Free Deed in Lieu of Foreclosure Template

The Deed in Lieu of Foreclosure is a legal instrument that allows homeowners facing financial difficulties to transfer ownership of their property to the lender, thereby avoiding the lengthy and often stressful process of foreclosure. This option can be beneficial for both parties involved. For homeowners, it provides a way to relinquish their mortgage obligations and mitigate the negative impact on their credit score that typically accompanies foreclosure. Lenders, on the other hand, may prefer this route as it can reduce the costs and time associated with foreclosing on a property. The process generally requires the homeowner to be in default on their mortgage payments, and the lender must agree to accept the deed in lieu as a resolution. Additionally, the homeowner may need to provide financial documentation to demonstrate their inability to continue making payments. It is important for individuals considering this option to understand the implications, including potential tax consequences and the effect on future borrowing capabilities. Overall, the Deed in Lieu of Foreclosure serves as an alternative solution that aims to facilitate a smoother transition for those in distress while also serving the interests of lenders.

Key takeaways

Filling out and using a Deed in Lieu of Foreclosure form can be a significant step for homeowners facing financial difficulties. Here are some key takeaways to consider:

- Understand the Process: A Deed in Lieu of Foreclosure allows you to transfer your property to the lender to avoid foreclosure.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically assess your financial situation and the property's condition.

- Consult with Professionals: It's advisable to seek guidance from a real estate attorney or a housing counselor before proceeding.

- Prepare Documentation: Gather necessary documents, such as your mortgage statement and proof of income, to support your request.

- Communicate with Your Lender: Open lines of communication can help facilitate the process and clarify any questions you may have.

- Consider Tax Implications: Transferring your property may have tax consequences. Consult a tax professional to understand potential impacts.

- Impact on Credit Score: A Deed in Lieu of Foreclosure can affect your credit score, but it may be less damaging than a foreclosure.

- Release from Debt: This process can help you walk away from your mortgage debt, but be aware of any remaining obligations.

- Seek Alternatives: Explore other options, such as loan modifications or short sales, which might be more beneficial for your situation.

Being informed and prepared can make the process smoother and help you make the best decision for your financial future.

Guide to Writing Deed in Lieu of Foreclosure

Once you have completed the Deed in Lieu of Foreclosure form, the next step involves submitting it to the appropriate parties, typically your lender. This document will facilitate the transfer of property ownership and help you avoid the lengthy foreclosure process. Ensure that all information is accurate and complete to prevent any delays.

- Begin by downloading the Deed in Lieu of Foreclosure form from a reliable source or obtain a copy from your lender.

- Read through the entire form carefully to understand the requirements and ensure you have all necessary information at hand.

- Fill in your name and contact information in the designated fields, ensuring accuracy.

- Provide the property address, including the city, state, and ZIP code.

- Include the legal description of the property, which can often be found on your mortgage documents or property tax statements.

- Indicate the lender's name and address in the appropriate section of the form.

- Specify the loan number associated with the property to help the lender identify your account.

- Sign and date the form in the designated areas. Ensure that all signatures are notarized as required.

- Make copies of the completed form for your records before submission.

- Submit the form to your lender, either by mail or in person, and keep a record of the submission date.

Create Popular Types of Deed in Lieu of Foreclosure Templates

Correction Deed Form California - This form is essential for fixing errors found in property deeds, ensuring accuracy in property records.

Obtaining a Doctor's Excuse Note is essential for individuals who need to validate their absence due to medical reasons, ensuring their obligations to work or school are respected. For those seeking a reliable template to simplify this process, a great resource can be found at https://smarttemplates.net/fillable-doctors-excuse-note, which offers fillable options to meet various needs and streamline the communication between healthcare providers and institutions.

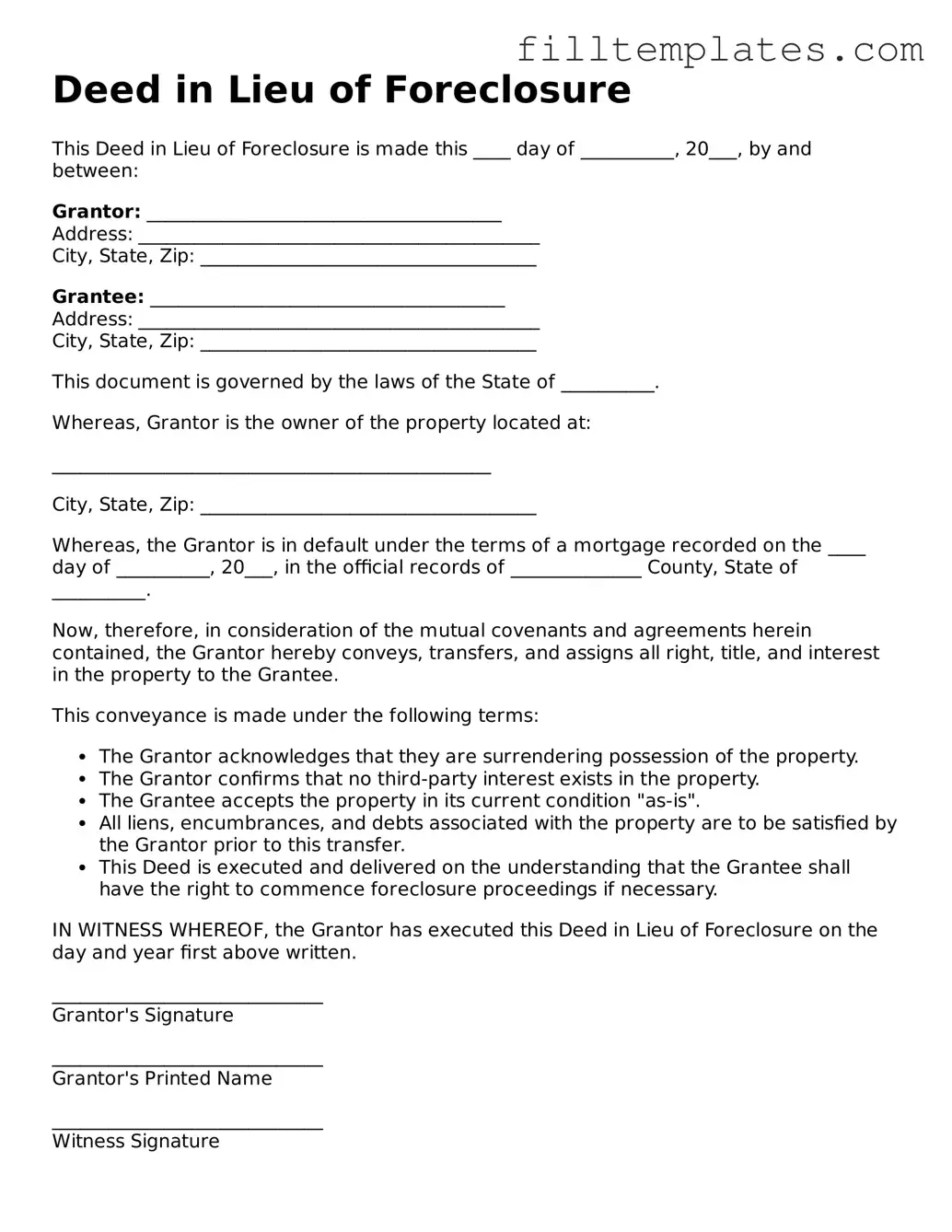

Form Preview Example

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made this ____ day of __________, 20___, by and between:

Grantor: ______________________________________

Address: ___________________________________________

City, State, Zip: ____________________________________

Grantee: ______________________________________

Address: ___________________________________________

City, State, Zip: ____________________________________

This document is governed by the laws of the State of __________.

Whereas, Grantor is the owner of the property located at:

_______________________________________________

City, State, Zip: ____________________________________

Whereas, the Grantor is in default under the terms of a mortgage recorded on the ____ day of __________, 20___, in the official records of ______________ County, State of __________.

Now, therefore, in consideration of the mutual covenants and agreements herein contained, the Grantor hereby conveys, transfers, and assigns all right, title, and interest in the property to the Grantee.

This conveyance is made under the following terms:

- The Grantor acknowledges that they are surrendering possession of the property.

- The Grantor confirms that no third-party interest exists in the property.

- The Grantee accepts the property in its current condition "as-is".

- All liens, encumbrances, and debts associated with the property are to be satisfied by the Grantor prior to this transfer.

- This Deed is executed and delivered on the understanding that the Grantee shall have the right to commence foreclosure proceedings if necessary.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure on the day and year first above written.

_____________________________

Grantor's Signature

_____________________________

Grantor's Printed Name

_____________________________

Witness Signature

_____________________________

Witness Printed Name

_____________________________

Notary Public (if required)

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender in order to avoid foreclosure. When engaging in this process, several other forms and documents may be necessary to ensure a smooth transaction. Below is a list of commonly used documents that accompany a Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines the new terms of the mortgage, which may include changes to the interest rate, payment schedule, or loan balance. It is often used when a borrower seeks to adjust their loan instead of pursuing foreclosure.

- Property Inspection Report: This report provides an assessment of the property's condition. Lenders typically require this document to evaluate the property's value and any necessary repairs before accepting a deed in lieu.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage after the deed is executed. It protects the homeowner from being pursued for any remaining debt on the loan.

- Title Search Report: A title search is conducted to ensure that the property title is clear of any liens or claims. This report is essential for the lender to confirm ownership before accepting the deed.

- Affidavit of Title: This sworn statement confirms that the seller has the right to transfer the property and that there are no undisclosed issues affecting the title. It provides additional assurance to the lender.

- FedEx Bill of Lading: This important document outlines the terms and conditions for shipping goods via FedEx services, ensuring accountability between all parties involved. For more detailed information, visit https://toptemplates.info.

- Closing Statement: This document outlines all financial transactions related to the transfer of the property. It includes details about any fees, credits, and the final amounts exchanged between the parties.

- Power of Attorney: If the homeowner cannot be present to sign the deed, a power of attorney may be used. This document allows another person to act on behalf of the homeowner in the transaction.

Understanding these documents can help facilitate the process of a Deed in Lieu of Foreclosure. Each plays a crucial role in ensuring that both the homeowner and the lender are protected during this transition. It is advisable to review these documents carefully and consult with a professional if needed.