Official Deed in Lieu of Foreclosure Template for the State of Illinois

In Illinois, the Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing financial distress and the possibility of losing their property. This option allows homeowners to voluntarily transfer ownership of their property back to the lender, effectively avoiding the lengthy and often stressful foreclosure process. By signing this document, the homeowner can settle their mortgage obligations, potentially alleviating some of the burdens associated with unpaid debts. The form outlines essential details, such as the property address, the parties involved, and any existing liens or encumbrances. Additionally, it may include clauses that address the lender’s acceptance of the property in lieu of foreclosure and the release of the homeowner from further liability. Understanding the implications of this form is vital for homeowners seeking to navigate their financial challenges while protecting their credit and future homeownership opportunities.

Key takeaways

When considering the Illinois Deed in Lieu of Foreclosure form, it is important to understand several key aspects that will guide the process effectively. Below are essential takeaways to keep in mind:

- The form allows a borrower to transfer property ownership to the lender to avoid foreclosure.

- Both parties must agree to the deed in lieu arrangement, ensuring mutual consent is documented.

- The borrower should confirm that the property is free of any liens or encumbrances before proceeding.

- It is advisable to consult with a legal or financial advisor to understand the implications of this decision.

- Completing the form accurately is crucial; errors can delay the process or lead to complications.

- Filing the deed with the appropriate county office is necessary for it to be legally binding.

- This process may impact the borrower’s credit score, but it is often less damaging than a foreclosure.

Understanding these points can help ensure a smoother transition and minimize potential issues during the deed in lieu process.

Guide to Writing Illinois Deed in Lieu of Foreclosure

Once you have the Illinois Deed in Lieu of Foreclosure form ready, it's time to fill it out accurately. This document requires specific information about the property and the parties involved. Completing it correctly is essential for a smooth process.

- Begin by entering the date at the top of the form.

- Provide the name of the grantor, which is typically the borrower or property owner.

- List the name of the grantee, usually the lender or financial institution.

- Clearly describe the property being transferred. Include the street address, city, state, and zip code.

- Insert the legal description of the property. This can often be found on the property deed or tax documents.

- State any encumbrances on the property, such as mortgages or liens, if applicable.

- Sign the form in the designated area. Ensure that the signature matches the name of the grantor.

- Have the signature notarized. A notary public must witness the signing.

- Make copies of the completed form for your records.

- Submit the original form to the appropriate county recorder’s office for official recording.

Discover Popular Deed in Lieu of Foreclosure Templates for Specific States

Foreclosure Process in Georgia - This form can potentially streamline the process of selling the property back to the lender.

To effectively utilize a Release of Liability form, it's essential to understand the specific language and terms used within the document. By customizing this form to meet your particular needs, you can ensure that both parties are adequately informed and protected. For a comprehensive template that can help guide you through this process, you can visit smarttemplates.net, where you'll find practical resources to assist you in creating legally binding agreements.

Deed in Lieu Vs Foreclosure - This agreement is often seen as a last resort for borrowers facing financial hardship.

Form Preview Example

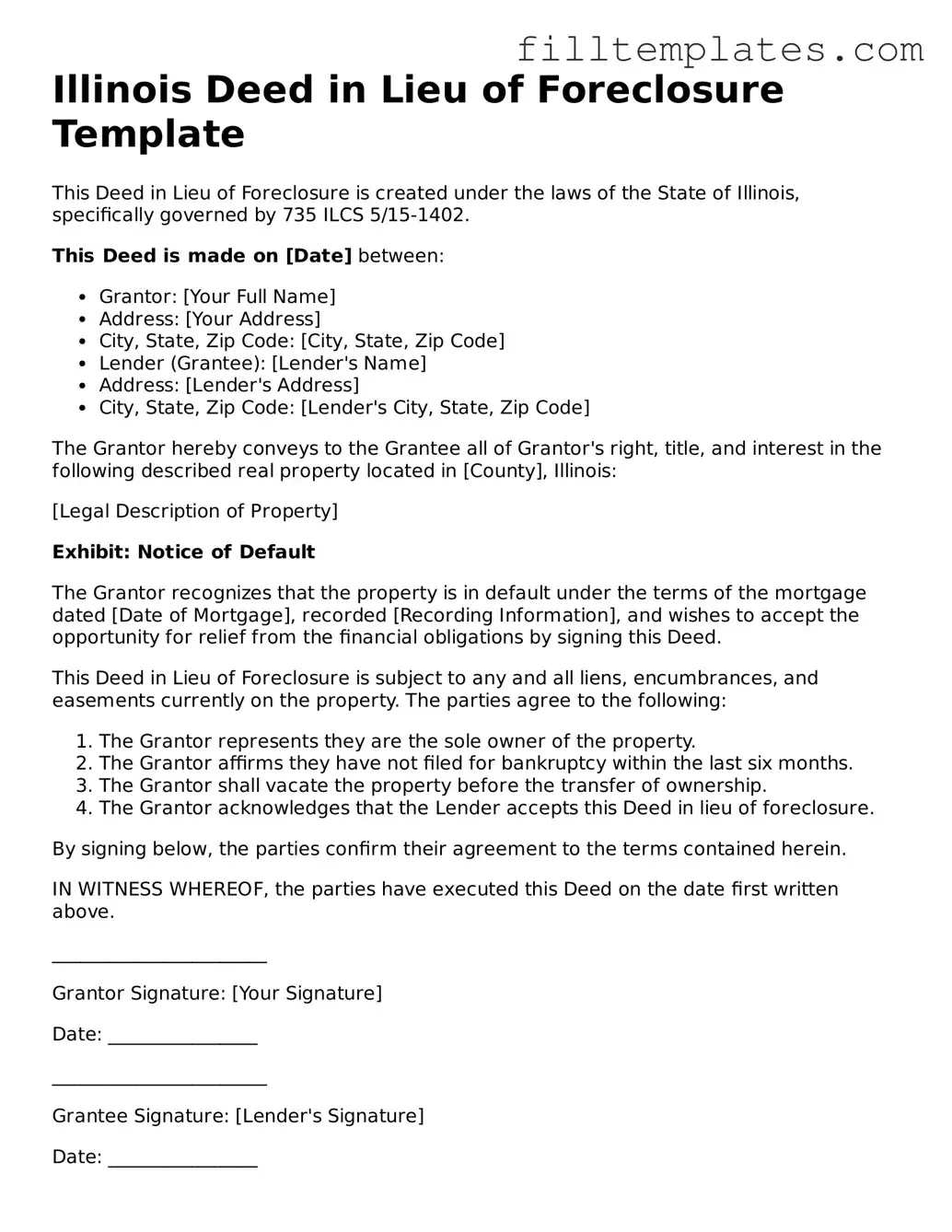

Illinois Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is created under the laws of the State of Illinois, specifically governed by 735 ILCS 5/15-1402.

This Deed is made on [Date] between:

- Grantor: [Your Full Name]

- Address: [Your Address]

- City, State, Zip Code: [City, State, Zip Code]

- Lender (Grantee): [Lender's Name]

- Address: [Lender's Address]

- City, State, Zip Code: [Lender's City, State, Zip Code]

The Grantor hereby conveys to the Grantee all of Grantor's right, title, and interest in the following described real property located in [County], Illinois:

[Legal Description of Property]

Exhibit: Notice of Default

The Grantor recognizes that the property is in default under the terms of the mortgage dated [Date of Mortgage], recorded [Recording Information], and wishes to accept the opportunity for relief from the financial obligations by signing this Deed.

This Deed in Lieu of Foreclosure is subject to any and all liens, encumbrances, and easements currently on the property. The parties agree to the following:

- The Grantor represents they are the sole owner of the property.

- The Grantor affirms they have not filed for bankruptcy within the last six months.

- The Grantor shall vacate the property before the transfer of ownership.

- The Grantor acknowledges that the Lender accepts this Deed in lieu of foreclosure.

By signing below, the parties confirm their agreement to the terms contained herein.

IN WITNESS WHEREOF, the parties have executed this Deed on the date first written above.

_______________________

Grantor Signature: [Your Signature]

Date: ________________

_______________________

Grantee Signature: [Lender's Signature]

Date: ________________

Notary Public:

_______________________

Notary Signature: _________________

Date: ________________

This document should be recorded in the appropriate county clerk's office to ensure proper notice to third parties.

Documents used along the form

When navigating the process of a deed in lieu of foreclosure in Illinois, several other forms and documents may be involved. These documents help clarify the terms and ensure all parties understand their rights and responsibilities. Below is a list of common forms that are often used alongside the Illinois Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines changes to the original loan terms, which may include adjustments to the interest rate or payment schedule. It serves as a way to help borrowers avoid foreclosure by making their mortgage more manageable.

- Notice of Default: This notice is sent by the lender to inform the borrower that they have fallen behind on mortgage payments. It typically outlines the amount owed and the consequences if the default is not resolved.

- Release of Liability: This form releases the borrower from any further obligations related to the mortgage after the deed in lieu has been executed. It ensures that the borrower will not be held responsible for any remaining debt on the property.

- Property Inspection Report: A report that details the condition of the property being surrendered. Lenders often require this inspection to assess any damages or necessary repairs before accepting the deed in lieu.

- Motor Vehicle Bill of Sale: This document serves as a crucial receipt for the sale of a vehicle, providing proof of ownership transfer, and can be found at toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/.

- Affidavit of Title: This sworn statement confirms the ownership of the property and discloses any liens or encumbrances. It helps ensure that the lender is aware of any potential issues with the title before proceeding with the deed in lieu.

- Quitclaim Deed: This document is used to transfer ownership of the property from the borrower to the lender. It is often executed as part of the deed in lieu process to formalize the transfer of the property title.

Understanding these documents is crucial for anyone involved in a deed in lieu of foreclosure. Each form plays a significant role in the process, ensuring that both the borrower and lender are protected and informed. Proper documentation can help streamline the transition and mitigate potential disputes.