Download Independent Contractor Pay Stub Template

When working as an independent contractor, understanding how to manage your finances is crucial. One important tool in this process is the Independent Contractor Pay Stub form. This form serves as a detailed record of earnings and deductions, helping contractors keep track of their income from various clients. It typically includes essential information such as the contractor's name, the pay period, and the total amount earned. Additionally, it may outline any deductions for taxes or other expenses, providing a clear picture of net income. Having a pay stub can simplify tax preparation and serve as proof of income when applying for loans or other financial services. By keeping accurate records through this form, independent contractors can maintain better control over their financial health and ensure compliance with tax regulations.

Key takeaways

Filling out and using the Independent Contractor Pay Stub form can be straightforward if you keep a few key points in mind. Here are some essential takeaways:

- Understand the Purpose: The pay stub serves as a record of payments made to independent contractors, detailing hours worked and rates paid.

- Accurate Information: Ensure that all information, including the contractor's name, address, and tax identification number, is correct.

- Detail Payments: Clearly outline the total amount paid, including any deductions or bonuses, to provide transparency.

- Include Payment Dates: Specify the date of payment to help both parties keep track of financial records.

- Document Hours Worked: Record the number of hours worked or the specific project completed to justify the payment amount.

- Use Clear Language: Avoid technical jargon. Use simple language that both parties can easily understand.

- Keep Copies: Both the contractor and the hiring party should keep copies of the pay stub for their records.

- Tax Considerations: Be aware that independent contractors are responsible for their own taxes, so provide necessary tax forms when required.

- Review Regularly: Regularly review pay stubs to ensure that all payments are accurately reflected and up to date.

- Stay Compliant: Ensure that your pay stub complies with any relevant state or federal laws regarding independent contractors.

By following these guidelines, you can effectively manage the payment process for independent contractors while maintaining clear and accurate records.

Guide to Writing Independent Contractor Pay Stub

Completing the Independent Contractor Pay Stub form is an essential step in ensuring accurate payment records for your work. By carefully following the steps outlined below, you will create a clear and professional pay stub that reflects your earnings and deductions. This will help maintain transparency in your business transactions and provide you with a reliable record for your financial management.

- Begin by entering your name in the designated field at the top of the form.

- Next, fill in your address, including city, state, and ZIP code.

- Locate the section for your contractor identification number and input it accurately.

- In the payment period section, specify the start and end dates for the work performed.

- Record the total hours worked during that period in the hours section.

- Input your hourly rate in the designated field.

- Calculate your gross pay by multiplying the total hours worked by your hourly rate and enter this figure.

- If applicable, list any deductions, such as taxes or benefits, in the deductions section.

- Subtract the total deductions from your gross pay to determine your net pay and enter this amount.

- Finally, review all the information for accuracy and sign the form where indicated.

Browse Other PDFs

Share Transfer Form J30 - Document who shares were transferred to and from clearly.

When engaging in a motorcycle sale, having the proper documentation is essential. The California Motorcycle Bill of Sale form serves to eliminate uncertainties by formally documenting the transfer of ownership. This form lays out all pertinent details regarding the motorcycle and the agreement between the parties involved, offering protection for both buyers and sellers. For more information and a template, visit https://toptemplates.info/bill-of-sale/motorcycle-bill-of-sale/california-motorcycle-bill-of-sale/.

What Are Ndas Used for - This form serves as a crucial protection tool in collaborative business efforts.

96 Well Plate Format - Supports educational settings for teaching laboratory techniques effectively.

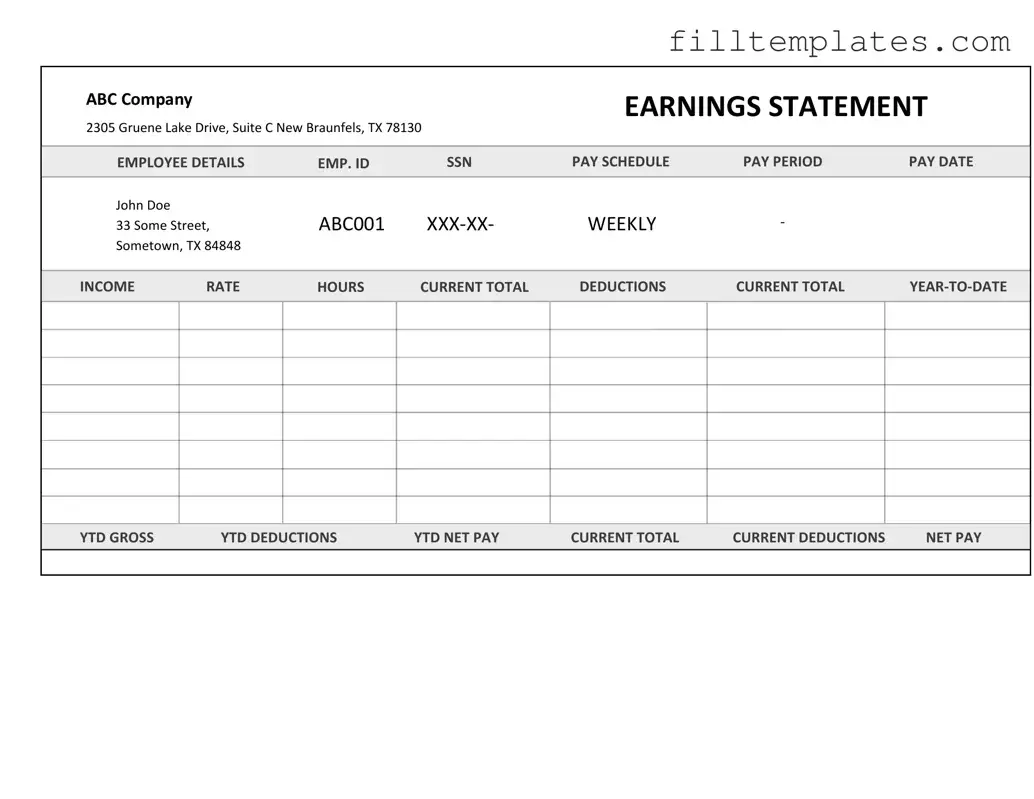

Form Preview Example

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Documents used along the form

When working with independent contractors, several forms and documents are essential for proper record-keeping and compliance. These documents help clarify the relationship between the contractor and the hiring party, ensuring that both parties understand their rights and obligations. Below is a list of common forms that are often used alongside the Independent Contractor Pay Stub form.

- Independent Contractor Agreement: This document outlines the terms of the working relationship, including payment rates, project scope, and deadlines. It serves as a contract between the contractor and the hiring party.

- Employment Verification Form: This document is crucial for confirming the employment status of current or former employees, particularly during processes such as loan applications and background checks. For more information, visit OnlineLawDocs.com.

- W-9 Form: This form is used by independent contractors to provide their taxpayer identification number to the hiring party. It is essential for tax reporting purposes.

- Invoice: Contractors typically submit invoices to request payment for their services. This document details the work performed, hours worked, and the total amount due.

- 1099-MISC Form: At the end of the tax year, this form is issued to independent contractors who earned $600 or more. It reports the total income paid to the contractor, which is necessary for tax filing.

- Timesheet: A timesheet records the hours worked by the contractor. This document can help verify hours billed on invoices and ensure accurate payments.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared between the contractor and the hiring party. It ensures that confidential information remains private.

- Work Product Release: This document clarifies the ownership of any work created by the contractor. It typically states that the hiring party owns the rights to the work upon payment.

- Termination Letter: If the working relationship needs to end, a termination letter formally notifies the contractor. It outlines the reasons for termination and any final payments owed.

- Expense Reimbursement Form: If the contractor incurs expenses while performing their duties, this form allows them to request reimbursement for those costs.

Using these forms and documents helps ensure a smooth working relationship between independent contractors and the hiring parties. Keeping accurate records not only aids in compliance with tax laws but also fosters transparency and trust in the business relationship.