Official Last Will and Testament Template for the State of Illinois

In Illinois, the Last Will and Testament form serves as a crucial legal document that allows individuals to outline their wishes regarding the distribution of their property and assets after their passing. This form not only provides a means for individuals to designate beneficiaries but also allows them to appoint guardians for minor children, ensuring that their loved ones are cared for according to their preferences. Additionally, the document can specify funeral arrangements and other final wishes, which can alleviate the burden on family members during a difficult time. It is important to note that for a will to be considered valid in Illinois, it must be signed by the testator, the person creating the will, and witnessed by at least two individuals who are not beneficiaries. This requirement emphasizes the importance of having an objective verification of the testator's intentions. Furthermore, the Illinois Last Will and Testament form can be customized to reflect personal circumstances, making it a flexible tool for estate planning. Understanding the various components and legal requirements associated with this form is essential for anyone looking to ensure that their final wishes are honored and respected.

Key takeaways

When filling out and using the Illinois Last Will and Testament form, it is important to keep several key points in mind. Below are essential takeaways that can help ensure the process goes smoothly.

- The form must be completed in writing. This ensures that your wishes are clearly documented.

- It is important to sign the will in front of at least two witnesses. These individuals should not be beneficiaries of the will.

- Make sure to include your full name and address at the beginning of the document to establish your identity.

- Clearly state how you wish your assets to be distributed after your passing. Specificity can help avoid confusion later.

- Consider appointing an executor. This person will be responsible for carrying out the terms of your will.

- Review and update your will periodically, especially after significant life events such as marriage, divorce, or the birth of a child.

Following these guidelines can help ensure that your Last Will and Testament accurately reflects your wishes and is legally valid in the state of Illinois.

Guide to Writing Illinois Last Will and Testament

After gathering all necessary information, you are ready to fill out the Illinois Last Will and Testament form. This document allows you to outline how your assets will be distributed after your passing. Completing it accurately ensures your wishes are honored.

- Begin by writing your full name at the top of the form. Make sure to include any middle names or initials.

- Next, provide your current address. This should include your street address, city, state, and zip code.

- Indicate your date of birth. This is typically formatted as month, day, and year.

- Designate an executor. This person will be responsible for ensuring your wishes are carried out. Include their full name and contact information.

- List your beneficiaries. These are the individuals or organizations that will receive your assets. Provide their full names and relationships to you.

- Detail the specific assets you wish to leave to each beneficiary. Be clear and specific to avoid any confusion.

- Include any additional instructions or wishes you have regarding your estate. This might include funeral arrangements or guardianship for minor children.

- Sign the document in the presence of at least two witnesses. They should also sign the form, acknowledging they witnessed your signature.

- Make copies of the signed document for your records and for your executor.

Once completed, store the form in a safe place and inform your executor and family members of its location. Regularly review the document to ensure it reflects your current wishes and circumstances.

Discover Popular Last Will and Testament Templates for Specific States

Last Will and Testament Template Georgia - A guide for your loved ones on your wishes regarding property and guardianship.

When preparing for a sale, it's important to have the necessary documents, including an official ATV Bill of Sale for your transaction. This form not only helps in documenting the sale but also serves as a legal safeguard for both parties involved in the exchange.

Writing a Will in Nc - Provides a method to legally distribute your digital assets, such as online accounts.

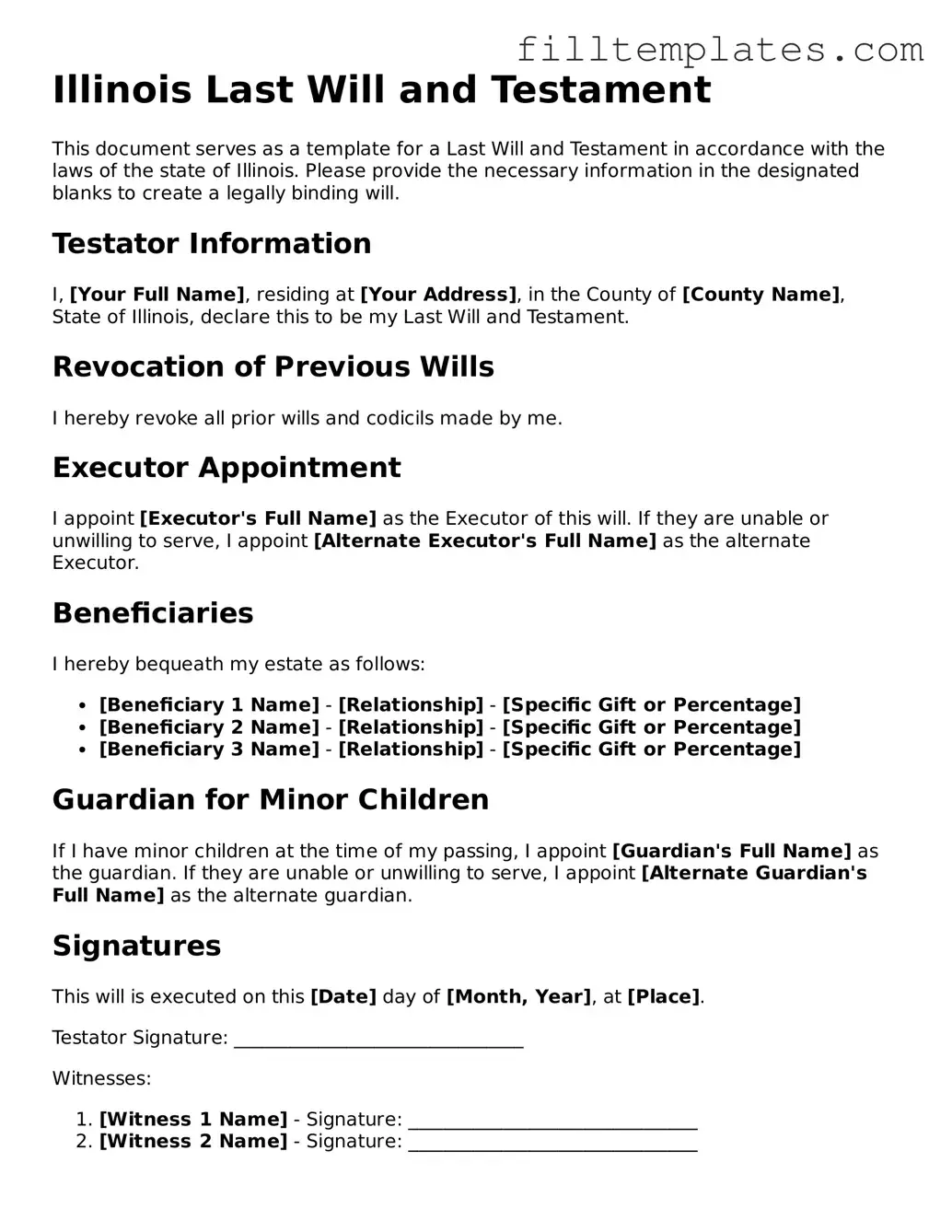

Form Preview Example

Illinois Last Will and Testament

This document serves as a template for a Last Will and Testament in accordance with the laws of the state of Illinois. Please provide the necessary information in the designated blanks to create a legally binding will.

Testator Information

I, [Your Full Name], residing at [Your Address], in the County of [County Name], State of Illinois, declare this to be my Last Will and Testament.

Revocation of Previous Wills

I hereby revoke all prior wills and codicils made by me.

Executor Appointment

I appoint [Executor's Full Name] as the Executor of this will. If they are unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as the alternate Executor.

Beneficiaries

I hereby bequeath my estate as follows:

- [Beneficiary 1 Name] - [Relationship] - [Specific Gift or Percentage]

- [Beneficiary 2 Name] - [Relationship] - [Specific Gift or Percentage]

- [Beneficiary 3 Name] - [Relationship] - [Specific Gift or Percentage]

Guardian for Minor Children

If I have minor children at the time of my passing, I appoint [Guardian's Full Name] as the guardian. If they are unable or unwilling to serve, I appoint [Alternate Guardian's Full Name] as the alternate guardian.

Signatures

This will is executed on this [Date] day of [Month, Year], at [Place].

Testator Signature: _______________________________

Witnesses:

- [Witness 1 Name] - Signature: _______________________________

- [Witness 2 Name] - Signature: _______________________________

By signing above, the witnesses affirm that they are not named as beneficiaries in this will and are of legal age to serve as witnesses in accordance with Illinois law.

Documents used along the form

When creating a Last Will and Testament in Illinois, several other forms and documents may be necessary to ensure that your wishes are carried out effectively. Each of these documents serves a unique purpose and can help clarify your intentions regarding your estate and loved ones. Below is a list of common forms that often accompany a Last Will and Testament.

- Durable Power of Attorney for Healthcare: This document allows you to appoint someone to make medical decisions on your behalf if you become unable to do so. It ensures that your healthcare preferences are respected.

- Bill of Sale: This document serves as proof of purchase and transfer of ownership, detailing the terms of sale and identifying the buyer and seller. For more information, visit smarttemplates.net/.

- Durable Power of Attorney for Property: Similar to the healthcare version, this document lets you designate someone to manage your financial affairs if you become incapacitated. It can cover everything from paying bills to managing investments.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you are terminally ill or unable to communicate. It provides guidance to your healthcare providers and loved ones about your preferences.

- Revocable Trust: A revocable trust allows you to place your assets into a trust during your lifetime, which can simplify the distribution process after your death and help avoid probate. You can change or revoke the trust at any time while you are alive.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. These designations can bypass probate and ensure that assets go directly to your chosen individuals.

- Letter of Intent: While not a legally binding document, a letter of intent can provide guidance to your executor or loved ones about your wishes for your estate, funeral arrangements, or specific bequests.

- Pet Trust: If you have pets, a pet trust can ensure that they are cared for according to your wishes after your passing. This document can specify how funds should be used for their care and who will take responsibility for them.

- Affidavit of Heirship: This document can help establish the heirs of an estate when someone dies without a will. It can simplify the process of transferring property by providing proof of heirship.

- Estate Inventory: An estate inventory lists all of your assets and debts. It can help your executor manage your estate and ensure that all obligations are met before distribution to beneficiaries.

Understanding these documents can help you create a comprehensive estate plan that reflects your wishes and protects your loved ones. It's always a good idea to consult with a legal professional to ensure that all necessary forms are completed accurately and in accordance with Illinois law.