Download Generic Direct Deposit Template

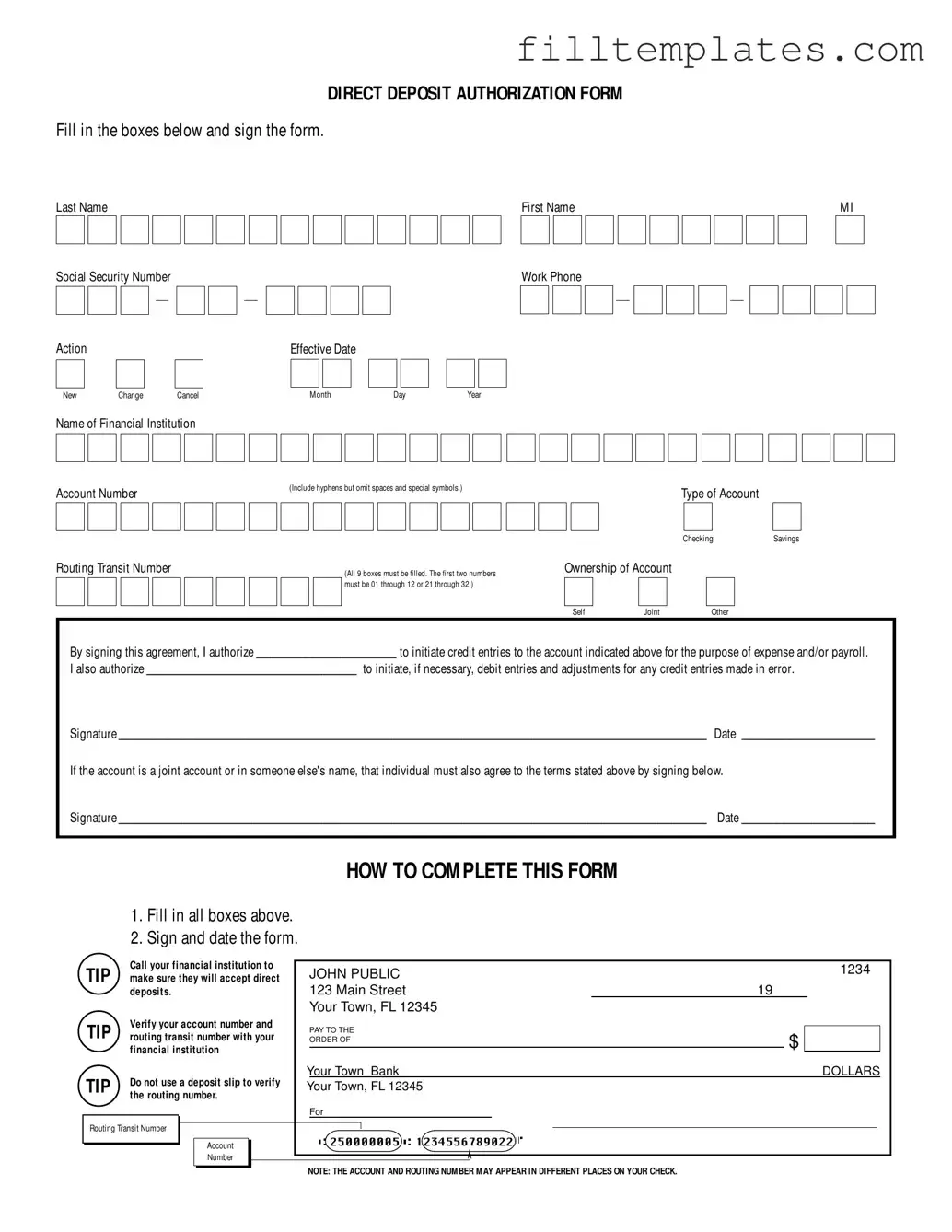

The Generic Direct Deposit form is a crucial document for individuals seeking to streamline their payment processes. It facilitates the electronic transfer of funds directly into a bank account, eliminating the need for physical checks. To complete this form, users must provide essential personal information, including their name, Social Security number, and contact details. Additionally, the form requires the account number and routing transit number of the designated financial institution. This ensures that payments are directed accurately and promptly. Users can indicate whether they are setting up a new direct deposit, making changes to an existing arrangement, or canceling a previous authorization. The form also includes sections for account ownership, allowing for both individual and joint accounts. Signatures from all account holders are necessary to validate the agreement. Completing the form involves careful attention to detail, as errors in the account or routing numbers can lead to delays in payment. Tips are provided to assist users in verifying their account information with their financial institution, ensuring a smooth setup process.

Key takeaways

Ensure all fields are completed accurately. This includes your name, Social Security number, account number, and routing transit number.

Sign and date the form to authorize the direct deposit. Without a signature, the form will not be valid.

Confirm with your financial institution that they accept direct deposits. This step helps avoid any potential issues with processing.

Double-check your account number and routing transit number for accuracy. Mistakes can lead to delays or errors in deposits.

If using a joint account, ensure that all account holders sign the form. Each individual's consent is necessary for processing.

Do not rely on a deposit slip for verifying your routing number. Always confirm with your bank directly to ensure the correct information is used.

Guide to Writing Generic Direct Deposit

Once you have the Generic Direct Deposit form in front of you, follow these steps carefully to ensure all information is filled out correctly. This will help set up your direct deposit smoothly.

- Fill in your Last Name, First Name, and M.I. in the designated boxes.

- Enter your Social Security Number in the appropriate format: ###-##-####.

- Select the Action you want to take: New, Change, or Cancel.

- Fill in the Effective Date using the format Month/Day/Year.

- Provide your Work Phone number in the format ###-###-####.

- Write the name of your Financial Institution in the box provided.

- Input your Account Number (include hyphens, but omit spaces and special symbols).

- Choose your Type of Account: Savings or Checking.

- Fill in the Routing Transit Number (ensure all 9 boxes are filled correctly).

- Select the Ownership of Account: Self, Joint, or Other.

- Sign the form to authorize your employer or financial institution to process your direct deposit.

- Date your signature.

- If applicable, have the other account holder sign and date the form as well.

After completing the form, double-check all entries for accuracy. It's a good idea to confirm with your bank that they accept direct deposits. This will help avoid any delays in receiving your funds.

Browse Other PDFs

What Is Veteran Designation - Applicants must certify their service under penalty of perjury when filling out this form.

CBP Declaration Form 6059B - Honesty in the CBP 6059B form contributes to a smoother entry process.

One important resource for those involved in real estate transactions is the Texas Real Estate Purchase Agreement, which can be found at smarttemplates.net. This form outlines key terms and conditions, ensuring clarity and protection for both buyers and sellers.

Vaccine Records - The form includes a section for registering ID numbers for tracking purposes.

Form Preview Example

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

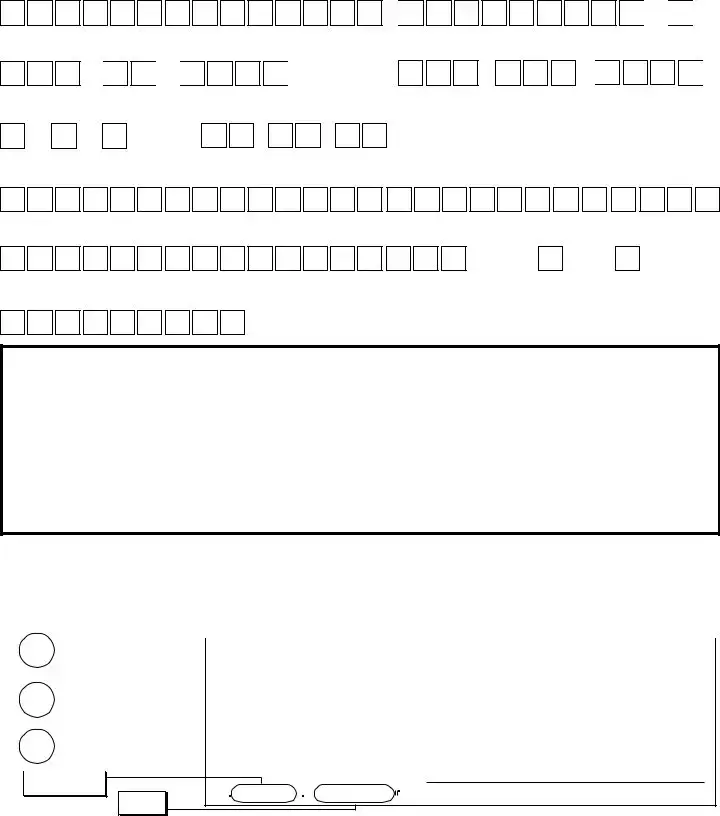

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Documents used along the form

When setting up direct deposit, several other forms and documents may be required alongside the Generic Direct Deposit form. Each of these documents serves a specific purpose and helps ensure that the process runs smoothly. Below is a list of commonly used forms.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from paychecks.

- New York Residential Lease Agreement: For those renting properties, our comprehensive guide to Residential Lease Agreement templates ensures clarity and legal compliance in your rental arrangements.

- Bank Account Verification Letter: This letter, often provided by the bank, confirms the account holder's name and account number. It ensures that the direct deposit is set up correctly.

- Employee Information Form: Employers may require this form to collect essential details about new hires, including contact information and emergency contacts.

- Payroll Authorization Form: This document allows employees to authorize their employer to process payroll payments. It may also include consent for deductions.

- Tax Identification Number (TIN) Form: This form is necessary for tax reporting purposes. It provides the employer with the employee's Social Security number or Employer Identification Number.

- Direct Deposit Change Form: If an employee needs to change their bank account information for direct deposit, this form is used to submit the new details.

- State Tax Withholding Form: Similar to the W-4, this form is used to specify state tax withholding preferences. It varies by state and is essential for accurate payroll processing.

- Employment Agreement: This document outlines the terms of employment, including salary, benefits, and other conditions. It often includes provisions about payment methods.

- Consent to Electronic Delivery Form: Employees may need to sign this form to agree to receive pay stubs and tax documents electronically rather than in paper form.

These documents collectively help streamline the direct deposit process and ensure compliance with tax and employment regulations. Keeping them organized and readily available can facilitate a smoother transition to direct deposit for employees.