Download Gift Letter Template

When it comes to purchasing a home, financial assistance from family or friends can make a significant difference. This is where the Gift Letter form comes into play. It serves as a formal document that outlines the details of a monetary gift given to a homebuyer, clarifying that the funds are not a loan but a true gift. The form typically includes essential information such as the donor's name, the recipient's name, the amount of the gift, and a statement confirming that the funds do not require repayment. Lenders often require this documentation to ensure that the buyer's financial situation is accurately represented. By providing transparency, the Gift Letter helps streamline the mortgage approval process and reinforces the legitimacy of the funds being used for the down payment. Understanding the components and significance of this form can help both donors and recipients navigate the home buying process more effectively.

Key takeaways

When filling out and using a Gift Letter form, several important considerations come into play. Here are key takeaways to keep in mind:

- Purpose of the Gift Letter: This document serves to clarify that the funds received are a gift and not a loan, which can impact mortgage applications.

- Donor Information: Clearly include the donor's name, address, and relationship to the recipient. This establishes the legitimacy of the gift.

- Recipient Information: Provide the recipient's name and address. This ensures that the lender knows who is receiving the funds.

- Gift Amount: Specify the exact amount of the gift. This transparency is crucial for financial institutions.

- Source of Funds: The donor may need to disclose where the funds are coming from, such as savings or a sale of an asset.

- Signature Requirement: Both the donor and the recipient should sign the letter. This adds an extra layer of authenticity.

- Timing Matters: Submit the Gift Letter form promptly as part of the mortgage application process to avoid delays.

- Consult Lenders: Different lenders may have specific requirements for Gift Letters, so it’s wise to check with them beforehand.

- Record Keeping: Keep a copy of the Gift Letter for personal records. This can be helpful for future reference or in case of audits.

Understanding these points can facilitate a smoother process when utilizing a Gift Letter in financial transactions.

Guide to Writing Gift Letter

Completing the Gift Letter form is an essential step in documenting financial gifts, especially when it pertains to real estate transactions. This process ensures that all parties involved have a clear understanding of the gift's nature and intent. Following the steps outlined below will help in accurately filling out the form.

- Begin by gathering the necessary information about the donor. This includes their full name, address, and relationship to the recipient.

- Next, provide the recipient's details. Include their full name and address as well.

- Indicate the amount of the gift clearly. Make sure to write this number in both numeric and written forms to avoid any confusion.

- In the designated section, specify the purpose of the gift. Common purposes include down payments for a home or other financial assistance.

- Both the donor and recipient should sign and date the form. Ensure that the signatures are legible and that the dates are current.

- Finally, review the completed form for any errors or omissions before submitting it as part of the required documentation.

Browse Other PDFs

Mvt 20-1 - All parties involved must sign the form to confirm their agreement to the lien recording.

Hazmat Shipping Papers Template - Used to detail the nature and quantity of hazardous materials being shipped.

For those looking to understand their requirements, a reliable guide to the ATV Bill of Sale process is essential for ensuring a smooth transaction when buying or selling an ATV. You can find a helpful template at this resource for an ATV Bill of Sale.

T47 Paralympics - The T-47 can expedite the closing process for real estate deals.

Form Preview Example

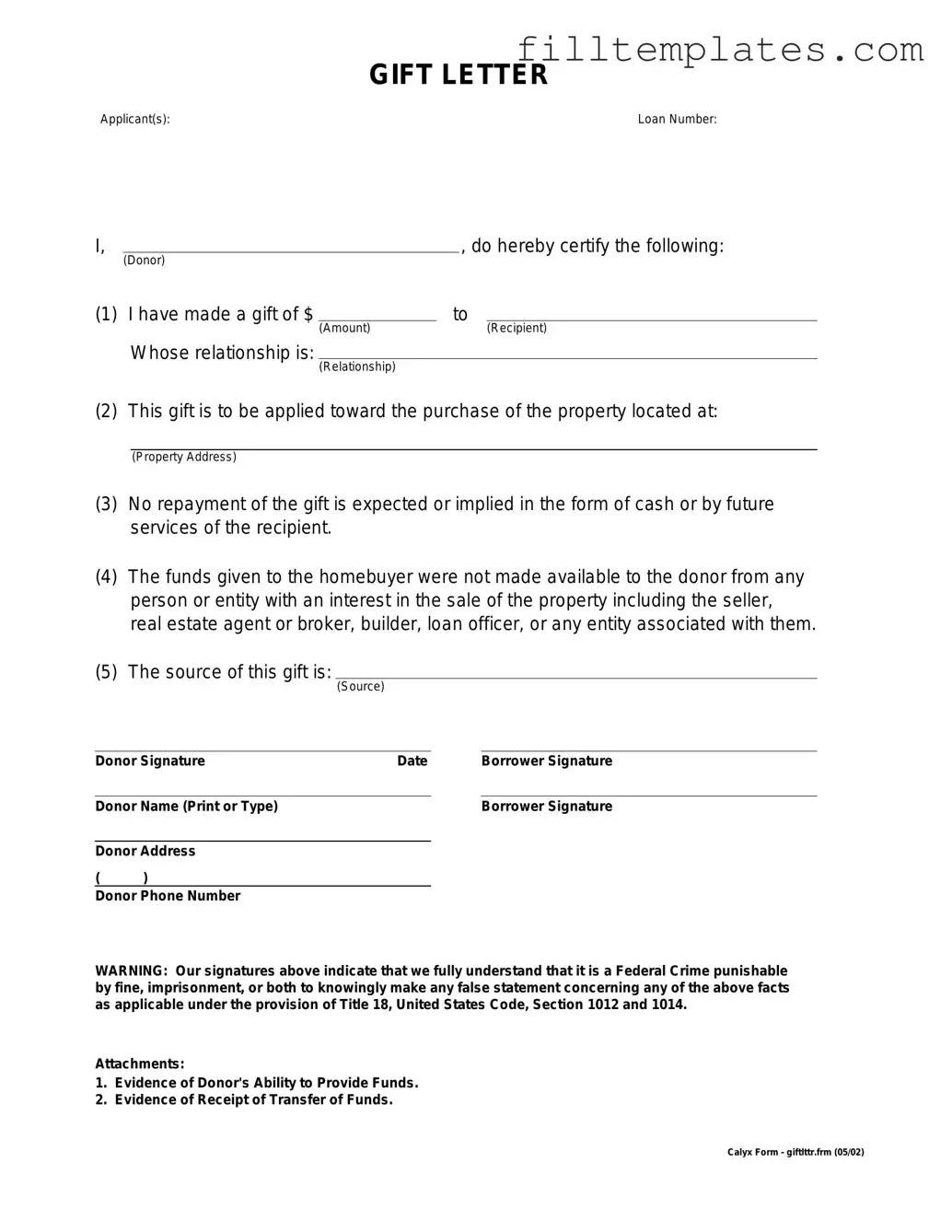

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Documents used along the form

When preparing a Gift Letter form, several other documents may be required to support the transaction. These documents help clarify the source of the gift, confirm the relationship between the parties involved, and ensure compliance with financial regulations. Below is a list of commonly used forms and documents that may accompany a Gift Letter.

- Bank Statements: These documents provide proof of the donor's financial ability to give the gift. They show the funds available and demonstrate that the gift is legitimate.

- Proof of Relationship: This could include documents like birth certificates or marriage licenses that verify the relationship between the donor and the recipient.

- Gift Tax Return (Form 709): This form is used to report gifts that exceed the annual exclusion amount. It helps ensure that any potential tax implications are addressed.

- Settlement Statement: Often required in real estate transactions, this document outlines the financial details of the sale and may include the gift as part of the down payment.

- Donor's Affidavit: A sworn statement from the donor confirming the intent to give the gift and clarifying that it does not need to be repaid.

- Letter of Intent: This letter outlines the donor's intentions regarding the gift, including the amount and purpose, providing additional context for the transaction.

- Financial Statements: For larger gifts, financial statements may be provided to further validate the donor's financial situation and ability to provide the gift.

- Gift Agreement: This formal document outlines the terms of the gift, including any conditions or expectations associated with it.

- Employment Verification Form: This form is essential in confirming the employment status of the borrower, providing details such as job title, dates of employment, and salary. It is particularly important during mortgage applications and may be requested alongside other documents. For more information, visit OnlineLawDocs.com.

- Tax Identification Numbers: Both the donor and recipient may need to provide their Social Security numbers or Employer Identification Numbers for tax purposes.

Gathering these documents can facilitate a smoother transaction and help avoid potential issues during the gift process. Ensuring that all necessary forms are completed accurately and submitted in a timely manner is crucial for compliance and peace of mind.