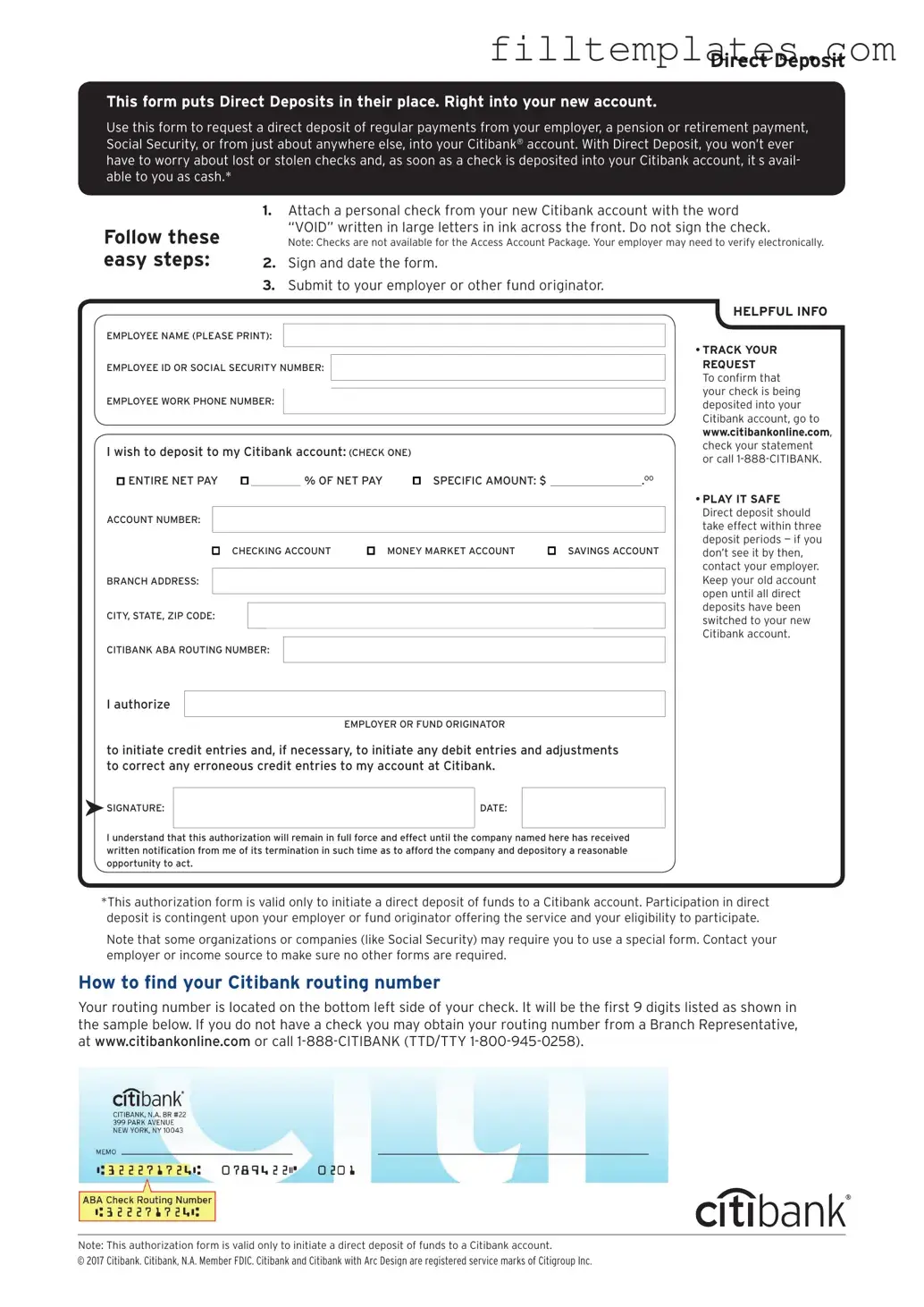

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Documents used along the form

When setting up direct deposit with Citibank, several other forms and documents may be required to ensure a smooth process. Each document serves a specific purpose and helps verify your information or facilitate the direct deposit setup. Here’s a list of common forms you might encounter:

- W-4 Form: This form is used to determine the amount of federal income tax to withhold from your paycheck. It ensures that your tax deductions align with your financial situation.

- Bank Account Verification Letter: A letter from your bank confirming your account details, including your account number and routing number, may be needed to validate your direct deposit information.

- Employment Verification Form: This document confirms your employment status and may be required by Citibank to process your direct deposit request.

- Payroll Authorization Form: This form authorizes your employer to deposit your salary directly into your bank account, streamlining the payment process.

- Tax Identification Number (TIN) Certification: This form certifies your TIN, which is essential for tax reporting purposes and may be required for setting up direct deposit.

- Direct Deposit Authorization Agreement: This agreement outlines the terms and conditions of your direct deposit arrangement with your employer or Citibank.

- Change of Address Form: If you’ve recently moved, this form updates your address with your employer and ensures that all correspondence is sent to the correct location.

- Texas Motorcycle Bill of Sale: A crucial document for finalizing the sale and purchase of a motorcycle in Texas, confirming ownership transfer between parties. For more information, visit smarttemplates.net.

- State Tax Withholding Form: Depending on your state, this form allows you to specify how much state tax should be withheld from your paycheck.

Having these documents ready can help you navigate the direct deposit setup process more efficiently. Always ensure that you provide accurate and up-to-date information to avoid any delays in receiving your funds.