Official Power of Attorney Template for the State of Michigan

The Michigan Power of Attorney form serves as a crucial legal document that empowers individuals to designate another person to act on their behalf in various matters, including financial, medical, and legal decisions. This form is particularly significant for individuals who may face situations where they are unable to make decisions due to illness, injury, or incapacity. In Michigan, the form can be tailored to meet specific needs, allowing the principal—the person granting the authority—to specify the powers granted to the agent, or attorney-in-fact. It is essential to understand that the Michigan Power of Attorney can be either durable, remaining effective even if the principal becomes incapacitated, or non-durable, which becomes void upon the principal's incapacity. Furthermore, the form requires careful consideration of the agent's responsibilities and the principal's wishes, ensuring that the appointed individual is trustworthy and capable of managing the designated tasks. Additionally, the completion and execution of this form must adhere to Michigan’s legal requirements, including signatures and, in some cases, notarization, to ensure its validity and enforceability. Understanding these components is vital for anyone considering the use of a Power of Attorney in Michigan, as it can provide peace of mind and a clear plan for future decision-making.

Key takeaways

Filling out and using a Michigan Power of Attorney form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways to guide you:

- Understand the Purpose: A Power of Attorney allows you to designate someone to make decisions on your behalf, particularly in financial or medical matters.

- Choose the Right Agent: Select someone you trust completely. This person will have significant authority over your affairs.

- Specify the Powers: Clearly outline what powers you are granting. This can include managing finances, making healthcare decisions, or both.

- Consider Durability: A durable Power of Attorney remains effective even if you become incapacitated. This is often the preferred option.

- Sign and Date: Ensure that you sign and date the document in the presence of a notary public. This step is crucial for its validity.

- Keep Copies: After executing the document, make several copies. Share them with your agent, healthcare providers, and financial institutions as necessary.

- Review Regularly: Life circumstances change. Regularly review and update your Power of Attorney to reflect your current wishes and relationships.

Guide to Writing Michigan Power of Attorney

Filling out the Michigan Power of Attorney form is an important step in designating someone to act on your behalf. After completing the form, you will need to sign it in front of a notary public or witnesses, depending on the requirements. This ensures that the document is valid and recognized by the state.

- Obtain the Michigan Power of Attorney form. You can find it online or at a legal office.

- Begin by filling in your name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. Make sure this person is trustworthy.

- Specify the powers you want to grant to your agent. You can choose general powers or limit them to specific tasks.

- Indicate when the Power of Attorney becomes effective. You can set it to start immediately or at a later date.

- Sign and date the form. This shows your agreement and intention to grant authority to your agent.

- Have the document notarized or signed by two witnesses, as required by Michigan law.

- Keep a copy of the completed form for your records. Provide a copy to your agent and any relevant institutions.

Discover Popular Power of Attorney Templates for Specific States

Ohio Power of Attorney Requirements - Understanding the scope of authority granted in the document is essential for all parties involved.

When completing the transfer of a vehicle, utilizing the Texas Motor Vehicle Bill of Sale form is essential to ensure all necessary details are clearly documented. This legal document not only captures the vital information about the transaction, including the date, price, and vehicle specifics, but it also serves as a safeguard for both the buyer and seller. For more information on this form, you can visit https://toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/texas-motor-vehicle-bill-of-sale.

How to Get Power of Attorney for Elderly Parent in Georgia - Your Power of Attorney can help facilitate timely access to your funds.

How to Get Power of Attorney in Nc - Using a Power of Attorney can help avoid delays in care or financial transactions.

Illinois Power of Attorney Form - It's important to choose an agent who is reliable and capable of making decisions on your behalf.

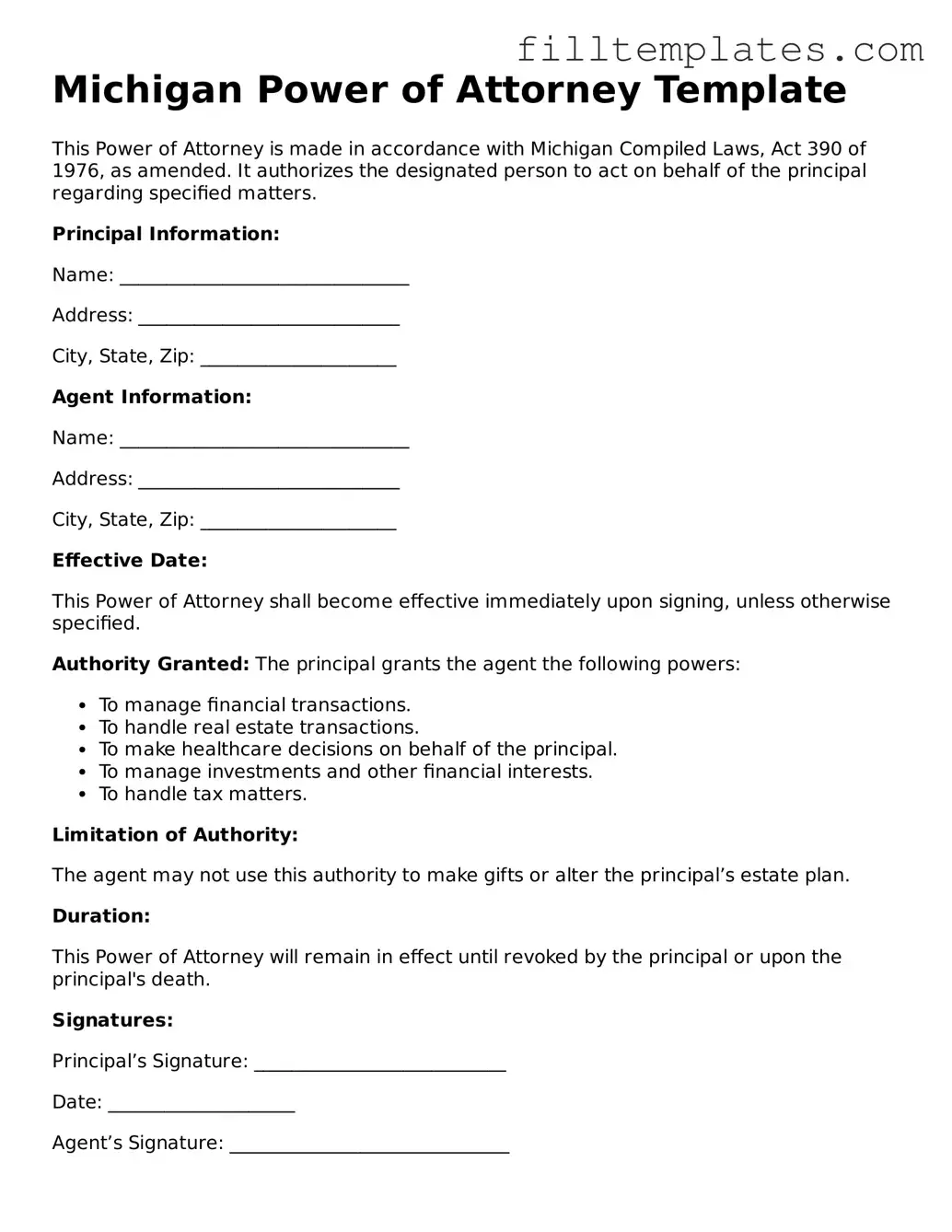

Form Preview Example

Michigan Power of Attorney Template

This Power of Attorney is made in accordance with Michigan Compiled Laws, Act 390 of 1976, as amended. It authorizes the designated person to act on behalf of the principal regarding specified matters.

Principal Information:

Name: _______________________________

Address: ____________________________

City, State, Zip: _____________________

Agent Information:

Name: _______________________________

Address: ____________________________

City, State, Zip: _____________________

Effective Date:

This Power of Attorney shall become effective immediately upon signing, unless otherwise specified.

Authority Granted: The principal grants the agent the following powers:

- To manage financial transactions.

- To handle real estate transactions.

- To make healthcare decisions on behalf of the principal.

- To manage investments and other financial interests.

- To handle tax matters.

Limitation of Authority:

The agent may not use this authority to make gifts or alter the principal’s estate plan.

Duration:

This Power of Attorney will remain in effect until revoked by the principal or upon the principal's death.

Signatures:

Principal’s Signature: ___________________________

Date: ____________________

Agent’s Signature: ______________________________

Date: ____________________

Witness:

Witness Signature: _____________________________

Date: ____________________

Notary Public:

State of Michigan

County of ____________________

Subscribed and sworn before me this ___ day of __________, 20__.

Notary Public Signature: ______________________

My commission expires: _______________

Documents used along the form

When establishing a Power of Attorney (POA) in Michigan, several other forms and documents may be necessary to ensure that all legal and financial matters are properly addressed. These documents complement the POA by providing clarity and additional authority where needed. Below is a list of commonly used forms that often accompany the Michigan Power of Attorney.

- Durable Power of Attorney: This document allows an individual to designate someone to make decisions on their behalf, even if they become incapacitated. It remains effective until revoked or the principal passes away.

- Medical Power of Attorney: Also known as a healthcare proxy, this form allows an individual to appoint someone to make medical decisions for them if they are unable to do so themselves.

- Motor Vehicle Power of Attorney: This form grants another person the authority to manage vehicle ownership and registration issues on behalf of the owner, especially useful when the owner is unavailable. For more information, visit smarttemplates.net.

- Advance Directive: This document outlines a person's wishes regarding medical treatment and end-of-life care. It works in conjunction with the Medical Power of Attorney to guide healthcare decisions.

- Living Will: A living will specifies the types of medical treatment an individual does or does not want in case they become terminally ill or incapacitated.

- HIPAA Release Form: This form grants permission for healthcare providers to share an individual’s medical information with designated persons, ensuring that the appointed agent can make informed decisions.

- Financial Power of Attorney: Similar to the general POA, this document specifically focuses on financial matters, allowing the agent to manage financial affairs, pay bills, and handle investments.

- Trust Documents: If a trust is established, these documents outline how assets are to be managed and distributed, often working alongside the POA to ensure a seamless transition of asset management.

- Will: A will outlines how an individual’s assets should be distributed after their death. It can be important to have this document in place alongside a POA for comprehensive estate planning.

- Property Deed: If real estate is involved, a property deed may be necessary to transfer ownership or manage property on behalf of the principal.

Having these documents prepared and organized can help ensure that your wishes are respected and that your affairs are managed according to your preferences. It’s always a good idea to consult with a legal professional to ensure that all necessary forms are completed correctly and align with your overall estate planning strategy.