Download IRS Schedule C 1040 Template

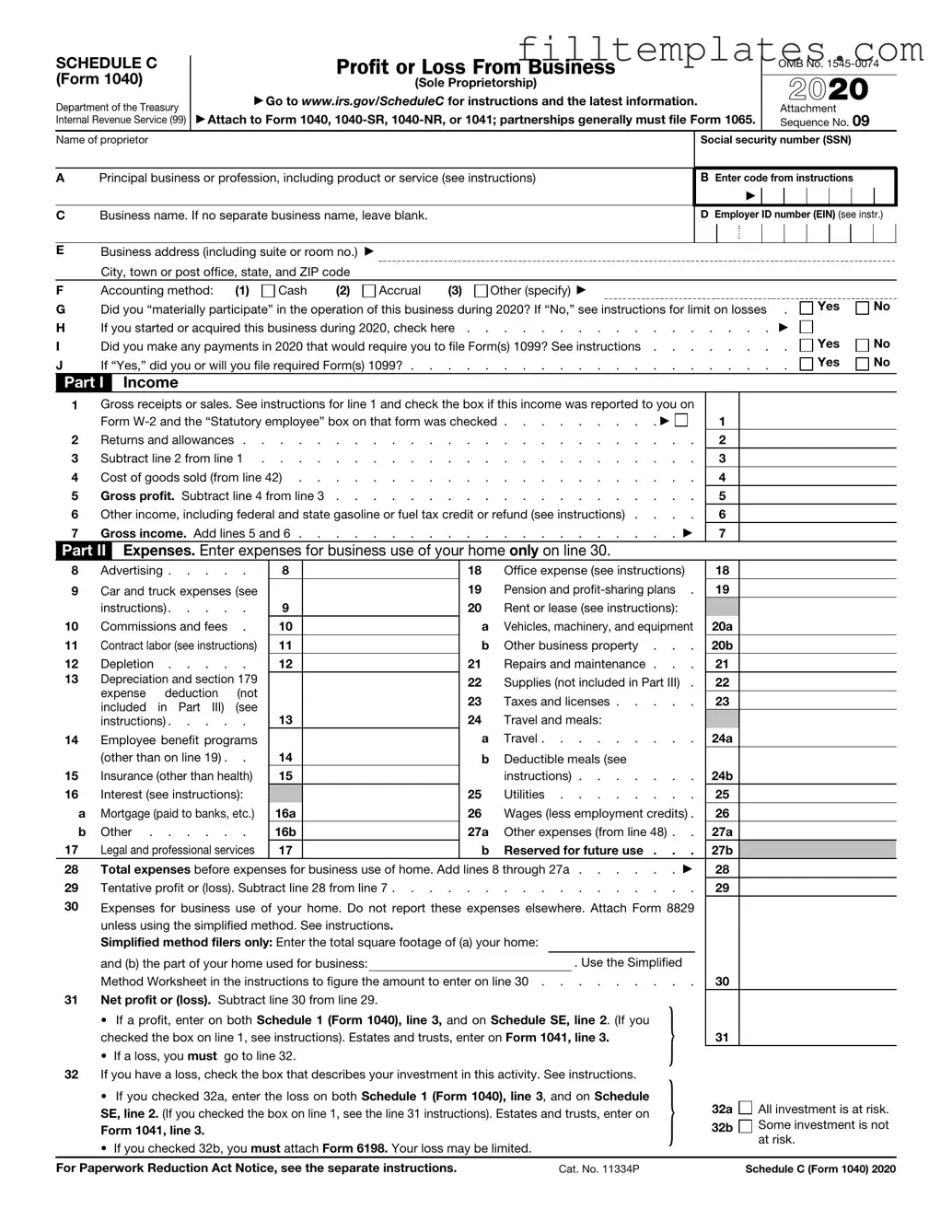

The IRS Schedule C (Form 1040) is an essential document for individuals who are self-employed or operate a sole proprietorship. This form allows taxpayers to report income earned from their business activities, providing a clear picture of earnings and expenses related to their operations. On Schedule C, individuals will detail their gross receipts, which represent the total income generated before any deductions. Additionally, the form requires the listing of various business expenses, such as costs for supplies, utilities, and other operational necessities, which can help reduce taxable income. It is crucial for self-employed individuals to accurately complete this form, as it not only impacts their tax liability but also plays a role in determining eligibility for certain benefits, such as loans or retirement plans. Furthermore, understanding the nuances of Schedule C can empower business owners to maximize their deductions and ensure compliance with tax regulations, ultimately supporting their financial health and stability.

Key takeaways

When filling out and using the IRS Schedule C (Form 1040), it is important to keep several key points in mind. These takeaways can help ensure accuracy and compliance.

- Understand Your Business Type: Schedule C is designed for sole proprietors. Make sure you qualify as a sole proprietor before using this form.

- Keep Detailed Records: Maintain accurate records of all income and expenses related to your business. This documentation will support your claims on the form.

- Report All Income: Include all income generated from your business activities. This includes cash, checks, and any other forms of payment.

- Deduct Eligible Expenses: Familiarize yourself with what expenses can be deducted. Common deductions include costs for supplies, travel, and home office expenses.

- File on Time: Ensure you file Schedule C along with your Form 1040 by the tax deadline to avoid penalties and interest.

- Consult a Professional if Needed: If you have questions or complex situations, consider seeking help from a tax professional to ensure compliance and maximize deductions.

By keeping these points in mind, you can navigate the process of filling out and using Schedule C more effectively.

Guide to Writing IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals and small business owners. This form helps report income and expenses related to your business. Completing it accurately ensures that you fulfill your tax obligations while also maximizing any potential deductions. Here are the steps to guide you through the process of filling out this form.

- Begin by downloading the IRS Schedule C form from the IRS website or obtaining a physical copy.

- At the top of the form, enter your name and Social Security number. If you have a business name, include it in the designated area.

- Fill in your business address, including city, state, and ZIP code.

- Indicate the type of business you operate by checking the appropriate box or providing a brief description.

- In Part I, report your gross receipts or sales. This is the total income your business generated before any expenses are deducted.

- Next, move to Part II to list your business expenses. Carefully categorize each expense, such as advertising, car and truck expenses, or supplies.

- Sum up your total expenses at the bottom of Part II and subtract this amount from your gross receipts to determine your net profit or loss.

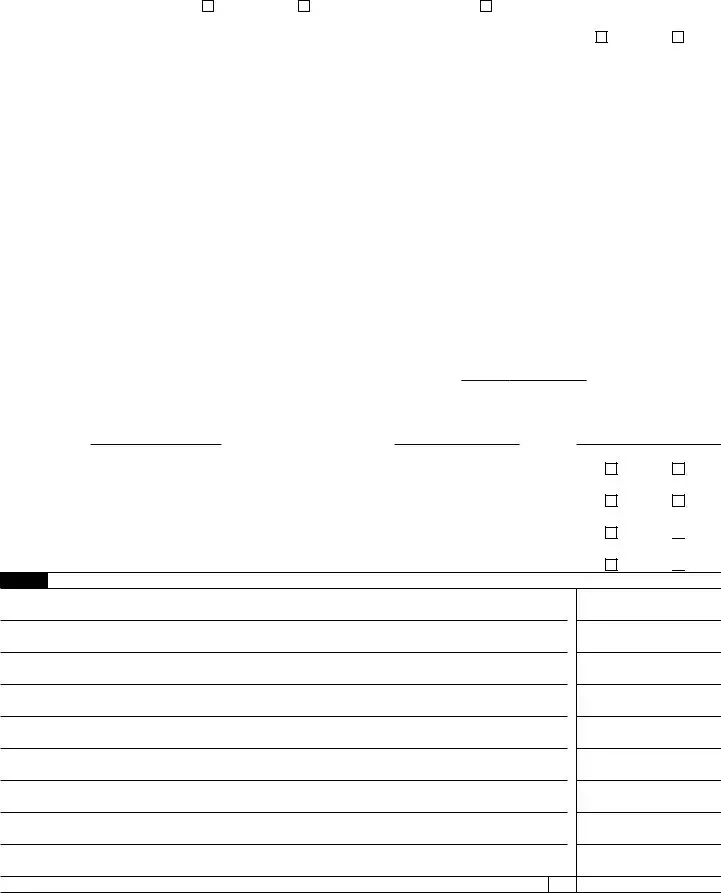

- In Part III, if applicable, provide information about your cost of goods sold. This section is important if your business sells products.

- Complete Part IV if you have any information about your vehicle expenses. This includes mileage and other related costs.

- Review your entries for accuracy. Make sure all numbers are correct and that you’ve included all necessary information.

- Sign and date the form. If someone else prepared it, ensure they also sign it in the appropriate section.

- Finally, keep a copy of the completed Schedule C for your records before submitting it with your Form 1040.

Browse Other PDFs

Section 8 Gold Street - Securing a housing unit requires attention to detail and prompt action.

Hillsborough County Tag Office - Supports efficient resolution of ownership disputes or claims.

To streamline the process of confirming employment history, many employers utilize an Employment Verification Form, which typically comprises essential details such as the employee's job title, dates of employment, and, at times, salary information. This form is crucial for new employers, lending institutions, or government agencies aiming to verify the accuracy of an applicant's employment history. For more information, you can visit OnlineLawDocs.com, which offers valuable resources related to employment verification forms.

Musicians Contract Template - Emergency contacts are listed to facilitate communication regarding performance logistics.

Form Preview Example

SCHEDULE C |

|

Profit or Loss From Business |

|

OMB No. |

|||||||

|

|

||||||||||

(Form 1040) |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||

|

(Sole Proprietorship) |

|

2020 |

|

|||||||

Department of the Treasury |

|

▶ Go to www.irs.gov/ScheduleC for instructions and the latest information. |

|

|

|||||||

|

|

|

|

Attachment |

|||||||

Internal Revenue Service (99) |

|

▶ Attach to Form 1040, |

Sequence No. 09 |

||||||||

Name of proprietor |

|

|

|

Social security number (SSN) |

|||||||

|

|

|

|

|

|

|

|

|

|

||

A |

Principal business or profession, including product or service (see instructions) |

|

B Enter code from instructions |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C |

Business name. If no separate business name, leave blank. |

D Employer ID number (EIN) (see instr.) |

|||||||||

EBusiness address (including suite or room no.) ▶ City, town or post office, state, and ZIP code

F |

Accounting method: |

(1) |

Cash |

(2) |

Accrual |

(3) |

Other (specify) ▶ |

G |

Did you “materially participate” in the operation of this business during 2020? If “No,” see instructions for limit on losses . |

||||||

H |

If you started or acquired this business during 2020, check here . |

. . . . . . . . . . . . . . . . ▶ |

|||||

I |

Did you make any payments in 2020 that would require you to file Form(s) 1099? See instructions |

||||||

J |

If “Yes,” did you or will you file required Form(s) 1099? |

||||||

Yes

Yes  No

No

Yes

Yes

No

No

Yes

Yes  No

No

Part I Income

1 |

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on |

|

|

|||||||||||

|

Form |

. . . . . . . . |

. ▶ |

1 |

|

|||||||||

2 |

Returns and allowances |

. . . . . . . . . . . |

|

2 |

|

|||||||||

3 |

Subtract line 2 from line 1 |

. . . . . . . . . . . |

|

3 |

|

|||||||||

4 |

Cost of goods sold (from line 42) |

. . . . . . . . . . . |

|

4 |

|

|||||||||

5 |

Gross profit. Subtract line 4 from line 3 |

. . . . . . . . . . . |

|

5 |

|

|||||||||

6 |

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . |

6 |

|

|||||||||||

7 |

Gross income. Add lines 5 and 6 |

. . . . . . . . |

. |

. ▶ |

7 |

|

||||||||

Part II |

Expenses. Enter expenses for business use of your home only on line 30. |

|

|

|

|

|

||||||||

8 |

Advertising |

8 |

|

|

18 |

Office expense (see instructions) |

18 |

|

||||||

9 |

Car and truck expenses (see |

|

|

|

19 |

Pension and |

19 |

|

||||||

|

instructions) |

9 |

|

|

20 |

Rent or lease (see instructions): |

|

|

||||||

10 |

Commissions and fees . |

10 |

|

|

a |

Vehicles, machinery, and equipment |

20a |

|

||||||

11 |

Contract labor (see instructions) |

11 |

|

|

b |

Other business property . . . |

20b |

|

||||||

12 |

Depletion |

12 |

|

|

21 |

Repairs and maintenance . . . |

21 |

|

||||||

13 |

Depreciation and section 179 |

|

|

|

22 |

Supplies (not included in Part III) . |

22 |

|

||||||

|

expense deduction (not |

|

|

|

|

|||||||||

|

|

|

|

23 |

Taxes and licenses |

23 |

|

|||||||

|

included in Part III) (see |

|

|

|

|

|||||||||

|

instructions) |

13 |

|

|

24 |

Travel and meals: |

|

|

|

|

|

|||

14 |

Employee benefit programs |

|

|

|

a |

Travel |

24a |

|

||||||

|

(other than on line 19) . . |

14 |

|

|

b |

Deductible meals (see |

|

|

|

|

|

|||

15 |

Insurance (other than health) |

15 |

|

|

|

instructions) |

24b |

|

||||||

16 |

Interest (see instructions): |

|

|

|

25 |

Utilities |

25 |

|

||||||

a |

Mortgage (paid to banks, etc.) |

16a |

|

|

26 |

Wages (less employment credits) . |

26 |

|

||||||

b |

Other |

16b |

|

|

27a |

Other expenses (from line 48) . . |

27a |

|

||||||

17 |

Legal and professional services |

17 |

|

|

b |

Reserved for future use . . . |

27b |

|

||||||

28 |

Total expenses before expenses for business use of home. Add lines 8 through 27a . . . . |

. |

. ▶ |

28 |

|

|||||||||

29 |

Tentative profit or (loss). Subtract line 28 from line 7 |

. . . . . . . . . . . |

|

29 |

|

|||||||||

30 |

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 |

|

|

|||||||||||

|

unless using the simplified method. See instructions. |

|

|

|

|

|

|

|

|

|

||||

|

Simplified method filers only: Enter the total square footage of (a) your home: |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

and (b) the part of your home used for business: |

|

|

|

|

. Use the Simplified |

|

|

||||||

|

Method Worksheet in the instructions to figure the amount to enter on line 30 |

30 |

|

|||||||||||

31 |

Net profit or (loss). Subtract line 30 from line 29. |

|

|

|

|

|

} |

|

|

|

||||

|

• If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you |

|

|

|

|

|||||||||

|

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. |

|

|

31 |

|

|||||||||

|

• If a loss, you must go to line 32. |

|

|

|

|

|

|

|

|

|||||

32 |

If you have a loss, check the box that describes your investment in this activity. See instructions. |

|

} |

|

|

|

||||||||

|

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule |

|

|

32a |

All investment is at risk. |

|||||||||

|

SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on |

|

|

|||||||||||

|

|

|

32b |

Some investment is not |

||||||||||

|

Form 1041, line 3. |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

at risk. |

|||

|

• If you checked 32b, you must attach Form 6198. Your loss may be limited. |

|

|

|

|

|

||||||||

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

Cat. No. 11334P |

|

|

|

|

Schedule C (Form 1040) 2020 |

||||||

Schedule C (Form 1040) 2020 |

Page 2 |

|

Part III |

Cost of Goods Sold (see instructions) |

|

33 |

Method(s) used to |

|

|

|

|

|

|

|

value closing inventory: |

a |

Cost |

b |

Lower of cost or market |

c |

Other (attach explanation) |

34Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

If “Yes,” attach explanation |

Yes |

No

35 |

Inventory at beginning of year. If different from last year’s closing inventory, attach explanation . . . |

35 |

|

|||

36 |

Purchases less cost of items withdrawn for personal use |

36 |

|

|||

37 |

Cost of labor. Do not include any amounts paid to yourself |

37 |

|

|||

38 |

Materials and supplies |

38 |

|

|||

39 |

Other costs |

39 |

|

|||

40 |

Add lines 35 through 39 |

40 |

|

|||

41 |

Inventory at end of year |

41 |

|

|||

42 |

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 |

42 |

|

|||

Part IV |

Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 |

|||||

|

|

and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must |

||||

|

|

file Form 4562. |

|

|

|

|

43 |

When did you place your vehicle in service for business purposes? (month/day/year) |

▶ |

/ |

/ |

|

|

44Of the total number of miles you drove your vehicle during 2020, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see instructions) |

c Other |

|

45 |

Was your vehicle available for personal use during |

. . . . . . . . . . . . . |

Yes |

|

46 |

Do you (or your spouse) have another vehicle available for personal use?. |

. . . . . . . . . . . . . |

Yes |

|

47a |

Do you have evidence to support your deduction? |

. . . . . . . . . . . . . |

Yes |

|

b |

If “Yes,” is the evidence written? |

. . . . . . . . . . . . . |

Yes |

|

Part V Other Expenses. List below business expenses not included on lines

No

No

No

No

No

No

48 Total other expenses. Enter here and on line 27a . . . . . . . . . . . . . . . .

48

Schedule C (Form 1040) 2020

Documents used along the form

When filing taxes as a self-employed individual, the IRS Schedule C (Form 1040) is a crucial document. It reports income and expenses from a business operated as a sole proprietorship. However, several other forms and documents are often needed to provide a complete picture of your financial situation. Below is a list of commonly used forms that complement the Schedule C.

- IRS Form 1040: This is the standard individual income tax return form used to report personal income, including income from self-employment.

- IRS Schedule SE: This form calculates self-employment tax, which includes Social Security and Medicare taxes for individuals who work for themselves.

- IRS Form 4562: Used to claim depreciation on assets and to report the Section 179 deduction for certain types of property.

- IRS Form 8829: This form is for claiming expenses for business use of your home, allowing you to deduct a portion of your home expenses related to your business.

- IRS Form 1099-MISC: This form reports miscellaneous income received, often used by independent contractors to report payments from clients.

- Dirt Bike Bill of Sale Form: For those selling off-road vehicles, refer to the official Dirt Bike Bill of Sale documentation guide to ensure all legalities are thoroughly addressed.

- IRS Form 1099-NEC: This form specifically reports nonemployee compensation, useful for freelancers and contractors who receive payments from businesses.

- State Tax Forms: Depending on your state, you may need to file additional tax forms to report state income taxes or business taxes.

- Business Licenses and Permits: Documentation proving that your business is legally registered and compliant with local regulations.

- Expense Receipts: Keeping detailed receipts for business expenses is essential for accurately reporting deductions on Schedule C.

- Profit and Loss Statement: A summary of income and expenses for a specific period, which helps in preparing the Schedule C and understanding your business's financial health.

Gathering these documents ensures a smooth tax filing process and helps maximize deductions. By being organized and thorough, individuals can navigate their tax responsibilities more effectively.