Official Transfer-on-Death Deed Template for the State of Georgia

The Georgia Transfer-on-Death Deed (TOD) form serves as a valuable estate planning tool, allowing individuals to transfer real property to designated beneficiaries without the need for probate. This form enables property owners to maintain control over their assets during their lifetime while ensuring a smooth transition upon their passing. One of the key features of the TOD deed is its simplicity; it requires minimal formalities and can be executed without the involvement of a lawyer, although legal advice is often recommended. The form must be properly filled out and recorded with the county clerk's office to be effective. Importantly, the transfer occurs automatically at the owner's death, which means that beneficiaries do not need to wait for the probate process to inherit the property. This deed also allows the property owner to revoke or change the beneficiary designation at any time before death, providing flexibility in estate planning. Additionally, the TOD deed can help avoid potential disputes among heirs, as it clearly outlines the intended recipients of the property. Overall, the Georgia Transfer-on-Death Deed form presents a practical option for those looking to streamline the transfer of real estate while minimizing legal complexities and costs associated with traditional inheritance methods.

Key takeaways

Filling out and using the Georgia Transfer-on-Death Deed form can be straightforward if you keep a few important points in mind. Here are some key takeaways:

- Understand the Purpose: The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death, avoiding probate.

- Complete the Form Accurately: Ensure all required information is filled out correctly, including the property description and beneficiary details. Errors can lead to complications later.

- Sign and Notarize: The deed must be signed by the property owner in the presence of a notary public. This step is crucial for the deed to be legally valid.

- File with the County: After completing the deed, file it with the appropriate county office where the property is located. This action officially records the transfer arrangement.

By keeping these points in mind, property owners can effectively use the Transfer-on-Death Deed to manage their estate planning needs in Georgia.

Guide to Writing Georgia Transfer-on-Death Deed

Once you have the Georgia Transfer-on-Death Deed form in hand, you’re ready to begin filling it out. This deed allows you to transfer real estate to a beneficiary upon your passing without going through probate. Follow the steps below to ensure that you complete the form accurately.

- Begin by entering your name as the grantor. This is the person transferring the property.

- Provide your current address. Make sure this is accurate, as it will be used for identification purposes.

- Identify the property being transferred. Include the full legal description of the property, which can typically be found on your property tax bill or deed.

- Next, write the name of the beneficiary. This is the person who will receive the property upon your death.

- Include the beneficiary’s address. This ensures that they can be contacted regarding the property.

- Sign the form in the presence of a notary public. Your signature must be notarized to make the deed valid.

- Finally, file the completed deed with the county clerk’s office in the county where the property is located. This step is crucial to ensure the deed is legally recognized.

After completing these steps, the deed will be recorded, and your beneficiary will be set to receive the property as specified. Make sure to keep a copy for your records.

Discover Popular Transfer-on-Death Deed Templates for Specific States

North Carolina Transfer on Death Deed - Property owners can name multiple beneficiaries if desired in the deed.

In order to create a comprehensive document for your transaction, you can utilize resources like smarttemplates.net, which provides fillable templates that ensure all necessary details are captured, safeguarding both parties during the sale process.

Tod in California - Tax implications may arise for beneficiaries, and it can be important for them to seek financial advice once they inherit.

Form Preview Example

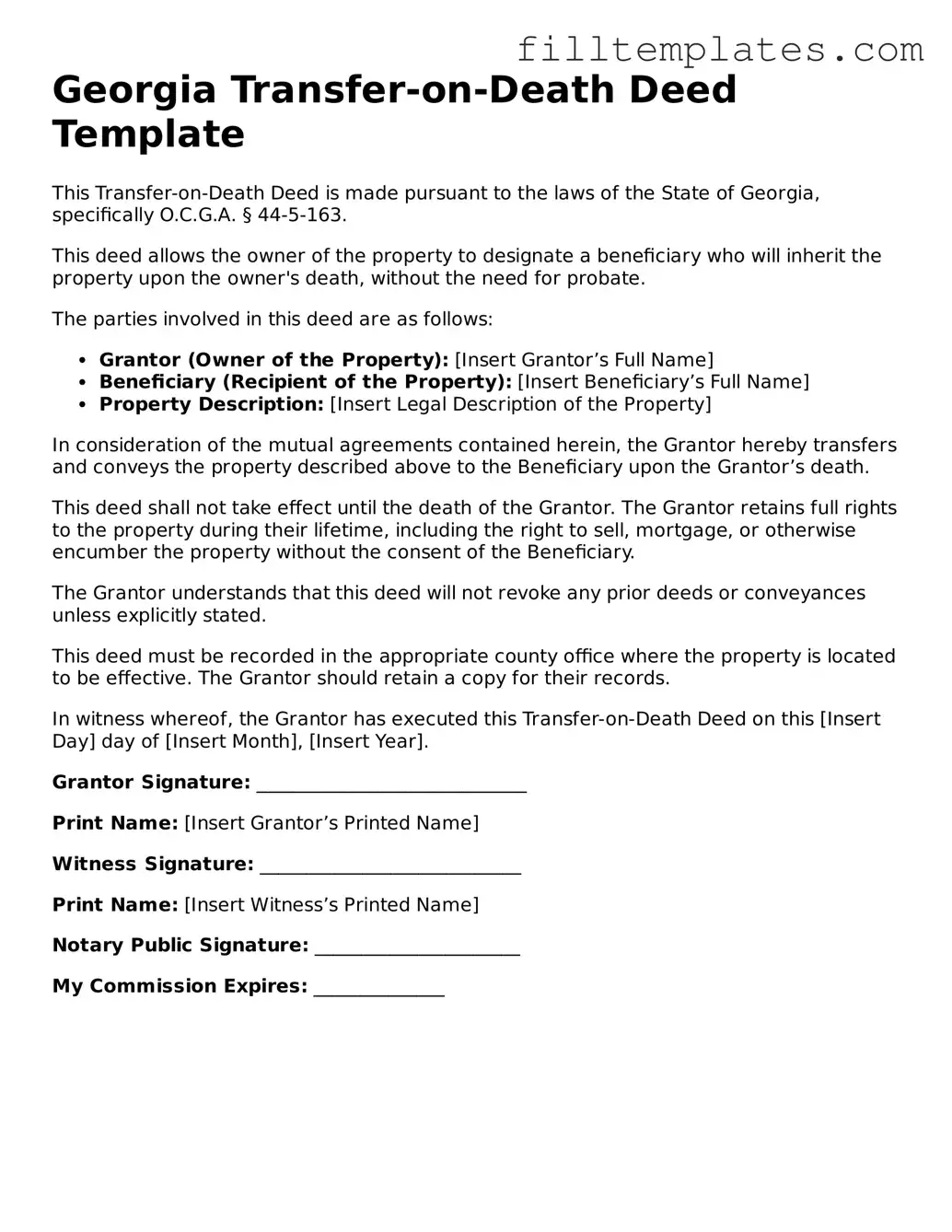

Georgia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the laws of the State of Georgia, specifically O.C.G.A. § 44-5-163.

This deed allows the owner of the property to designate a beneficiary who will inherit the property upon the owner's death, without the need for probate.

The parties involved in this deed are as follows:

- Grantor (Owner of the Property): [Insert Grantor’s Full Name]

- Beneficiary (Recipient of the Property): [Insert Beneficiary’s Full Name]

- Property Description: [Insert Legal Description of the Property]

In consideration of the mutual agreements contained herein, the Grantor hereby transfers and conveys the property described above to the Beneficiary upon the Grantor’s death.

This deed shall not take effect until the death of the Grantor. The Grantor retains full rights to the property during their lifetime, including the right to sell, mortgage, or otherwise encumber the property without the consent of the Beneficiary.

The Grantor understands that this deed will not revoke any prior deeds or conveyances unless explicitly stated.

This deed must be recorded in the appropriate county office where the property is located to be effective. The Grantor should retain a copy for their records.

In witness whereof, the Grantor has executed this Transfer-on-Death Deed on this [Insert Day] day of [Insert Month], [Insert Year].

Grantor Signature: _____________________________

Print Name: [Insert Grantor’s Printed Name]

Witness Signature: ____________________________

Print Name: [Insert Witness’s Printed Name]

Notary Public Signature: ______________________

My Commission Expires: ______________

Documents used along the form

When dealing with property transfers in Georgia, the Transfer-on-Death Deed is a useful tool. However, it often works in conjunction with several other important documents. Understanding these documents can help ensure a smooth transfer process and clarify the intentions of the property owner.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It can provide additional instructions that complement the Transfer-on-Death Deed.

- Motor Vehicle Bill of Sale: A necessary document for vehicle ownership transfer, providing essential details about the transaction, including the https://toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/texas-motor-vehicle-bill-of-sale/ and signatures of both parties.

- Affidavit of Heirship: This document helps establish the heirs of a deceased person. It can be useful in situations where there is no will or formal estate process.

- Property Deed: The original document that proves ownership of the property. It is essential to have this when executing a Transfer-on-Death Deed.

- Durable Power of Attorney: This allows someone to make decisions on behalf of the property owner if they become incapacitated. It can be important for managing property before death.

- Notice of Death: A document that may be filed to inform interested parties of the death of the property owner. This can help prevent disputes over property ownership.

- Title Search Report: A report that provides a history of the property’s ownership. It ensures that there are no liens or claims against the property before transferring it.

- Transfer Tax Return: A form that may be required by the state when property ownership changes. It ensures that any applicable taxes are paid during the transfer process.

Each of these documents plays a crucial role in property transfer and estate planning. By understanding their purposes, individuals can better navigate the complexities of property ownership and ensure that their wishes are honored after their passing.