Free Letter of Intent to Lease Commercial Property Template

The Letter of Intent to Lease Commercial Property serves as a preliminary document that outlines the key terms and conditions under which a prospective tenant and landlord may agree to enter into a lease agreement. This form typically includes essential elements such as the proposed rental rate, lease duration, and specific details about the property, including its location and size. Additionally, it may address any contingencies that need to be met before the lease is finalized, such as zoning approvals or financing arrangements. By clarifying the intentions of both parties, this letter helps to facilitate negotiations and can serve as a foundation for drafting a more comprehensive lease agreement. It is important to note that while the Letter of Intent is not legally binding in the same way a lease is, it does express a mutual interest and can indicate the seriousness of both parties in pursuing a rental arrangement. Understanding the components of this form can significantly impact the leasing process and help ensure that all parties are aligned in their expectations from the outset.

Key takeaways

Filling out a Letter of Intent (LOI) to lease commercial property can be a crucial step in securing a lease agreement. Here are some key takeaways to consider:

- Purpose of the LOI: The LOI outlines the preliminary terms of the lease agreement, serving as a framework for negotiation.

- Clarity is Key: Be clear and concise in your language. Ambiguity can lead to misunderstandings down the line.

- Essential Terms: Include critical elements such as lease duration, rental rates, and any options for renewal.

- Contingencies: Consider including contingencies, such as financing or zoning approvals, which can protect your interests.

- Non-Binding Nature: Remember that an LOI is typically non-binding, meaning it does not create a legal obligation to lease the property.

- Negotiation Tool: Use the LOI as a negotiation tool. It can help both parties reach a mutually agreeable lease before drafting a formal contract.

- Consult Professionals: Always consider consulting with a real estate attorney or broker to ensure you cover all necessary aspects.

- Timeline: Establish a timeline for the lease process. This can help keep both parties accountable and on track.

- Flexibility: Be open to changes. The terms may evolve during negotiations, and flexibility can lead to a better agreement.

- Follow-Up: After submitting the LOI, follow up to ensure the other party received it and to discuss any questions they may have.

By keeping these takeaways in mind, you can navigate the process of leasing commercial property more effectively, setting a solid foundation for your future business endeavors.

Guide to Writing Letter of Intent to Lease Commercial Property

Completing the Letter of Intent to Lease Commercial Property form is an important step in securing a lease agreement. Once filled out, this document will serve as a basis for negotiations between you and the property owner. Follow these steps carefully to ensure that all necessary information is included and accurately presented.

- Gather Required Information: Collect all necessary details such as your business name, contact information, and the property address.

- Property Description: Clearly describe the commercial property you wish to lease, including the size, type, and any specific features that are important to your business.

- Lease Terms: Specify the desired lease term, including the start date and duration. Indicate whether you prefer a fixed term or a month-to-month arrangement.

- Rental Rate: State your proposed rental rate. Consider market rates and your budget when making this decision.

- Deposit Information: Mention any security deposit you are willing to provide and any conditions associated with it.

- Intended Use: Explain how you plan to use the property. This helps the landlord understand your business and its needs.

- Contingencies: Include any contingencies that may affect the lease, such as obtaining financing or permits.

- Sign and Date: After reviewing the information for accuracy, sign and date the form to validate it.

Once the form is completed, you can present it to the property owner or their representative. This will initiate discussions about the lease terms and pave the way for a formal lease agreement.

Create Popular Types of Letter of Intent to Lease Commercial Property Templates

Grant Loi Template - Evaluation methods to assess project success.

To ensure a successful homeschooling experience, parents should familiarize themselves with the important aspects of submitting a Homeschool Letter of Intent, which acts as a formal notification to the state.

Letter of Intent for Business - This document may not cover every detail but establishes a mutual understanding of the transaction's framework.

Form Preview Example

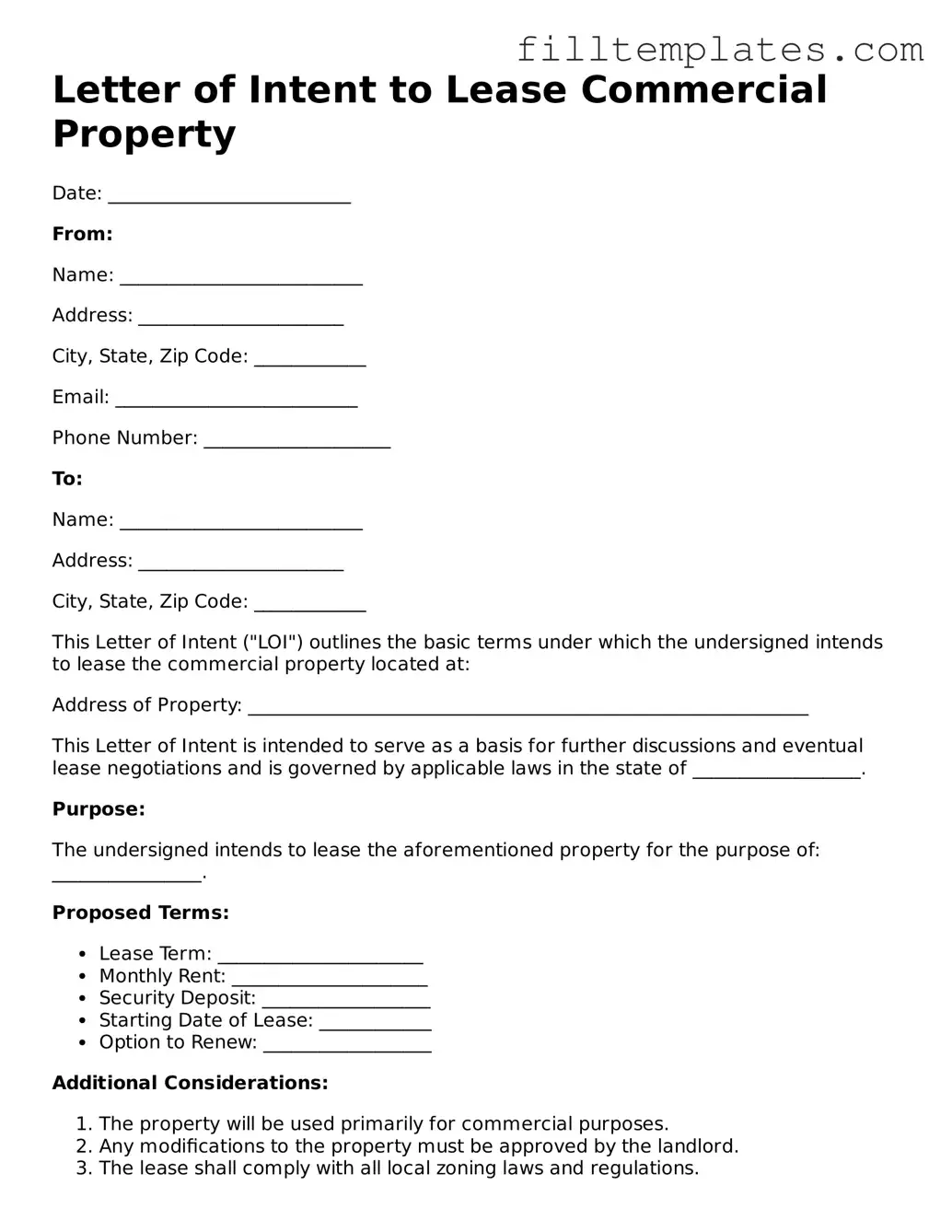

Letter of Intent to Lease Commercial Property

Date: __________________________

From:

Name: __________________________

Address: ______________________

City, State, Zip Code: ____________

Email: __________________________

Phone Number: ____________________

To:

Name: __________________________

Address: ______________________

City, State, Zip Code: ____________

This Letter of Intent ("LOI") outlines the basic terms under which the undersigned intends to lease the commercial property located at:

Address of Property: ____________________________________________________________

This Letter of Intent is intended to serve as a basis for further discussions and eventual lease negotiations and is governed by applicable laws in the state of __________________.

Purpose:

The undersigned intends to lease the aforementioned property for the purpose of: ________________.

Proposed Terms:

- Lease Term: ______________________

- Monthly Rent: _____________________

- Security Deposit: __________________

- Starting Date of Lease: ____________

- Option to Renew: __________________

Additional Considerations:

- The property will be used primarily for commercial purposes.

- Any modifications to the property must be approved by the landlord.

- The lease shall comply with all local zoning laws and regulations.

Upon mutual agreement of terms outlined herein, a formal lease agreement will be drafted and executed. The undersigned trusts that this LOI expresses a genuine interest in proceeding with the lease.

Signature:

__________________________

Name: ______________________

Date: ___________________

Documents used along the form

When entering into a lease agreement for commercial property, several documents often accompany the Letter of Intent to Lease. These documents help clarify the terms and conditions of the lease and protect the interests of both parties involved. Here’s a list of common forms and documents you might encounter.

- Lease Agreement: This is the formal contract that outlines the terms of the lease, including rent, duration, and responsibilities of both the landlord and tenant.

- Confidentiality Agreement: This document ensures that any sensitive information shared during negotiations remains private and is not disclosed to outside parties.

- Property Disclosure Statement: This form provides important details about the property's condition, including any known issues or repairs that may be needed.

- Financial Statements: Landlords may request these documents to assess the tenant’s financial stability and ability to meet lease obligations.

- Personal Guarantee: This is a promise made by an individual to be personally responsible for the lease obligations, typically required from new businesses or startups.

- Security Deposit Receipt: This document confirms the amount of the security deposit paid by the tenant and outlines the conditions for its return at the end of the lease.

- Insurance Certificates: Tenants may need to provide proof of insurance coverage to protect against potential liabilities associated with the property.

- Investment Letter of Intent: This document outlines the preliminary agreement between investors and a business regarding proposed investment terms, helping to establish a clear understanding of expectations. For more information, you can visit Top Forms Online.

- Amendments or Addendums: These are changes or additions to the original lease agreement, often made to address specific needs or updates during the lease term.

Understanding these documents can help ensure a smooth leasing process. Each one serves a unique purpose and contributes to a clear and mutually beneficial agreement between landlords and tenants.