Free Deed of Trust Template

When navigating the world of real estate transactions, understanding the Deed of Trust form is essential for both buyers and lenders. This legal document serves as a pivotal instrument in securing a loan, effectively establishing a relationship between the borrower, the lender, and a third-party trustee. Unlike a traditional mortgage, which directly ties the borrower to the lender, a Deed of Trust introduces an intermediary, ensuring that the property acts as collateral for the loan. Within its pages, the form outlines crucial details such as the loan amount, interest rate, and repayment terms, as well as the responsibilities of each party involved. It also delineates the process for foreclosure should the borrower default on the loan, providing a clear pathway for the lender to reclaim the property. By understanding the nuances of the Deed of Trust, individuals can better navigate their financial obligations and protect their interests in the property market.

Key takeaways

Filling out and using a Deed of Trust form is a significant step in real estate transactions. Here are some essential takeaways to consider:

- Understand the Purpose: A Deed of Trust serves as a security instrument for a loan, allowing a lender to secure a borrower's obligation.

- Identify the Parties: Clearly specify the borrower, lender, and trustee involved in the agreement to avoid confusion.

- Property Description: Provide a detailed description of the property being financed. This includes the address and any relevant legal descriptions.

- Loan Amount: Clearly state the total loan amount being secured by the Deed of Trust.

- Terms of the Loan: Outline the repayment terms, including interest rates and payment schedules, to ensure all parties are informed.

- Signatures Required: Ensure that all parties involved sign the document. This includes the borrower, lender, and trustee.

- Notarization: Have the Deed of Trust notarized to add an extra layer of authenticity and legal standing.

- Record the Deed: Submit the Deed of Trust to the appropriate county office for recording. This protects the lender's interest in the property.

- Consult Legal Counsel: Consider seeking legal advice to ensure compliance with local laws and regulations, especially if questions arise.

By following these key points, individuals can navigate the complexities of a Deed of Trust more effectively and secure their interests in real estate transactions.

Guide to Writing Deed of Trust

Once you have the Deed of Trust form in hand, you are ready to begin filling it out. This form requires specific information to ensure that it is completed correctly. Follow the steps below to provide the necessary details accurately.

- Start with the date at the top of the form. Write the date when the document is being executed.

- Identify the borrower. Fill in the full legal name of the borrower or borrowers. Include any middle names or initials as necessary.

- Provide the address of the borrower. This should be the primary residence of the borrower, including street address, city, state, and zip code.

- Next, enter the lender's information. Write the full legal name of the lender or lending institution.

- Include the lender's address. This should be the official address of the lender, including street address, city, state, and zip code.

- Fill in the amount of the loan. Clearly state the total loan amount in both numbers and words to avoid any confusion.

- Specify the property address. Write the full address of the property that is being secured by the Deed of Trust.

- List any additional terms or conditions if applicable. This may include specific agreements between the borrower and lender.

- Sign the form. The borrower must sign and date the document at the designated area.

- Have the document notarized. A notary public should witness the signing and provide their seal.

After completing the Deed of Trust form, ensure that all information is accurate. The next step involves submitting the form to the appropriate county office for recording. This will officially document the Deed of Trust in public records.

Create Popular Types of Deed of Trust Templates

Ladybird Deed Michigan Form - This type of deed is recognized in many states and can be adapted to meet specific state laws.

For those looking to navigate the process of transferring property ownership in Georgia, utilizing the correct legal documentation is essential; you can find the necessary forms and guidance at Georgia PDF.

Simple Deed of Gift Template - A properly executed Gift Deed can prevent future claims against the gifted property.

Deed-in-lieu of Foreclosure - This alternative requires careful consideration from both borrower and lender regarding terms and conditions.

Form Preview Example

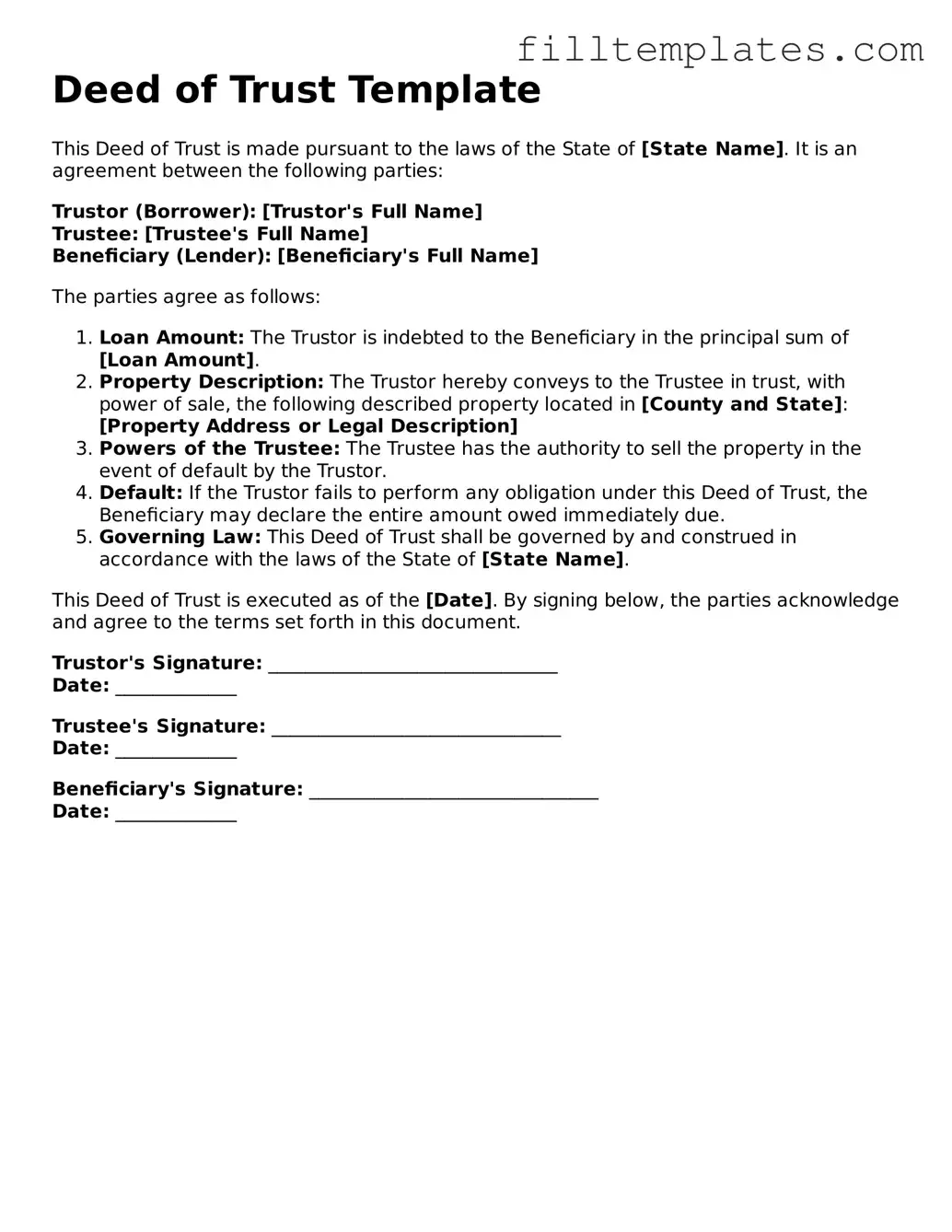

Deed of Trust Template

This Deed of Trust is made pursuant to the laws of the State of [State Name]. It is an agreement between the following parties:

Trustor (Borrower): [Trustor's Full Name]

Trustee: [Trustee's Full Name]

Beneficiary (Lender): [Beneficiary's Full Name]

The parties agree as follows:

- Loan Amount: The Trustor is indebted to the Beneficiary in the principal sum of [Loan Amount].

- Property Description: The Trustor hereby conveys to the Trustee in trust, with power of sale, the following described property located in [County and State]:

[Property Address or Legal Description] - Powers of the Trustee: The Trustee has the authority to sell the property in the event of default by the Trustor.

- Default: If the Trustor fails to perform any obligation under this Deed of Trust, the Beneficiary may declare the entire amount owed immediately due.

- Governing Law: This Deed of Trust shall be governed by and construed in accordance with the laws of the State of [State Name].

This Deed of Trust is executed as of the [Date]. By signing below, the parties acknowledge and agree to the terms set forth in this document.

Trustor's Signature: _______________________________

Date: _____________

Trustee's Signature: _______________________________

Date: _____________

Beneficiary's Signature: _______________________________

Date: _____________

Documents used along the form

The Deed of Trust is a critical document in real estate transactions, particularly in states that use this form instead of a mortgage. However, it is often accompanied by several other important documents that play essential roles in the lending and property transfer process. Below is a list of commonly used forms and documents that you may encounter alongside a Deed of Trust.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It specifies the loan amount, interest rate, repayment schedule, and consequences of default.

- Loan Application: Also known as the 1003 form, this application collects essential information about the borrower’s financial history, employment, and creditworthiness.

- Quitclaim Deed: This document allows the transfer of property ownership without any guarantees on the title's validity, often used between family members or to resolve title issues. More information can be found at quitclaimdeedtemplate.com/colorado-quitclaim-deed-template/.

- Title Insurance Policy: This protects the lender and/or borrower against any claims or disputes regarding the property’s title. It ensures that the title is clear of any liens or encumbrances.

- Closing Disclosure: Required by law, this document provides a detailed account of the final terms and costs of the mortgage. It ensures transparency in the closing process.

- Property Inspection Report: This report assesses the condition of the property and identifies any necessary repairs or issues that could affect its value.

- Appraisal Report: Conducted by a licensed appraiser, this document determines the property's market value, which is essential for the lender’s risk assessment.

- Escrow Agreement: This outlines the terms under which an escrow agent holds funds and documents until all conditions of the sale are met.

- Deed of Reconveyance: Once the loan is paid off, this document is issued to transfer the title back to the borrower, confirming that the debt has been satisfied.

- Affidavit of Title: This sworn statement by the seller affirms their ownership of the property and that there are no undisclosed liens or claims against it.

Understanding these documents is vital for anyone involved in a real estate transaction. Each plays a specific role in ensuring that the process is smooth and legally sound. Being informed can empower borrowers and lenders alike, reducing the risk of complications down the line.