Free Deed Template

The Deed form serves as a critical instrument in property transactions, establishing ownership and outlining the rights associated with a property. This legal document is essential for transferring real estate and can include various types such as warranty deeds, quitclaim deeds, and special purpose deeds. Each type has its own implications for both the grantor and grantee. The form must include specific details, including the names of the parties involved, a clear description of the property, and the signature of the grantor, which must be notarized in many jurisdictions. Understanding the nuances of the Deed form can help ensure a smooth transfer of property rights and protect the interests of all parties involved. Whether you are buying, selling, or transferring property, knowing how to properly execute a Deed form is fundamental to safeguarding your investment and ensuring legal compliance.

Deed - Adapted for State

Key takeaways

When filling out and using a Deed form, it’s essential to understand its purpose and the details involved. Here are some key takeaways to consider:

- Understand the Purpose: A Deed is a legal document that conveys ownership or interest in property.

- Identify the Parties: Clearly state the names and addresses of all parties involved in the transaction.

- Property Description: Provide a detailed description of the property being transferred, including boundaries and any relevant identifiers.

- Signatures Required: Ensure that all parties sign the Deed in the presence of a notary public, as this adds a layer of authenticity.

- Consider Witnesses: Depending on state laws, having witnesses sign may be necessary to validate the Deed.

- Record the Deed: After signing, file the Deed with the appropriate county office to make the transfer official and public.

- Review State Laws: Each state has specific requirements regarding Deeds, so familiarize yourself with local regulations.

- Seek Legal Advice: If unsure about any aspect of the Deed, consulting with a legal professional can provide clarity and prevent future issues.

Guide to Writing Deed

After obtaining the Deed form, you are ready to complete it with the necessary information. This process involves providing accurate details about the parties involved and the property in question. Following these steps will help ensure that the form is filled out correctly.

- Begin by entering the date at the top of the form.

- Identify the grantor (the person transferring the property) by writing their full name and address in the designated section.

- Next, identify the grantee (the person receiving the property) by including their full name and address.

- Provide a legal description of the property. This may include the lot number, block number, and any other identifying information.

- Specify the consideration, which is the amount of money or value exchanged for the property.

- Include any additional terms or conditions relevant to the transfer, if applicable.

- Have the grantor sign and date the form in the appropriate area.

- If required, have the signature notarized by a licensed notary public.

- Finally, submit the completed form to the appropriate local office for recording.

Other Forms:

Letter of Rec Format - This letter emphasizes the candidate's unique skills and potential for success.

To obtain a valid Doctor's Excuse Note, individuals can utilize various resources available online, including helpful templates that simplify the process of documentation. For instance, one can visit smarttemplates.net/fillable-doctors-excuse-note to find fillable forms that ensure all essential information is accurately captured, streamlining the verification process for work or school absences.

Who Buys Art Prints - Allows for the identification of the artwork sold.

House Rental Application - An application may allow for multiple tenants to apply together.

Form Preview Example

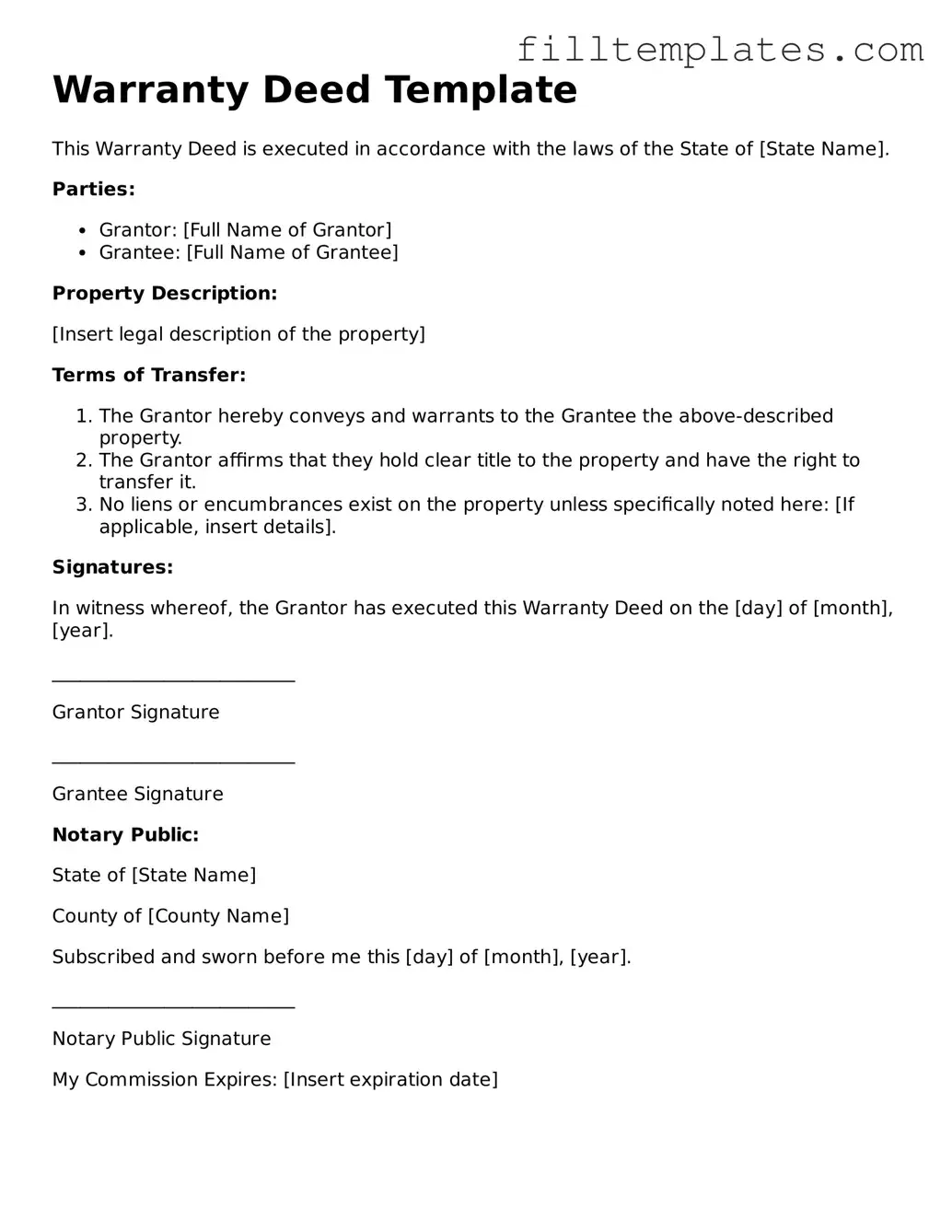

Warranty Deed Template

This Warranty Deed is executed in accordance with the laws of the State of [State Name].

Parties:

- Grantor: [Full Name of Grantor]

- Grantee: [Full Name of Grantee]

Property Description:

[Insert legal description of the property]

Terms of Transfer:

- The Grantor hereby conveys and warrants to the Grantee the above-described property.

- The Grantor affirms that they hold clear title to the property and have the right to transfer it.

- No liens or encumbrances exist on the property unless specifically noted here: [If applicable, insert details].

Signatures:

In witness whereof, the Grantor has executed this Warranty Deed on the [day] of [month], [year].

__________________________

Grantor Signature

__________________________

Grantee Signature

Notary Public:

State of [State Name]

County of [County Name]

Subscribed and sworn before me this [day] of [month], [year].

__________________________

Notary Public Signature

My Commission Expires: [Insert expiration date]

Documents used along the form

When dealing with property transactions, the Deed form is a critical document. However, it is often accompanied by other forms and documents that help clarify ownership, facilitate the transfer, and ensure compliance with legal requirements. Here are five important documents that are commonly used alongside the Deed form:

- Title Search Report: This document provides a detailed history of the property’s ownership. It helps identify any liens, encumbrances, or claims against the property, ensuring that the buyer is fully informed before making a purchase.

- Emotional Support Animal Letter: This letter serves as a formal document from a licensed mental health professional, verifying an individual's need for the companionship of an emotional support animal (ESA). For more information, visit OnlineLawDocs.com.

- Bill of Sale: Often used in conjunction with a Deed, this document transfers ownership of personal property that may be included in the sale, such as appliances or fixtures. It serves as proof of the transaction between the buyer and seller.

- Affidavit of Title: This sworn statement from the seller confirms their legal ownership of the property and asserts that there are no undisclosed claims or liens. It provides additional assurance to the buyer regarding the property’s title status.

- Closing Statement: Also known as a settlement statement, this document outlines all the financial aspects of the transaction. It details the costs involved, including closing costs, taxes, and any adjustments, ensuring transparency for both parties.

- Property Disclosure Statement: This document requires the seller to disclose any known issues with the property, such as structural problems or past repairs. It protects the buyer by providing essential information about the condition of the property.

Understanding these documents can help ensure a smooth property transaction. Each plays a vital role in protecting the interests of both buyers and sellers, making the process clearer and more secure.