Official Gift Deed Template for the State of Georgia

The Georgia Gift Deed form serves as an essential legal document for individuals wishing to transfer property ownership without monetary compensation. This form is designed to facilitate the gifting process, ensuring that the transfer is clear, valid, and recognized by the state. It outlines the details of the property being gifted, including its legal description, and identifies both the donor and the recipient. Additionally, the form may require notarization to confirm the identities of the parties involved and to prevent potential disputes. It is crucial to understand the implications of a gift deed, as it can affect tax obligations and property rights. By using this form, individuals can formalize their intentions and ensure a smooth transfer of ownership, making it a valuable tool in estate planning and family transactions.

Key takeaways

When considering the Georgia Gift Deed form, it's essential to understand the implications and requirements involved in the process. Here are some key takeaways to keep in mind:

- Purpose of the Gift Deed: This document is used to transfer property ownership without any exchange of money. It signifies a voluntary gift from the donor to the recipient.

- Eligibility: Both the donor and recipient must be competent individuals, meaning they are of legal age and mentally capable of understanding the transaction.

- Property Description: Clearly describe the property being gifted. This includes the address, legal description, and any relevant identifying information.

- Signatures Required: The deed must be signed by the donor in the presence of a notary public. This step is crucial to validate the document.

- Recording the Deed: After signing, the gift deed should be filed with the local county clerk’s office. This ensures that the transfer is officially recognized and recorded.

- Tax Implications: While a gift deed itself does not incur immediate tax obligations, it’s wise to consult with a tax professional regarding potential gift taxes or implications for the recipient.

Understanding these points can help ensure a smooth process when filling out and using the Georgia Gift Deed form. Careful attention to detail will aid in avoiding potential issues down the line.

Guide to Writing Georgia Gift Deed

Filling out the Georgia Gift Deed form is an important step in transferring property ownership without a monetary exchange. Ensure you have all necessary information at hand, as accuracy is key to a smooth process. Once the form is completed, you will need to sign it in front of a notary public to make it legally binding.

- Begin by entering the full names of the grantor (the person giving the gift) and the grantee (the person receiving the gift) at the top of the form.

- Provide the complete address of the property being gifted. This includes the street address, city, state, and zip code.

- Next, include a description of the property. This may involve the legal description found in the property deed or a simple description of the property type.

- Indicate the date of the transfer. This is the date when the property is officially given to the grantee.

- Sign the form where indicated. The grantor must sign the document to validate the gift.

- Find a notary public to witness the signing. The notary will need to verify the identities of the grantor and grantee.

- After notarization, make copies of the completed Gift Deed for your records and for the grantee.

- Finally, file the original Gift Deed with the county clerk’s office in the county where the property is located to ensure public record of the transfer.

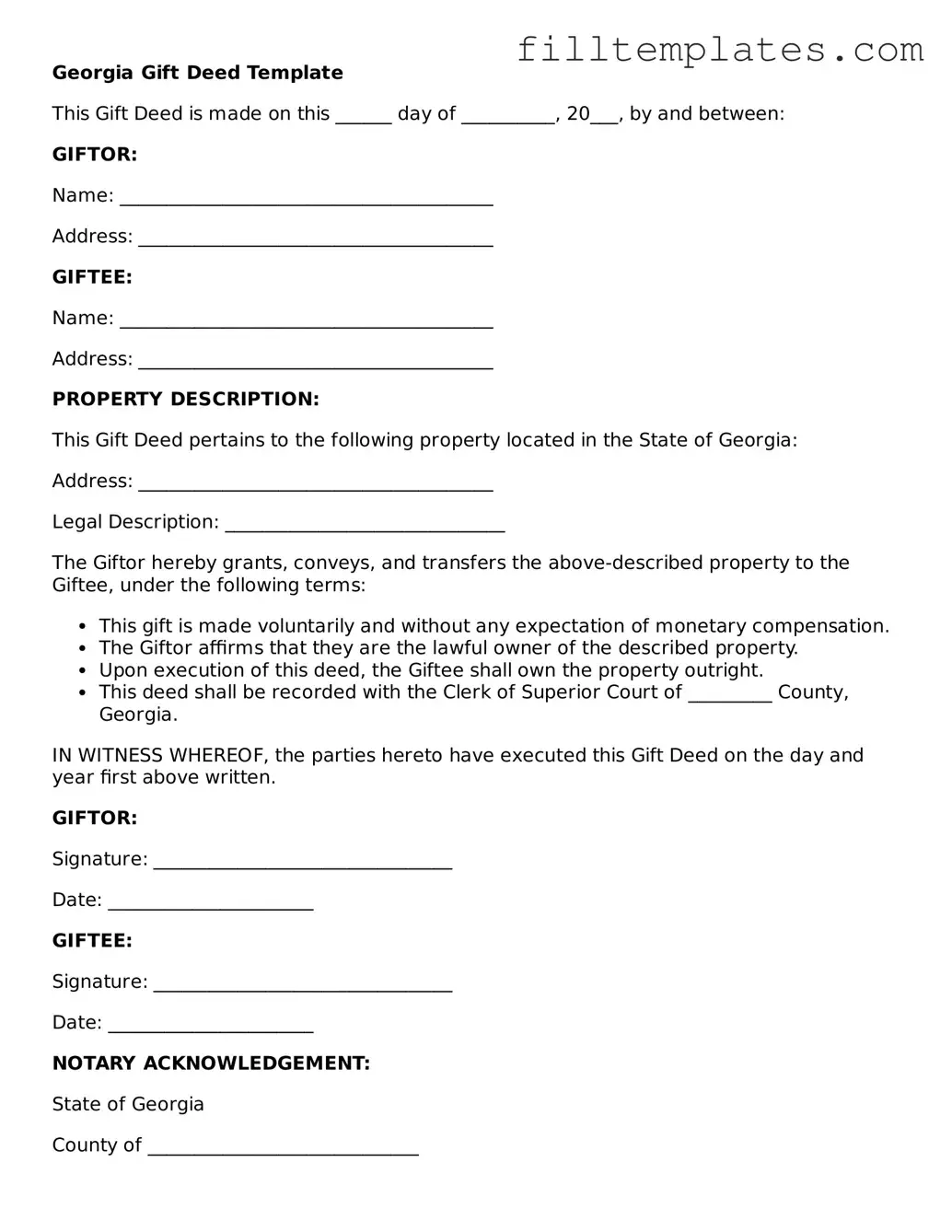

Form Preview Example

Georgia Gift Deed Template

This Gift Deed is made on this ______ day of __________, 20___, by and between:

GIFTOR:

Name: ________________________________________

Address: ______________________________________

GIFTEE:

Name: ________________________________________

Address: ______________________________________

PROPERTY DESCRIPTION:

This Gift Deed pertains to the following property located in the State of Georgia:

Address: ______________________________________

Legal Description: ______________________________

The Giftor hereby grants, conveys, and transfers the above-described property to the Giftee, under the following terms:

- This gift is made voluntarily and without any expectation of monetary compensation.

- The Giftor affirms that they are the lawful owner of the described property.

- Upon execution of this deed, the Giftee shall own the property outright.

- This deed shall be recorded with the Clerk of Superior Court of _________ County, Georgia.

IN WITNESS WHEREOF, the parties hereto have executed this Gift Deed on the day and year first above written.

GIFTOR:

Signature: ________________________________

Date: ______________________

GIFTEE:

Signature: ________________________________

Date: ______________________

NOTARY ACKNOWLEDGEMENT:

State of Georgia

County of _____________________________

Subscribed and sworn to before me, this ____ day of __________, 20__.

Notary Public: ______________________

My Commission Expires: ______________

Documents used along the form

When executing a Georgia Gift Deed, several other forms and documents may be required to ensure a smooth transfer of property. These documents help clarify ownership, provide necessary disclosures, and facilitate the legal process. Below is a list of commonly used forms that accompany the Georgia Gift Deed.

- Quitclaim Deed: This document transfers any interest the grantor has in the property without making any warranties about the title. It is often used to clear up any potential claims or disputes regarding ownership.

- Affidavit of Gift: This affidavit serves as a sworn statement confirming that the property is being given as a gift. It may include details about the relationship between the giver and the recipient, as well as the value of the gift.

- Property Transfer Tax Exemption Form: In Georgia, certain gifts may be exempt from transfer taxes. This form must be completed to claim the exemption and must be submitted along with the Gift Deed.

- Tax Return Transcript: A detailed representation of the taxpayer's tax return data, including income, adjustments, and credits, which can be accessed through smarttemplates.net, providing clarity and transparency for both donors and recipients during the gift transfer process.

- Title Search Report: This report provides a comprehensive review of the property's title history. It identifies any liens, encumbrances, or claims against the property, ensuring that the gift can be transferred without issues.

These documents play a crucial role in the property transfer process, ensuring that both parties are protected and that the transaction is legally sound. Properly preparing and submitting these forms can help avoid complications down the line.