Official Deed in Lieu of Foreclosure Template for the State of Georgia

When facing the possibility of foreclosure, many homeowners in Georgia may find themselves searching for alternatives that can help alleviate their financial burdens. One such option is the Deed in Lieu of Foreclosure, a legal process that allows a homeowner to voluntarily transfer their property back to the lender in exchange for the cancellation of their mortgage debt. This form serves as a crucial tool in simplifying the often complicated and stressful foreclosure process. By signing the Deed in Lieu of Foreclosure, homeowners can avoid the lengthy court proceedings associated with foreclosure, while also potentially protecting their credit score from the harsher impacts of foreclosure. The form outlines essential details, including the property description, the names of the parties involved, and any agreements related to the transfer of ownership. Understanding this form can empower homeowners to make informed decisions about their financial future and explore pathways to a fresh start.

Key takeaways

Filling out and using the Georgia Deed in Lieu of Foreclosure form requires careful attention to detail. Here are some key takeaways to consider:

- The deed transfers ownership of the property from the borrower to the lender.

- This option can help avoid the lengthy foreclosure process.

- Both parties must agree to the terms outlined in the deed.

- The borrower should ensure that the property is free of liens before proceeding.

- It is advisable to seek legal advice before signing the deed.

- The lender may require the borrower to provide financial documents.

- Filing the deed with the county clerk is essential for it to be valid.

- The borrower may be responsible for any outstanding taxes or fees.

- This deed can impact the borrower’s credit score, so understanding the consequences is important.

- Both parties should keep copies of the signed deed for their records.

Guide to Writing Georgia Deed in Lieu of Foreclosure

After completing the Georgia Deed in Lieu of Foreclosure form, you will need to ensure that it is properly executed and recorded. This step is crucial as it formally transfers ownership of the property back to the lender and helps you avoid the foreclosure process. Follow these steps to fill out the form accurately.

- Obtain the Form: You can find the Georgia Deed in Lieu of Foreclosure form online or request it from your lender.

- Fill in the Property Information: Start by entering the property address, including the county, city, and zip code. Make sure all details are accurate.

- Identify the Grantor: Write your name as the grantor. If there are multiple owners, include all names as they appear on the title.

- Identify the Grantee: Enter the lender's name as the grantee. This is the institution to which you are transferring the property.

- Provide a Legal Description: Include the legal description of the property. This information can typically be found on your mortgage documents or the property deed.

- Sign the Document: As the grantor, you must sign the form. If there are multiple grantors, each must sign the document.

- Notarization: Have the document notarized. This step adds an extra layer of authenticity to the form.

- Record the Deed: Submit the completed and notarized form to the county recorder's office where the property is located. There may be a small fee for recording.

Once the form is recorded, you should keep a copy for your records. This will serve as proof that you have transferred ownership of the property. It's also wise to follow up with your lender to confirm that they have received the deed and that the process is complete.

Discover Popular Deed in Lieu of Foreclosure Templates for Specific States

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Using a deed in lieu can lead to a more amicable termination of the mortgage relationship.

In addition to providing a verifiable record of the transaction, the New York Trailer Bill of Sale form can also be accessed and filled out efficiently online at smarttemplates.net/, ensuring that both parties have all necessary information at their fingertips for a smooth transfer of ownership.

Deed in Lieu Vs Foreclosure - Borrowers should keep copies of all documents related to the Deed in Lieu for their records.

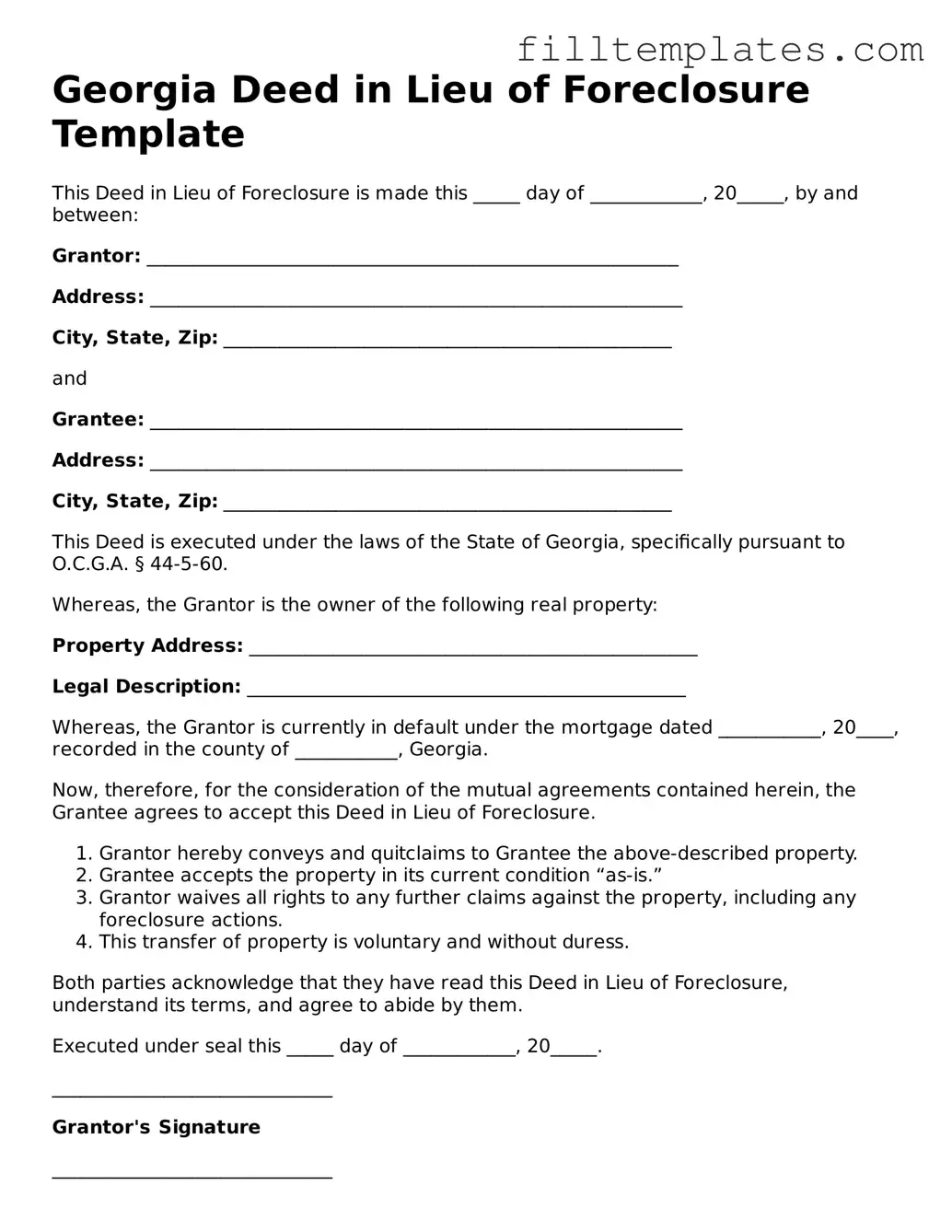

Form Preview Example

Georgia Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this _____ day of ____________, 20_____, by and between:

Grantor: _________________________________________________________

Address: _________________________________________________________

City, State, Zip: ________________________________________________

and

Grantee: _________________________________________________________

Address: _________________________________________________________

City, State, Zip: ________________________________________________

This Deed is executed under the laws of the State of Georgia, specifically pursuant to O.C.G.A. § 44-5-60.

Whereas, the Grantor is the owner of the following real property:

Property Address: ________________________________________________

Legal Description: _______________________________________________

Whereas, the Grantor is currently in default under the mortgage dated ___________, 20____, recorded in the county of ___________, Georgia.

Now, therefore, for the consideration of the mutual agreements contained herein, the Grantee agrees to accept this Deed in Lieu of Foreclosure.

- Grantor hereby conveys and quitclaims to Grantee the above-described property.

- Grantee accepts the property in its current condition “as-is.”

- Grantor waives all rights to any further claims against the property, including any foreclosure actions.

- This transfer of property is voluntary and without duress.

Both parties acknowledge that they have read this Deed in Lieu of Foreclosure, understand its terms, and agree to abide by them.

Executed under seal this _____ day of ____________, 20_____.

______________________________

Grantor's Signature

______________________________

Grantee's Signature

______________________________

Witness Signature

______________________________

Notary Public Signature

My Commission Expires: _______________

Documents used along the form

A Deed in Lieu of Foreclosure is a significant step for homeowners facing financial difficulties. To ensure a smooth process, several other documents are often used in conjunction with this form. Below is a list of common forms and documents that may be necessary during this transaction.

- Loan Modification Agreement: This document outlines the changes made to the original loan terms. It may include adjustments to interest rates, payment schedules, or the total amount owed, helping borrowers avoid foreclosure.

- Notice of Default: A formal notification sent by the lender to the borrower, indicating that the borrower has fallen behind on payments. This document serves as a warning and may initiate the foreclosure process if not addressed.

- Affidavit of Support: This document is essential for ensuring the immigrant has adequate financial backing, preventing them from becoming a public charge, as outlined on TopTemplates.info.

- Release of Liability: This document releases the borrower from any further obligation on the mortgage after the Deed in Lieu of Foreclosure is executed. It provides peace of mind that the borrower will not be held accountable for any remaining debt.

- Title Search Report: A report that confirms the ownership of the property and checks for any liens or encumbrances. This ensures that the property can be transferred without any legal issues.

- Property Condition Disclosure: This document requires the homeowner to disclose any known issues with the property. Transparency helps the lender assess the property's condition before accepting the deed.

- Settlement Statement: A detailed account of the financial aspects of the transaction, including any costs or fees associated with the Deed in Lieu of Foreclosure. This document ensures all parties understand the financial implications.

Each of these documents plays a vital role in the process surrounding a Deed in Lieu of Foreclosure. Understanding them can help homeowners navigate their options and make informed decisions during a challenging time.