Official Durable Power of Attorney Template for the State of Georgia

The Georgia Durable Power of Attorney form is an essential legal document that allows individuals to appoint someone they trust to make decisions on their behalf when they are unable to do so. This form can cover a wide range of decisions, including financial matters, healthcare choices, and property management. It is designed to remain effective even if the person who created it becomes incapacitated. By establishing a durable power of attorney, individuals can ensure that their affairs are handled according to their wishes, providing peace of mind for both themselves and their loved ones. The form must be signed and notarized to be valid, and it is crucial to choose an agent who is reliable and capable of acting in the best interest of the principal. Understanding the key components of this form, including the powers granted and the responsibilities of the agent, is vital for making informed decisions about one's future.

Key takeaways

When considering the Georgia Durable Power of Attorney form, it is important to understand its purpose and implications. Below are key takeaways to keep in mind:

- The form allows you to designate someone to make financial and legal decisions on your behalf.

- It remains effective even if you become incapacitated.

- You can specify the powers you wish to grant, which may include managing bank accounts, selling property, or handling investments.

- It is advisable to choose a trusted individual, as they will have significant control over your affairs.

- The form must be signed in the presence of a notary public to be valid.

- Consider discussing your wishes with the person you designate to ensure they understand your preferences.

- Revoking the Durable Power of Attorney is possible at any time, as long as you are competent to do so.

- Keep a copy of the signed document in a safe place and provide copies to relevant parties, such as your agent and financial institutions.

- Review the document periodically to ensure it still reflects your wishes and circumstances.

Guide to Writing Georgia Durable Power of Attorney

When preparing to fill out the Georgia Durable Power of Attorney form, it is important to approach the process thoughtfully. This document allows you to designate someone to make decisions on your behalf if you become unable to do so. Follow these steps carefully to ensure that the form is completed correctly.

- Begin by obtaining the Georgia Durable Power of Attorney form. You can find it online or at legal supply stores.

- At the top of the form, enter the name of the person granting the power of attorney. This is known as the "Principal."

- Next, fill in the name of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Specify the powers you wish to grant to your agent. You can choose to give broad powers or limit them to specific areas such as financial decisions or healthcare matters.

- Include any specific instructions or limitations you want to place on your agent’s authority. This helps clarify your wishes.

- Provide the date the powers will begin. You can choose for them to start immediately or at a future date.

- Sign and date the form in the designated area. Your signature is crucial for the document to be valid.

- Have the form notarized. A notary public must witness your signature to ensure authenticity.

- Make copies of the completed form for your records and to provide to your agent and any relevant institutions.

By following these steps, you can ensure that your Durable Power of Attorney form is completed accurately and effectively. Remember to keep a copy in a safe place and inform your agent about its existence and contents.

Discover Popular Durable Power of Attorney Templates for Specific States

Power of Attorney Illinois - The document can facilitate seamless management of your estate if you become incapacitated.

For those seeking to clarify their rental agreements, the New York Residential Lease Agreement is an essential document that sets forth the terms and conditions of the lease. You can find an insightful template to help you outline these terms at our free resource for a thorough Residential Lease Agreement template.

Michigan Power of Attorney Form - It provides peace of mind knowing someone is authorized to act in emergencies.

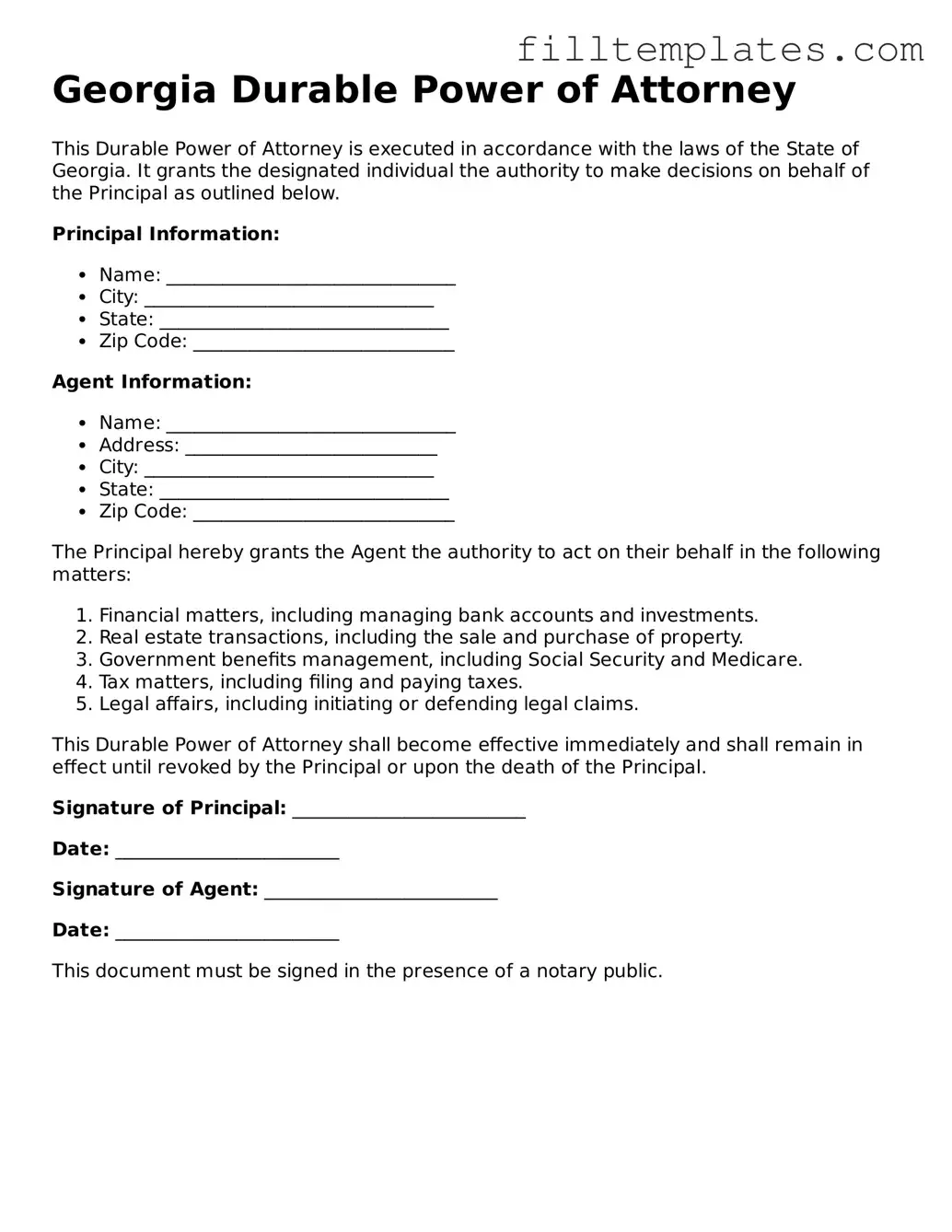

Form Preview Example

Georgia Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the laws of the State of Georgia. It grants the designated individual the authority to make decisions on behalf of the Principal as outlined below.

Principal Information:

- Name: _______________________________

- City: _______________________________

- State: _______________________________

- Zip Code: ____________________________

Agent Information:

- Name: _______________________________

- Address: ___________________________

- City: _______________________________

- State: _______________________________

- Zip Code: ____________________________

The Principal hereby grants the Agent the authority to act on their behalf in the following matters:

- Financial matters, including managing bank accounts and investments.

- Real estate transactions, including the sale and purchase of property.

- Government benefits management, including Social Security and Medicare.

- Tax matters, including filing and paying taxes.

- Legal affairs, including initiating or defending legal claims.

This Durable Power of Attorney shall become effective immediately and shall remain in effect until revoked by the Principal or upon the death of the Principal.

Signature of Principal: _________________________

Date: ________________________

Signature of Agent: _________________________

Date: ________________________

This document must be signed in the presence of a notary public.

Documents used along the form

When preparing a Georgia Durable Power of Attorney, it's essential to consider other related forms and documents that may enhance your estate planning. Each document serves a specific purpose and can help ensure your wishes are honored. Below is a list of commonly used forms that complement the Durable Power of Attorney.

- Advance Healthcare Directive: This document allows you to specify your healthcare preferences and appoint someone to make medical decisions on your behalf if you become unable to do so.

- Real Estate Purchase Agreement: This essential document outlines the terms and conditions for buying or selling property in Texas, providing protection for both parties involved. For more information, you can visit smarttemplates.net.

- Last Will and Testament: A will outlines how you want your assets distributed after your death. It can also name guardians for minor children.

- Living Trust: A living trust holds your assets during your lifetime and specifies how they should be managed and distributed after your death, potentially avoiding probate.

- HIPAA Release Form: This form allows designated individuals access to your medical records, ensuring they can make informed decisions regarding your healthcare.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document grants someone authority to manage your financial affairs, but it may not remain effective if you become incapacitated.

- Beneficiary Designation Forms: These forms allow you to designate beneficiaries for accounts like life insurance, retirement plans, and bank accounts, ensuring they pass directly to your chosen individuals.

- Property Deed: If you own real estate, updating the deed can ensure that your property is transferred according to your wishes upon your passing.

- Guardianship Designation: This document allows you to appoint a guardian for your minor children, providing peace of mind regarding their care in the event of your death or incapacity.

Each of these documents plays a crucial role in comprehensive estate planning. Consider consulting a legal professional to ensure all forms are properly completed and aligned with your wishes. Taking these steps can help protect your interests and those of your loved ones.