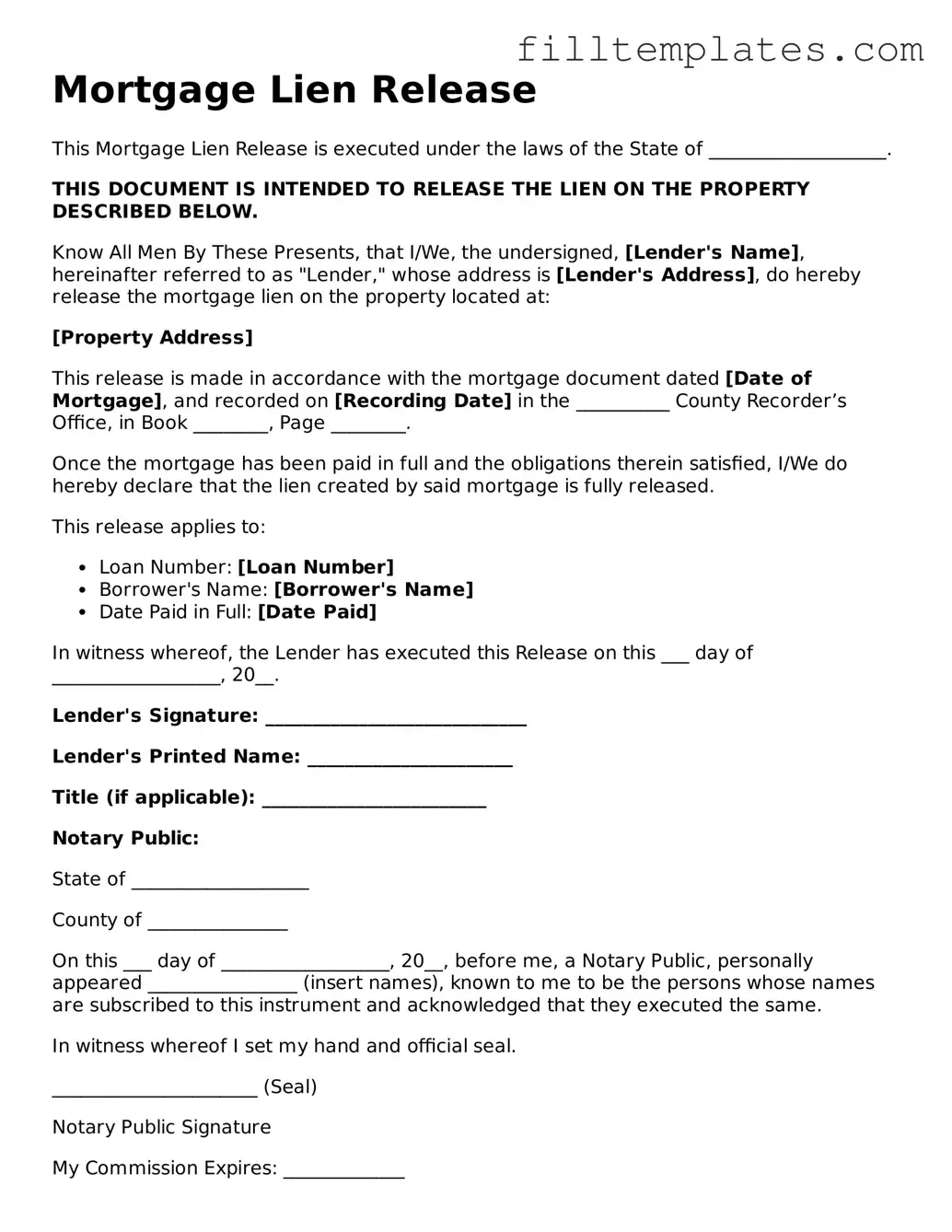

Mortgage Lien Release

This Mortgage Lien Release is executed under the laws of the State of ___________________.

THIS DOCUMENT IS INTENDED TO RELEASE THE LIEN ON THE PROPERTY DESCRIBED BELOW.

Know All Men By These Presents, that I/We, the undersigned, [Lender's Name], hereinafter referred to as "Lender," whose address is [Lender's Address], do hereby release the mortgage lien on the property located at:

[Property Address]

This release is made in accordance with the mortgage document dated [Date of Mortgage], and recorded on [Recording Date] in the __________ County Recorder’s Office, in Book ________, Page ________.

Once the mortgage has been paid in full and the obligations therein satisfied, I/We do hereby declare that the lien created by said mortgage is fully released.

This release applies to:

- Loan Number: [Loan Number]

- Borrower's Name: [Borrower's Name]

- Date Paid in Full: [Date Paid]

In witness whereof, the Lender has executed this Release on this ___ day of __________________, 20__.

Lender's Signature: ____________________________

Lender's Printed Name: ______________________

Title (if applicable): ________________________

Notary Public:

State of ___________________

County of _______________

On this ___ day of __________________, 20__, before me, a Notary Public, personally appeared ________________ (insert names), known to me to be the persons whose names are subscribed to this instrument and acknowledged that they executed the same.

In witness whereof I set my hand and official seal.

______________________ (Seal)

Notary Public Signature

My Commission Expires: _____________