Free Lady Bird Deed Template

The Lady Bird Deed, a unique estate planning tool, offers homeowners an efficient way to transfer property while retaining control during their lifetime. This form allows individuals to transfer their real estate to beneficiaries upon their passing without the need for probate, simplifying the process significantly. One of its most notable features is that it enables the original owner to maintain the right to live in and manage the property, ensuring that they can continue to enjoy their home without interruption. Additionally, the Lady Bird Deed can help protect the property from creditors, providing peace of mind to the owner. As an alternative to traditional methods of property transfer, such as wills or trusts, this deed stands out for its straightforward approach and the flexibility it offers. By understanding the key components and benefits of the Lady Bird Deed, homeowners can make informed decisions about their estate planning needs, ensuring their wishes are honored and their loved ones are taken care of after their passing.

Lady Bird Deed - Adapted for State

Key takeaways

The Lady Bird Deed, also known as an enhanced life estate deed, is a powerful tool for estate planning. Understanding its key aspects can help ensure that your wishes are honored and that your loved ones are taken care of. Here are six essential takeaways regarding the use of the Lady Bird Deed form:

- Ownership Retention: The grantor retains full control over the property during their lifetime, allowing for the ability to sell, mortgage, or change the deed without the consent of the beneficiaries.

- Avoids Probate: Properties transferred via a Lady Bird Deed pass directly to beneficiaries upon the grantor's death, bypassing the often lengthy and costly probate process.

- Tax Benefits: The property can maintain its tax basis, which can be advantageous for beneficiaries, potentially reducing capital gains taxes when they sell the property.

- Medicaid Eligibility: Properly executed, the Lady Bird Deed can help protect the property from being counted as an asset for Medicaid eligibility, allowing the grantor to qualify for benefits.

- Simple to Execute: Filling out the Lady Bird Deed form is straightforward, but it is essential to ensure that all information is accurate and complete to avoid complications.

- Consultation Recommended: While the form can be completed without legal assistance, consulting with an estate planning attorney is advisable to ensure compliance with state laws and to address specific circumstances.

By understanding these key points, individuals can make informed decisions about their estate planning and the use of the Lady Bird Deed form.

Guide to Writing Lady Bird Deed

Filling out the Lady Bird Deed form is an important step in ensuring that property is transferred according to your wishes. It’s essential to complete this form accurately to avoid any complications in the future. Follow these steps carefully to ensure that everything is filled out correctly.

- Obtain the form: Download the Lady Bird Deed form from a reliable legal website or obtain a hard copy from a local office supply store.

- Identify the property: Clearly write the legal description of the property you are transferring. This can usually be found on the property deed or tax documents.

- List the grantor: Fill in your name as the current property owner (grantor). Include your address and any other required identifying information.

- Identify the grantee: Write the name of the person or people who will receive the property (grantee). Include their addresses and relationship to you.

- Include any conditions: If you have specific conditions or limitations regarding the transfer, clearly outline these in the designated section.

- Sign the document: Sign the form in the presence of a notary public. Ensure that the notary also signs and stamps the document.

- File the deed: After notarization, file the completed Lady Bird Deed with the appropriate county clerk’s office where the property is located.

Once the form is filled out and filed, it will be part of the public record. Keep a copy for your records. It’s wise to consult with a legal professional if you have any questions or need assistance during the process.

Create Popular Types of Lady Bird Deed Templates

Simple Deed of Gift Template - Gift Deeds typically do not require the approval of a court for validity.

New Jersey Quitclaim Deed Form - The form does not require a warranty that the property title is free of defects.

To ensure all essential details are captured in the transaction, it is highly recommended to utilize resources such as TopTemplates.info for a comprehensive California Vehicle Purchase Agreement form, which can help facilitate a smooth sale process and protect the interests of both the buyer and the seller.

Correction Deed Form California - This document is often executed when an estate needs clarification regarding inherited property ownership.

Form Preview Example

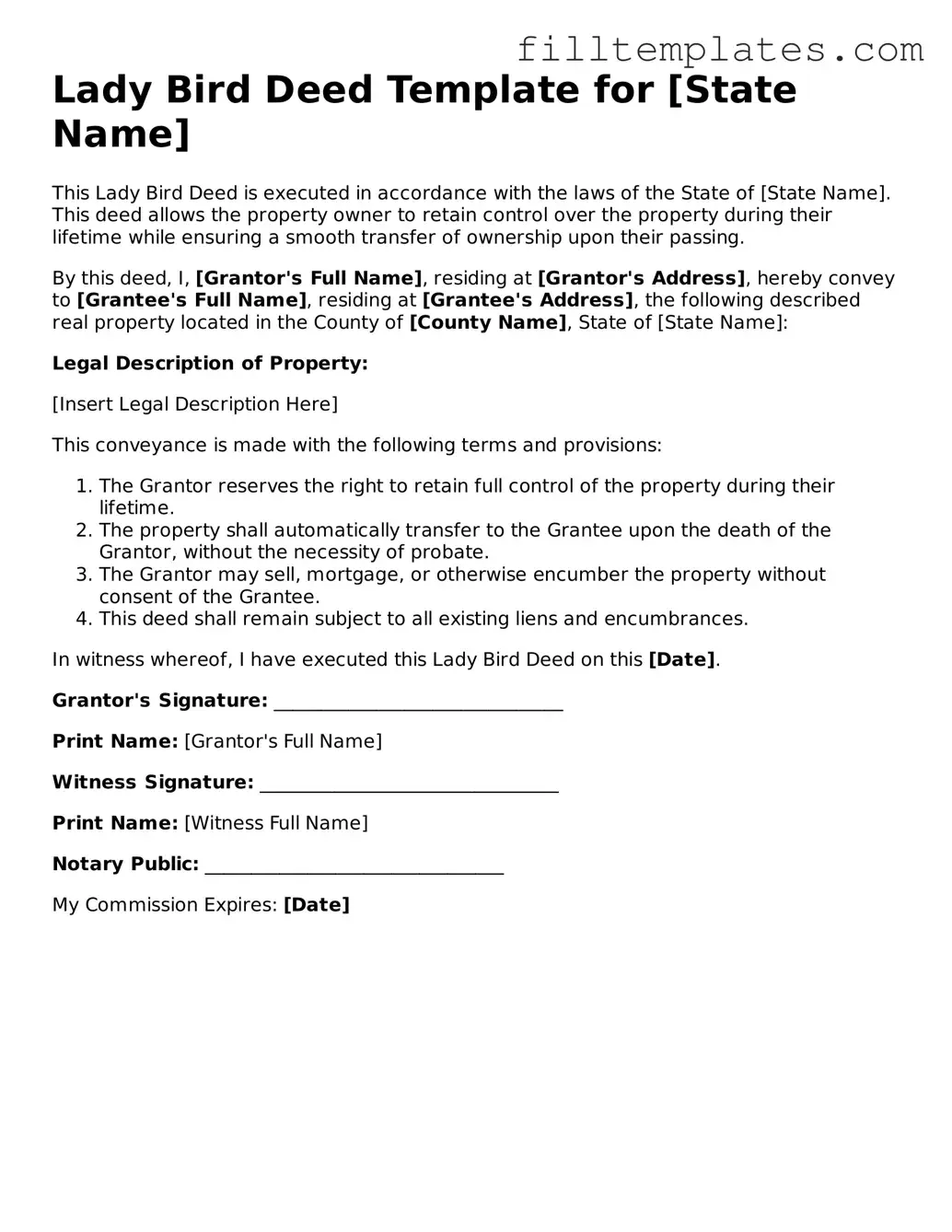

Lady Bird Deed Template for [State Name]

This Lady Bird Deed is executed in accordance with the laws of the State of [State Name]. This deed allows the property owner to retain control over the property during their lifetime while ensuring a smooth transfer of ownership upon their passing.

By this deed, I, [Grantor's Full Name], residing at [Grantor's Address], hereby convey to [Grantee's Full Name], residing at [Grantee's Address], the following described real property located in the County of [County Name], State of [State Name]:

Legal Description of Property:

[Insert Legal Description Here]

This conveyance is made with the following terms and provisions:

- The Grantor reserves the right to retain full control of the property during their lifetime.

- The property shall automatically transfer to the Grantee upon the death of the Grantor, without the necessity of probate.

- The Grantor may sell, mortgage, or otherwise encumber the property without consent of the Grantee.

- This deed shall remain subject to all existing liens and encumbrances.

In witness whereof, I have executed this Lady Bird Deed on this [Date].

Grantor's Signature: _______________________________

Print Name: [Grantor's Full Name]

Witness Signature: ________________________________

Print Name: [Witness Full Name]

Notary Public: ________________________________

My Commission Expires: [Date]

Documents used along the form

A Lady Bird Deed is a useful estate planning tool that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. Several other documents may accompany the Lady Bird Deed to ensure a comprehensive estate plan. Below is a list of commonly used forms and documents.

- Last Will and Testament: This document outlines how a person wishes to distribute their assets after death. It can address any property not transferred by the Lady Bird Deed.

- Durable Power of Attorney: This form grants someone the authority to make financial decisions on behalf of the property owner if they become incapacitated.

- Health Care Proxy: This document designates an individual to make medical decisions for the property owner if they are unable to do so themselves.

- Living Will: This form specifies the property owner's wishes regarding medical treatment and end-of-life care, providing guidance to healthcare providers and family members.

- Beneficiary Designation Forms: These forms are used for accounts such as life insurance or retirement plans, allowing the owner to name beneficiaries directly.

- Trust Documents: A trust can hold property and specify how it should be managed during the owner’s lifetime and distributed after death, often avoiding probate.

- California Bill of Sale: This document serves as proof of ownership transfer and is especially important for personal property transactions. More details can be found at onlinelawdocs.com/california-bill-of-sale.

- Property Deed: This document establishes ownership of real estate and may need to be updated or referenced when creating a Lady Bird Deed.

- Affidavit of Heirship: This document can help establish the heirs of a deceased property owner, particularly when the property was not transferred through a will.

Incorporating these documents into an estate plan can provide clarity and ensure that a person's wishes are honored. Each document serves a specific purpose and works together to create a comprehensive strategy for managing assets and healthcare decisions.