Official Quitclaim Deed Template for the State of Illinois

In Illinois, the Quitclaim Deed form serves as a vital tool for property transfers, allowing individuals to convey their interest in real estate without making any promises about the property's title. This straightforward document is particularly useful in situations like family transfers, divorce settlements, or when a property owner wishes to add or remove someone from the title. Unlike other types of deeds, a quitclaim deed does not guarantee that the title is clear or free of liens, which means the recipient assumes any risks associated with the property. Completing the form requires basic information, including the names of the grantor and grantee, a legal description of the property, and the date of the transfer. Once signed and notarized, the deed must be filed with the county recorder to ensure that the change in ownership is officially recognized. Understanding how to properly use the Illinois Quitclaim Deed can simplify the process of transferring property, making it a valuable resource for both individuals and families navigating real estate transactions.

Key takeaways

Filling out and using the Illinois Quitclaim Deed form can be straightforward if you keep a few important points in mind. Here are some key takeaways:

- Understand the Purpose: A quitclaim deed transfers ownership of property without guaranteeing that the title is clear. It’s often used between family members or in divorce settlements.

- Gather Necessary Information: You will need details about the property, including its legal description, the names of the current owner(s), and the names of the new owner(s).

- Complete the Form Accurately: Fill out the form completely and correctly to avoid any issues. Double-check names and property details.

- Signatures Matter: All parties involved must sign the deed. Ensure that signatures are notarized to make the document legally binding.

- Consider Tax Implications: Transferring property may have tax consequences. It’s wise to consult a tax professional for guidance.

- File with the County: After completing the deed, file it with the appropriate county recorder’s office. This step is crucial for the transfer to be official.

- Keep Copies: Always retain copies of the completed deed for your records. This can be helpful for future reference.

- Check Local Requirements: Different counties may have specific requirements or fees for filing a quitclaim deed. Research your local rules.

- Be Aware of Limitations: A quitclaim deed does not protect against claims from creditors or other parties. It simply transfers whatever interest the grantor has.

- Consult an Attorney if Needed: If you’re unsure about the process or the implications of the transfer, seeking legal advice can provide clarity and peace of mind.

By keeping these takeaways in mind, you can navigate the Illinois Quitclaim Deed process more confidently.

Guide to Writing Illinois Quitclaim Deed

After obtaining the Illinois Quitclaim Deed form, it’s time to fill it out accurately. This process is essential for ensuring that the transfer of property rights is clear and legally recognized. Follow the steps below to complete the form correctly.

- Gather Necessary Information: Collect details about the property, including the legal description, the current owner’s name, and the new owner’s name.

- Title of the Form: At the top of the form, write “Quitclaim Deed” to clearly identify the document.

- Grantor Information: In the designated area, enter the name of the person or entity transferring the property (the grantor).

- Grantee Information: Next, fill in the name of the person or entity receiving the property (the grantee).

- Property Description: Provide a complete legal description of the property. This may include lot numbers, block numbers, and any other identifying information.

- Consideration: State the amount of money or value exchanged for the property. This is often a nominal amount, such as $1.

- Signatures: Both the grantor and grantee must sign the document. Make sure to date the signatures.

- Notarization: Have the document notarized to ensure its validity. This step is crucial for the deed to be legally binding.

- Filing the Deed: Finally, submit the completed and notarized Quitclaim Deed to the appropriate county recorder’s office for recording.

Once you have completed these steps, the Quitclaim Deed will be ready for submission. Ensure that all information is accurate to avoid any issues in the property transfer process.

Discover Popular Quitclaim Deed Templates for Specific States

Quit Claim Deed Ohio - This deed type provides a way for co-owners to clarify ownership after a relationship ends.

The New York Room Rental Agreement serves as an essential tool for landlords and tenants, elucidating their obligations and rights during the rental period. For those looking to create a legally binding document, they can find a helpful guide to drafting a Room Rental Agreement that covers all necessary provisions and requirements.

Quick Deed Process - This deed can facilitate inheritance transactions among heirs.

How to Transfer Property Title to Family Member - Sometimes, it is a wise choice to use a Quitclaim Deed to prevent lengthy court processes over property rights.

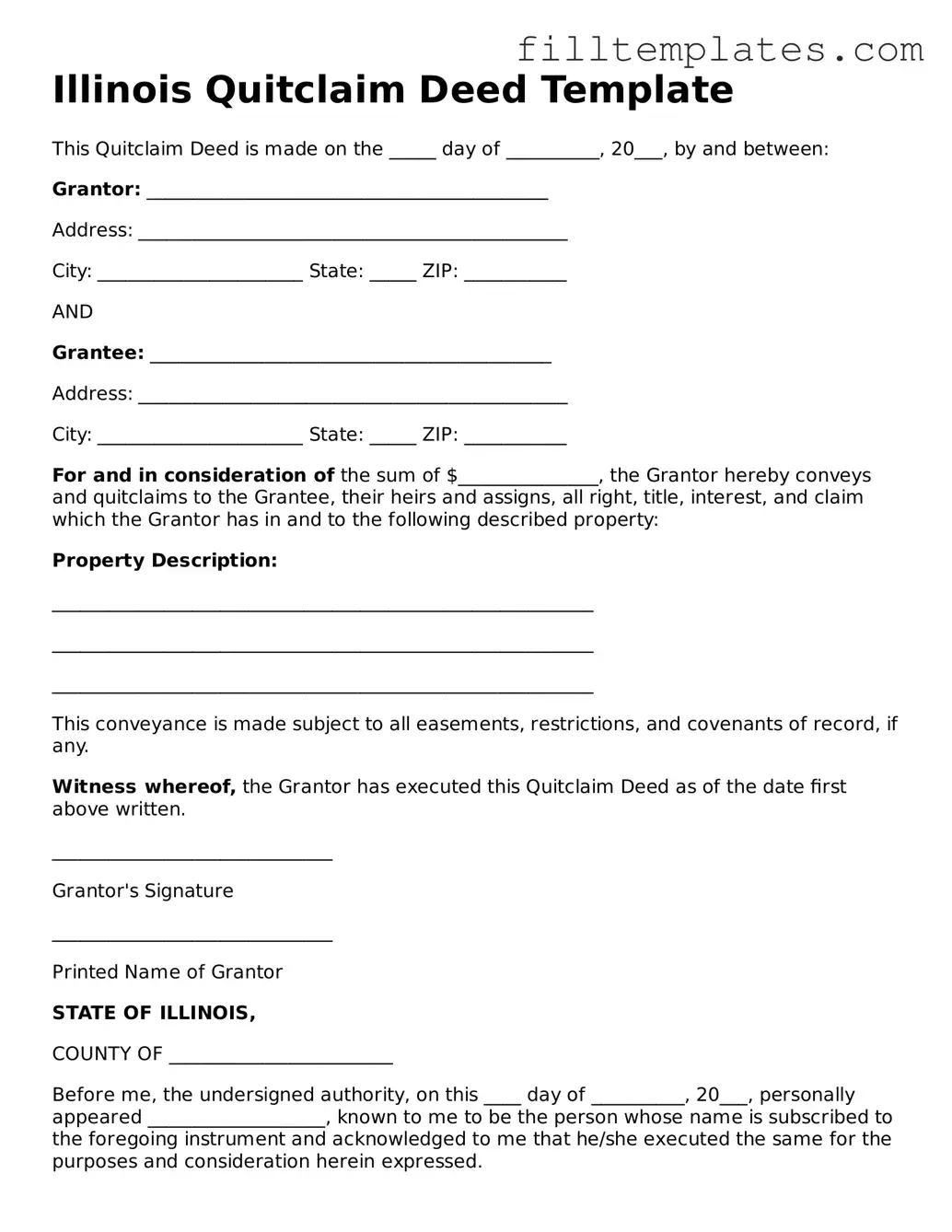

Form Preview Example

Illinois Quitclaim Deed Template

This Quitclaim Deed is made on the _____ day of __________, 20___, by and between:

Grantor: ___________________________________________

Address: ______________________________________________

City: ______________________ State: _____ ZIP: ___________

AND

Grantee: ___________________________________________

Address: ______________________________________________

City: ______________________ State: _____ ZIP: ___________

For and in consideration of the sum of $_______________, the Grantor hereby conveys and quitclaims to the Grantee, their heirs and assigns, all right, title, interest, and claim which the Grantor has in and to the following described property:

Property Description:

__________________________________________________________

__________________________________________________________

__________________________________________________________

This conveyance is made subject to all easements, restrictions, and covenants of record, if any.

Witness whereof, the Grantor has executed this Quitclaim Deed as of the date first above written.

______________________________

Grantor's Signature

______________________________

Printed Name of Grantor

STATE OF ILLINOIS,

COUNTY OF ________________________

Before me, the undersigned authority, on this ____ day of __________, 20___, personally appeared ___________________, known to me to be the person whose name is subscribed to the foregoing instrument and acknowledged to me that he/she executed the same for the purposes and consideration herein expressed.

----------------------------------------

Notary Public

My Commission Expires: ____________

Documents used along the form

When dealing with property transfers in Illinois, the Quitclaim Deed is often accompanied by several other important documents. Each of these forms serves a specific purpose, ensuring a smooth and legally sound transaction. Below is a list of commonly used forms that complement the Quitclaim Deed.

- Property Transfer Tax Declaration: This document is required to report the sale or transfer of property to the local taxing authority. It helps in calculating any applicable transfer taxes.

- Employment Verification Form: This document is essential for confirming the employment status of current or former employees and is often required for processes such as loan applications and background checks. More information can be found at OnlineLawDocs.com.

- Affidavit of Title: This sworn statement confirms that the seller has clear ownership of the property and that there are no undisclosed liens or encumbrances.

- Title Insurance Policy: While not mandatory, this policy protects the buyer against potential claims or issues related to the property title that may arise after the transfer.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including the price, closing date, and any contingencies that must be met before the transaction is finalized.

- Closing Statement: This document summarizes all financial aspects of the transaction, including the purchase price, closing costs, and any adjustments made during the closing process.

- Power of Attorney: If the seller cannot be present at the closing, this document allows another person to act on their behalf, ensuring that the transaction can proceed smoothly.

Understanding these documents will help you navigate the property transfer process with confidence. Each form plays a vital role in protecting your interests and ensuring that everything is in order for a successful transaction.