Official Transfer-on-Death Deed Template for the State of Illinois

The Illinois Transfer-on-Death Deed (TODD) form serves as a valuable estate planning tool that allows property owners to transfer real estate to designated beneficiaries upon their death, bypassing the often lengthy and costly probate process. This form enables individuals to retain full control of their property during their lifetime, as the transfer does not take effect until the owner's passing. Beneficiaries named in the deed can include individuals or entities, providing flexibility in estate distribution. Importantly, the TODD must be executed with specific formalities to ensure its validity, including proper notarization and recording with the appropriate county office. Furthermore, property owners can revoke or alter the deed at any point prior to their death, allowing for adjustments in response to changing circumstances or preferences. Understanding the nuances of the Illinois Transfer-on-Death Deed is crucial for anyone looking to streamline the transfer of their real estate assets and secure a smoother transition for their loved ones after their passing.

Key takeaways

- The Illinois Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate.

- To create a valid deed, the property owner must be at least 18 years old and legally competent.

- The deed must include the legal description of the property, which can be found on the property’s current deed or tax bill.

- It is essential to list the beneficiaries clearly, including their full names and any relevant identifying information.

- The form must be signed by the property owner in the presence of a notary public to ensure its legality.

- Once completed, the deed must be recorded with the county recorder’s office where the property is located.

- Beneficiaries do not have any rights to the property until the owner passes away.

- The property owner can revoke or change the deed at any time before their death by completing a new deed and recording it.

- Consulting with an attorney can provide additional guidance and help ensure that the deed meets all legal requirements.

Guide to Writing Illinois Transfer-on-Death Deed

After completing the Illinois Transfer-on-Death Deed form, you will need to ensure that it is properly signed and recorded with the appropriate county office. This will help facilitate the transfer of property upon your passing without the need for probate.

- Obtain the Illinois Transfer-on-Death Deed form. This can be found online or at your local county clerk's office.

- Fill in your name and address in the designated section as the owner of the property.

- Provide the legal description of the property you wish to transfer. This information can usually be found on your property deed.

- List the name(s) and address(es) of the beneficiary or beneficiaries who will receive the property upon your death.

- Include the date on which you are signing the deed.

- Sign the deed in the presence of a notary public. The notary will verify your identity and witness your signature.

- Make copies of the signed deed for your records and for the beneficiary or beneficiaries.

- File the original deed with the county recorder’s office in the county where the property is located. There may be a filing fee.

Discover Popular Transfer-on-Death Deed Templates for Specific States

Transfer on Death Deed Georgia Form - The beneficiaries named in the deed must survive the property owner to inherit the property.

In today's rental market, having a well-structured Rental Application form is essential for both landlords and potential tenants, as it streamlines the process of assessing applicants. By utilizing resources like smarttemplates.net, landlords can ensure they gather all necessary personal, financial, and employment information efficiently, facilitating informed decisions when selecting suitable tenants.

Tod in California - Owners can change or revoke the deed at any time before their death, providing flexibility in their estate plans.

Form Preview Example

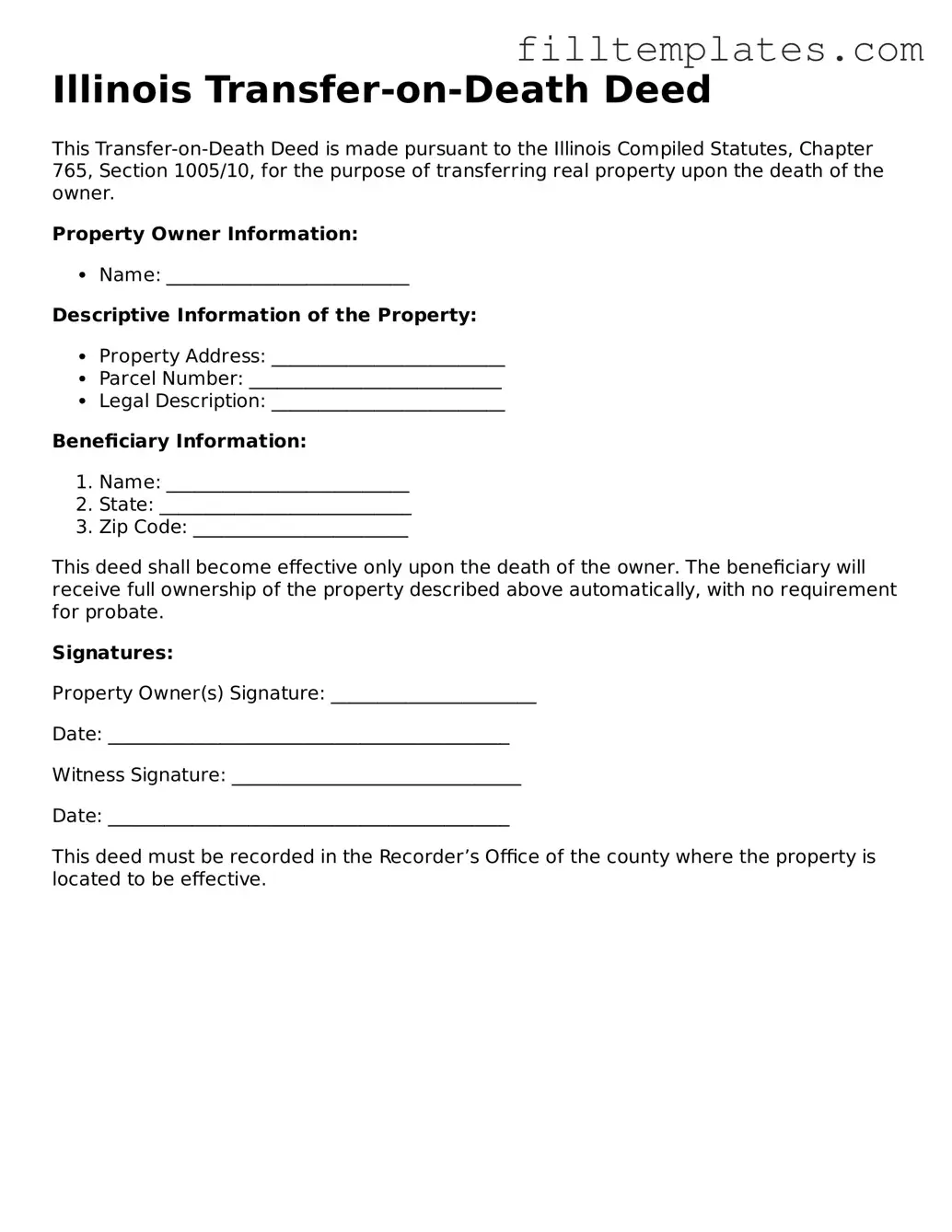

Illinois Transfer-on-Death Deed

This Transfer-on-Death Deed is made pursuant to the Illinois Compiled Statutes, Chapter 765, Section 1005/10, for the purpose of transferring real property upon the death of the owner.

Property Owner Information:

- Name: __________________________

Descriptive Information of the Property:

- Property Address: _________________________

- Parcel Number: ___________________________

- Legal Description: _________________________

Beneficiary Information:

- Name: __________________________

- State: ___________________________

- Zip Code: _______________________

This deed shall become effective only upon the death of the owner. The beneficiary will receive full ownership of the property described above automatically, with no requirement for probate.

Signatures:

Property Owner(s) Signature: ______________________

Date: ___________________________________________

Witness Signature: _______________________________

Date: ___________________________________________

This deed must be recorded in the Recorder’s Office of the county where the property is located to be effective.

Documents used along the form

The Illinois Transfer-on-Death Deed is a valuable tool for individuals looking to transfer property to beneficiaries without going through probate. However, several other forms and documents may be necessary to ensure a smooth transfer process and to address various aspects of estate planning. Below is a list of commonly used documents that complement the Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets should be distributed upon their death. It can also appoint guardians for minor children and specify funeral arrangements.

- Living Trust: This document allows individuals to place their assets into a trust during their lifetime. It can help avoid probate and provide more control over asset distribution after death.

- Power of Attorney: A legal form that grants someone the authority to make decisions on behalf of another person, particularly in financial or medical matters, if they become incapacitated.

- Beneficiary Designation Forms: These forms are used to specify who will receive certain assets, like life insurance policies or retirement accounts, directly upon the owner's death, bypassing probate.

- Affidavit of Heirship: A document that helps establish the heirs of a deceased person, which can be particularly useful when property is transferred without a will.

- Deed of Distribution: This document is used to formally transfer property from an estate to beneficiaries after the probate process is complete.

- California Motor Vehicle Bill of Sale: This essential document records the transfer of ownership of a vehicle within California, ensuring legal acknowledgment of the sale. More details can be found at https://toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/california-motor-vehicle-bill-of-sale.

- Notice of Death: A formal notification that informs interested parties, including creditors and heirs, of an individual's passing, which may be necessary for settling the estate.

- Estate Inventory: A comprehensive list of all assets owned by a deceased person, which helps in the valuation and distribution of the estate.

These documents play crucial roles in estate planning and property transfer. By understanding their purposes and how they work together, individuals can better prepare for the future and ensure their wishes are honored. Proper documentation can facilitate smoother transitions and minimize potential disputes among heirs.