Official Lady Bird Deed Template for the State of Michigan

In Michigan, the Lady Bird Deed has emerged as a valuable estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This unique form of deed enables individuals to maintain the right to live in and use their property, ensuring they can continue to enjoy their home without interruption. At the same time, it streamlines the transfer process upon the owner's passing, allowing for a smooth transition of property without the need for probate. The Lady Bird Deed also offers significant tax advantages, as it can help avoid capital gains taxes for the beneficiaries. Furthermore, this deed can protect the property from creditors, providing peace of mind for both the owner and their loved ones. Understanding the intricacies of the Lady Bird Deed is essential for anyone looking to plan their estate effectively while safeguarding their family's future.

Key takeaways

A Michigan Lady Bird Deed allows property owners to transfer real estate to their beneficiaries while retaining the right to live in and control the property during their lifetime.

This deed avoids probate, simplifying the transfer process upon the owner’s death and ensuring a smoother transition for heirs.

To fill out the form correctly, include the legal description of the property, the names of the grantor and grantee, and any specific instructions regarding the transfer.

It is crucial to sign the deed in the presence of a notary public to validate the document and ensure its acceptance by the county register of deeds.

Consulting with a legal expert is recommended to ensure that the deed aligns with your overall estate planning goals and complies with Michigan laws.

Guide to Writing Michigan Lady Bird Deed

Once you have the Michigan Lady Bird Deed form in hand, it’s essential to complete it accurately to ensure it serves its intended purpose. Follow the steps carefully to fill out the form correctly. After completing the form, you will need to sign it in front of a notary and then file it with the appropriate county office to make it legally binding.

- Begin by entering the name of the property owner at the top of the form. This should be the individual who currently holds the title to the property.

- Next, provide the address of the property. Include the street address, city, state, and zip code to ensure clarity.

- Identify the beneficiaries. List the names of the individuals who will inherit the property. Be sure to include their full names and relationship to the property owner.

- Specify any conditions or limitations regarding the transfer of the property. If there are none, you may leave this section blank.

- In the designated area, indicate whether the property owner retains the right to live in the property during their lifetime. This is a crucial part of the deed.

- Fill in the date on which the deed is being executed. This should reflect the current date when you are completing the form.

- Finally, sign the form. Ensure that you do this in the presence of a notary public, who will also need to sign and stamp the document.

After completing these steps, make sure to keep a copy for your records. The original form must be filed with the local county register of deeds office to finalize the process. This step is vital for ensuring that the deed is recognized legally.

Discover Popular Lady Bird Deed Templates for Specific States

Ladybird Deed North Carolina - This approach to property transfer may significantly lessen the burden of estate administration for families.

The comprehensive Motorcycle Bill of Sale is vital for ensuring that both parties involved in the motorcycle transaction have a clear understanding of the terms and conditions, safeguarding their interests throughout the transfer process.

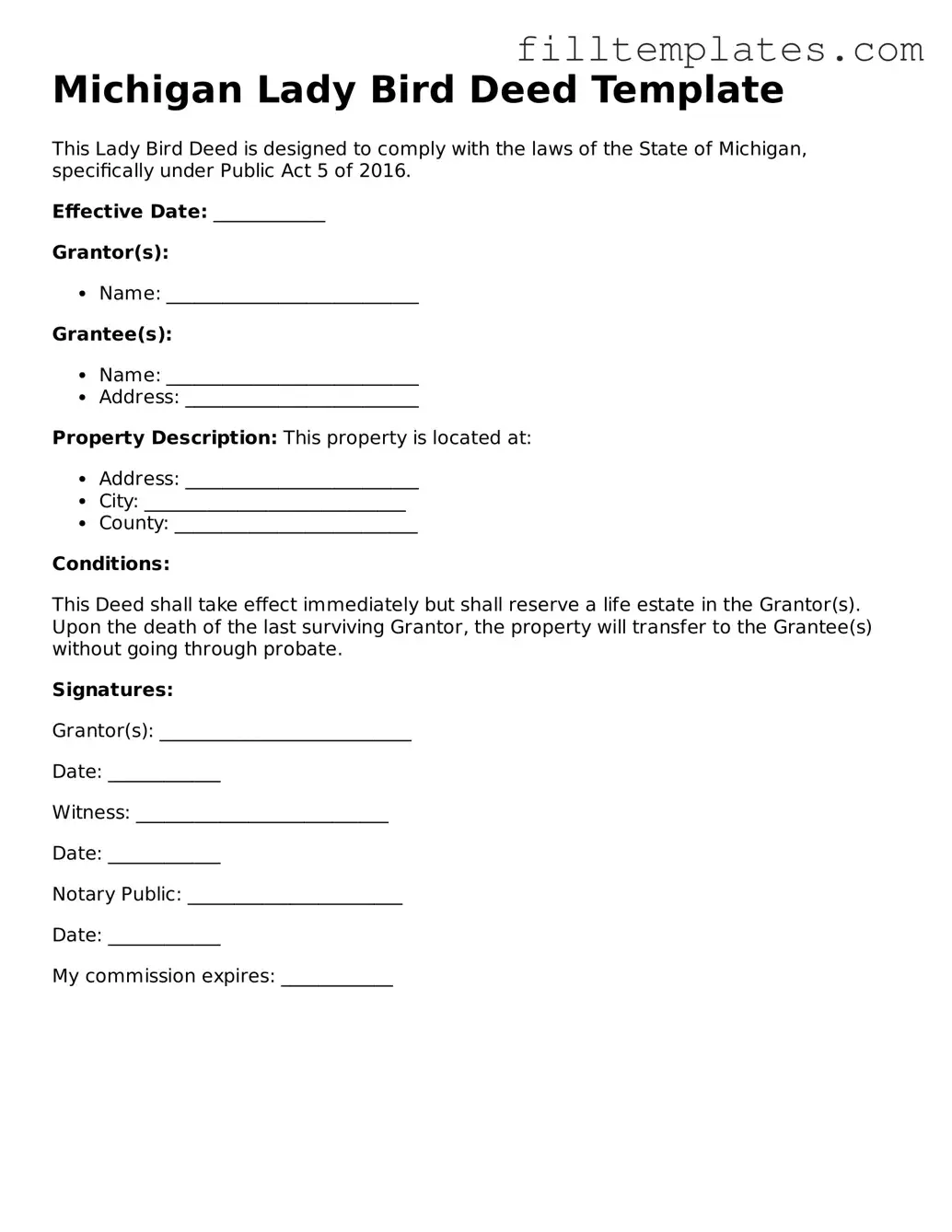

Form Preview Example

Michigan Lady Bird Deed Template

This Lady Bird Deed is designed to comply with the laws of the State of Michigan, specifically under Public Act 5 of 2016.

Effective Date: ____________

Grantor(s):

- Name: ___________________________

Grantee(s):

- Name: ___________________________

- Address: _________________________

Property Description: This property is located at:

- Address: _________________________

- City: ____________________________

- County: __________________________

Conditions:

This Deed shall take effect immediately but shall reserve a life estate in the Grantor(s). Upon the death of the last surviving Grantor, the property will transfer to the Grantee(s) without going through probate.

Signatures:

Grantor(s): ___________________________

Date: ____________

Witness: ___________________________

Date: ____________

Notary Public: _______________________

Date: ____________

My commission expires: ____________

Documents used along the form

The Michigan Lady Bird Deed is a valuable estate planning tool, often used to transfer property while retaining certain rights. When preparing this deed, several other documents may also be relevant to ensure a smooth transfer and proper management of the property. Below is a list of forms and documents frequently associated with the Lady Bird Deed.

- Warranty Deed: This document provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. It ensures the buyer is protected against any claims to the property.

- Quit Claim Deed: Used to transfer any interest the grantor has in the property without warranties. It is often used among family members or in situations where the title is not in dispute.

- Bill of Sale: This document is essential for any personal property transaction, serving as proof of ownership and the terms between buyer and seller. For more information, you can visit smarttemplates.net.

- Power of Attorney: This legal document allows one person to act on behalf of another. It can be crucial if the property owner is unable to sign the Lady Bird Deed themselves.

- Trust Agreement: If the property is held in a trust, this document outlines the terms of the trust and how the property should be managed and distributed.

- Affidavit of Heirship: This document establishes the heirs of a deceased property owner, which can be important for transferring ownership if the owner passed away without a will.

- Beneficiary Designation Form: This form allows property owners to designate beneficiaries for their property, ensuring it passes directly to them upon the owner's death.

- Real Estate Purchase Agreement: If the property is being sold, this agreement outlines the terms of the sale, including price, conditions, and obligations of both parties.

- Title Insurance Policy: This document protects the buyer against losses due to defects in the title, ensuring that the property is free from liens or other claims.

- Property Tax Exemption Application: If applicable, this form allows property owners to apply for exemptions that could reduce their property tax burden.

- Estate Planning Documents: These may include wills, trusts, and other documents that outline how a person’s assets should be managed and distributed after their death.

Understanding these documents can facilitate a more effective estate planning process. Each serves a specific purpose and can help clarify the intentions of the property owner while ensuring compliance with Michigan law.