Download Fl Dr 312 Template

The FL DR 312 form, known as the Affidavit of No Florida Estate Tax Due, serves a crucial role for personal representatives managing estates in Florida. This form is utilized when an estate is not subject to Florida estate tax under Chapter 198 of the Florida Statutes, and it is confirmed that a federal estate tax return is not required. The personal representative must complete the form, providing details about the decedent, including their name, date of death, and residency status. The form also requires the representative to acknowledge their liability for any distributions made from the estate. By filing the FL DR 312, the personal representative can effectively remove the Department of Revenue's estate tax lien, thus facilitating the transfer of property. It is important to note that this affidavit cannot be used for estates that are required to file federal Form 706 or 706-NA. The completed form must be filed directly with the clerk of the circuit court in the county where the decedent owned property, and it is not to be mailed to the Florida Department of Revenue. Understanding the proper use and filing process of the FL DR 312 form is essential for personal representatives to ensure compliance with state tax regulations.

Key takeaways

- Form Purpose: The Fl Dr 312 form, known as the Affidavit of No Florida Estate Tax Due, is used to confirm that an estate does not owe Florida estate tax and that no federal estate tax return is required.

- Who Can Use It: This form can be completed by personal representatives or anyone in possession of property included in the decedent's gross estate.

- Filing Instructions: File the form directly with the clerk of the circuit court in the county where the decedent owned property. Do not send it to the Florida Department of Revenue.

- Important Limitations: The Fl Dr 312 cannot be used if a federal estate tax return (Form 706 or 706-NA) is required. Ensure that you check the federal thresholds before filing.

Guide to Writing Fl Dr 312

Filling out the Fl Dr 312 form is a necessary step for personal representatives when no Florida estate tax is due. This form, titled "Affidavit of No Florida Estate Tax Due," must be submitted to the appropriate clerk of the court. It serves to confirm that the estate does not owe any taxes and helps release any liens related to the estate tax.

- Begin by printing your name in the designated space for the personal representative at the top of the form.

- Next, write the name of the decedent in the space provided.

- Fill in the date of death in the format of MM/DD/YYYY.

- Indicate the state where the decedent was domiciled at the time of death.

- Check the appropriate box to indicate whether the decedent was a U.S. citizen or not.

- Confirm that a federal estate tax return (Form 706 or 706-NA) is not required by marking the corresponding statement.

- State that the estate does not owe Florida estate tax as per Chapter 198, F.S.

- Acknowledge your personal liability regarding the distribution of the estate by checking the acknowledgment box.

- Sign and date the form in the provided spaces.

- Print your name again beneath your signature.

- Provide your telephone number, mailing address, and city/state/ZIP code in the respective fields.

- Ensure that you leave the 3-inch by 3-inch space in the upper right corner blank for the clerk's use.

- Submit the completed form to the clerk of the circuit court in the county where the decedent owned property.

Browse Other PDFs

Contracts for Owner Operators - All transportation must comply with federal, state, and local regulations, especially when handling hazardous materials.

Charts in Ms Word - Column 2: Marketing Strategies

For those looking to ensure compliance in their transactions, the New York Boat Bill of Sale provides a crucial framework for documenting the sale, making it an essential resource for any buyer or seller. You can find a comprehensive guide to this process in our detailed Boat Bill of Sale template.

Ps Form 2574 - The form is updated periodically, so versions may vary over time.

Form Preview Example

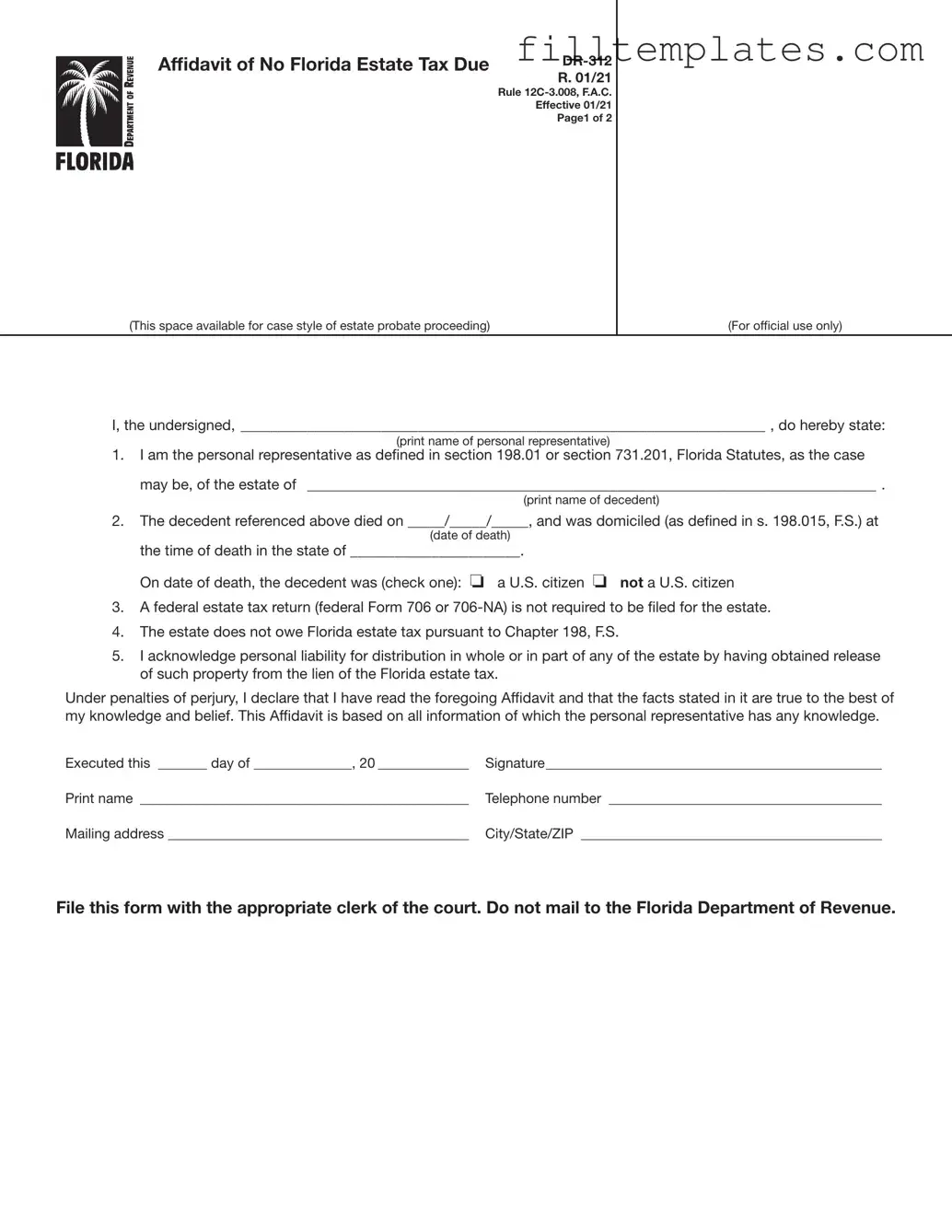

Affidavit of No Florida Estate Tax Due

Rule

Effective 01/21

Page1 of 2

(This space available for case style of estate probate proceeding) |

(For official use only) |

I, the undersigned, _______________________________________________________________________ , do hereby state:

(print name of personal representative)

1.I am the personal representative as defined in section 198.01 or section 731.201, Florida Statutes, as the case may be, of the estate of _____________________________________________________________________________ .

(print name of decedent)

2.The decedent referenced above died on _____/_____/_____, and was domiciled (as defined in s. 198.015, F.S.) at

(date of death)

the time of death in the state of _______________________.

On date of death, the decedent was (check one): o a U.S. citizen o not a U.S. citizen

3.A federal estate tax return (federal Form 706 or

4.The estate does not owe Florida estate tax pursuant to Chapter 198, F.S.

5.I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of such property from the lien of the Florida estate tax.

Under penalties of perjury, I declare that I have read the foregoing Affidavit and that the facts stated in it are true to the best of my knowledge and belief. This Affidavit is based on all information of which the personal representative has any knowledge.

Executed this _______ day of ______________, 20 _____________ |

Signature________________________________________________ |

Print name _______________________________________________ |

Telephone number _______________________________________ |

Mailing address ___________________________________________ |

City/State/ZIP ___________________________________________ |

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

R. 01/21

Page 2 of 2

Instructions for Completing Form

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

General Information

If Florida estate tax is not due and a federal estate tax return (federal Form 706 or

Form

The

Where to File Form

Form

When to Use Form

Form

and a federal estate tax return (federal Form 706 or

Federal thresholds for filing federal Form 706 only: (For informational purposes only. Please confirm with Form 706 instructions.)

Date of Death |

Dollar Threshold |

(year) |

for Filing Form 706 |

|

(value of gross estate) |

|

|

2000 and 2001 |

$675,000 |

|

|

2002 and 2003 |

$1,000,000 |

|

|

2004 and 2005 |

$1,500,000 |

|

|

For 2006 and forward |

|

go to the IRS website at |

|

www.irs.gov to obtain |

|

thresholds. |

|

|

|

For thresholds for filing federal Form

If an administration proceeding is pending for an estate, Form

To Contact Us

Information, forms, and tutorials are available on the Department’s website floridarevenue.com

If you have any questions, or need assistance, call Taxpayer Services at

To find a taxpayer service center near you, go to: floridarevenue.com/taxes/servicecenters

For written replies to tax questions, write to: Taxpayer Services - Mail Stop

5050 W Tennessee St Tallahassee FL

Subscribe to Receive Email Alerts from the Department.

Subscribe to receive an email when Tax Information Publications and proposed rules are posted to the Department’s website. Subscribe today at floridarevenue.com/dor/subscribe.

Reference Material

Rule Chapter

Documents used along the form

When dealing with estate matters in Florida, several forms and documents are commonly used alongside the FL DR-312 form. Each of these documents serves a specific purpose in the probate process, ensuring compliance with state laws and facilitating the proper administration of the estate.

- Federal Form 706: This form is used to report the estate's value and determine if federal estate taxes are owed. It is required for estates that exceed the federal threshold for filing.

- Federal Form 706-NA: This form is specifically for nonresident aliens and serves a similar purpose as Form 706. It helps establish whether federal estate taxes are applicable to the estate of a non-U.S. citizen decedent.

- Bill of Sale: In Texas, a Bill of Sale serves as a legal document that proves the purchase and sale of personal property, ensuring clarity and record-keeping for both parties involved. For templates and more details, visit smarttemplates.net.

- Notice of Administration: This document informs interested parties about the initiation of probate proceedings. It outlines the rights of heirs and beneficiaries and provides details about the estate's administration.

- Last Will and Testament: This legal document outlines the decedent's wishes regarding the distribution of their assets. It is crucial for guiding the probate process and ensuring that the estate is settled according to the decedent's intentions.

- Petition for Probate: This form initiates the probate process by requesting the court to validate the decedent's will and appoint a personal representative. It is essential for formally starting the legal proceedings related to the estate.

Understanding these forms is vital for anyone involved in estate administration. Properly completing and filing these documents can help avoid delays and complications in the probate process, ensuring that the estate is settled efficiently and in accordance with the law.