Official Articles of Incorporation Template for the State of Illinois

The Illinois Articles of Incorporation form is a crucial document for individuals or groups looking to establish a corporation within the state. This form serves as the foundation for a corporation's legal existence and outlines essential information that is necessary for compliance with state laws. Key aspects include the corporation's name, which must be unique and not deceptively similar to existing entities, and the purpose of the corporation, which should clearly define its business activities. Additionally, the form requires details about the registered agent, who will receive legal documents on behalf of the corporation, and the address of the corporation's principal office. Incorporators must also provide information about the number of shares the corporation is authorized to issue, which is vital for determining ownership and investment structure. Filing this form with the Illinois Secretary of State is a critical step in the incorporation process, and it is essential to ensure that all information is accurate and complete to avoid potential delays or legal issues in the future.

Key takeaways

Filling out the Illinois Articles of Incorporation form is a crucial step in establishing a corporation in the state. Here are some key takeaways to keep in mind:

- The form requires basic information about the corporation, including its name, purpose, and registered agent.

- It is important to ensure that the name of the corporation is unique and complies with state naming requirements.

- Filing fees must be paid at the time of submission, and these fees can vary based on the type of corporation being formed.

- Once filed, the Articles of Incorporation become a public record, making it essential to provide accurate and truthful information.

- After receiving confirmation of incorporation, it is advisable to obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

These steps will help facilitate a smoother incorporation process in Illinois.

Guide to Writing Illinois Articles of Incorporation

Once the Illinois Articles of Incorporation form is completed, it must be submitted to the appropriate state office along with the required filing fee. This step is crucial for officially establishing your corporation in Illinois. Ensure that all information is accurate and complete to avoid delays in processing.

- Obtain the Illinois Articles of Incorporation form from the Illinois Secretary of State's website or office.

- Fill in the name of the corporation. Ensure that it complies with Illinois naming requirements.

- Provide the purpose of the corporation. Be clear and concise in describing the business activities.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Specify the duration of the corporation. Most corporations choose perpetual duration unless otherwise stated.

- Include the names and addresses of the initial directors. This information is essential for governance.

- Indicate the number of shares the corporation is authorized to issue. Provide details about the classes of shares, if applicable.

- Sign and date the form. Ensure that the signature is from an authorized individual.

- Prepare the filing fee, which varies based on the type of corporation. Check the latest fee schedule.

- Submit the completed form and payment to the Illinois Secretary of State by mail or in person.

Discover Popular Articles of Incorporation Templates for Specific States

Georgia Secretary of State Corporations - Include clauses on transferring ownership of shares.

For those looking to establish a corporation in California, the necessary Articles of Incorporation form requirements provide critical guidance on adhering to state regulations and ensuring legal compliance.

Ohio Business Forms - The filing can be done online or via mail, depending on the state.

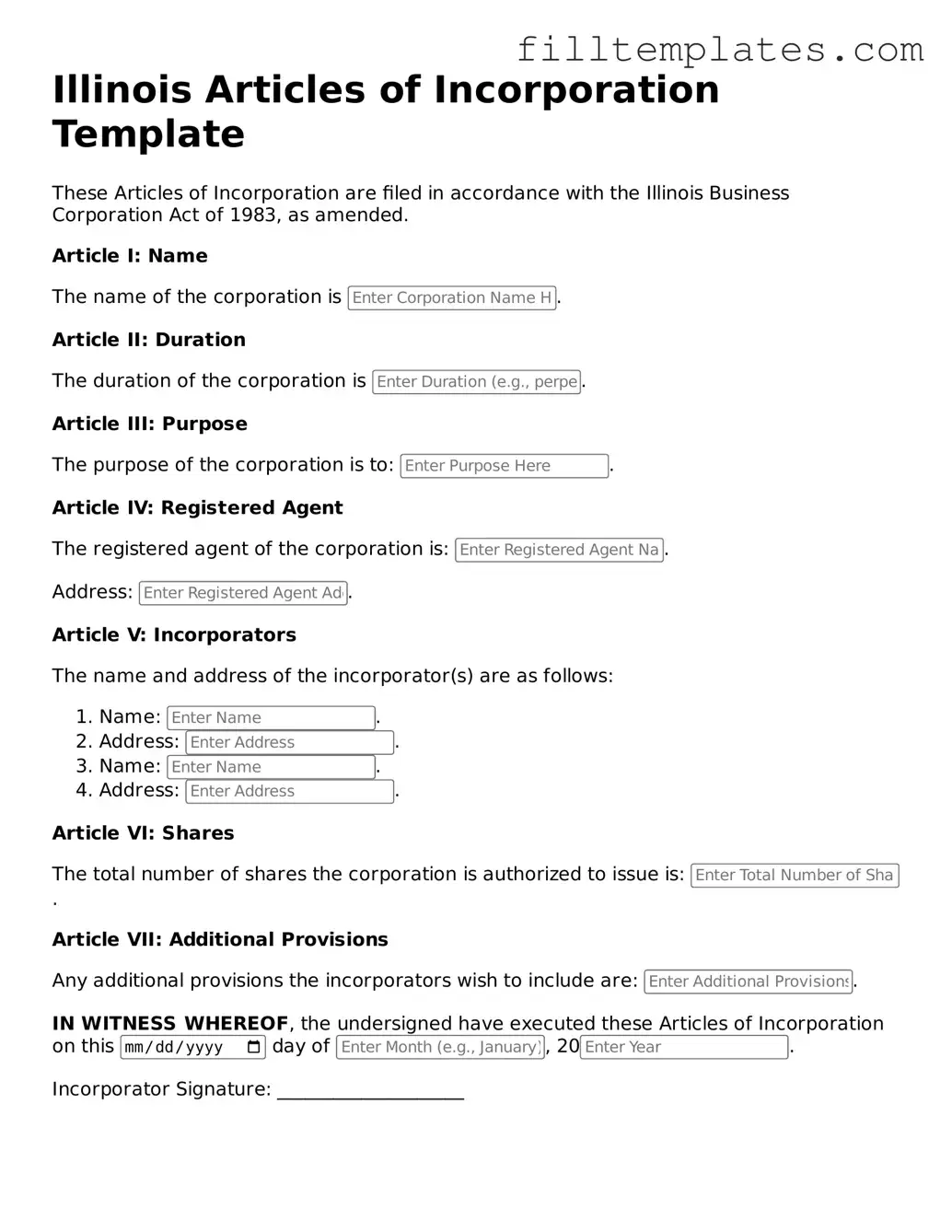

Form Preview Example

Illinois Articles of Incorporation Template

These Articles of Incorporation are filed in accordance with the Illinois Business Corporation Act of 1983, as amended.

Article I: Name

The name of the corporation is .

Article II: Duration

The duration of the corporation is .

Article III: Purpose

The purpose of the corporation is to: .

Article IV: Registered Agent

The registered agent of the corporation is: .

Address: .

Article V: Incorporators

The name and address of the incorporator(s) are as follows:

- Name: .

- Address: .

- Name: .

- Address: .

Article VI: Shares

The total number of shares the corporation is authorized to issue is: .

Article VII: Additional Provisions

Any additional provisions the incorporators wish to include are: .

IN WITNESS WHEREOF, the undersigned have executed these Articles of Incorporation on this day of , 20.

Incorporator Signature: ____________________

Documents used along the form

When filing the Illinois Articles of Incorporation, several other forms and documents may be necessary to ensure compliance with state regulations. Below is a list of common documents that are often used in conjunction with the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for the corporation. It governs the management structure and operational guidelines.

- Registered Agent Consent Form: This form confirms the appointment of a registered agent who will receive legal documents on behalf of the corporation.

- Initial Report: Required by some states, this report provides information about the corporation's directors and officers shortly after incorporation.

- Employer Identification Number (EIN) Application: This form is necessary for obtaining a unique identification number from the IRS for tax purposes.

- ATV Bill of Sale: Used to document the transaction and transfer of ownership for all-terrain vehicles, the form is essential for both buyers and sellers in Arizona. For more details, refer to the Bill of Sale for a Four Wheeler.

- Business License Application: Depending on the type of business, a license may be required to operate legally within the state or municipality.

- Certificate of Good Standing: This document verifies that the corporation is compliant with state requirements and is in good standing to conduct business.

Each of these documents plays a crucial role in the incorporation process and helps establish a solid foundation for the corporation's legal and operational framework.