Download IRS Schedule B 941 Template

The IRS Schedule B (Form 941) serves a critical role in the realm of payroll tax reporting for employers in the United States. This form is specifically designed for reporting the employer's share of Social Security and Medicare taxes, along with federal income tax withheld from employees' wages. It is important for employers to accurately complete this form to ensure compliance with federal tax regulations and avoid potential penalties. Schedule B is particularly relevant for those who have a significant payroll tax liability, as it provides a detailed account of the tax liabilities incurred during a given quarter. Employers must fill out this schedule if they meet certain criteria, such as having a liability of $100,000 or more in a tax period. The information included on Schedule B is essential for the IRS to track tax obligations and ensure that employers are fulfilling their tax responsibilities. Additionally, the form requires employers to report specific details about their tax deposits, which can help the IRS monitor compliance and identify any discrepancies in reported tax liabilities.

Key takeaways

Filling out the IRS Schedule B (Form 941) can seem daunting, but understanding its key components can make the process smoother. Here are some essential takeaways to keep in mind:

- Purpose: Schedule B is used to report your tax liability for the quarter, specifically for employment taxes.

- Who Needs It: Employers who withhold federal income tax, Social Security tax, or Medicare tax from employees must complete this form.

- Filing Frequency: Schedule B is filed quarterly, along with Form 941.

- Payment Schedule: It helps determine your tax deposit schedule based on your tax liability.

- Record Keeping: Accurate records of payroll and tax withholdings are essential for filling out Schedule B correctly.

- Tax Liability Calculation: Make sure to calculate your total tax liability accurately for the period to avoid penalties.

- Due Dates: Be aware of the due dates for filing Form 941 and Schedule B to stay compliant.

- Amendments: If you make a mistake, you can amend your Schedule B by filing a corrected Form 941.

- Online Resources: The IRS website provides helpful guidance and instructions for filling out Schedule B.

By keeping these points in mind, you can navigate the process of completing Schedule B more confidently and ensure compliance with IRS regulations.

Guide to Writing IRS Schedule B 941

After gathering all necessary information and documents, you are ready to fill out the IRS Schedule B (Form 941). This form is crucial for reporting your tax obligations accurately. Following these steps will help ensure that you complete it correctly.

- Begin by entering your business name, address, and Employer Identification Number (EIN) at the top of the form.

- In Part 1, indicate the number of employees you had during the quarter.

- Next, provide the total wages, tips, and other compensation paid to employees during the quarter.

- Fill in the total taxes withheld from employees’ paychecks for the quarter in the appropriate section.

- In Part 2, report any adjustments to your tax liability, if applicable.

- Double-check your entries for accuracy, ensuring that all amounts are correctly calculated and reflected on the form.

- Sign and date the form at the bottom. Ensure that the person signing is authorized to do so on behalf of the business.

- Finally, submit the completed form to the IRS by the specified deadline, either by mail or electronically, as per your preference.

Browse Other PDFs

Parent Consent Form - It may also address photography and media release permissions.

An Employment Verification Form is a document used by employers to confirm the employment history of current or former employees. This form typically includes details such as the employee's job title, dates of employment, and sometimes salary information. For comprehensive resources regarding these forms, you can visit OnlineLawDocs.com. Its primary purpose is to verify the accuracy of an applicant's employment history for new employers, lending institutions, or government agencies.

Army 1750 - It encompasses all necessary information for military shipments.

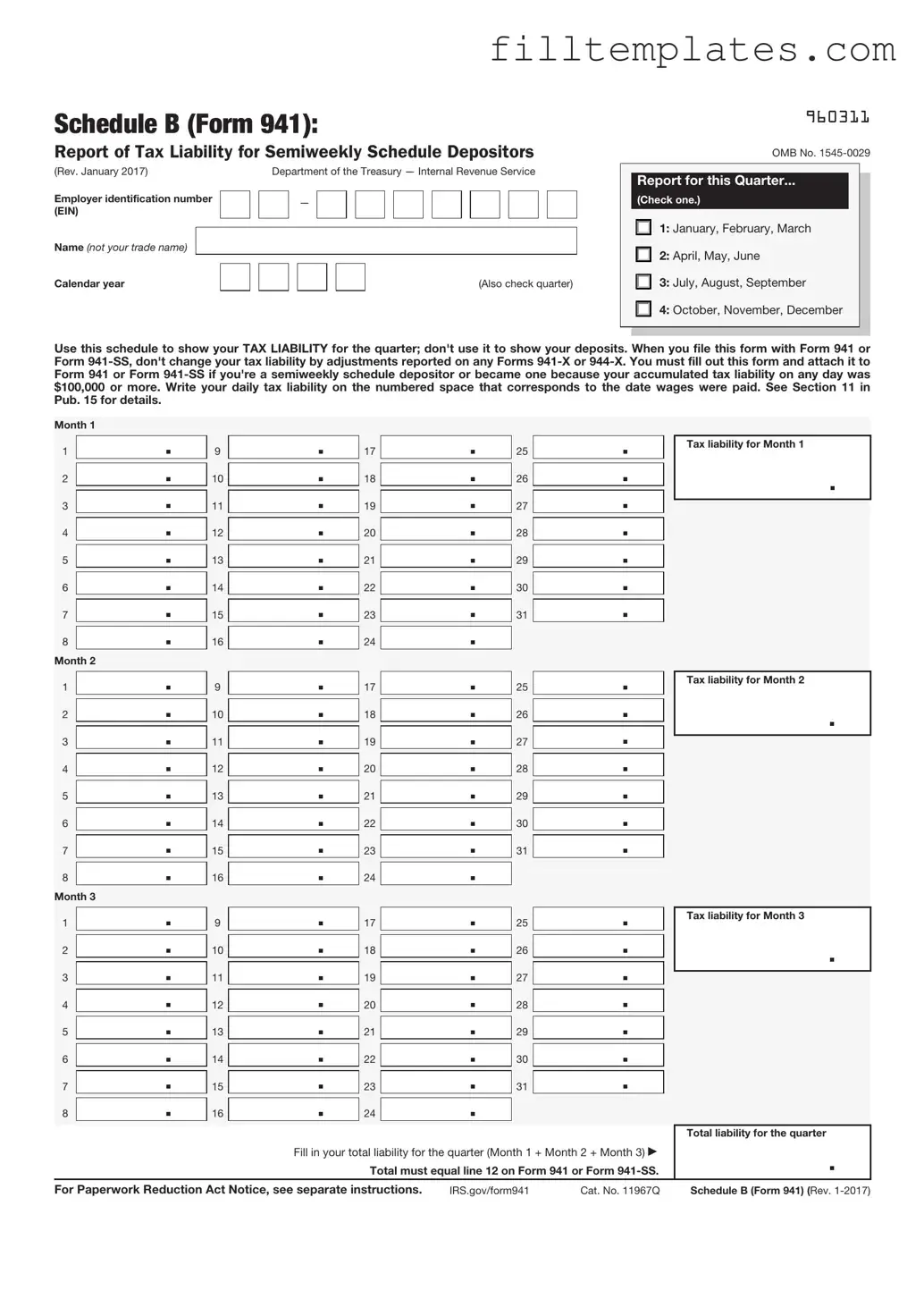

Form Preview Example

Schedule B (Form 941):

Report of Tax Liability for Semiweekly Schedule Depositors

(Rev. January 2017) |

|

|

Department of the Treasury — Internal Revenue Service |

|||||||||||||||||||

Employer identification number |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Also check quarter) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

960311

OMB No.

Report for this Quarter...

(Check one.)

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or Form

Month 1

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 2

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 3

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

Tax liability for Month 1

.

Tax liability for Month 2

.

1 |

|

. |

9 |

|

. |

17 |

|

|

. |

25 |

|

. |

|

Tax liability for Month 3 |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

2 |

|

. |

10 |

|

. |

18 |

|

|

. |

26 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

. |

11 |

|

. |

19 |

|

|

. |

27 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

. |

12 |

|

. |

20 |

|

|

. |

28 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

. |

13 |

|

. |

21 |

|

|

. |

29 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

. |

14 |

|

. |

22 |

|

|

. |

30 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

. |

15 |

|

. |

23 |

|

|

. |

31 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

. |

16 |

|

. |

24 |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liability for the quarter |

|

|

|

|

Fill in your total liability for the quarter (Month 1 + Month 2 + Month 3) |

. |

|||||||||

|

|

|

|

|

|

Total must equal line 12 on Form 941 or Form |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

IRS.gov/form941 |

Cat. No. 11967Q |

Schedule B (Form 941) (Rev. |

|||||||||||

Documents used along the form

When dealing with IRS Schedule B (Form 941), it's essential to understand that several other forms and documents often accompany it. These documents help ensure accurate reporting and compliance with tax obligations. Here’s a list of key forms and documents you may encounter alongside Schedule B.

- Form 941: This is the Employer's Quarterly Federal Tax Return. It reports income taxes, Social Security tax, and Medicare tax withheld from employee wages, as well as the employer's portion of Social Security and Medicare taxes.

- Form W-2: This form reports an employee's annual wages and the taxes withheld from their paycheck. Employers must provide this to employees by January 31 each year.

- Sample Tax Return Transcript: This document provides essential details about an individual’s filed tax return, presenting income details, tax liabilities, and adjustments. For more information, visit smarttemplates.net/.

- Form W-3: This is the Transmittal of Wage and Tax Statements. It summarizes all W-2 forms issued by an employer and is submitted to the Social Security Administration.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It reports and pays unemployment taxes to the federal government.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It’s particularly important for independent contractors and freelancers.

- Form 8822: This form is used to notify the IRS of a change of address. Keeping the IRS updated ensures that all correspondence reaches the correct location.

- Form 4506-T: This form allows taxpayers to request a transcript of their tax return. It can be useful for verifying income or tax information.

- Form 941-X: This is the Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund. It is used to correct errors on previously filed Form 941.

Being familiar with these forms can streamline the process of managing payroll taxes and ensure compliance with IRS requirements. Each document plays a specific role in the overall tax reporting process, making it easier for employers to maintain accurate records and fulfill their obligations.