Download IRS 8879 Template

The IRS 8879 form plays a crucial role in the tax filing process for taxpayers who choose to e-file their federal tax returns. This form serves as an electronic signature authorization, allowing taxpayers to grant their tax preparers permission to file their returns on their behalf. By signing this form, individuals confirm that the information provided in their tax return is accurate and complete. The IRS 8879 is particularly significant for those who utilize professional tax services, as it streamlines the e-filing process and ensures compliance with IRS regulations. Taxpayers must carefully review their returns before signing the form, as it holds them accountable for any discrepancies that may arise. Additionally, the form includes essential details such as the taxpayer's Social Security number, the preparer's information, and the date of signing, which are all vital for the verification process. Understanding the importance of the IRS 8879 form can help taxpayers navigate the complexities of e-filing and ensure a smoother tax submission experience.

Key takeaways

The IRS 8879 form, also known as the "IRS e-file Signature Authorization," is an important document for taxpayers and tax preparers. Here are some key takeaways about this form:

- The form allows taxpayers to authorize their tax preparers to electronically file their tax returns.

- It is necessary for both the taxpayer and the preparer to sign the form before e-filing.

- The form includes personal information such as the taxpayer's name, address, and Social Security number.

- Taxpayers should review their tax return carefully before signing the IRS 8879.

- The form must be retained by the tax preparer for three years after the return is filed.

- Taxpayers can revoke their authorization at any time before the return is filed.

- It is important to ensure that the preparer's information is accurate on the form.

- The IRS 8879 can be signed electronically, making the process quicker and easier.

- Filing the form is a requirement for e-filing; paper returns do not need this form.

- Always keep a copy of the signed IRS 8879 for your records.

Guide to Writing IRS 8879

After you have gathered all necessary information and documents, it’s time to fill out the IRS Form 8879. This form requires specific details to ensure accurate processing. Follow these steps carefully to complete the form correctly.

- Start by entering your name and Social Security Number (SSN) in the designated fields at the top of the form.

- Provide your spouse's name and SSN if applicable. Make sure to check for any errors.

- Fill in your address, including city, state, and ZIP code. Ensure that this information matches your tax return.

- In the section for the tax year, enter the year for which you are filing.

- Next, input the amount of your refund or the amount owed, as indicated on your tax return.

- Sign and date the form in the appropriate sections. If filing jointly, your spouse must also sign and date.

- Finally, provide your preparer’s information if you used a tax professional. Include their signature and date if applicable.

Once completed, the form should be submitted to the appropriate IRS office along with your tax return. Ensure you keep a copy for your records.

Browse Other PDFs

Horse Training Agreement Template - Details regarding the care provided by the Trainer, including feed and facilities, are expressly stated in the contract.

For those seeking clarity on legal documentation, a crucial resource is this informative guide on how a Power of Attorney template can serve your needs effectively.

Fillable 1099 Nec - The information on the 1099-NEC should match other tax documents to avoid discrepancies.

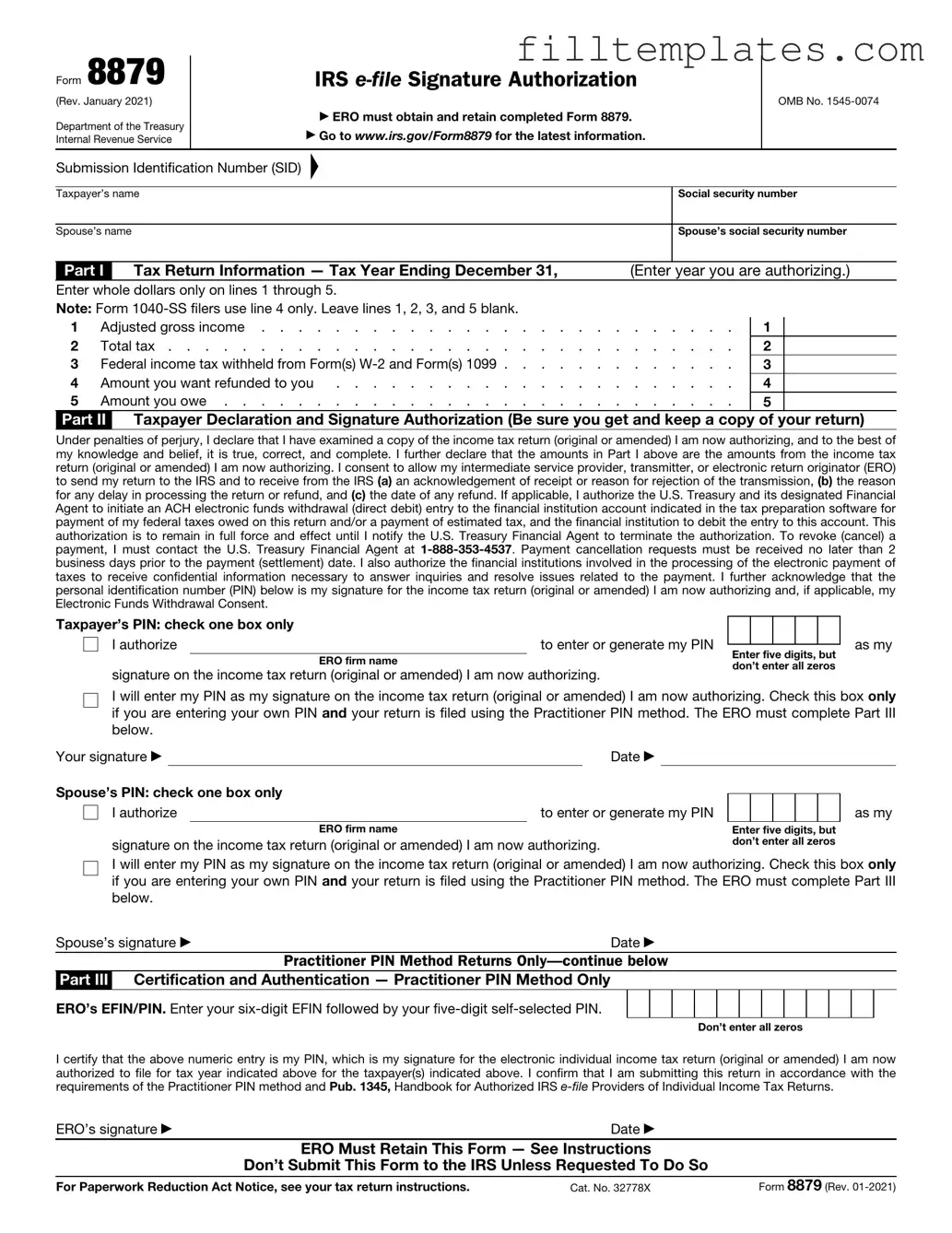

Form Preview Example

Form 8879

(Rev. January 2021)

Department of the Treasury Internal Revenue Service

IRS

▶ ERO must obtain and retain completed Form 8879.

▶Go to www.irs.gov/Form8879 for the latest information.

OMB No.

Submission Identification Number (SID)

▲

Taxpayer’s name |

|

|

|

Social security number |

||||

|

|

|

|

|

|

|

||

Spouse’s name |

|

|

|

|

Spouse’s social security number |

|||

|

|

|

|

|

|

|||

Part I |

|

Tax Return Information — Tax Year Ending December 31, |

|

(Enter |

year you are authorizing.) |

|||

Enter whole dollars only on lines 1 through 5. |

|

|

|

|

|

|||

Note: Form |

|

|

|

|

|

|||

1 |

Adjusted gross income |

. |

. . |

. |

. . . |

1 |

||

2 |

Total tax |

. |

. . |

. |

. . . |

2 |

||

3 |

Federal income tax withheld from Form(s) |

. |

. . |

. |

. . . |

3 |

||

4 |

Amount you want refunded to you |

. |

. . |

. |

. . . |

4 |

||

5 |

Amount you owe |

. |

. . |

. |

. . . |

5 |

||

Part II Taxpayer Declaration and Signature Authorization (Be sure you get and keep a copy of your return)

Under penalties of perjury, I declare that I have examined a copy of the income tax return (original or amended) I am now authorizing, and to the best of my knowledge and belief, it is true, correct, and complete. I further declare that the amounts in Part I above are the amounts from the income tax return (original or amended) I am now authorizing. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ERO) to send my return to the IRS and to receive from the IRS (a) an acknowledgement of receipt or reason for rejection of the transmission, (b) the reason for any delay in processing the return or refund, and (c) the date of any refund. If applicable, I authorize the U.S. Treasury and its designated Financial Agent to initiate an ACH electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of my federal taxes owed on this return and/or a payment of estimated tax, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke (cancel) a payment, I must contact the U.S. Treasury Financial Agent at

Taxpayer’s PIN: check one box only |

|

|

|

|

|

|

|

||

I authorize |

|

|

to enter or generate my PIN |

|

|

|

|

|

|

|

Enter five digits, but |

||||||||

|

|

ERO firm name |

|||||||

|

|

don’t enter all zeros |

|||||||

signature on the income tax return (original or amended) I am now authorizing. |

|||||||||

|

|

|

|

|

|||||

as my

I will enter my PIN as my signature on the income tax return (original or amended) I am now authorizing. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Your signature ▶ |

|

|

Date ▶ |

|

|

|

|

|

|

Spouse’s PIN: check one box only |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

I authorize |

to enter or generate my PIN |

|

|

|

|

|

|||

|

|

ERO firm name |

|

|

Enter five digits, but |

||||

signature on the income tax return (original or amended) I am now authorizing. |

don’t enter all zeros |

||||||||

as my

I will enter my PIN as my signature on the income tax return (original or amended) I am now authorizing. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Spouse’s signature ▶ |

Date ▶ |

|

Practitioner PIN Method Returns |

Part III Certification and Authentication — Practitioner PIN Method Only

ERO’s EFIN/PIN. Enter your

Don’t enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the electronic individual income tax return (original or amended) I am now authorized to file for tax year indicated above for the taxpayer(s) indicated above. I confirm that I am submitting this return in accordance with the requirements of the Practitioner PIN method and Pub. 1345, Handbook for Authorized IRS

ERO’s signature ▶ |

Date ▶ |

|

ERO Must Retain This Form — See Instructions |

|

|

Don’t Submit This Form to the IRS Unless Requested To Do So |

|

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 32778X |

Form 8879 (Rev. |

Form 8879 (Rev. |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future developments. For the latest information about developments related to Form 8879 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8879.

What's New. Form 8879 is used to authorize the electronic filing

Purpose of Form

Form 8879 is the declaration document and signature authorization for an

|

|

▲ |

|

! |

Don’t send this form to the IRS. |

The ERO must retain Form 8879. |

|

CAUTION |

|

When and How To Complete

Use this chart to determine when and how to complete Form 8879.

IF the ERO is . . . |

THEN . . . |

|

|

|

|

Not using the Practitioner |

Don’t complete |

|

PIN method and the |

Form 8879. |

|

taxpayer enters his or her |

|

|

own PIN |

|

|

|

|

|

Not using the Practitioner |

Complete Form |

|

PIN method and is |

8879, Parts I and II. |

|

authorized to enter or |

|

|

generate the taxpayer’s |

|

|

PIN |

|

|

|

|

|

Using the Practitioner PIN |

Complete Form 8879, |

|

method and is authorized |

Parts I, II, and III. |

|

to enter or generate the |

|

|

taxpayer’s PIN |

|

|

|

|

|

Using the Practitioner PIN |

Complete Form 8879, |

|

Parts I, II, and III. |

||

method and the taxpayer |

||

|

||

enters his or her own PIN |

|

|

|

|

ERO Responsibilities

The ERO must:

1.Enter the name(s) and social security number(s) of the taxpayer(s) at the top of the form.

2.Complete Part I using the amounts (zeros may be entered when appropriate) from the taxpayer’s tax return. Form

3.Enter or generate, if authorized by the taxpayer, the taxpayer’s PIN and enter it in the boxes provided in Part II.

4.Enter on the authorization line in Part II the ERO firm name (not the name of the individual preparing the return) if the ERO is authorized to enter the taxpayer’s PIN.

5.Provide the taxpayer(s) Form 8879 by hand delivery, U.S. mail, private delivery service, email, Internet website, or fax.

6.Enter the

You must receive the completed ▲! and signed Form 8879 from the

taxpayer before the electronic CAUTION return is transmitted (or released

for transmission).

For additional information, see Pub. 1345.

Taxpayer Responsibilities

Taxpayers must:

1.Verify the accuracy of the prepared income tax return, including direct deposit information.

2.Check the appropriate box in Part II to authorize the ERO to enter or generate your PIN or to do it yourself.

3.Indicate or verify your PIN when authorizing the ERO to enter or generate it (the PIN must be five digits other than all zeros).

4.Sign and date Form 8879. Taxpayers must sign Form 8879 by handwritten signature, or electronic signature if supported by computer software.

5.Return the completed Form 8879 to the ERO by hand delivery, U.S. mail, private delivery service, email, Internet website, or fax.

Your return won’t be transmitted to the IRS until the ERO receives your signed Form 8879.

Refund information. You can check on the status of your refund if it has been at least 72 hours since the IRS acknowledged receipt of your

•Go to www.irs.gov/Refunds.

•Call

•Call

Important Notes for EROs

•Don’t send Form 8879 to the IRS unless requested to do so. Retain the completed Form 8879 for 3 years from the return due date or IRS received date, whichever is later. Form 8879 may be retained electronically in accordance with the recordkeeping guidelines in Rev. Proc.

•Confirm the identity of the taxpayer(s).

•Complete Part III only if you are filing the return using the Practitioner PIN method. You aren’t required to enter the taxpayer’s date of birth, prior year adjusted gross income, or PIN in the Authentication Record of the electronically filed return.

•If you aren’t using the Practitioner PIN method, enter the taxpayer(s) date of birth and either the adjusted gross income or the PIN, or both, from the taxpayer’s prior year originally filed return in the Authentication Record of the taxpayer’s electronically filed return. Don’t use an amount from an amended return or a math error correction made by the IRS.

•Enter the taxpayer’s PIN(s) on the input screen only if the taxpayer has authorized you to do so. If married filing jointly, it is acceptable for one spouse to authorize you to enter his or her PIN, and for the other spouse to enter his or her own PIN. It isn’t acceptable for a taxpayer to select or enter the PIN of an absent spouse.

•Taxpayers must use a PIN to sign their

•Provide the taxpayer with a copy of the signed Form 8879 for his or her records upon request.

•Provide the taxpayer with a corrected copy of Form 8879 if changes are made to the return (for example, based on taxpayer review).

•EROs can sign the form using a rubber stamp, mechanical device (such as a signature pen), or computer software program. See Notice

•Go to www.irs.gov/Efile for the latest information.

Documents used along the form

The IRS 8879 form, also known as the e-file Signature Authorization, is an important document that allows taxpayers to authorize their tax preparer to electronically file their tax return. Along with this form, there are several other documents that are commonly used in the tax preparation process. Below is a list of these forms and documents.

- Form 1040: This is the standard individual income tax return form used by U.S. citizens and residents to report their annual income and calculate their tax liability.

- Motorcycle Bill of Sale: This document is essential for the sale of a motorcycle in New York, serving as proof of purchase and transfer of ownership, and can be accessed at https://smarttemplates.net.

- Form W-2: Employers provide this form to employees, detailing wages earned and taxes withheld during the year. It is essential for accurate tax filing.

- Form 1099: This form reports various types of income received by individuals, such as freelance earnings or interest income, which are not reported on a W-2.

- Form 4868: This is the application for an automatic extension of time to file a U.S. individual income tax return. It allows taxpayers more time to prepare their return.

- Form 8889: Used by individuals with Health Savings Accounts (HSAs), this form reports contributions, distributions, and other related information for the tax year.

- Schedule A: This form is used to itemize deductions on a tax return, allowing taxpayers to detail their eligible expenses to potentially lower their tax bill.

Understanding these forms can simplify the tax preparation process. Each document plays a crucial role in ensuring accurate reporting and compliance with tax regulations.