Official Operating Agreement Template for the State of Georgia

In the state of Georgia, the Operating Agreement is a crucial document for limited liability companies (LLCs) that outlines the management structure and operational guidelines of the business. This form serves as a roadmap for members, detailing their rights, responsibilities, and the distribution of profits and losses. It also addresses how decisions will be made, how new members can be added, and the procedures for handling disputes among members. By establishing clear rules and expectations, the Operating Agreement helps to prevent misunderstandings and conflicts in the future. While Georgia law does not require LLCs to have an Operating Agreement, having one in place is highly recommended, as it provides legal protection and clarity for all parties involved. Additionally, this document can be tailored to fit the unique needs of the business, ensuring that it reflects the members' intentions and operational goals.

Key takeaways

When it comes to forming a Limited Liability Company (LLC) in Georgia, an Operating Agreement is a crucial document. Here are some key takeaways to keep in mind while filling out and using the Georgia Operating Agreement form:

- Defines Ownership and Management: The Operating Agreement clearly outlines who owns the LLC and how it will be managed. This clarity helps prevent disputes among members in the future.

- Establishes Operational Procedures: It sets forth the procedures for running the business, including decision-making processes and profit distribution. Having these guidelines in place can streamline operations.

- Protects Limited Liability Status: A well-drafted Operating Agreement helps reinforce the limited liability protection for members. This means personal assets are generally safeguarded from business debts and liabilities.

- Facilitates Changes: The agreement provides a framework for making changes to the LLC, such as adding new members or altering management structures. This adaptability is key to a growing business.

By understanding these key aspects, you can ensure that your Georgia Operating Agreement serves its purpose effectively, providing a solid foundation for your LLC.

Guide to Writing Georgia Operating Agreement

Once you have the Georgia Operating Agreement form, you are ready to begin the process of filling it out. This document is essential for outlining the management structure and operational guidelines of your business. Follow the steps below to complete the form accurately.

- Begin by entering the name of your LLC at the top of the form. Ensure the name matches the one registered with the state.

- Next, provide the principal office address of your LLC. This should be a physical address where business records are kept.

- List the names and addresses of all members involved in the LLC. Include each member's ownership percentage to clarify their stake in the business.

- Outline the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Detail the purpose of the LLC. This should describe the nature of the business and its intended activities.

- Specify the duration of the LLC. You may choose a specific term or state that it will exist indefinitely.

- Include provisions for adding or removing members. This will help manage changes in membership in the future.

- Lastly, review the document for accuracy. Ensure all members sign the agreement to validate it.

Discover Popular Operating Agreement Templates for Specific States

Operating Agreement Llc Ohio Template - A well-crafted Operating Agreement ensures everyone understands their rights and obligations.

When engaging in the sale of a vehicle in Texas, it is essential to utilize the Texas Motor Vehicle Bill of Sale form to ensure a clear and legally binding agreement between both parties. This document not only captures vital details such as the transaction date and vehicle identification but also serves as a safeguard against potential disputes in the future. For more information on how to obtain this important form, you can visit https://toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/texas-motor-vehicle-bill-of-sale.

Nc Operating Agreement Template - This document can provide tax treatment guidance for the LLC's income.

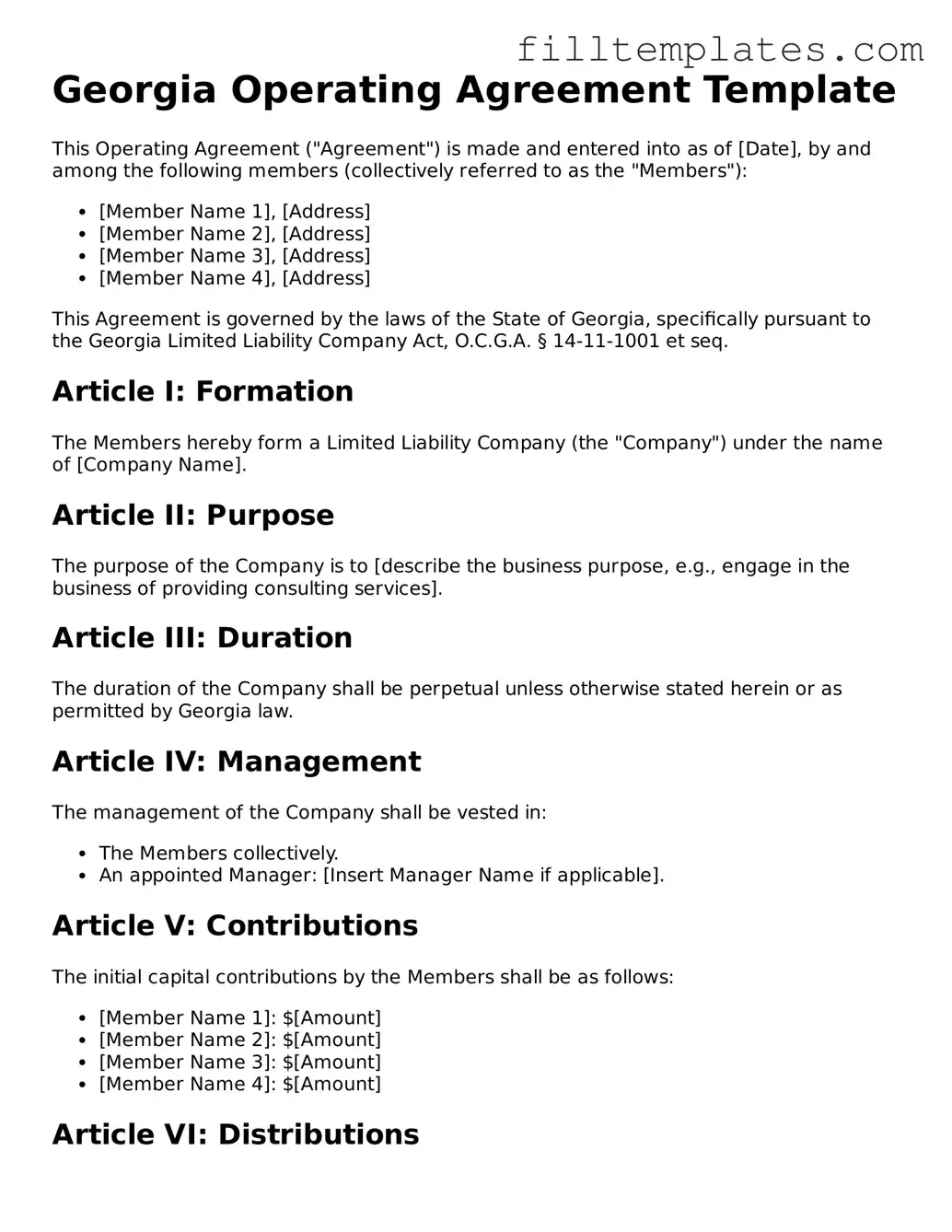

Form Preview Example

Georgia Operating Agreement Template

This Operating Agreement ("Agreement") is made and entered into as of [Date], by and among the following members (collectively referred to as the "Members"):

- [Member Name 1], [Address]

- [Member Name 2], [Address]

- [Member Name 3], [Address]

- [Member Name 4], [Address]

This Agreement is governed by the laws of the State of Georgia, specifically pursuant to the Georgia Limited Liability Company Act, O.C.G.A. § 14-11-1001 et seq.

Article I: Formation

The Members hereby form a Limited Liability Company (the "Company") under the name of [Company Name].

Article II: Purpose

The purpose of the Company is to [describe the business purpose, e.g., engage in the business of providing consulting services].

Article III: Duration

The duration of the Company shall be perpetual unless otherwise stated herein or as permitted by Georgia law.

Article IV: Management

The management of the Company shall be vested in:

- The Members collectively.

- An appointed Manager: [Insert Manager Name if applicable].

Article V: Contributions

The initial capital contributions by the Members shall be as follows:

- [Member Name 1]: $[Amount]

- [Member Name 2]: $[Amount]

- [Member Name 3]: $[Amount]

- [Member Name 4]: $[Amount]

Article VI: Distributions

Distributions shall be made to the Members in proportion to their respective ownership interests, unless otherwise agreed in writing.

Article VII: Books and Records

The Company shall maintain complete and accurate books of account and records of the Company’s business, which shall be kept at the principal office of the Company.

Article VIII: Indemnification

The Company shall indemnify and hold harmless any Member or Manager from and against any and all expenses and liabilities incurred in connection with the Company, to the fullest extent permitted by Georgia law.

Article IX: Amendments

This Agreement may be amended only by a written document signed by all the Members.

Article X: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the date first above written.

___________________________

[Member Name 1]

___________________________

[Member Name 2]

___________________________

[Member Name 3]

___________________________

[Member Name 4]

Documents used along the form

When forming a limited liability company (LLC) in Georgia, the Operating Agreement is a crucial document that outlines the management structure and operating procedures. However, several other forms and documents are often used in conjunction with the Georgia Operating Agreement to ensure compliance and clarity in business operations. Below is a list of important documents that you may consider when establishing your LLC.

- Articles of Organization: This is the foundational document that officially establishes your LLC with the state. It includes essential information such as the business name, address, and the names of the members.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is necessary for tax purposes. This number is used to identify your business for tax filings and can be required for opening a business bank account.

- Operating Agreement Addendum: If there are changes to the original Operating Agreement, an addendum can be created to document those changes formally. This helps maintain clarity and ensures all members are informed.

- Membership Certificates: These certificates serve as proof of ownership for each member in the LLC. They outline the member's ownership percentage and can be important for record-keeping and future transactions.

- Bylaws: Although not required for LLCs, bylaws can provide additional structure by detailing the internal rules and procedures for the organization. They can cover topics like voting rights and meeting protocols.

- Employment Verification Form: This document is essential for confirming the employment history of current or former employees, ensuring the accuracy of an applicant's employment history for potential employers, lending institutions, or government agencies. For more information, visit OnlineLawDocs.com.

- Annual Reports: Many states, including Georgia, require LLCs to file annual reports. These reports provide updated information about the business and ensure that it remains in good standing with the state.

Understanding these documents can significantly benefit anyone looking to establish or manage an LLC in Georgia. Each form plays a unique role in ensuring that your business operates smoothly and remains compliant with state regulations.