Official Loan Agreement Template for the State of Georgia

The Georgia Loan Agreement form serves as a crucial document in the lending process, outlining the terms and conditions agreed upon by both the lender and the borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It also specifies the rights and responsibilities of each party, ensuring clarity and reducing the potential for disputes. Additionally, the agreement may address late fees, default provisions, and any applicable state laws governing the loan. By providing a structured framework, the Georgia Loan Agreement form helps facilitate a transparent lending relationship, protecting both parties' interests and promoting responsible borrowing practices.

Key takeaways

The Georgia Loan Agreement form is essential for documenting the terms of a loan between a lender and a borrower.

Both parties should clearly identify themselves at the beginning of the agreement, including full names and addresses.

Specify the loan amount in both numerical and written form to avoid any misunderstandings.

Clearly outline the interest rate, whether it is fixed or variable, and how it will be calculated.

Include the repayment schedule, detailing when payments are due and the method of payment.

Address any late fees or penalties for missed payments to ensure both parties understand the consequences.

Consider including a clause about prepayment, which allows the borrower to pay off the loan early without penalties.

Both parties must sign and date the agreement to make it legally binding.

Keep a copy of the signed agreement for both the lender and borrower for future reference.

Consult a legal professional if there are any uncertainties about the terms or conditions of the agreement.

Guide to Writing Georgia Loan Agreement

Once you have the Georgia Loan Agreement form in hand, you’re ready to begin the process of filling it out. This form requires careful attention to detail to ensure that all parties involved are clear about the terms of the loan. Follow the steps below to complete the form accurately.

- Read the Instructions: Before you start filling out the form, take a moment to read any provided instructions carefully. This will help you understand what information is required.

- Identify the Parties: Fill in the names and addresses of both the lender and the borrower. Make sure to include all relevant contact information.

- Loan Amount: Clearly state the total amount of the loan. Double-check this number to avoid any errors.

- Interest Rate: Specify the interest rate applicable to the loan. Ensure that it is clearly stated whether it is fixed or variable.

- Loan Term: Indicate the duration of the loan. This should include the start date and the end date of the loan period.

- Payment Schedule: Outline how and when payments will be made. Be specific about due dates and the frequency of payments.

- Signatures: Both the lender and the borrower must sign the agreement. Make sure to date the signatures as well.

- Witness or Notary: If required, have a witness or notary public sign the document to validate it. Check local requirements to see if this step is necessary.

After completing the form, review it thoroughly to ensure all information is accurate and complete. Once everything is in order, you can proceed with the next steps, which may include sharing copies with all parties involved or filing it with the appropriate authorities.

Discover Popular Loan Agreement Templates for Specific States

Promissory Note Template Illinois - This loan agreement is adaptable for various types of loans, personal or business-related.

When considering the creation of a Power of Attorney, it is essential to understand the implications of granting authority to another individual, which can be easily facilitated through resources such as smarttemplates.net. This form can significantly streamline the process of appointing someone you trust to handle your affairs efficiently and legally.

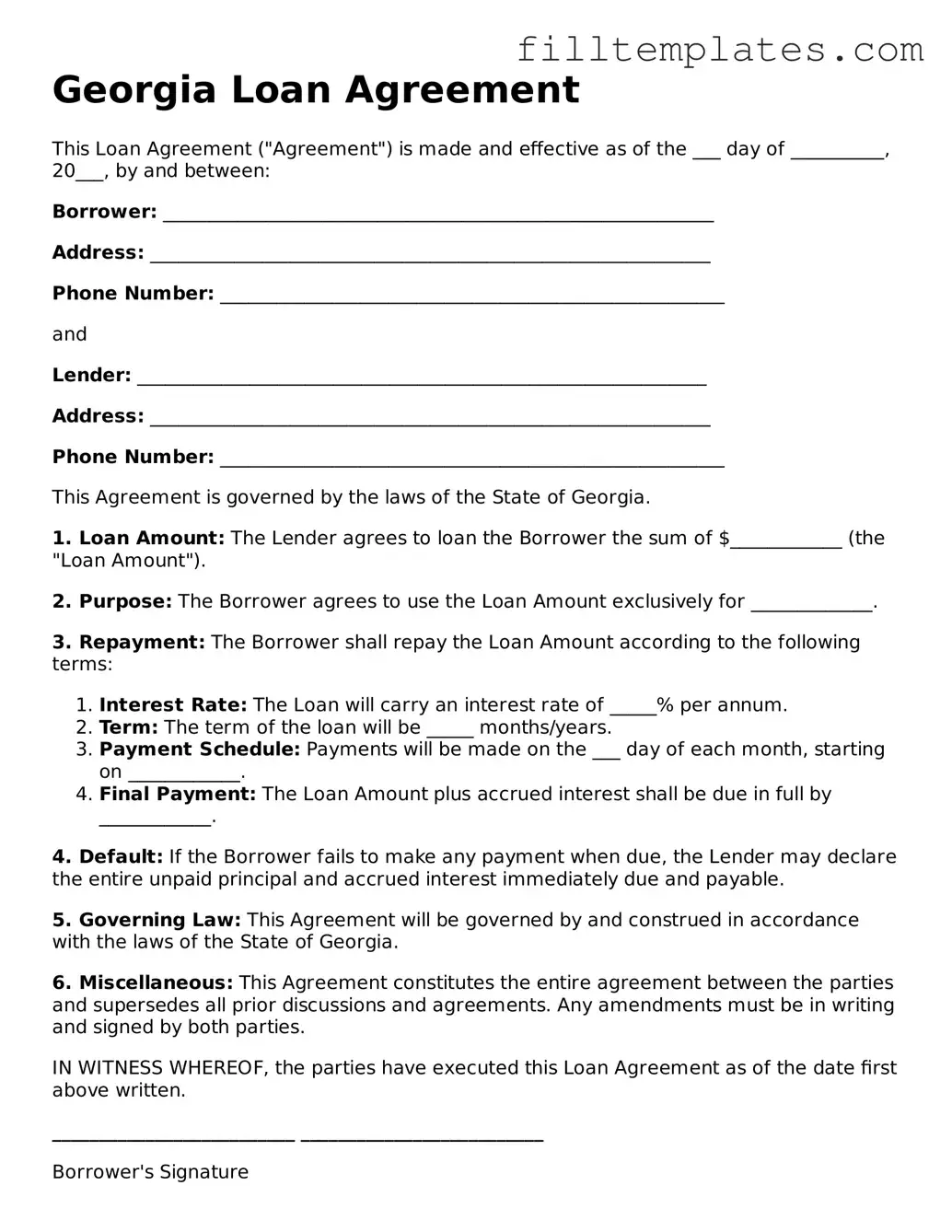

Form Preview Example

Georgia Loan Agreement

This Loan Agreement ("Agreement") is made and effective as of the ___ day of __________, 20___, by and between:

Borrower: ___________________________________________________________

Address: ____________________________________________________________

Phone Number: ______________________________________________________

and

Lender: _____________________________________________________________

Address: ____________________________________________________________

Phone Number: ______________________________________________________

This Agreement is governed by the laws of the State of Georgia.

1. Loan Amount: The Lender agrees to loan the Borrower the sum of $____________ (the "Loan Amount").

2. Purpose: The Borrower agrees to use the Loan Amount exclusively for _____________.

3. Repayment: The Borrower shall repay the Loan Amount according to the following terms:

- Interest Rate: The Loan will carry an interest rate of _____% per annum.

- Term: The term of the loan will be _____ months/years.

- Payment Schedule: Payments will be made on the ___ day of each month, starting on ____________.

- Final Payment: The Loan Amount plus accrued interest shall be due in full by ____________.

4. Default: If the Borrower fails to make any payment when due, the Lender may declare the entire unpaid principal and accrued interest immediately due and payable.

5. Governing Law: This Agreement will be governed by and construed in accordance with the laws of the State of Georgia.

6. Miscellaneous: This Agreement constitutes the entire agreement between the parties and supersedes all prior discussions and agreements. Any amendments must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

__________________________ __________________________

Borrower's Signature

Lender's Signature

Printed Name: ____________________________ Printed Name: ____________________________

Date: ____________________________ Date: ____________________________

Documents used along the form

When entering into a loan agreement in Georgia, several other forms and documents may be necessary to ensure everything is clear and legally binding. These documents help protect both the lender and the borrower, providing a comprehensive framework for the loan transaction.

- Promissory Note: This is a written promise from the borrower to repay the loan under specified terms. It outlines the loan amount, interest rate, and repayment schedule.

- Loan Application: This document gathers information about the borrower’s financial situation. It helps lenders assess the risk involved in granting the loan.

- Motor Vehicle Bill of Sale: Essential for vehicle transactions, this form documents the sale between buyer and seller, providing a clear record of ownership transfer and details such as condition and price. For more information, visit toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/.

- Credit Report Authorization: Borrowers often sign this form to allow lenders to check their credit history. This helps lenders evaluate the borrower's creditworthiness.

- Disclosure Statement: This document provides essential information about the loan, including fees, interest rates, and other terms. It ensures transparency in the loan process.

- Security Agreement: If the loan is secured, this document outlines the collateral that the borrower offers. It protects the lender's interests in case of default.

- Personal Guarantee: This form may be required if the borrower is a business. It holds the business owner personally responsible for the loan repayment.

- Loan Closing Statement: This document summarizes the final terms of the loan at closing. It includes all costs and fees associated with the loan.

- Amendment Agreement: If any terms of the original loan agreement need to change, this document formally updates those terms, ensuring both parties agree to the new conditions.

Each of these documents plays a crucial role in the loan process, helping to clarify expectations and responsibilities. Understanding them can lead to a smoother borrowing experience.