Official Promissory Note Template for the State of Michigan

In the realm of financial agreements, a promissory note serves as a critical document that outlines the terms of a loan between a borrower and a lender. In Michigan, this form encapsulates essential details such as the principal amount borrowed, the interest rate applicable, and the repayment schedule. It is designed to protect the rights of both parties involved, ensuring clarity and accountability throughout the lending process. Additionally, the Michigan Promissory Note includes provisions for late fees, default consequences, and any collateral that may be involved in the transaction. Understanding the nuances of this form is vital for anyone engaging in a loan agreement, as it not only formalizes the commitment but also serves as a legal record should disputes arise. By adhering to the guidelines set forth in this document, both borrowers and lenders can navigate their financial obligations with confidence and security.

Key takeaways

When filling out and using the Michigan Promissory Note form, it is essential to understand several key aspects to ensure clarity and legality. Here are some important takeaways:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This information is crucial for establishing who is involved in the agreement.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This ensures both parties have a mutual understanding of the financial obligation.

- Outline the Interest Rate: If applicable, include the interest rate associated with the loan. This should be stated as an annual percentage rate (APR) to avoid confusion.

- Define Payment Terms: Clearly outline how and when payments will be made. Include due dates, the frequency of payments, and acceptable payment methods.

- Include Default Terms: Specify what constitutes a default on the loan and the consequences that follow. This can help protect the lender’s interests.

- Signatures Required: Both the borrower and lender must sign the document. This signifies that both parties agree to the terms laid out in the note.

- Consider Notarization: While not always required, having the document notarized can provide an extra layer of authenticity and may help in case of disputes.

- Keep Copies: Each party should retain a copy of the signed Promissory Note. This ensures that both sides have access to the agreement for future reference.

By following these guidelines, individuals can create a clear and effective Promissory Note that serves both parties well.

Guide to Writing Michigan Promissory Note

Once you have the Michigan Promissory Note form in front of you, it’s time to begin the process of filling it out. This document is essential for establishing the terms of a loan agreement between a borrower and a lender. Careful attention to detail is crucial to ensure that all necessary information is accurately recorded. Follow the steps below to complete the form correctly.

- Begin by entering the date at the top of the form. This should reflect the date when the agreement is being made.

- Next, provide the full name and address of the borrower. This information is critical as it identifies who is responsible for repaying the loan.

- Then, fill in the lender's full name and address. Just like with the borrower, this identifies who is providing the loan.

- Specify the principal amount of the loan. This is the total amount that the borrower is agreeing to repay.

- Indicate the interest rate. If applicable, be clear whether this is a fixed or variable rate.

- Outline the repayment terms. Include details such as the frequency of payments (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties that will apply if payments are missed.

- State whether the loan is secured or unsecured. If secured, provide details about the collateral involved.

- Both parties should sign and date the form. This signifies that both the borrower and the lender agree to the terms laid out in the document.

- Finally, make copies of the signed document for both parties. This ensures that everyone has a record of the agreement.

Discover Popular Promissory Note Templates for Specific States

Promissory Note Georgia - Interest rates on the note can be fixed or variable, depending on the agreement.

Promissory Note Friendly Loan Agreement Format - It can help build trust by documenting the terms of the loan arrangement.

Utilizing the Texas Motor Vehicle Power of Attorney form can significantly simplify the process of managing vehicle ownership and registration, especially when the owner is unable to attend to these responsibilities personally. For those looking to fill out this important document, resources such as smarttemplates.net offer valuable assistance in creating and understanding the necessary steps involved.

Promissory Note Illinois - Both parties should review the note thoroughly before signing.

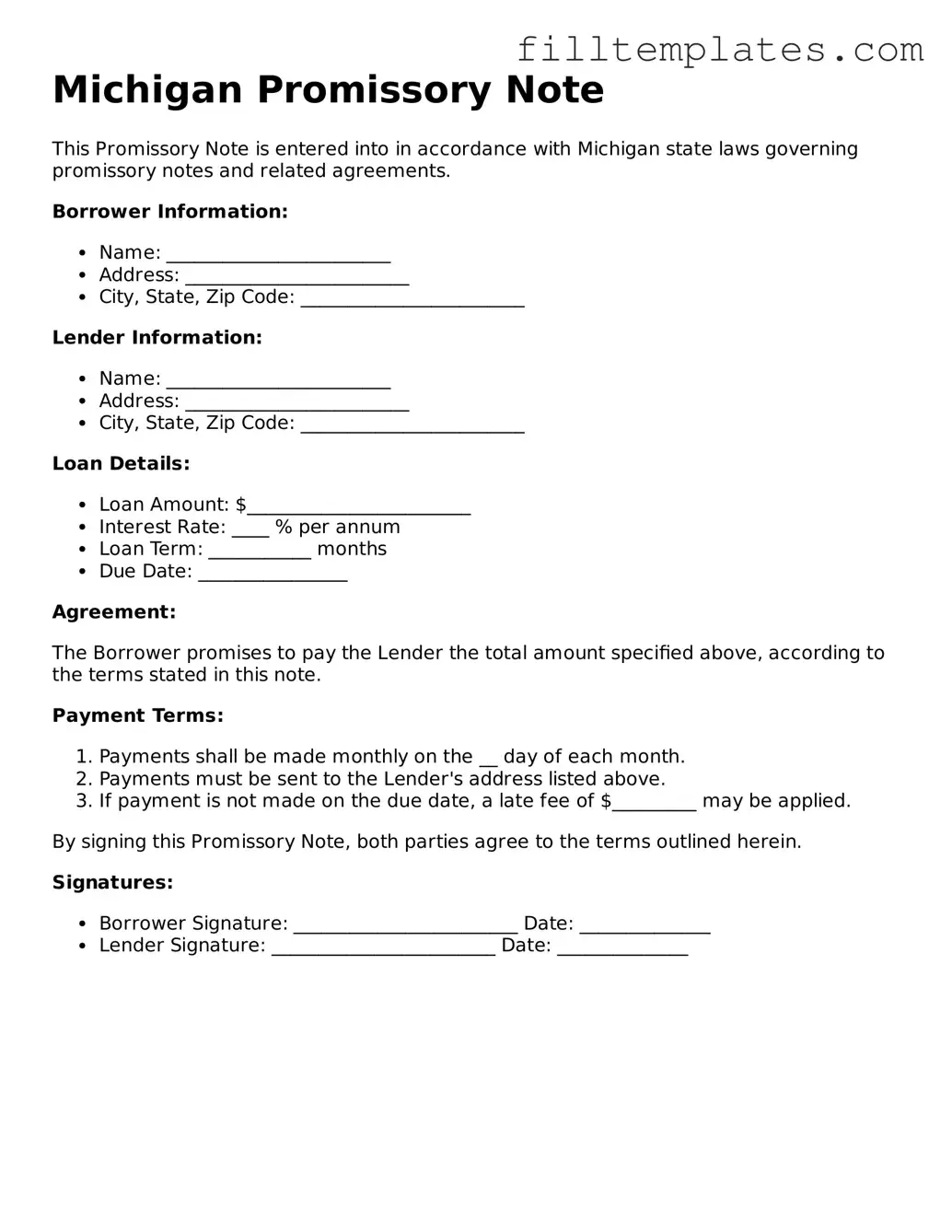

Form Preview Example

Michigan Promissory Note

This Promissory Note is entered into in accordance with Michigan state laws governing promissory notes and related agreements.

Borrower Information:

- Name: ________________________

- Address: ________________________

- City, State, Zip Code: ________________________

Lender Information:

- Name: ________________________

- Address: ________________________

- City, State, Zip Code: ________________________

Loan Details:

- Loan Amount: $________________________

- Interest Rate: ____ % per annum

- Loan Term: ___________ months

- Due Date: ________________

Agreement:

The Borrower promises to pay the Lender the total amount specified above, according to the terms stated in this note.

Payment Terms:

- Payments shall be made monthly on the __ day of each month.

- Payments must be sent to the Lender's address listed above.

- If payment is not made on the due date, a late fee of $_________ may be applied.

By signing this Promissory Note, both parties agree to the terms outlined herein.

Signatures:

- Borrower Signature: ________________________ Date: ______________

- Lender Signature: ________________________ Date: ______________

Documents used along the form

When dealing with a Michigan Promissory Note, several other forms and documents may be needed to ensure clarity and legal protection for all parties involved. Each of these documents serves a unique purpose and helps outline the terms of the agreement. Here’s a brief overview of some commonly used forms:

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved.

- Texas Motor Vehicle Bill of Sale: This document is essential for the transfer of ownership of a vehicle and includes vital details such as the transaction's date, price, terms, and the vehicle's identifying information. For more information, you can visit https://toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/texas-motor-vehicle-bill-of-sale.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets that are pledged to guarantee the loan.

- Guaranty Agreement: This form is used when a third party agrees to repay the loan if the borrower defaults. It provides additional security for the lender.

- Disclosure Statement: This document informs the borrower of all terms and conditions related to the loan, including fees and penalties, ensuring transparency.

- Payment Schedule: A detailed schedule that outlines when payments are due, the amount of each payment, and the total repayment period.

- Amendment Agreement: If changes need to be made to the original promissory note or loan terms, this document formally updates the agreement.

- Default Notice: This notice is sent to the borrower if they fail to meet the repayment terms, outlining the consequences and next steps.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations under the promissory note.

Having these documents prepared and understood can help protect both the lender and the borrower. Clear agreements lead to fewer misunderstandings and a smoother lending process.