Official Promissory Note Template for the State of Illinois

When engaging in a loan agreement in Illinois, understanding the Illinois Promissory Note form is essential. This legal document serves as a written promise to repay borrowed money, detailing the amount owed, interest rate, and repayment schedule. It outlines the obligations of the borrower and the rights of the lender, ensuring both parties are clear on the terms of the loan. The form typically includes sections for the names and addresses of the parties involved, the principal amount, and any applicable fees or penalties for late payments. Additionally, it may specify whether the loan is secured or unsecured, which can significantly affect the lender's recourse in case of default. By utilizing this form, individuals and businesses can protect their interests and establish a clear framework for their financial transactions.

Key takeaways

Filling out and using the Illinois Promissory Note form requires careful attention to detail. Here are some key takeaways to keep in mind:

- Understand the purpose of a promissory note: It is a legal document that outlines a borrower's promise to repay a loan.

- Clearly identify the parties involved: Include the full names and addresses of both the lender and the borrower.

- Specify the loan amount: Clearly state the total amount being borrowed to avoid any confusion.

- Outline the interest rate: If applicable, include the interest rate and specify whether it is fixed or variable.

- Detail the repayment schedule: Indicate when payments are due and the frequency of those payments (e.g., monthly, quarterly).

- Include any late fees: Specify any penalties for late payments to encourage timely repayment.

- Address prepayment options: Clarify whether the borrower can pay off the loan early without penalties.

- Sign and date the document: Both parties must sign and date the promissory note for it to be valid.

- Keep copies of the note: Both the lender and borrower should retain copies for their records.

- Consider legal advice: If uncertain, consult a legal professional to ensure the note meets all requirements.

By following these guidelines, you can effectively create and utilize an Illinois Promissory Note that protects both parties involved in the transaction.

Guide to Writing Illinois Promissory Note

After acquiring the Illinois Promissory Note form, you will need to fill it out accurately to ensure that it serves its intended purpose. This process involves providing specific information about the loan agreement between the borrower and the lender. Follow the steps outlined below to complete the form effectively.

- Identify the Parties: At the top of the form, clearly write the full name and address of the borrower. Below that, provide the lender's full name and address.

- Loan Amount: Specify the total amount of money being borrowed. This figure should be clearly stated in both numerical and written form to avoid any confusion.

- Interest Rate: Indicate the annual interest rate that will apply to the loan. Ensure that this rate is expressed as a percentage.

- Payment Schedule: Detail the repayment terms, including how often payments will be made (e.g., monthly, quarterly) and the due date for the first payment.

- Loan Term: State the duration of the loan. This could be a number of months or years, depending on your agreement.

- Late Fees: If applicable, outline any late fees that will be incurred if payments are not made on time. Clearly specify the amount or percentage of the late fee.

- Signatures: Both the borrower and lender must sign the form. Include the date of signing next to each signature to validate the agreement.

Once you have filled out the form completely, it is advisable to keep a copy for your records. Both parties should retain a signed version to ensure clarity and avoid potential disputes in the future.

Discover Popular Promissory Note Templates for Specific States

Promissory Note Georgia - A Promissory Note serves as proof of a borrower's commitment to repay a debt.

To create a comprehensive framework for an LLC, it is essential to utilize an Operating Agreement form, which delineates the essential financial and operational aspects of the business. This document not only establishes the guidelines for decision-making but also promotes clarity among members, thereby reducing potential conflicts. Multi-member LLCs especially require this agreement, but even single-member LLCs can gain advantages from its structure. For those looking to draft such an agreement, resources like https://smarttemplates.net/ can be invaluable.

Promissory Note Template Michigan - They can also be used as a tool for building credit, as timely repayments can improve credit scores.

Promissory Note Friendly Loan Agreement Format - Both parties should fully understand the note before signing to ensure clarity.

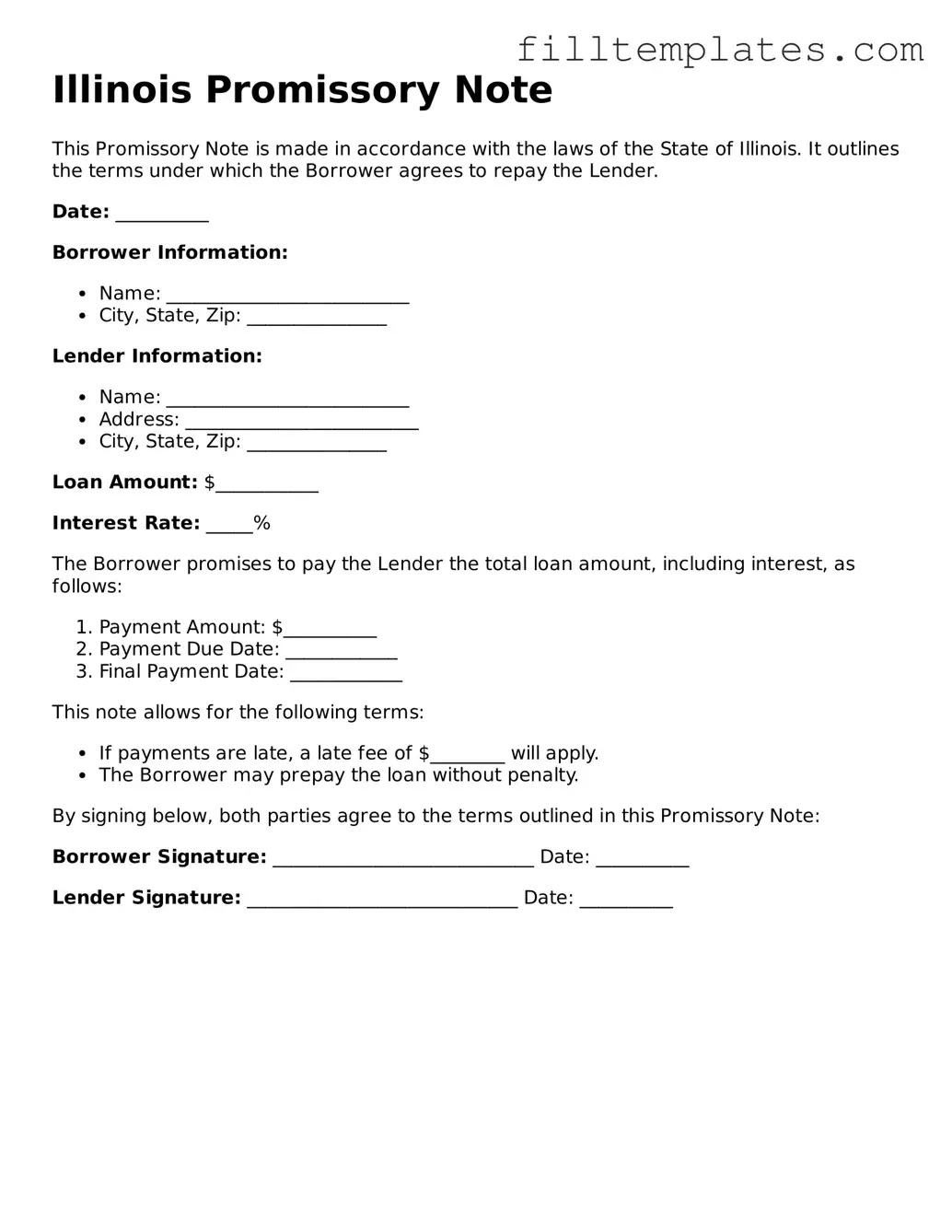

Form Preview Example

Illinois Promissory Note

This Promissory Note is made in accordance with the laws of the State of Illinois. It outlines the terms under which the Borrower agrees to repay the Lender.

Date: __________

Borrower Information:

- Name: __________________________

- City, State, Zip: _______________

Lender Information:

- Name: __________________________

- Address: _________________________

- City, State, Zip: _______________

Loan Amount: $___________

Interest Rate: _____%

The Borrower promises to pay the Lender the total loan amount, including interest, as follows:

- Payment Amount: $__________

- Payment Due Date: ____________

- Final Payment Date: ____________

This note allows for the following terms:

- If payments are late, a late fee of $________ will apply.

- The Borrower may prepay the loan without penalty.

By signing below, both parties agree to the terms outlined in this Promissory Note:

Borrower Signature: ____________________________ Date: __________

Lender Signature: _____________________________ Date: __________

Documents used along the form

When dealing with financial agreements in Illinois, a Promissory Note is often accompanied by various other documents that help clarify terms, establish obligations, and protect the interests of both parties. Here’s a list of common forms and documents that you may encounter alongside a Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both parties.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security and the conditions under which the lender can claim them if the borrower defaults.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay the loan if the borrowing entity fails to do so. This adds an extra layer of security for the lender.

- Disclosure Statement: This document provides important information about the loan terms, including any fees, interest rates, and the total cost of borrowing. It ensures transparency between the lender and borrower.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components, showing how the loan balance decreases over time. It helps borrowers understand their repayment obligations.

- Default Notice: In the event of non-payment, a default notice is sent to inform the borrower of the breach of contract and the potential consequences, including legal action.

- Payment Receipt: This is a simple document acknowledging that a payment has been received. It provides proof of payment and can be important for record-keeping.

- Vehicle Purchase Agreement: This vital document, like the one found at TopTemplates.info, outlines the terms of vehicle sales in California, ensuring clarity and compliance for both parties involved in the transaction.

- Modification Agreement: If any terms of the original Promissory Note need to be changed, a modification agreement formally updates those terms and must be signed by both parties.

- Release of Liability: Once the loan is fully paid, this document releases the borrower from any further obligations and confirms that the lender has no claims against them.

Understanding these documents can help ensure that both lenders and borrowers are on the same page, reducing the risk of misunderstandings. Always consider consulting with a legal expert when navigating these agreements to safeguard your interests.