Official Promissory Note Template for the State of Georgia

In the realm of personal and business finance, the Georgia Promissory Note serves as a crucial tool for establishing clear terms between lenders and borrowers. This legally binding document outlines the borrower's promise to repay a specific amount of money, including interest, within a designated timeframe. By detailing essential components such as the loan amount, interest rate, repayment schedule, and any applicable penalties for late payments, the Promissory Note protects the interests of both parties involved. Additionally, it can specify whether the loan is secured or unsecured, providing clarity on whether collateral is involved. Understanding this form is essential for anyone entering into a lending agreement in Georgia, as it not only formalizes the transaction but also sets the stage for a positive financial relationship. By adhering to the guidelines of the Georgia Promissory Note, both lenders and borrowers can navigate their financial commitments with confidence and transparency.

Key takeaways

When filling out and using the Georgia Promissory Note form, keep these key takeaways in mind:

- Identify the Parties Clearly: Make sure to clearly state the names and addresses of both the borrower and the lender.

- Specify the Loan Amount: Clearly indicate the total amount of money being borrowed. This amount should be written both in numbers and in words.

- Define the Interest Rate: If applicable, include the interest rate. Specify whether it is fixed or variable and provide the calculation method.

- Outline Payment Terms: Clearly outline the repayment schedule. Include the due dates, frequency of payments, and the total number of payments.

- Include Default Terms: Specify what constitutes a default and the consequences of defaulting on the loan.

- Signatures Required: Ensure that both parties sign the document. A witness or notary signature may also be needed for added legal validity.

- Keep Copies: After signing, both parties should retain a copy of the completed Promissory Note for their records.

Guide to Writing Georgia Promissory Note

After obtaining the Georgia Promissory Note form, it's important to fill it out accurately to ensure that all necessary details are included. This will help avoid any issues in the future. Follow the steps below carefully to complete the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- In the first section, write the name of the borrower. This is the person who is borrowing the money.

- Next, provide the borrower's address. Include the street address, city, state, and zip code.

- In the following section, write the name of the lender. This is the person or entity providing the loan.

- Then, include the lender's address, ensuring all details are accurate.

- Specify the principal amount of the loan. This is the total amount being borrowed.

- Indicate the interest rate. Be clear about whether it’s a fixed or variable rate.

- Set the repayment terms. This includes the frequency of payments (monthly, quarterly, etc.) and the due date for each payment.

- Next, outline any late fees or penalties for missed payments. Be specific about the amounts and conditions.

- Include a section for any prepayment options. Specify if the borrower can pay off the loan early without penalties.

- Finally, both the borrower and lender should sign and date the form at the bottom. Ensure that all signatures are clear and legible.

Once the form is completed, make sure to keep a copy for your records. The original should be given to the lender, and both parties should understand the terms outlined in the document.

Discover Popular Promissory Note Templates for Specific States

Ohio Promissory Note - A promissory note can be beneficial for both short-term and long-term loans.

Promissory Note Template Michigan - No matter the context, promissory notes provide a transparent and structured way to manage debt.

When preparing for an event or activity, it is essential to utilize a well-drafted Release of Liability form to clearly outline the responsibilities and risks involved. This ensures that all participants understand the terms and conditions, effectively guarding against potential legal issues. For a reliable template, you can visit smarttemplates.net, which offers resources to create an appropriate form tailored to your needs.

Promissory Note Friendly Loan Agreement Format - A promissory note is a written agreement to pay a specific amount of money at a defined future date.

Promissory Note Illinois - This type of document often includes the borrower's authorization to take action if necessary.

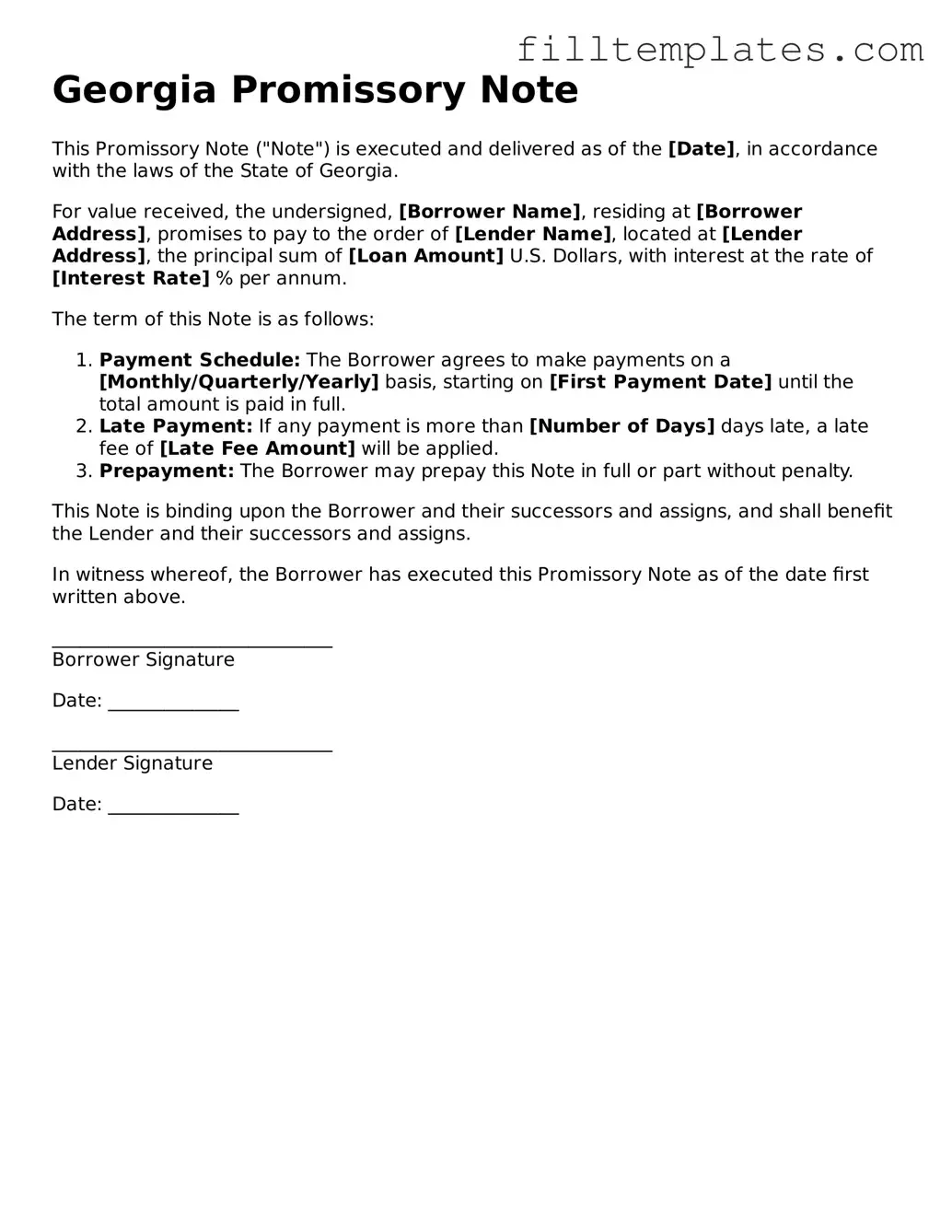

Form Preview Example

Georgia Promissory Note

This Promissory Note ("Note") is executed and delivered as of the [Date], in accordance with the laws of the State of Georgia.

For value received, the undersigned, [Borrower Name], residing at [Borrower Address], promises to pay to the order of [Lender Name], located at [Lender Address], the principal sum of [Loan Amount] U.S. Dollars, with interest at the rate of [Interest Rate] % per annum.

The term of this Note is as follows:

- Payment Schedule: The Borrower agrees to make payments on a [Monthly/Quarterly/Yearly] basis, starting on [First Payment Date] until the total amount is paid in full.

- Late Payment: If any payment is more than [Number of Days] days late, a late fee of [Late Fee Amount] will be applied.

- Prepayment: The Borrower may prepay this Note in full or part without penalty.

This Note is binding upon the Borrower and their successors and assigns, and shall benefit the Lender and their successors and assigns.

In witness whereof, the Borrower has executed this Promissory Note as of the date first written above.

______________________________

Borrower Signature

Date: ______________

______________________________

Lender Signature

Date: ______________

Documents used along the form

When dealing with a Georgia Promissory Note, several other forms and documents may be necessary to ensure clarity and legal compliance. Each of these documents plays a vital role in the lending process, helping both parties understand their rights and obligations.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Motor Vehicle Bill of Sale Form: When transferring vehicle ownership, ensure compliance with the proper Motor Vehicle Bill of Sale documentation to facilitate a smooth transaction.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged as security. It establishes the lender's rights to the collateral in case of default.

- Disclosure Statement: This document provides important information about the loan, including fees, interest rates, and the total cost of borrowing. It ensures that the borrower is fully informed before signing the Promissory Note.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally responsible for the loan if the borrowing entity defaults, adding an extra layer of security for the lender.

- Payment Schedule: A detailed payment schedule outlines the dates and amounts due for each payment. It helps borrowers stay organized and ensures timely payments, reducing the risk of default.

Understanding these documents can help facilitate a smoother lending process. Each plays a crucial role in protecting the interests of both the lender and the borrower, ensuring that all parties are aware of their commitments and responsibilities.