Free Letter of Intent to Purchase Business Template

In the dynamic landscape of business transactions, a Letter of Intent to Purchase Business serves as a pivotal document that outlines the preliminary agreement between a buyer and a seller. This form encapsulates key elements such as the purchase price, terms of payment, and the timeline for due diligence, all of which are critical for both parties as they navigate the complexities of a potential acquisition. By providing a framework for negotiation, the letter not only clarifies the intentions of the buyer but also sets expectations for the seller, thereby fostering transparency and trust. Additionally, it often includes contingencies that must be satisfied before the final sale can occur, such as financing approvals or regulatory compliance. As such, this document acts as a roadmap, guiding the parties through the initial stages of the transaction while laying the groundwork for a more detailed purchase agreement to follow. Understanding its components and implications can significantly enhance the efficiency of the buying process, ensuring that both sides are aligned before embarking on the more intricate phases of a business sale.

Key takeaways

When filling out and using the Letter of Intent to Purchase Business form, consider the following key takeaways:

- The letter serves as a preliminary agreement outlining the basic terms of a potential business purchase.

- It is important to clearly state the purchase price and payment terms to avoid misunderstandings.

- Include a timeline for the transaction, which helps both parties manage expectations.

- Specify any conditions that must be met before the sale can proceed, such as financing or due diligence.

- Both parties should sign the letter to indicate their agreement to the outlined terms.

- While the letter is not a binding contract, it can serve as a foundation for future negotiations.

- Consulting with a legal professional before finalizing the letter can provide valuable insights and ensure compliance with applicable laws.

Guide to Writing Letter of Intent to Purchase Business

Once you have the Letter of Intent to Purchase Business form in hand, it's time to fill it out carefully. This document is crucial as it outlines the basic terms of the proposed transaction and sets the stage for further negotiations. Following the steps below will help ensure that you complete the form accurately and effectively.

- Begin with your information: Write your full name, address, and contact details at the top of the form.

- Identify the seller: Include the name and contact information of the business owner or entity selling the business.

- Describe the business: Provide a brief description of the business being purchased, including its name, location, and type of business.

- State the purchase price: Clearly indicate the proposed purchase price for the business.

- Outline terms and conditions: Specify any terms and conditions related to the purchase, such as payment terms, contingencies, or due diligence periods.

- Include a timeline: Indicate the expected timeline for completing the transaction.

- Sign and date: Ensure you sign and date the form to validate your intent.

After completing the form, review it for accuracy and clarity. Once finalized, you can present it to the seller, marking the beginning of negotiations for the purchase of the business.

Create Popular Types of Letter of Intent to Purchase Business Templates

How to Write a Letter of Intent for a Job - This document marks a significant step in the hiring journey for both parties.

When embarking on the homeschooling journey, it's essential to have the right resources, and one such invaluable tool is the Templates Online, which provides a comprehensive guide to the Tennessee Homeschool Letter of Intent form. This resource helps ensure that parents are well-informed and equipped to navigate the requirements set by their school district.

Investment Letter of Intent - This letter often marks the transition from informal discussions to more serious investment considerations.

Intent to Rent Letter - A clear outline in the Letter of Intent may reduce the likelihood of disputes later in the process.

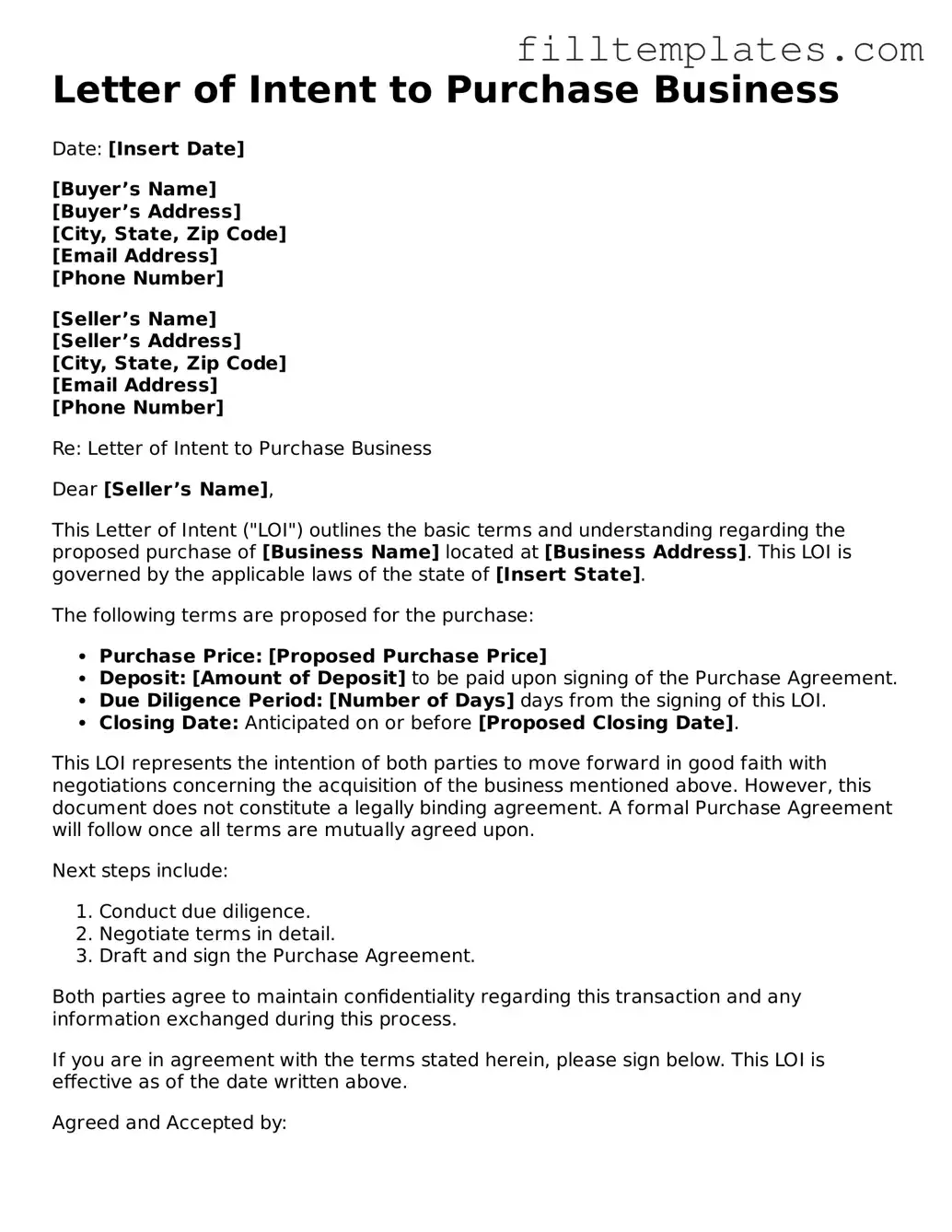

Form Preview Example

Letter of Intent to Purchase Business

Date: [Insert Date]

[Buyer’s Name]

[Buyer’s Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Seller’s Name]

[Seller’s Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

Re: Letter of Intent to Purchase Business

Dear [Seller’s Name],

This Letter of Intent ("LOI") outlines the basic terms and understanding regarding the proposed purchase of [Business Name] located at [Business Address]. This LOI is governed by the applicable laws of the state of [Insert State].

The following terms are proposed for the purchase:

- Purchase Price: [Proposed Purchase Price]

- Deposit: [Amount of Deposit] to be paid upon signing of the Purchase Agreement.

- Due Diligence Period: [Number of Days] days from the signing of this LOI.

- Closing Date: Anticipated on or before [Proposed Closing Date].

This LOI represents the intention of both parties to move forward in good faith with negotiations concerning the acquisition of the business mentioned above. However, this document does not constitute a legally binding agreement. A formal Purchase Agreement will follow once all terms are mutually agreed upon.

Next steps include:

- Conduct due diligence.

- Negotiate terms in detail.

- Draft and sign the Purchase Agreement.

Both parties agree to maintain confidentiality regarding this transaction and any information exchanged during this process.

If you are in agreement with the terms stated herein, please sign below. This LOI is effective as of the date written above.

Agreed and Accepted by:

______________________________

Buyer’s Signature

[Buyer’s Name]

______________________________

Seller’s Signature

[Seller’s Name]

Documents used along the form

When engaging in the process of purchasing a business, various documents complement the Letter of Intent to Purchase Business. Each of these forms serves a specific purpose, helping both parties navigate the complexities of the transaction. Below is a list of commonly used documents that may accompany the Letter of Intent.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains protected. It prevents either party from disclosing proprietary details to third parties.

- Due Diligence Checklist: A comprehensive list that outlines the information and documents the buyer needs to review. It typically includes financial statements, contracts, and operational details.

- Purchase Agreement: This legally binding contract outlines the terms of the sale, including price, payment terms, and any contingencies. It formalizes the transaction once negotiations are complete.

- Asset Purchase Agreement: If the buyer intends to purchase specific assets rather than the entire business, this document details the assets being acquired and their associated liabilities.

- Stock Purchase Agreement: Used when a buyer acquires the stock of a corporation, this document specifies the number of shares, purchase price, and representations made by the seller.

- Letter of Authorization: This letter grants permission for the buyer to access certain information or documents from third parties, often necessary for due diligence.

- Financing Agreement: If the buyer requires financing to complete the purchase, this document outlines the terms of the loan, including interest rates and repayment schedules.

- Letter of Intent Form: To better understand the nature of agreements, consult our guidelines on the Letter of Intent process for effective transaction planning.

- Transition Services Agreement: This agreement may be established to facilitate a smooth transition after the sale, detailing the support the seller will provide to the buyer during the initial period post-sale.

Understanding these documents is crucial for anyone involved in a business acquisition. Each plays a vital role in ensuring that both parties are protected and that the transaction proceeds smoothly.