Free Loan Agreement Template

When entering into a financial arrangement, understanding the Loan Agreement form is essential for both borrowers and lenders. This document serves as a formal contract that outlines the terms and conditions of the loan, ensuring that both parties are on the same page. Key components of the form include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it specifies the consequences of defaulting on the loan, which helps protect the lender’s interests while also informing the borrower of their obligations. The agreement may also include provisions for prepayment, late fees, and other relevant terms that can impact the overall loan experience. By clearly detailing these aspects, the Loan Agreement form aims to foster transparency and trust, allowing both parties to engage in the transaction with confidence.

Loan Agreement Categories

Key takeaways

Understanding the Loan Agreement form is crucial for both lenders and borrowers. Here are some key takeaways to consider:

- Identify Parties Clearly: Clearly state the names and contact information of both the lender and the borrower. This ensures that all parties are identifiable and accountable.

- Specify Loan Amount: Clearly indicate the total amount being loaned. This should be a precise figure to avoid any confusion later.

- Outline Interest Rates: Include the interest rate applicable to the loan. Whether it is fixed or variable, this detail is essential for understanding repayment obligations.

- Define Repayment Terms: Specify the repayment schedule. Indicate whether payments will be made monthly, quarterly, or in another format, along with the due dates.

- Include Default Provisions: Outline what happens in the event of default. This may include late fees, acceleration of the loan, or other consequences.

- Address Governing Law: Specify which state’s laws will govern the agreement. This is important for resolving any disputes that may arise.

- Signatures Required: Ensure that both parties sign the agreement. Signatures validate the contract and indicate mutual consent to the terms.

By following these guidelines, both lenders and borrowers can create a clear and enforceable Loan Agreement, minimizing potential disputes in the future.

Guide to Writing Loan Agreement

Filling out the Loan Agreement form is an important step in securing a loan. It requires careful attention to detail to ensure all necessary information is accurately provided. Once completed, the form can be submitted to the lender for review.

- Begin by entering the date at the top of the form.

- Fill in your full name as the borrower, ensuring it matches your identification documents.

- Provide your current address, including city, state, and zip code.

- Enter your phone number and email address for contact purposes.

- Indicate the amount of the loan you are requesting.

- Specify the purpose of the loan in the designated section.

- Fill in the repayment terms, including the interest rate and repayment schedule.

- Include any collateral details if required by the lender.

- Sign and date the form at the bottom to confirm your agreement to the terms.

- Review the completed form for accuracy before submission.

Other Forms:

Megger Test Form - Encourage consistent documentation practices across projects.

For those navigating the complexities of real estate transactions in Texas, it's vital to have access to reliable resources, such as the agreements found at smarttemplates.net, which can help in drafting a Texas Real Estate Purchase Agreement that clearly delineates the rights and responsibilities of both buyers and sellers.

Printable Salon Booth Rental Agreement Pdf - It can cover policies related to customer complaints and feedback.

Form Preview Example

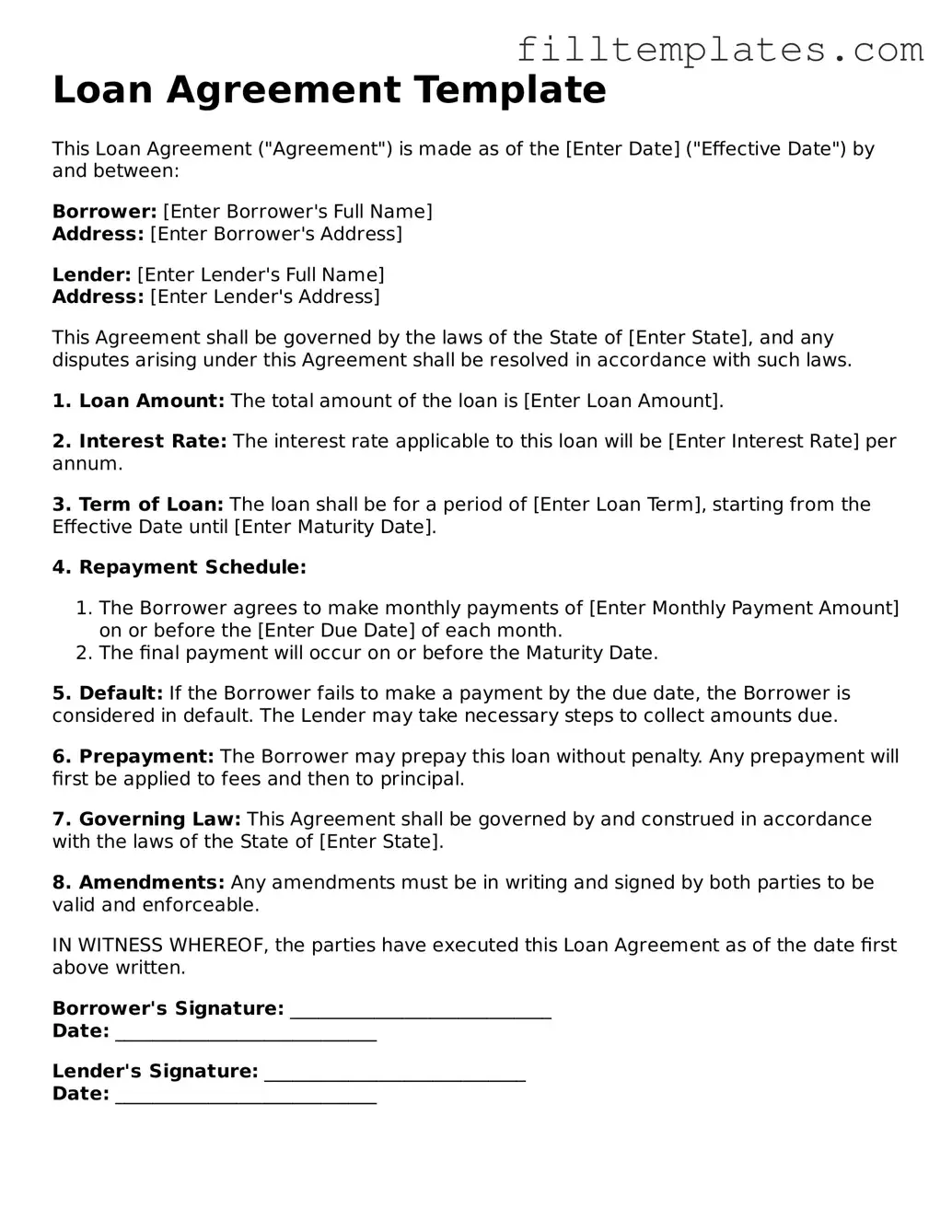

Loan Agreement Template

This Loan Agreement ("Agreement") is made as of the [Enter Date] ("Effective Date") by and between:

Borrower: [Enter Borrower's Full Name]

Address: [Enter Borrower's Address]

Lender: [Enter Lender's Full Name]

Address: [Enter Lender's Address]

This Agreement shall be governed by the laws of the State of [Enter State], and any disputes arising under this Agreement shall be resolved in accordance with such laws.

1. Loan Amount: The total amount of the loan is [Enter Loan Amount].

2. Interest Rate: The interest rate applicable to this loan will be [Enter Interest Rate] per annum.

3. Term of Loan: The loan shall be for a period of [Enter Loan Term], starting from the Effective Date until [Enter Maturity Date].

4. Repayment Schedule:

- The Borrower agrees to make monthly payments of [Enter Monthly Payment Amount] on or before the [Enter Due Date] of each month.

- The final payment will occur on or before the Maturity Date.

5. Default: If the Borrower fails to make a payment by the due date, the Borrower is considered in default. The Lender may take necessary steps to collect amounts due.

6. Prepayment: The Borrower may prepay this loan without penalty. Any prepayment will first be applied to fees and then to principal.

7. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of [Enter State].

8. Amendments: Any amendments must be in writing and signed by both parties to be valid and enforceable.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

Borrower's Signature: ____________________________

Date: ____________________________

Lender's Signature: ____________________________

Date: ____________________________

Documents used along the form

A Loan Agreement is a critical document in any borrowing scenario. However, several other forms and documents are often used in conjunction with it to ensure clarity and protection for all parties involved. Below is a list of commonly associated documents.

- Promissory Note: This is a written promise from the borrower to repay the loan. It outlines the amount borrowed, interest rate, and repayment schedule. It serves as a legal instrument that can be enforced in court if necessary.

- Durable Power of Attorney Form: When planning for incapacitation, it’s important to have a comprehensive Durable Power of Attorney to protect your interests and authorize a trusted individual to manage your affairs.

- Loan Application: This document is completed by the borrower to provide the lender with detailed information about their financial status, credit history, and purpose of the loan. It helps the lender assess the risk of lending.

- Security Agreement: If the loan is secured by collateral, this document outlines the specific assets pledged by the borrower. It details the rights of the lender to claim the collateral in case of default.

- Personal Guarantee: This document may be required from individuals who agree to be personally responsible for the loan. It adds an extra layer of security for the lender, ensuring that they can pursue the guarantor for repayment if the borrower defaults.

- Disclosure Statement: This document provides important information about the loan terms, including fees, interest rates, and total repayment amounts. It ensures that borrowers understand the costs associated with their loan.

Understanding these documents can significantly impact the borrowing process. Each serves a unique purpose and contributes to the overall security and clarity of the lending arrangement.