Free Investment Letter of Intent Template

The Investment Letter of Intent form serves as an important tool for individuals and entities looking to outline their intentions regarding a potential investment. This document typically includes essential details such as the names of the parties involved, the amount of investment being considered, and the terms under which the investment will take place. It may also specify any conditions that must be met before the investment is finalized, providing a clear framework for both parties. By laying out these intentions, the form helps to establish a mutual understanding and can pave the way for more formal agreements in the future. Additionally, it can serve as a preliminary step in negotiations, allowing both sides to assess the viability of the investment before committing significant resources. Overall, the Investment Letter of Intent form is a key element in the investment process, facilitating communication and clarity between prospective investors and recipients.

Key takeaways

Filling out the Investment Letter of Intent form can be a straightforward process if you keep a few key points in mind. Here are some important takeaways to consider:

- Be Clear and Concise: When providing information, clarity is essential. Avoid vague language and ensure that your intentions are communicated effectively.

- Double-Check All Information: Mistakes can lead to delays. Review the form carefully to ensure that all details are accurate, including names, amounts, and dates.

- Understand the Terms: Familiarize yourself with the terms and conditions outlined in the form. Knowing what you are agreeing to will help you make informed decisions.

- Keep a Copy: After submitting the form, retain a copy for your records. This can be useful for future reference or if any questions arise later.

By following these guidelines, you can navigate the Investment Letter of Intent form with confidence and ease.

Guide to Writing Investment Letter of Intent

After you have gathered all necessary information, you are ready to complete the Investment Letter of Intent form. This form is crucial for outlining your investment intentions and details. Follow the steps below to ensure that you fill it out accurately and completely.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- Input your phone number and email address for contact purposes.

- State the name of the investment opportunity you are interested in.

- Clearly specify the amount you intend to invest.

- Include the date on which you plan to make the investment.

- Sign the form to confirm your commitment to the investment.

- Finally, date your signature to complete the process.

Once you have filled out the form, review it carefully to ensure all information is accurate. After that, you can submit it as directed in your accompanying instructions.

Create Popular Types of Investment Letter of Intent Templates

Letter of Intent for Business - The letter is non-binding, meaning it does not legally obligate either party to complete the sale.

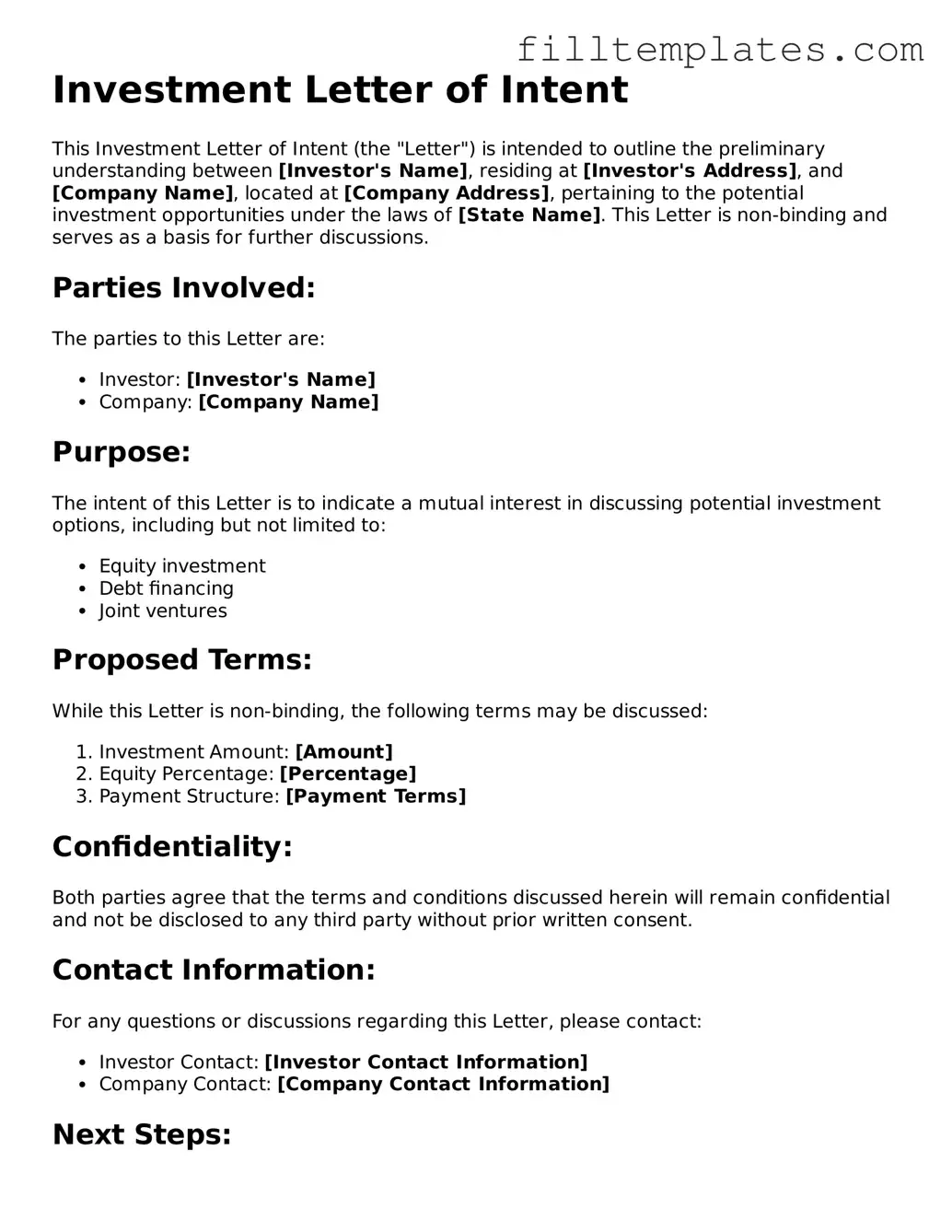

Form Preview Example

Investment Letter of Intent

This Investment Letter of Intent (the "Letter") is intended to outline the preliminary understanding between [Investor's Name], residing at [Investor's Address], and [Company Name], located at [Company Address], pertaining to the potential investment opportunities under the laws of [State Name]. This Letter is non-binding and serves as a basis for further discussions.

Parties Involved:

The parties to this Letter are:

- Investor: [Investor's Name]

- Company: [Company Name]

Purpose:

The intent of this Letter is to indicate a mutual interest in discussing potential investment options, including but not limited to:

- Equity investment

- Debt financing

- Joint ventures

Proposed Terms:

While this Letter is non-binding, the following terms may be discussed:

- Investment Amount: [Amount]

- Equity Percentage: [Percentage]

- Payment Structure: [Payment Terms]

Confidentiality:

Both parties agree that the terms and conditions discussed herein will remain confidential and not be disclosed to any third party without prior written consent.

Contact Information:

For any questions or discussions regarding this Letter, please contact:

- Investor Contact: [Investor Contact Information]

- Company Contact: [Company Contact Information]

Next Steps:

Upon agreement on these preliminary terms, both parties will seek to formalize the investment agreement in a subsequent document.

Signatures:

By signing below, both parties acknowledge their understanding of this Letter and their desire to pursue further discussions.

- Investor Signature: ___________________________ Date: _______________

- Company Signature: _________________________ Date: _______________

Documents used along the form

When engaging in investment opportunities, several documents often accompany the Investment Letter of Intent (LOI). These documents help clarify terms, outline responsibilities, and ensure all parties are on the same page. Below is a list of common forms and documents that may be used alongside the Investment LOI.

- Confidentiality Agreement: This document protects sensitive information shared between parties during negotiations. It ensures that proprietary details remain confidential and are not disclosed to unauthorized individuals.

- Term Sheet: A summary of the key terms and conditions of an investment deal. It outlines the main points of agreement, such as valuation, funding amount, and equity stake.

- Subscription Agreement: This legal document is used when an investor agrees to purchase shares in a company. It details the terms of the investment and the rights of the investor.

- Due Diligence Checklist: A comprehensive list of items that need to be reviewed before finalizing an investment. This may include financial statements, legal documents, and operational information.

- Shareholder Agreement: This agreement outlines the rights and obligations of shareholders in a company. It addresses issues like voting rights, dividend distribution, and what happens if a shareholder wants to sell their shares.

- Operating Agreement: For LLCs, this document governs the company's operations and outlines the responsibilities of its members. It can include management structure, profit distribution, and decision-making processes.

- Investment Memorandum: A detailed document that provides potential investors with comprehensive information about an investment opportunity. It includes market analysis, financial projections, and risk factors.

- Exit Strategy Document: This outlines how investors plan to exit their investment in the future. It discusses potential sale scenarios, IPO plans, or other exit options.

Using these documents in conjunction with the Investment Letter of Intent can streamline the investment process and help mitigate risks. Each form serves a specific purpose, contributing to a clearer understanding between all parties involved.