Download Letter To Purchase Land Template

When considering the purchase of land, a Letter To Purchase Land serves as a crucial first step in the negotiation process. This document outlines the intentions of the buyer and sets the groundwork for a more formal agreement. It begins with essential details such as the date, the involved parties, and a brief description of the property in question. The letter specifies the purchase price and terms of sale, which are fundamental for both parties to understand. Additionally, it introduces the concept of escrow, detailing how and when it will be opened, along with the initial deposits required. The feasibility period is another critical component, allowing the buyer time to conduct due diligence on the property, ensuring it meets their needs and expectations. The letter also addresses conditions that must be met before closing the sale, such as clear title and the absence of any development restrictions. Finally, it establishes an expiration date for the offer, ensuring that the seller cannot entertain other offers during the negotiation period. By carefully outlining these aspects, the Letter To Purchase Land not only facilitates a smooth transaction but also protects the interests of both the buyer and the seller.

Key takeaways

When filling out and using the Letter To Purchase Land form, consider the following key takeaways:

- Clear Identification: Ensure that both the buyer and seller are clearly identified, including their contact information.

- Property Description: Accurately describe the subject property, including the APN (Assessor's Parcel Number) for clarity.

- Purchase Price: Clearly state the purchase price to avoid confusion later in the process.

- Escrow Details: Specify the title company where escrow will be opened and the timeline for doing so.

- Deposits: Outline the initial and second deposits, noting which amounts are refundable and non-refundable.

- Feasibility Period: Provide a timeframe for the buyer to conduct due diligence, allowing for a thorough investigation of the property.

- Conditions Precedent: List any conditions that must be met before closing, such as title insurance and lien clearance.

- Expiration of Offer: Indicate a clear expiration date for the offer to ensure timely responses from the seller.

By following these takeaways, you can ensure a smoother transaction process when purchasing land.

Guide to Writing Letter To Purchase Land

After gathering all necessary information, you are ready to fill out the Letter To Purchase Land form. This document outlines your intention to buy a specific property and sets the stage for further negotiations. Follow the steps below to ensure you complete the form accurately.

- Date: Write the current date at the top of the form.

- Property Description: Fill in the description of the property and the city or county where it is located.

- Seller's Information: Enter the name of the seller(s) and their contact information.

- Buyer's Information: Provide your name as the buyer and your contact information. Remember, you can assign your interest to a corporation or partnership.

- Subject Property: Identify the property by its name and APN (Assessor's Parcel Number). Include any specific items that are part of the offer.

- Purchase Price: State the proposed purchase price in both words and numbers.

- Terms of Purchase: Outline the terms under which you intend to purchase the property.

- Opening of Escrow: Specify the title company where escrow will be opened and the timeline for doing so.

- Deposit Toward Purchase Price: Detail the initial and second deposits, including amounts and conditions for each.

- Feasibility Period: Indicate the timeframe for conducting feasibility and due diligence on the property.

- Buyer's Condition Precedent to Closing: List the conditions that must be met before closing the escrow.

- Close of Escrow: Provide the anticipated closing date.

- Other Provisions: Mention any additional provisions that may be included in the Purchase Agreement.

- Expiration of Offer: State the expiration date for the offer.

- Signatures: Sign and date the form as the buyer. Leave space for the seller's signature as well.

Once completed, review the form for accuracy. It is advisable to keep a copy for your records. After both parties have signed, you can proceed with the next steps in the purchasing process.

Browse Other PDFs

Bdsm Form - Finding inspiration can lead to new ideas and adventures.

For those seeking a comprehensive understanding of their tax situation, the Sample Tax Return Transcript form becomes an indispensable resource, especially when utilized alongside online tools available at smarttemplates.net. This document not only summarizes essential income and tax data but also provides insights into any adjustments made post-filing, ensuring clarity on the overall tax picture.

96 Well Plate Format - It features easy-to-use designs for greater laboratory productivity.

Form Preview Example

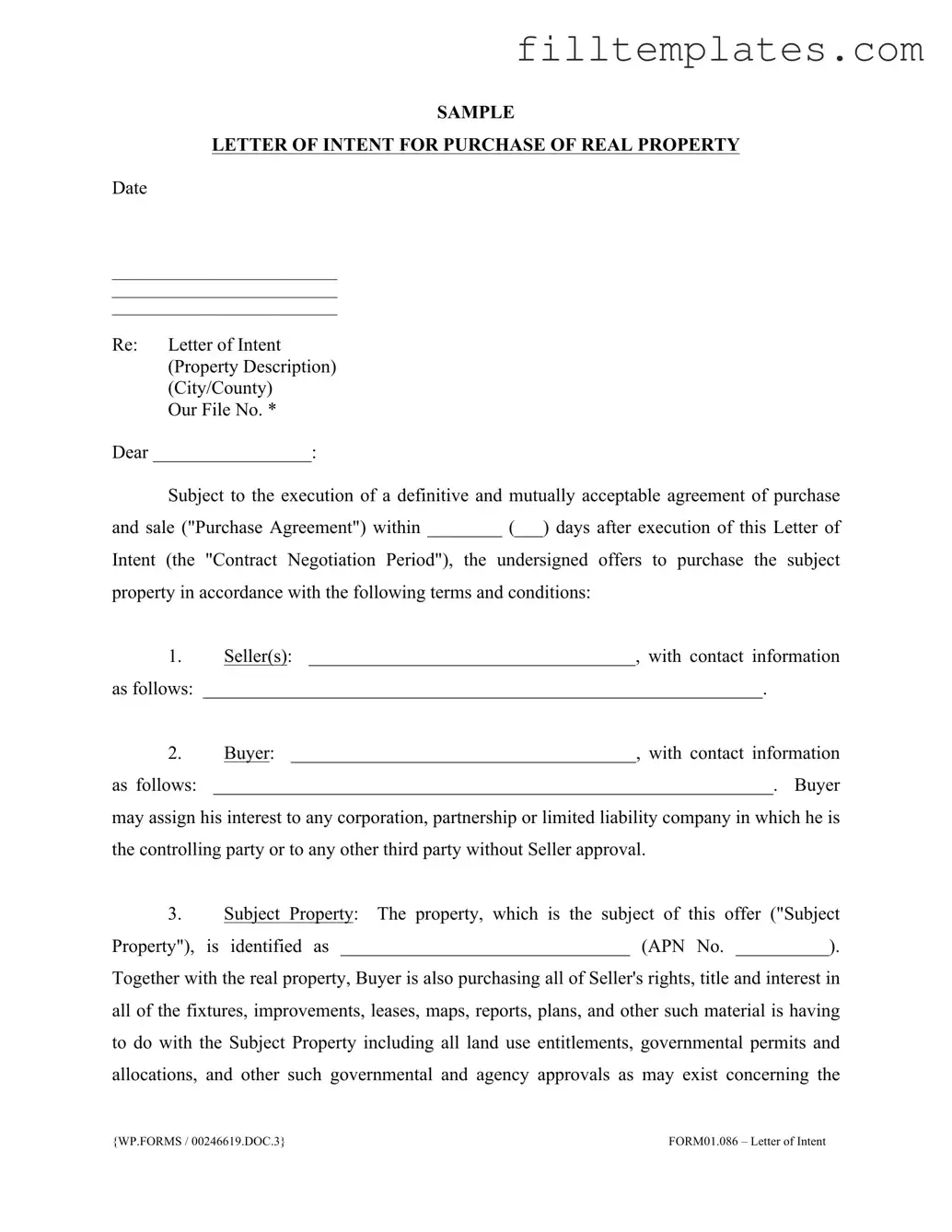

SAMPLE

LETTER OF INTENT FOR PURCHASE OF REAL PROPERTY

Date

_____________________________

_____________________________

_____________________________

Re: Letter of Intent (Property Description) (City/County)

Our File No. *

Dear _________________:

Subject to the execution of a definitive and mutually acceptable agreement of purchase and sale ("Purchase Agreement") within ________ (___) days after execution of this Letter of

Intent (the "Contract Negotiation Period"), the undersigned offers to purchase the subject property in accordance with the following terms and conditions:

1.Seller(s): ___________________________________, with contact information

as follows: ____________________________________________________________.

2.Buyer: _____________________________________, with contact information

as follows: ____________________________________________________________. Buyer may assign his interest to any corporation, partnership or limited liability company in which he is the controlling party or to any other third party without Seller approval.

3.Subject Property: The property, which is the subject of this offer ("Subject Property"), is identified as _______________________________ (APN No. __________). Together with the real property, Buyer is also purchasing all of Seller's rights, title and interest in all of the fixtures, improvements, leases, maps, reports, plans, and other such material is having to do with the Subject Property including all land use entitlements, governmental permits and allocations, and other such governmental and agency approvals as may exist concerning the

{WP.FORMS / 00246619.DOC.3} |

FORM01.086 – Letter of Intent |

_____________________

_____________________

Page 2

property. In addition, this offer to purchase includes the following specific items: ___________

____________________________________________.

4.Purchase Price: ___________________ ($________).

5.Terms of Purchase: ________________________________________________

___________________________________________________.

6.Opening of Escrow: Escrow ("the Purchase Escrow") shall be opened at

______________ Title Company within three (3) business days from execution of this Letter of Intent. The Purchase Agreement and Mutual Escrow Instructions shall be mutually prepared and executed by Buyer and Seller within ________ (___) days of execution by both parties of this Letter of Intent to purchase (the "Contract Negotiation Period").

7.Deposit Toward Purchase Price:

A.Initial Deposit: Concurrently with the opening of escrow, Buyer shall place therein the sum of ___________________________ Dollars ($____________) as a refundable deposit toward and applicable to the Purchase Price ("the Initial Deposit"). Escrow Holder shall deposit such sum in an

B.Second Deposit: An additional

__________________________ Dollars ($____________) shall be applicable to the Purchase Price and upon approval of the feasibility shall be released to Seller, inclusive of the Initial Deposit.

8.Feasibility Period: Buyer shall have until ________________ to perform all feasibility and due diligence for subject property. Seller shall fully cooperate with Buyer in

_____________________

_____________________

Page 3

providing any and all information available regarding the development potential of the property. Buyer may terminate this Letter of Intent and/or the Purchase Agreement at any time prior to the end of the Feasibility Period for any reason or no reason at all upon written notification to Seller and Escrow Holder of the termination. Upon notice of termination, Escrow Holder shall be instructed to immediately release the Initial Deposit made by Buyer and return to Buyer within five (5) business days of termination.

9.Buyer's Condition Precedent to Closing: Following the expiration of the Feasibility Period, Buyer's obligation to close escrow shall be subject only to the following conditions:

A.Title Company shall be in position to issue a policy of title insurance to Buyer in the full amount of the Purchase Price showing good and marketable title vested in Buyer subject only to such exceptions to title as have been approved by Buyer during the Feasibility Period.

B.The

C.Seller to provide Buyer title to property free and clear of liens except for

10.Close of Escrow: Close of escrow to be on _______________________.

_____________________

_____________________

Page 4

11.Other Provisions:

A.The Purchase Agreement may contain other provisions such as, but not limited to, a liquidated damages clause, attorney's fees, notices, mutual indemnifications, broker's commission, and the like.

B.Any and all documentation provided by Seller to Buyer shall be returned to Seller upon cancellation of this transaction.

12.Expiration of Offer: This Letter of Intent shall constitute an open offer until

____________, at which time it shall be automatically terminated if not executed by Seller.

If the above outline of terms and conditions are acceptable, please indicate by signing below. All parties to these transactions intend that this proposal be superseded by a the Purchase Agreement. In the meantime, all parties agree to proceed in accordance with terms and conditions outlined in this Letter of Intent. Seller understands the purpose of this Letter of Intent is to allow further investigation by both parties into the feasibility of entering into a formal agreement. This Letter of Intent is only binding on the parties during the Contract Negotiation period. If the Purchase Agreement is not mutually executed within the Contract Negotiation Period for any reason whatsoever or no reason at all, this Letter of Intent shall expire and no party shall have any further rights or duties hereunder. Seller shall not solicit other offers during the Contract Negotiation Period.

BUYER:

________________________________ |

Dated: _________________ |

SELLER:

________________________________ |

Dated: _________________ |

_____________________

_____________________

Page 5

Documents used along the form

When preparing to purchase land, various forms and documents accompany the Letter to Purchase Land. Each of these documents plays a crucial role in ensuring that the transaction is clear, legally binding, and properly executed. Below is a list of common documents used in conjunction with the Letter to Purchase Land.

- Purchase Agreement: This is the definitive contract that outlines the terms and conditions of the sale. It includes details such as the purchase price, payment terms, and any contingencies that must be met before the sale is finalized.

- Escrow Instructions: These instructions guide the escrow agent in managing the funds and documents involved in the transaction. They specify how and when the money will be transferred and what conditions must be met for the closing to occur.

- Trailer Bill of Sale: When selling a trailer, it's vital to have the correct documentation. Refer to our essential Trailer Bill of Sale template for accurate and legal transactions.

- Title Report: A title report provides information about the ownership history of the property. It reveals any liens, encumbrances, or other issues that may affect the buyer's ability to take clear title to the land.

- Disclosure Statements: Sellers are often required to provide disclosures about the property’s condition, including any known defects or issues. This document protects buyers by ensuring they are aware of potential problems before completing the purchase.

- Inspection Reports: Buyers may choose to have the property inspected to assess its condition. These reports can identify structural issues, environmental concerns, or other factors that could influence the buyer’s decision to proceed with the purchase.

- Financing Documents: If the buyer is obtaining a loan to finance the purchase, various financing documents will be necessary. These include loan applications, promissory notes, and mortgage agreements, which outline the terms of the financing arrangement.

Understanding these documents is essential for anyone involved in a land purchase. Each plays a significant role in protecting the interests of both the buyer and the seller, ensuring a smooth transaction process. Proper preparation and attention to detail can help prevent misunderstandings and disputes down the line.