Download Goodwill donation receipt Template

When donating items to Goodwill, it’s essential to understand the significance of the donation receipt form. This document serves as proof of your charitable contribution, which can be useful for tax deductions. The form typically includes key details such as the date of the donation, a description of the items donated, and the estimated value of those items. Donors are encouraged to list the specific items they are giving, as this information can help in accurately assessing their value. Additionally, the receipt may include the name and address of the Goodwill location where the donation was made. Keeping this receipt organized and accessible is crucial for tax purposes, as it provides the necessary documentation to support your charitable giving. Understanding how to fill out and utilize this form effectively can enhance your donation experience and ensure you receive the benefits associated with your generosity.

Key takeaways

When donating items to Goodwill, it is essential to understand how to properly fill out and utilize the donation receipt form. Here are some key takeaways to consider:

- Receipt Importance: The donation receipt serves as proof of your charitable contribution for tax purposes.

- Item Description: Clearly list the items you are donating. This helps in accurately assessing their value.

- Value Estimation: While Goodwill does not assign a value, it is your responsibility to estimate the fair market value of your donated items.

- Donation Date: Always include the date of your donation on the receipt. This is crucial for tax records.

- Signature Requirement: Sign the receipt to validate your donation. This adds authenticity to your claim.

- Multiple Donations: If you make several donations, request a separate receipt for each to ensure clarity in your records.

- Keep Copies: Retain a copy of the receipt for your personal records. This can be helpful during tax season.

- Check Local Laws: Be aware of local regulations regarding charitable donations, as they may affect how you report your contributions.

- Goodwill's Role: Understand that Goodwill uses the proceeds from the sale of donated items to fund job training and community services.

- Consult a Professional: If in doubt about the value of your donations or tax implications, consider consulting a tax professional.

By following these guidelines, donors can ensure that their contributions are both beneficial to the community and compliant with tax regulations.

Guide to Writing Goodwill donation receipt

After gathering your items for donation to Goodwill, you'll need to fill out the donation receipt form. This form serves as a record of your charitable contribution, which may be useful for tax purposes. Follow the steps below to ensure that you complete the form accurately and efficiently.

- Begin by writing the date of your donation in the designated space at the top of the form.

- Next, provide your name and address. This information is crucial for Goodwill to recognize you as the donor.

- List the items you are donating. Be specific and include a brief description of each item, such as “two pairs of shoes” or “a sofa.”

- Assign a fair market value to each item. This is the price you would expect to receive if you sold the items in a used condition.

- If applicable, indicate whether you received any goods or services in exchange for your donation. This may affect the value of your deduction.

- Finally, sign and date the form to validate your donation.

Once you have completed the form, keep a copy for your records. This will help you when filing your taxes and provide proof of your charitable contribution.

Browse Other PDFs

Therapy Session Notes Examples - Summarize the results of any tests conducted since the last visit.

To facilitate the purchase process, consider utilizing a reliable resource that provides a simple boat bill of sale template. This document can help ensure that both parties understand the transaction and can serve as a quick reference for any necessary details involved in the sale.

Dollar Fundraiser Sheets - We appreciate your willingness to help.

How to Gift a Car in Louisiana - Certain property types may require additional documentation alongside the act of donation form to complete the transfer.

Form Preview Example

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

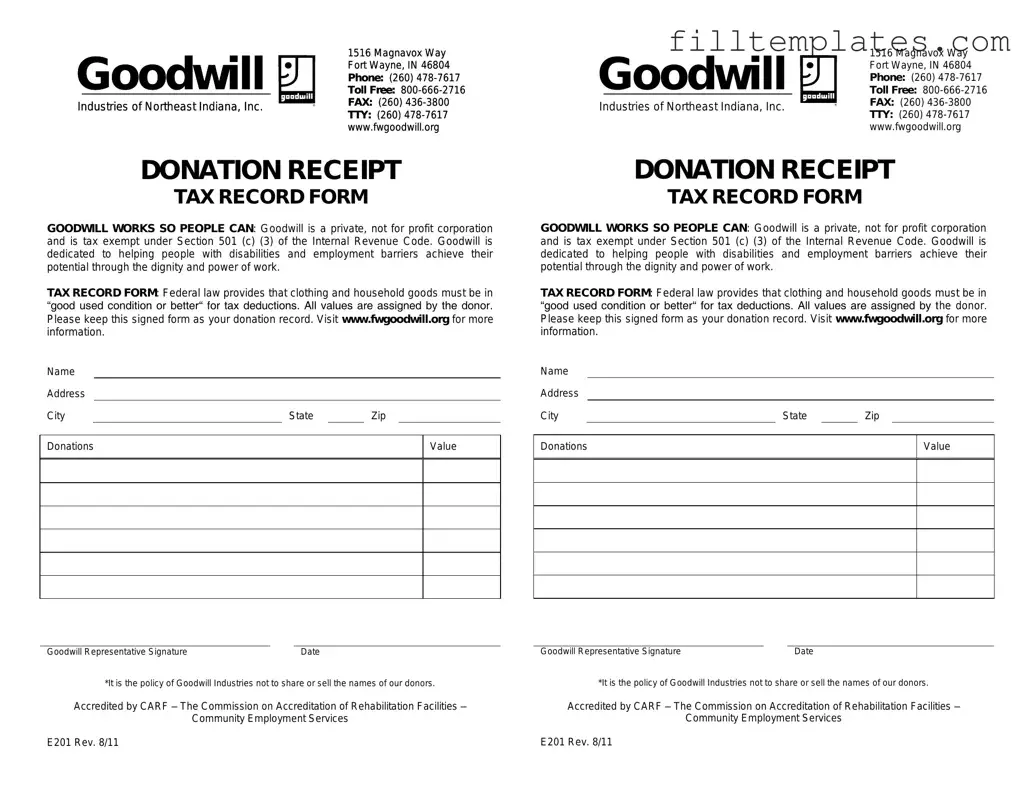

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Documents used along the form

When making a donation to Goodwill or similar organizations, several forms and documents may accompany the Goodwill donation receipt. Each of these documents serves a specific purpose, helping both the donor and the organization manage the donation process effectively. Below is a list of these documents.

- Donation Agreement: This document outlines the terms of the donation, including the items being donated and any conditions attached to the donation. It serves as a mutual understanding between the donor and the organization.

- Inventory List: An inventory list details the items being donated. It helps the donor keep track of what has been given and is useful for tax purposes.

- Texas Vehicle Purchase Agreement: This document outlines the terms of vehicle sales in Texas, ensuring clarity between buyers and sellers. For more details, visit TopTemplates.info.

- Tax Deduction Form: This form provides information on how to claim a tax deduction for the donation. It may include instructions on the necessary documentation required by the IRS.

- Appraisal Certificate: For high-value items, an appraisal certificate may be necessary. This document assesses the fair market value of the donated items, which can be crucial for tax reporting.

- Thank You Letter: After a donation, organizations often send a thank you letter. This letter acknowledges the donation and can serve as additional documentation for tax purposes.

- Donor Profile Form: Some organizations request a donor profile form. This document collects information about the donor, which helps the organization understand its supporters and improve outreach efforts.

- Gift Acceptance Policy: This policy outlines the types of donations the organization accepts and any conditions or restrictions that apply. It helps ensure that donations align with the organization's mission.

Understanding these documents can enhance the donation experience and ensure compliance with tax regulations. Each form plays a role in creating transparency and accountability in charitable giving.