Official Loan Agreement Template for the State of Illinois

The Illinois Loan Agreement form serves as a crucial document in establishing the terms and conditions of a loan between a lender and a borrower. This form outlines essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It also specifies the rights and responsibilities of both parties, ensuring clarity and mutual understanding. By including provisions for default, late fees, and dispute resolution, the agreement aims to protect the interests of both the lender and the borrower. Additionally, it may contain clauses regarding prepayment options and any applicable fees, making it a comprehensive tool for managing financial transactions. Understanding the nuances of this form is vital for anyone considering entering into a loan agreement in Illinois, as it lays the groundwork for a successful financial relationship.

Key takeaways

Here are key takeaways for filling out and using the Illinois Loan Agreement form:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender at the beginning of the agreement.

- Loan Amount: Specify the exact amount being loaned. This figure should be clear to avoid confusion later.

- Interest Rate: Include the interest rate applicable to the loan. Make sure it complies with Illinois state laws.

- Repayment Terms: Outline the repayment schedule, including due dates and payment amounts. Clarity is crucial.

- Default Clauses: Define what constitutes a default and the consequences of defaulting on the loan.

- Governing Law: State that the agreement is governed by Illinois law to ensure legal clarity.

- Signatures: Ensure both parties sign and date the agreement. This is essential for enforceability.

- Witness or Notary: Consider having the agreement witnessed or notarized to add an extra layer of authenticity.

- Keep Copies: Each party should retain a signed copy of the agreement for their records.

- Review Before Signing: Both parties should thoroughly review the agreement to ensure all terms are understood and acceptable.

Guide to Writing Illinois Loan Agreement

After obtaining the Illinois Loan Agreement form, you will need to fill it out accurately to ensure clarity between the lender and the borrower. Follow these steps to complete the form correctly.

- Title the Agreement: At the top of the form, write "Loan Agreement" to clearly identify the document.

- Enter the Date: Write the date on which the agreement is being signed.

- Identify the Parties: Fill in the names and addresses of both the lender and the borrower. Make sure to include any relevant contact information.

- Specify the Loan Amount: Clearly state the total amount of money being loaned.

- Detail the Interest Rate: Indicate the interest rate applicable to the loan, if any.

- Set the Loan Term: Specify the duration of the loan. Include start and end dates if applicable.

- Outline Repayment Terms: Describe how and when payments will be made. Include due dates and payment methods.

- Include Late Fees: If applicable, state any fees that will be charged for late payments.

- Signatures: Both the lender and borrower must sign and date the form at the bottom. Ensure that all parties receive a copy of the signed agreement.

Discover Popular Loan Agreement Templates for Specific States

Promissory Note Georgia - This form can be used for both secured and unsecured loans.

To ensure that your Power of Attorney form is crafted correctly and meets legal requirements, you may consider utilizing resources like smarttemplates.net, which offer templates designed to simplify the process.

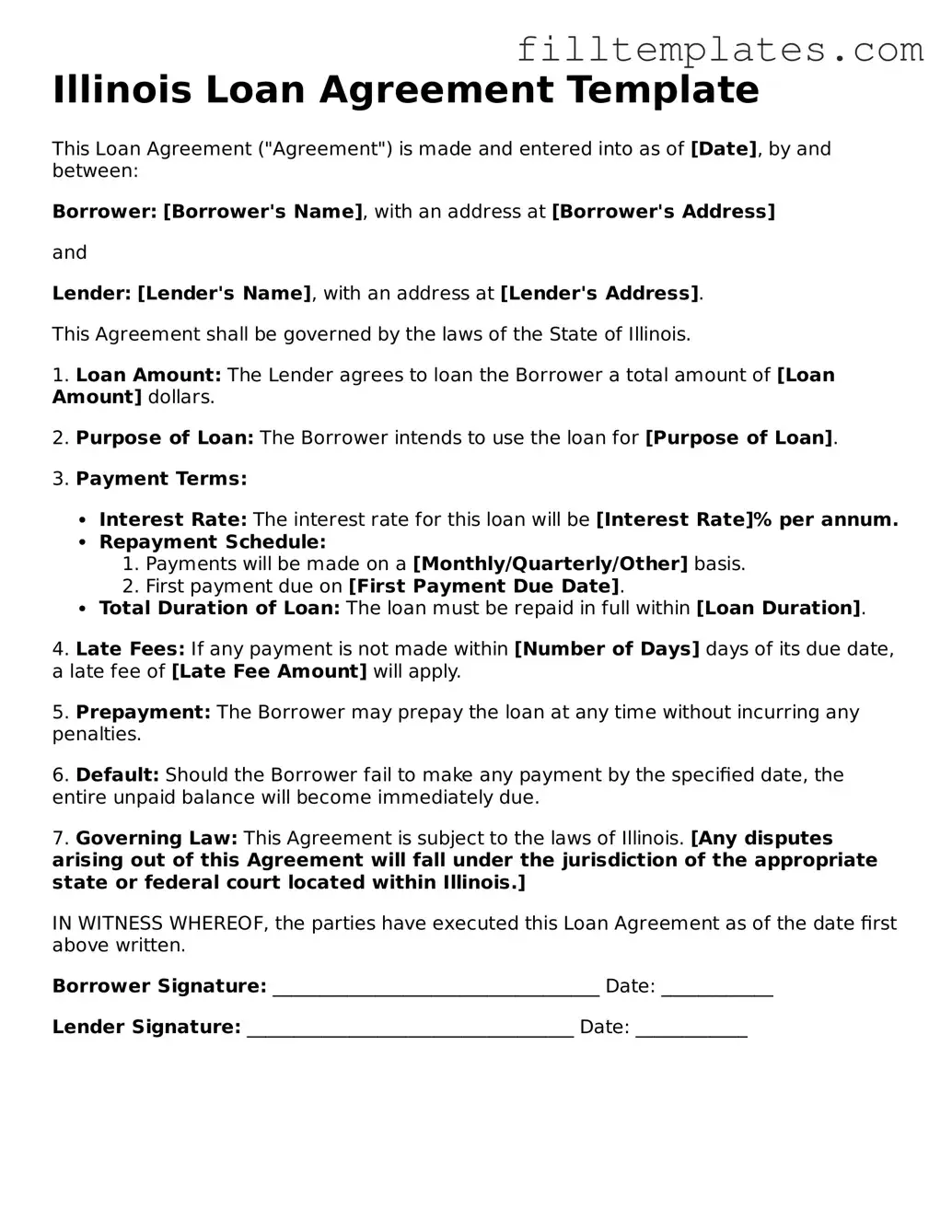

Form Preview Example

Illinois Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of [Date], by and between:

Borrower: [Borrower's Name], with an address at [Borrower's Address]

and

Lender: [Lender's Name], with an address at [Lender's Address].

This Agreement shall be governed by the laws of the State of Illinois.

1. Loan Amount: The Lender agrees to loan the Borrower a total amount of [Loan Amount] dollars.

2. Purpose of Loan: The Borrower intends to use the loan for [Purpose of Loan].

3. Payment Terms:

- Interest Rate: The interest rate for this loan will be [Interest Rate]% per annum.

- Repayment Schedule:

- Payments will be made on a [Monthly/Quarterly/Other] basis.

- First payment due on [First Payment Due Date].

- Total Duration of Loan: The loan must be repaid in full within [Loan Duration].

4. Late Fees: If any payment is not made within [Number of Days] days of its due date, a late fee of [Late Fee Amount] will apply.

5. Prepayment: The Borrower may prepay the loan at any time without incurring any penalties.

6. Default: Should the Borrower fail to make any payment by the specified date, the entire unpaid balance will become immediately due.

7. Governing Law: This Agreement is subject to the laws of Illinois. [Any disputes arising out of this Agreement will fall under the jurisdiction of the appropriate state or federal court located within Illinois.]

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

Borrower Signature: ___________________________________ Date: ____________

Lender Signature: ___________________________________ Date: ____________

Documents used along the form

When entering into a loan agreement in Illinois, several other forms and documents may be necessary to ensure a smooth transaction. Each of these documents plays a crucial role in clarifying the terms of the loan and protecting the interests of both parties involved. Below is a list of commonly used documents alongside the Illinois Loan Agreement form.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Motor Vehicle Bill of Sale: This form records the sale of a vehicle between the buyer and the seller, functioning as a receipt and proof of ownership transfer. For more information, visit https://toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale.

- Security Agreement: If the loan is secured by collateral, this document specifies the assets being pledged. It protects the lender's interests in case the borrower defaults on the loan.

- Personal Guarantee: In cases where a business is borrowing, a personal guarantee may be required from the business owner. This document holds the owner personally responsible for the loan if the business fails to repay it.

- Loan Disclosure Statement: This statement provides essential information about the loan, including terms, fees, and the total cost of borrowing. It ensures transparency and helps borrowers make informed decisions.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components over the life of the loan. It helps borrowers understand how their payments will affect the loan balance over time.

- Default Notice: This document is issued if the borrower fails to meet the terms of the loan agreement. It formally notifies the borrower of the default and outlines the next steps for the lender.

Understanding these documents can significantly enhance the borrowing experience. Each serves a specific purpose and contributes to a clearer understanding of the loan terms, ultimately fostering a more secure transaction for both parties.