Download Mortgage Statement Template

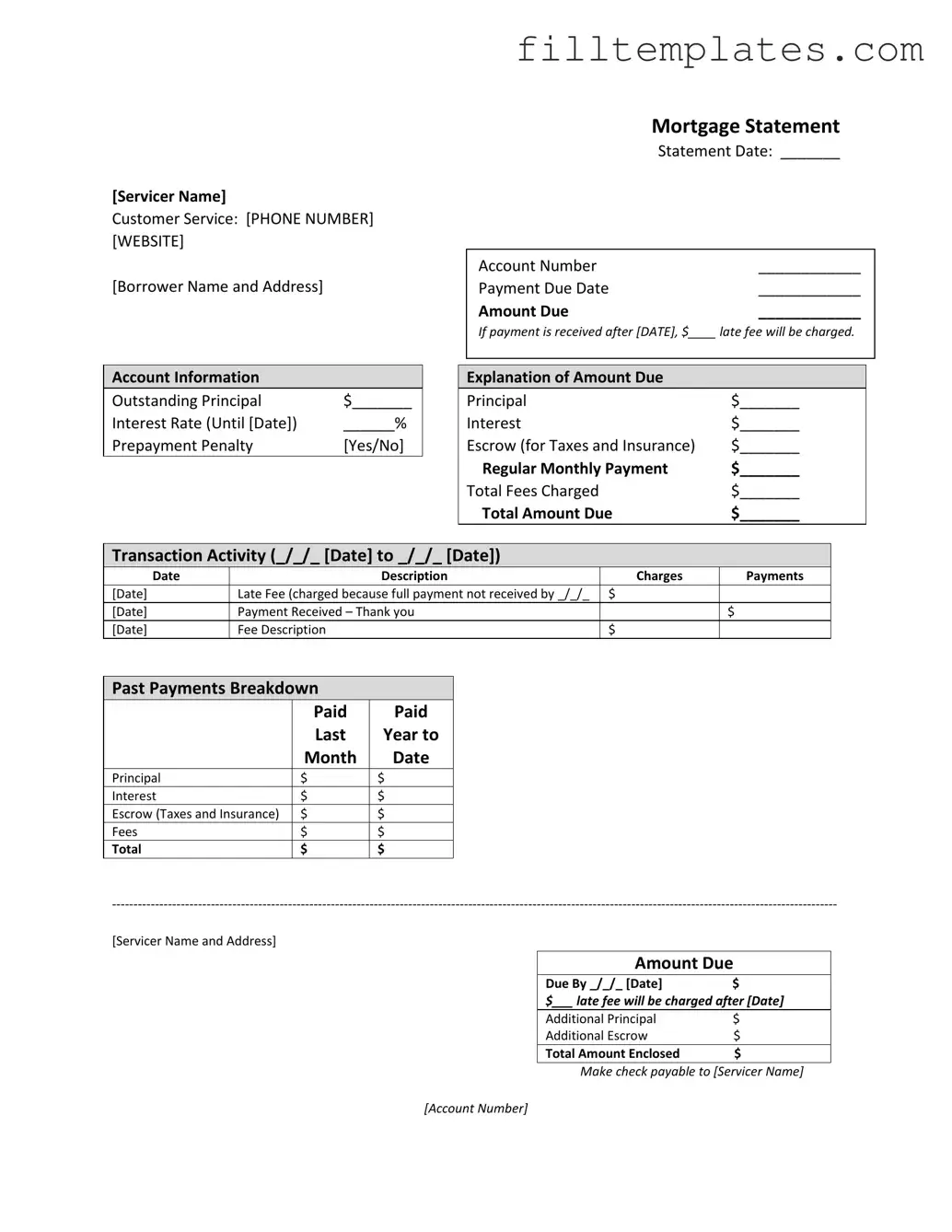

Understanding your mortgage statement is crucial for managing your home loan effectively. This important document provides a detailed overview of your mortgage account, including vital information such as the servicer's contact details, your account number, and the payment due date. You will find the amount due clearly outlined, along with any potential late fees that may apply if payment is not received on time. The statement breaks down your account information, detailing the outstanding principal, interest rate, and whether a prepayment penalty exists. Additionally, it explains the components of your total amount due, including principal, interest, and escrow for taxes and insurance. Transaction activity is also recorded, showing a history of charges and payments over a specific period. This can help you track your payment patterns and understand any late fees incurred. Furthermore, the statement may include important messages regarding partial payments and delinquency notices, which serve as reminders of your obligations and the potential consequences of late payments. If you're facing financial difficulties, the statement often directs you to resources for mortgage counseling or assistance, ensuring you have support during challenging times.

Key takeaways

When dealing with your Mortgage Statement form, understanding its components is crucial for managing your mortgage effectively. Here are some key takeaways to keep in mind:

- Account Information is Essential: The statement provides important details such as your outstanding principal, interest rate, and any prepayment penalties. This information helps you assess your financial obligations accurately.

- Payment Deadlines Matter: Pay attention to the payment due date. If your payment is received after this date, a late fee will be charged. Knowing these deadlines can help you avoid unnecessary fees.

- Review Transaction Activity: The transaction activity section outlines your payment history and any charges incurred. Regularly reviewing this can help you track your payments and identify any discrepancies.

- Understand Partial Payments: If you make a partial payment, it will not be applied to your mortgage immediately. Instead, it goes into a suspense account until the full payment is made. This can affect your overall payment status.

- Seek Help if Needed: If you find yourself struggling with payments, the statement often includes resources for mortgage counseling or assistance. Don’t hesitate to reach out for help if you're facing financial difficulties.

Guide to Writing Mortgage Statement

Filling out the Mortgage Statement form is essential for managing your mortgage account effectively. Follow these steps to complete the form accurately.

- Locate the Servicer Name and contact information at the top of the form.

- Fill in the Customer Service Phone Number and Website for easy reference.

- Enter your Borrower Name and Address in the designated fields.

- Input the Statement Date, Account Number, Payment Due Date, and Amount Due in the appropriate sections.

- Note the late fee information: write the Date after which a late fee will be charged and the amount of the fee.

- Provide your Outstanding Principal amount and Interest Rate (including the expiration date of the rate).

- Indicate whether there is a Prepayment Penalty by marking Yes or No.

- Break down the Amount Due into components: Principal, Interest, Escrow (for Taxes and Insurance), Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- Fill in the Transaction Activity section with relevant dates, descriptions, charges, and payments.

- Complete the Past Payments Breakdown by entering the amounts paid for Principal, Interest, Escrow, and Fees for the last year.

- Check the Amount Due and Due By Date at the bottom of the form, noting any late fees that apply.

- Write the Total Amount Enclosed if you are sending a payment, and ensure to make the check payable to the Servicer Name with your Account Number.

After completing the form, review all entries for accuracy. This will help ensure that your mortgage account remains in good standing and that you avoid any potential fees or issues.

Browse Other PDFs

USCIS Form I-864 - The form has specific guidelines around who qualifies as a sponsor.

In addition to serving as a legal record, the California Motorcycle Bill of Sale form can also be accessed online for convenience at toptemplates.info/bill-of-sale/motorcycle-bill-of-sale/california-motorcycle-bill-of-sale, making it easier for buyers and sellers to obtain the necessary documentation for their motorcycle transactions.

Coat of Arms Designs - An artistic expression conveying identity and lineage.

Form Preview Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Documents used along the form

When dealing with your mortgage, several important documents often accompany your Mortgage Statement. Understanding these forms can help you stay informed and organized. Here’s a list of essential documents you might encounter:

- Loan Agreement: This document outlines the terms of your mortgage, including the loan amount, interest rate, repayment schedule, and any fees. It serves as the foundational contract between you and your lender.

- Closing Disclosure: Provided before the closing of your mortgage, this form details the final terms and costs of your loan. It includes a breakdown of closing costs, which helps you understand what you are paying for.

- Property Deed: This legal document transfers ownership of the property from the seller to you. It is crucial for establishing your rights as the homeowner and is recorded with the county.

- Escrow Agreement: This outlines the terms under which your property taxes and insurance premiums are collected and paid. It helps ensure that these essential payments are made on time.

- Payment History Statement: This document provides a detailed account of your payment history, including dates, amounts paid, and any late fees incurred. It is vital for tracking your mortgage payments over time.

- Delinquency Notice: If you miss a payment, this notice informs you of your delinquent status and the potential consequences, such as late fees or foreclosure. It’s crucial to address this promptly.

- Employment Verification Form: Used to confirm the employment status of current or former employees, this form includes essential details such as job title, dates of employment, and salary information. It is important in processes like loan applications and background checks. For more information, visit OnlineLawDocs.com.

- Mortgage Release: Once your mortgage is paid off, this document confirms that the lender no longer has a claim on your property. It is essential for proving your ownership free of liens.

- Loan Modification Agreement: If you negotiate changes to your mortgage terms, this agreement outlines the new conditions. It’s important to keep this document on file for future reference.

Familiarizing yourself with these documents can empower you in managing your mortgage effectively. Always keep copies of your important paperwork organized and accessible to ensure you can act quickly when needed.