Official Transfer-on-Death Deed Template for the State of Michigan

The Michigan Transfer-on-Death Deed form serves as a vital tool for property owners seeking to streamline the transfer of real estate upon their death, ensuring that their assets pass directly to designated beneficiaries without the need for probate. This form allows individuals to retain full control over their property during their lifetime, as it does not take effect until the owner’s death. By designating one or more beneficiaries, property owners can simplify the inheritance process, potentially reducing the emotional and financial burdens on their loved ones. Importantly, the Transfer-on-Death Deed can be revoked or modified at any time before the owner’s death, providing flexibility to adapt to changing circumstances. Understanding the specific requirements for completing and recording this deed is crucial, as improper execution could lead to unintended consequences. In Michigan, the form must be signed, dated, and recorded with the county register of deeds to ensure its validity. This article will explore the nuances of the Transfer-on-Death Deed, highlighting its advantages, limitations, and the steps necessary to implement it effectively.

Key takeaways

When filling out and using the Michigan Transfer-on-Death Deed form, consider the following key takeaways:

- Eligibility: Only individuals who own real estate in Michigan can use this form. Ensure that you meet this requirement before proceeding.

- Beneficiary Designation: Clearly name your beneficiaries on the form. This is crucial as it determines who will inherit the property upon your death.

- Signature Requirement: The deed must be signed by the property owner in the presence of a notary public. This step is essential for the deed to be legally valid.

- Filing the Deed: After completing the form, file it with the county register of deeds where the property is located. This ensures that the deed is officially recorded.

- Revocation: You can revoke the Transfer-on-Death Deed at any time before your death. To do this, you must file a revocation form with the county register of deeds.

Understanding these points can help ensure that the Transfer-on-Death Deed is filled out correctly and serves its intended purpose effectively.

Guide to Writing Michigan Transfer-on-Death Deed

After you have gathered the necessary information, you will be ready to complete the Michigan Transfer-on-Death Deed form. This form allows you to designate a beneficiary who will receive your property upon your passing. Follow these steps carefully to ensure that the form is filled out correctly.

- Begin by downloading the Michigan Transfer-on-Death Deed form from the official state website or obtaining a physical copy from a local office.

- At the top of the form, fill in your name and address as the current property owner.

- Next, provide a legal description of the property. This can usually be found on your property deed or tax documents.

- Indicate the name and address of the beneficiary you wish to designate. Make sure to include their full name and current address.

- Include a statement that specifies the property will transfer to the beneficiary upon your death.

- Sign the form in the designated area. Your signature must be notarized, so ensure you do this in front of a notary public.

- After notarization, make copies of the completed form for your records.

- Finally, file the original Transfer-on-Death Deed with the county register of deeds in the county where the property is located.

Once you have completed these steps, your Transfer-on-Death Deed will be officially recorded. It is important to keep a copy for your records and inform your beneficiary about the deed and its implications. This ensures clarity and helps avoid any confusion in the future.

Discover Popular Transfer-on-Death Deed Templates for Specific States

North Carolina Transfer on Death Deed - This transfer method can help reduce family disputes about property after death.

Ohio Transfer on Death Form - Implementing a Transfer-on-Death Deed can create a straightforward path for your loved ones when handling your estate.

Acquiring the necessary documentation is vital, and our guide to the essential components of a Dirt Bike Bill of Sale template will assist you in creating a legally sound transaction record.

Transfer on Death Deed Georgia Form - Utilizing a Transfer-on-Death Deed can provide peace of mind regarding the future of your property.

Illinois Transfer on Death Instrument - Property owners can ensure that their favorite beneficiaries receive specific pieces of real estate through this deed.

Form Preview Example

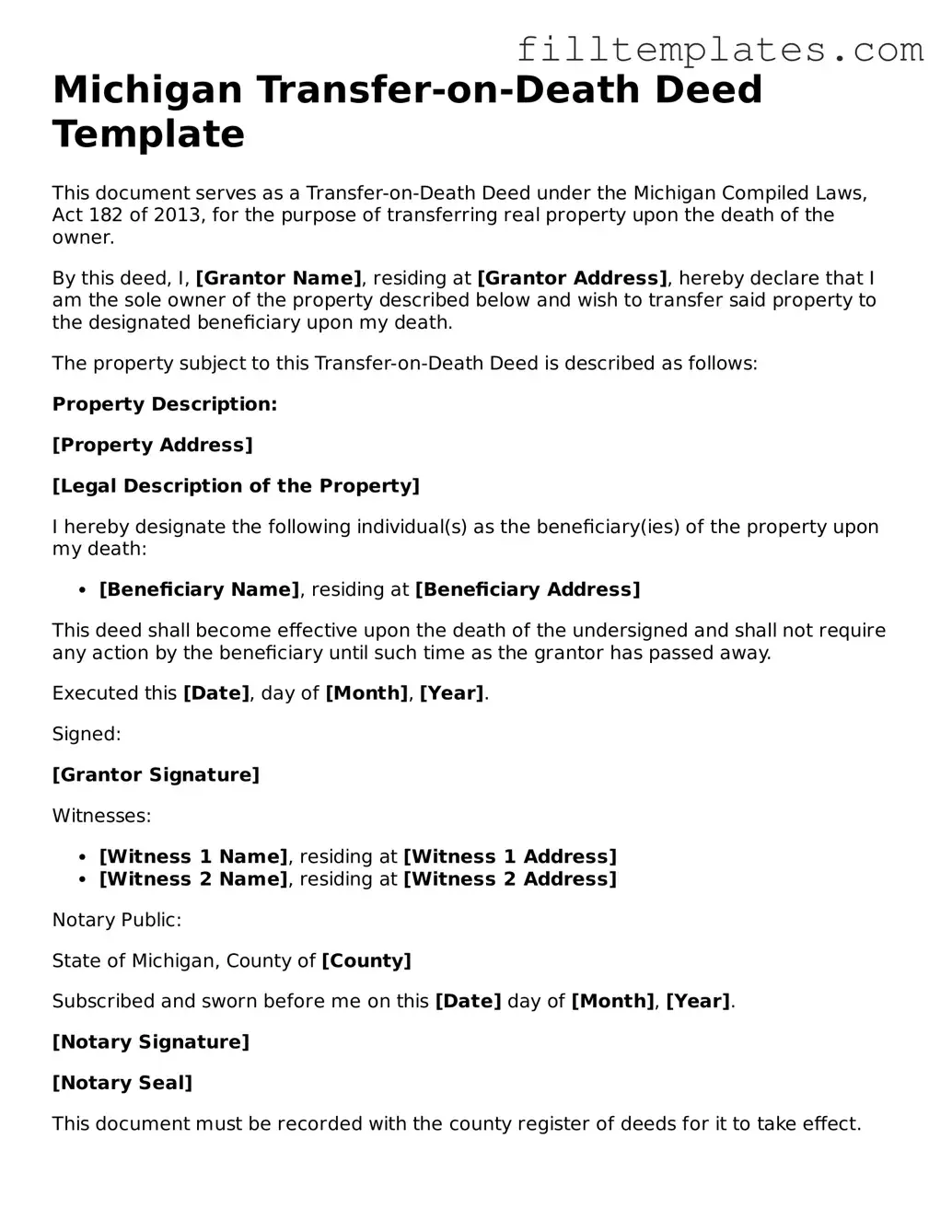

Michigan Transfer-on-Death Deed Template

This document serves as a Transfer-on-Death Deed under the Michigan Compiled Laws, Act 182 of 2013, for the purpose of transferring real property upon the death of the owner.

By this deed, I, [Grantor Name], residing at [Grantor Address], hereby declare that I am the sole owner of the property described below and wish to transfer said property to the designated beneficiary upon my death.

The property subject to this Transfer-on-Death Deed is described as follows:

Property Description:

[Property Address]

[Legal Description of the Property]

I hereby designate the following individual(s) as the beneficiary(ies) of the property upon my death:

- [Beneficiary Name], residing at [Beneficiary Address]

This deed shall become effective upon the death of the undersigned and shall not require any action by the beneficiary until such time as the grantor has passed away.

Executed this [Date], day of [Month], [Year].

Signed:

[Grantor Signature]

Witnesses:

- [Witness 1 Name], residing at [Witness 1 Address]

- [Witness 2 Name], residing at [Witness 2 Address]

Notary Public:

State of Michigan, County of [County]

Subscribed and sworn before me on this [Date] day of [Month], [Year].

[Notary Signature]

[Notary Seal]

This document must be recorded with the county register of deeds for it to take effect.

Documents used along the form

When considering a Michigan Transfer-on-Death Deed, it's essential to understand that this document often works in conjunction with several other forms and documents. These additional documents help ensure a smooth transition of property and clarify the intentions of the property owner. Below is a list of common forms that may accompany the Transfer-on-Death Deed.

- Property Deed: This is the primary document that establishes ownership of the property. It details who owns the property and may include information about the property's legal description.

- Will: A will outlines how a person's assets, including real estate, should be distributed upon their death. While a Transfer-on-Death Deed bypasses probate for the property it covers, a will can still address other assets and provide clarity on the deceased's wishes.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It can be particularly useful when the estate does not go through probate, as it helps clarify who inherits the property.

- Beneficiary Designation Form: This form is often used for financial accounts and life insurance policies. It designates who will receive the assets upon the account holder's death, similar to how a Transfer-on-Death Deed designates property heirs.

- Durable Power of Attorney: This document allows someone to make financial decisions on behalf of another person if they become incapacitated. It can be critical for managing property and financial matters before death.

- Living Trust: A living trust can hold property during a person's lifetime and specify how it should be distributed after death. This document can work in tandem with a Transfer-on-Death Deed to provide comprehensive estate planning.

- Notice of Death: This document may be filed with the local register of deeds to officially notify the public of a property owner's death, which can be important for legal clarity regarding property ownership.

- Tax Documents: These include property tax statements and any related forms that ensure all taxes are up to date. They are important for maintaining clear ownership and avoiding any tax-related issues for heirs.

- Disability Insurance Claim Form: To apply for financial support during health-related work absences, individuals must accurately complete the smarttemplates.net/fillable-edd-de-2501/ for Disability Insurance (DI) Benefits, which initiates their claim process.

- Release of Interest: If there are multiple owners of the property, this document may be necessary to relinquish ownership rights. It clarifies the intentions of co-owners and can help streamline the transfer process.

Understanding these documents can greatly assist in effective estate planning and ensure that property transfers occur smoothly after one's passing. Each form serves a unique purpose, contributing to a comprehensive approach to managing assets and fulfilling the property owner's wishes.