Free Employee Loan Agreement Template

When employees need financial assistance, an Employee Loan Agreement form can provide a clear framework for both parties. This document outlines the terms and conditions under which a loan is granted, ensuring that both the employer and employee have a mutual understanding of their responsibilities. Key aspects include the loan amount, repayment schedule, interest rates, and any applicable fees. It also details the consequences of defaulting on the loan, protecting the interests of the employer while providing transparency to the employee. Additionally, the agreement may specify whether the loan is secured or unsecured, and it often requires signatures from both the employee and a representative of the company. By using this form, employers can help employees navigate their financial needs while maintaining a professional relationship built on trust and clarity.

Key takeaways

Filling out and using the Employee Loan Agreement form is an important process for both employers and employees. Here are some key takeaways to keep in mind:

- Understand the Purpose: This form outlines the terms of a loan given to an employee by the employer.

- Clear Terms: Make sure all loan terms, including the amount, interest rate, and repayment schedule, are clearly stated.

- Legal Compliance: Ensure the agreement complies with local and federal laws regarding employee loans.

- Employee Acknowledgment: The employee must acknowledge their understanding of the terms before signing.

- Document Everything: Keep a signed copy of the agreement for both parties for record-keeping purposes.

- Repayment Process: Clearly outline how repayments will be deducted from the employee's paycheck.

- Default Consequences: Specify what happens if the employee fails to repay the loan as agreed.

- Interest Rates: If applicable, ensure the interest rate is reasonable and complies with regulations.

- Review Period: Allow time for both parties to review the agreement before signing.

Following these guidelines will help ensure that the Employee Loan Agreement is effective and fair for everyone involved.

Guide to Writing Employee Loan Agreement

Filling out the Employee Loan Agreement form is an important step in securing a loan. It is crucial to provide accurate information to ensure a smooth process. Follow these steps carefully to complete the form correctly.

- Begin by entering your full name in the designated field.

- Provide your employee identification number. This helps to verify your employment status.

- Fill in your current address, including city, state, and zip code.

- State the amount of the loan you are requesting. Be specific and clear.

- Indicate the purpose of the loan. This helps the employer understand your needs.

- Specify the repayment terms, including the duration and frequency of payments.

- Sign and date the form at the bottom. Your signature confirms your agreement to the terms outlined.

- Submit the completed form to the appropriate department as indicated in the instructions.

Once you have filled out the form, it will be reviewed by the necessary parties. They will assess your request and get back to you with further instructions or any additional information needed.

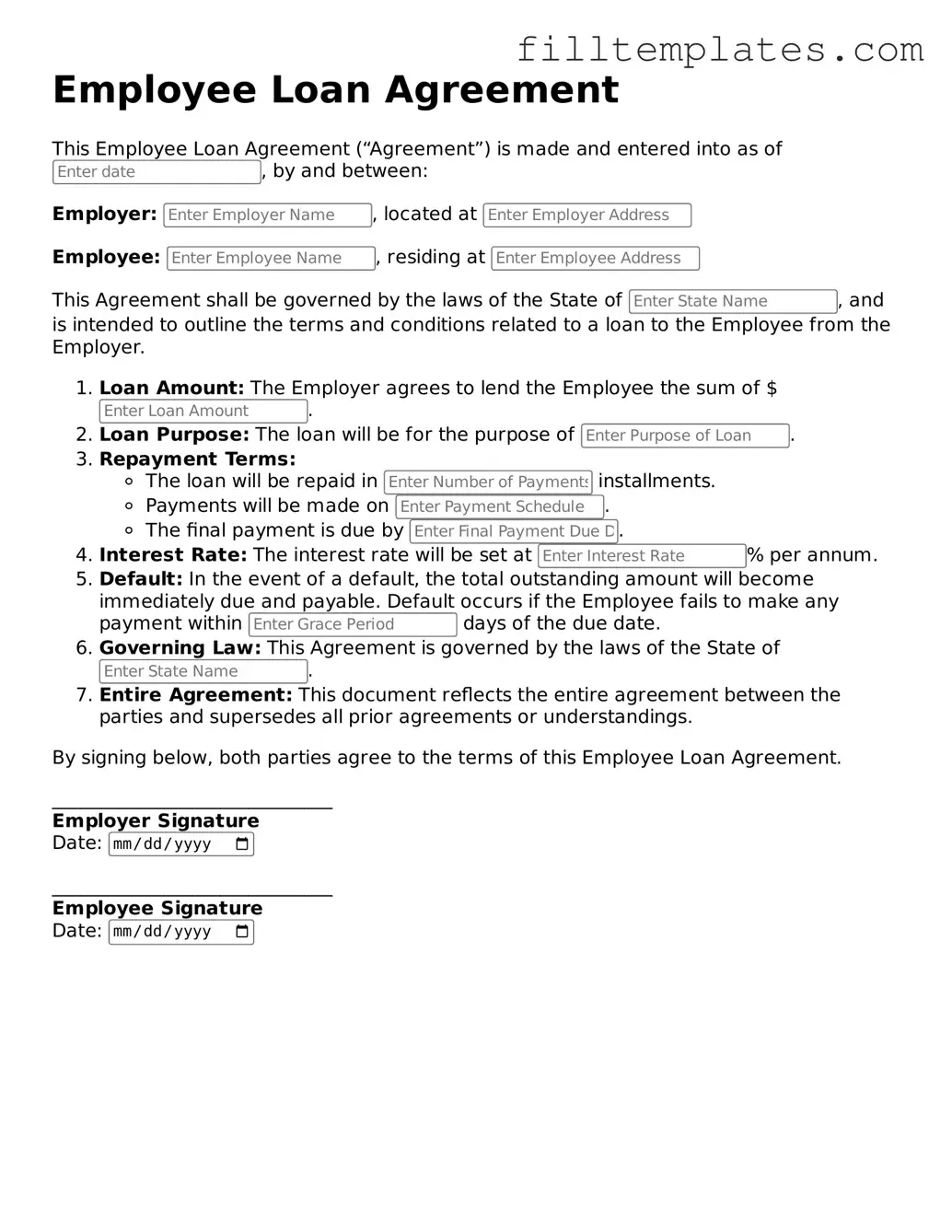

Form Preview Example

Employee Loan Agreement

This Employee Loan Agreement (“Agreement”) is made and entered into as of , by and between:

Employer: , located at

Employee: , residing at

This Agreement shall be governed by the laws of the State of , and is intended to outline the terms and conditions related to a loan to the Employee from the Employer.

- Loan Amount: The Employer agrees to lend the Employee the sum of $.

- Loan Purpose: The loan will be for the purpose of .

- Repayment Terms:

- The loan will be repaid in installments.

- Payments will be made on .

- The final payment is due by .

- Interest Rate: The interest rate will be set at % per annum.

- Default: In the event of a default, the total outstanding amount will become immediately due and payable. Default occurs if the Employee fails to make any payment within days of the due date.

- Governing Law: This Agreement is governed by the laws of the State of .

- Entire Agreement: This document reflects the entire agreement between the parties and supersedes all prior agreements or understandings.

By signing below, both parties agree to the terms of this Employee Loan Agreement.

______________________________

Employer Signature

Date:

______________________________

Employee Signature

Date:

Documents used along the form

When entering into an Employee Loan Agreement, several other forms and documents may be necessary to ensure clarity and protect the interests of both the employer and the employee. Each of these documents serves a specific purpose in the loan process, facilitating a smooth transaction and clear communication.

- Loan Application Form: This document is completed by the employee to request a loan. It typically includes personal information, the amount requested, and the purpose of the loan.

- Repayment Schedule: This outlines the terms of repayment, including the amount due, frequency of payments, and the total duration of the loan. It helps both parties understand their obligations.

- Promissory Note: A legal document in which the employee promises to repay the loan under the agreed terms. It includes details such as interest rates and penalties for late payments.

- Loan Agreement Template: This template serves as a guide to creating a customized loan agreement, ensuring all necessary terms are included. For a convenient option, you can explore the template available at legaldocumentstemplates.com.

- Employment Verification Form: This document confirms the employee’s job status and income, which can be crucial for assessing the employee’s ability to repay the loan.

- Loan Disclosure Statement: This provides detailed information about the loan terms, including interest rates and fees. It ensures transparency and helps the employee make informed decisions.

- Termination of Employment Agreement: This outlines what happens to the loan if the employee leaves the company. It clarifies the repayment process and any potential consequences for the employee.

These documents collectively help to create a comprehensive framework for the loan agreement. They ensure that both the employer and the employee are on the same page regarding expectations, responsibilities, and consequences, ultimately fostering a more transparent and secure lending environment.