Official Operating Agreement Template for the State of Michigan

When starting a business in Michigan, particularly a limited liability company (LLC), having a well-crafted Operating Agreement is crucial. This document serves as the backbone of your LLC, outlining the management structure and operational procedures that govern your business. It details the roles and responsibilities of members, how profits and losses are distributed, and the process for making major decisions. Moreover, the Operating Agreement can address important aspects such as the admission of new members, the procedures for resolving disputes, and the steps to take in the event of a member's departure. By clearly defining these elements, the Operating Agreement not only helps to prevent misunderstandings among members but also provides legal protection for the company and its members. In Michigan, while the law does not mandate an Operating Agreement, having one is highly recommended to ensure that your business runs smoothly and in accordance with the members’ intentions. Understanding the significance of this document can save you time, money, and potential legal headaches down the road.

Key takeaways

When filling out and using the Michigan Operating Agreement form, it is essential to keep several key points in mind:

- Understand the Purpose: The Operating Agreement outlines the management structure and operating procedures of your LLC.

- Identify Members: Clearly list all members of the LLC, including their names and addresses.

- Define Ownership Percentages: Specify each member's ownership interest in the company to avoid future disputes.

- Outline Management Structure: Decide whether the LLC will be member-managed or manager-managed, and detail the responsibilities accordingly.

- Include Voting Rights: Establish how decisions will be made and what voting rights each member holds.

- Address Profit and Loss Distribution: Clearly state how profits and losses will be allocated among members.

- Set Guidelines for Meetings: Specify how often meetings will occur and the procedures for calling and conducting them.

- Plan for Changes: Include provisions for adding new members, transferring ownership, or handling member departures.

- Comply with State Laws: Ensure that the agreement adheres to Michigan laws and regulations governing LLCs.

- Consult Legal Advice: It is wise to seek professional guidance to ensure that the agreement meets your specific needs.

Filling out the Michigan Operating Agreement form carefully can help set a solid foundation for your LLC. Taking the time to understand and complete this document properly will benefit all members involved.

Guide to Writing Michigan Operating Agreement

Once you have your Michigan Operating Agreement form ready, it's time to fill it out carefully. This document is crucial for outlining the structure and rules of your business. Make sure you have all the necessary information on hand before you begin. Here’s how to complete the form step by step.

- Title the Document: At the top of the form, clearly write "Operating Agreement" to indicate the purpose of the document.

- Company Name: Fill in the official name of your LLC as registered with the state of Michigan.

- Principal Office Address: Provide the complete address of your LLC's main office. This should include the street address, city, state, and zip code.

- Formation Date: Enter the date your LLC was formed. This is usually found in your Articles of Organization.

- Members: List the names and addresses of all members involved in the LLC. Include each member's percentage of ownership.

- Management Structure: Indicate whether your LLC will be member-managed or manager-managed. Provide details accordingly.

- Voting Rights: Specify the voting rights of each member. This may include how decisions are made and what constitutes a quorum.

- Profit and Loss Distribution: Describe how profits and losses will be allocated among the members.

- Amendments: Outline the procedure for making changes to the Operating Agreement in the future.

- Signatures: Ensure all members sign and date the document. This confirms their agreement to the terms outlined.

After completing the form, review it for accuracy. It's essential that all information is correct and clearly stated. Once finalized, keep a copy for your records and consider filing it with your state if necessary.

Discover Popular Operating Agreement Templates for Specific States

Operating Agreement Illinois - It may outline how tax responsibilities are handled among members.

Nc Operating Agreement Template - The agreement can specify how profits and losses are shared among members.

When transferring ownership of a vehicle, it is vital to complete the Texas Motor Vehicle Bill of Sale, which not only provides essential details regarding the transaction but also serves as a safeguard for both the buyer and seller. For those interested in accessing this important document, it can be found at https://toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/texas-motor-vehicle-bill-of-sale.

How to Write an Operating Agreement - An Operating Agreement can prevent disputes by establishing clear guidelines.

Operating Agreement Llc Ohio Template - Members can outline their goals and visions for the LLC within this formal agreement.

Form Preview Example

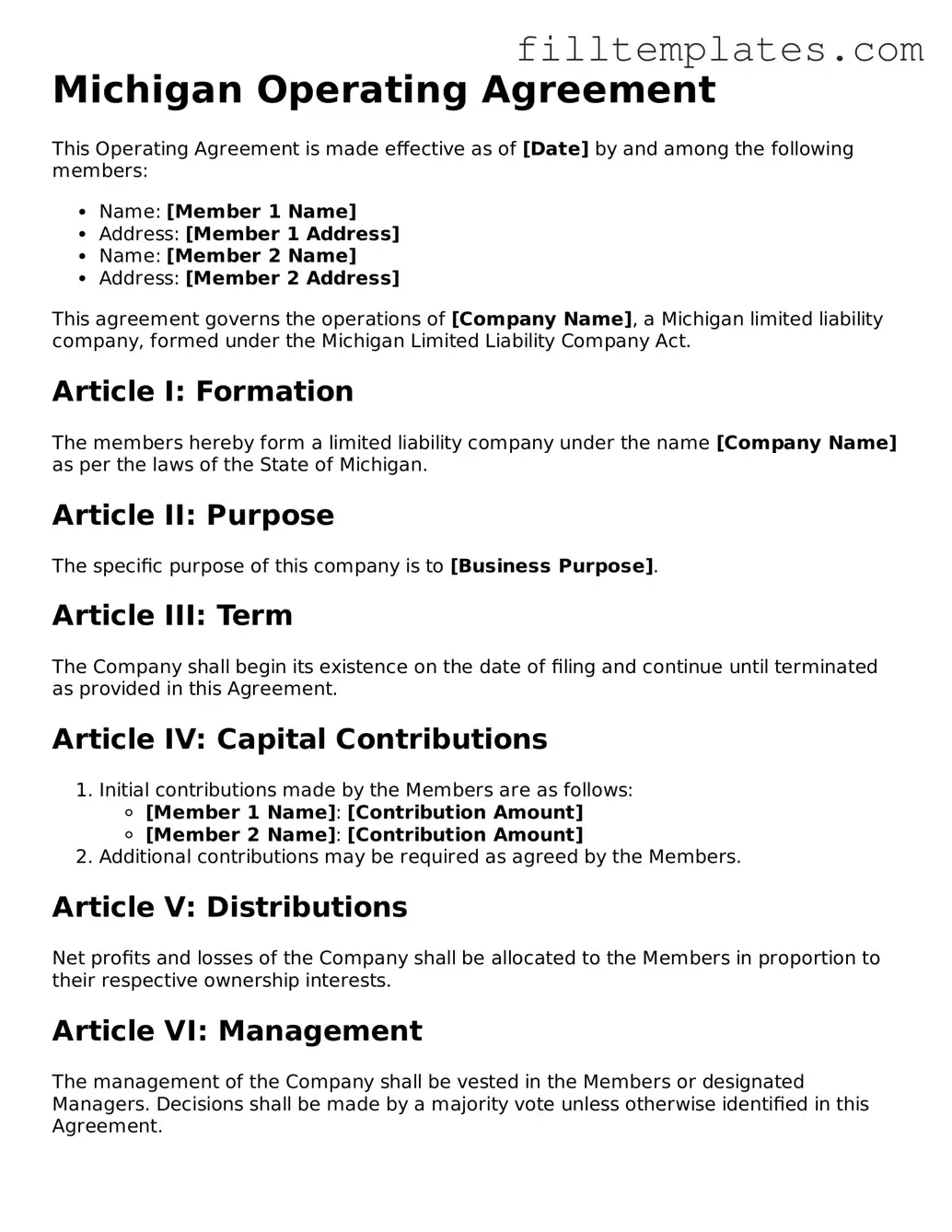

Michigan Operating Agreement

This Operating Agreement is made effective as of [Date] by and among the following members:

- Name: [Member 1 Name]

- Address: [Member 1 Address]

- Name: [Member 2 Name]

- Address: [Member 2 Address]

This agreement governs the operations of [Company Name], a Michigan limited liability company, formed under the Michigan Limited Liability Company Act.

Article I: Formation

The members hereby form a limited liability company under the name [Company Name] as per the laws of the State of Michigan.

Article II: Purpose

The specific purpose of this company is to [Business Purpose].

Article III: Term

The Company shall begin its existence on the date of filing and continue until terminated as provided in this Agreement.

Article IV: Capital Contributions

- Initial contributions made by the Members are as follows:

- [Member 1 Name]: [Contribution Amount]

- [Member 2 Name]: [Contribution Amount]

- Additional contributions may be required as agreed by the Members.

Article V: Distributions

Net profits and losses of the Company shall be allocated to the Members in proportion to their respective ownership interests.

Article VI: Management

The management of the Company shall be vested in the Members or designated Managers. Decisions shall be made by a majority vote unless otherwise identified in this Agreement.

Article VII: Records

The Company will maintain complete and accurate records of all financial and operational activity, located at [Company Address].

Article VIII: Amendment

This Operating Agreement may be amended only by a written agreement signed by all Members.

Signatures

Each Member agrees to the terms of this Operating Agreement as evidenced by their signatures below:

- [Member 1 Name] _____________________ Date: [Date]

- [Member 2 Name] _____________________ Date: [Date]

Documents used along the form

The Michigan Operating Agreement is an essential document for any limited liability company (LLC) formed in the state of Michigan. Alongside this agreement, several other forms and documents are often utilized to ensure the smooth operation and compliance of the LLC. Below is a list of commonly used documents that complement the Michigan Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the LLC's name, address, and registered agent.

- Bylaws: While not required for LLCs, bylaws outline the rules for managing the company. They cover the roles of members and managers, meeting procedures, and voting rights.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company.

- Operating Procedures: This document details the day-to-day operational processes of the LLC. It can include guidelines for decision-making, employee responsibilities, and service delivery.

- Meeting Minutes: Keeping accurate records of meetings is crucial. Meeting minutes document discussions and decisions made during member or manager meetings.

- Annual Reports: Michigan requires LLCs to file annual reports to maintain good standing. This document updates the state on the LLC’s business status and addresses.

- Tax Identification Number (EIN): This number is essential for tax purposes. Obtaining an EIN from the IRS allows the LLC to open bank accounts and hire employees.

- Member Agreements: These agreements can specify the terms of membership, including capital contributions, profit distribution, and exit strategies for members.

- Non-Disclosure Agreements (NDAs): When sensitive information is shared, NDAs protect the interests of the LLC by ensuring confidentiality among members and employees.

- Texas Motor Vehicle Power of Attorney: This legal document is vital for allowing another person to manage vehicle ownership and registration tasks when the owner is unavailable. For more information, visit smarttemplates.net.

- Buy-Sell Agreement: This document outlines the procedures for buying and selling ownership interests in the LLC. It is essential for managing changes in membership and protecting the interests of remaining members.

Utilizing these documents in conjunction with the Michigan Operating Agreement helps establish a strong foundation for your LLC. Ensuring that all necessary paperwork is in order can lead to smoother operations and better compliance with state regulations.