Official Operating Agreement Template for the State of North Carolina

In the vibrant landscape of North Carolina's business environment, the Operating Agreement form serves as a cornerstone for limited liability companies (LLCs). This essential document outlines the internal workings of an LLC, ensuring that all members are on the same page regarding management structure, profit distribution, and decision-making processes. By detailing the rights and responsibilities of each member, the Operating Agreement fosters transparency and helps prevent disputes that may arise in the course of business operations. It addresses crucial aspects such as voting procedures, the process for admitting new members, and the protocol for handling the departure of existing members. Additionally, this agreement can be tailored to fit the unique needs of the business, providing flexibility while still adhering to North Carolina's legal requirements. Understanding the significance of the Operating Agreement is vital for anyone looking to establish a solid foundation for their LLC, as it not only protects individual interests but also enhances the overall stability and credibility of the business.

Key takeaways

When filling out and using the North Carolina Operating Agreement form, consider the following key takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operating procedures of your LLC. It serves as a crucial internal document that governs member relationships.

- Member Information: Clearly list all members involved in the LLC. Include their names, addresses, and percentage of ownership to avoid confusion in the future.

- Management Structure: Specify whether the LLC will be member-managed or manager-managed. This decision affects how daily operations are handled and who has decision-making authority.

- Profit and Loss Distribution: Detail how profits and losses will be allocated among members. This should reflect each member's ownership percentage unless otherwise agreed upon.

- Amendment Procedures: Include a section that outlines how the Operating Agreement can be amended. This ensures that all members are aware of the process for making changes.

- Legal Compliance: Ensure that the agreement complies with North Carolina laws. It may be beneficial to consult with a legal professional to confirm that all necessary provisions are included.

By following these guidelines, you can create a comprehensive Operating Agreement that supports the successful management of your LLC in North Carolina.

Guide to Writing North Carolina Operating Agreement

Filling out the North Carolina Operating Agreement form is a straightforward process. This document will outline the structure and operational guidelines for your business. Ensure you have all necessary information at hand before you begin.

- Start with the title of the document. Clearly label it as "Operating Agreement."

- Fill in the name of your LLC. This should match the name registered with the state.

- Provide the principal office address. Include the street address, city, state, and zip code.

- List the names and addresses of all members. Include each member’s full name and corresponding address.

- Specify the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Outline the ownership percentages for each member. Clearly state how ownership is divided among the members.

- Include details on capital contributions. Note what each member is contributing to the LLC.

- Describe the profit and loss distribution. Specify how profits and losses will be shared among members.

- State the procedures for adding new members. Outline the steps required for bringing in additional members.

- Include provisions for member withdrawal or removal. Clearly define the process if a member decides to leave or needs to be removed.

- Provide a section for amendments. Explain how changes to the agreement can be made in the future.

- Finally, have all members sign and date the document. Ensure that each signature is accompanied by the printed name of the member.

Discover Popular Operating Agreement Templates for Specific States

Operating Agreement Llc Ohio Template - This document serves as a formal contract among the LLC members regarding the operation and governance of the business.

In order to complete the sale of a vehicle in Texas, using the Motor Vehicle Bill of Sale form is imperative, as it not only documents the transaction but also provides necessary legal backing for the transfer of ownership. This form ensures that both parties are on the same page and are protected in the event of any disputes. For those looking for a reliable source to obtain this document, they can find it at smarttemplates.net.

Michigan Llc Operating Agreement Template Free - It can outline the process for adding or removing members.

Operating Agreement Illinois - It helps delineate the authority of each member in the company.

Form Preview Example

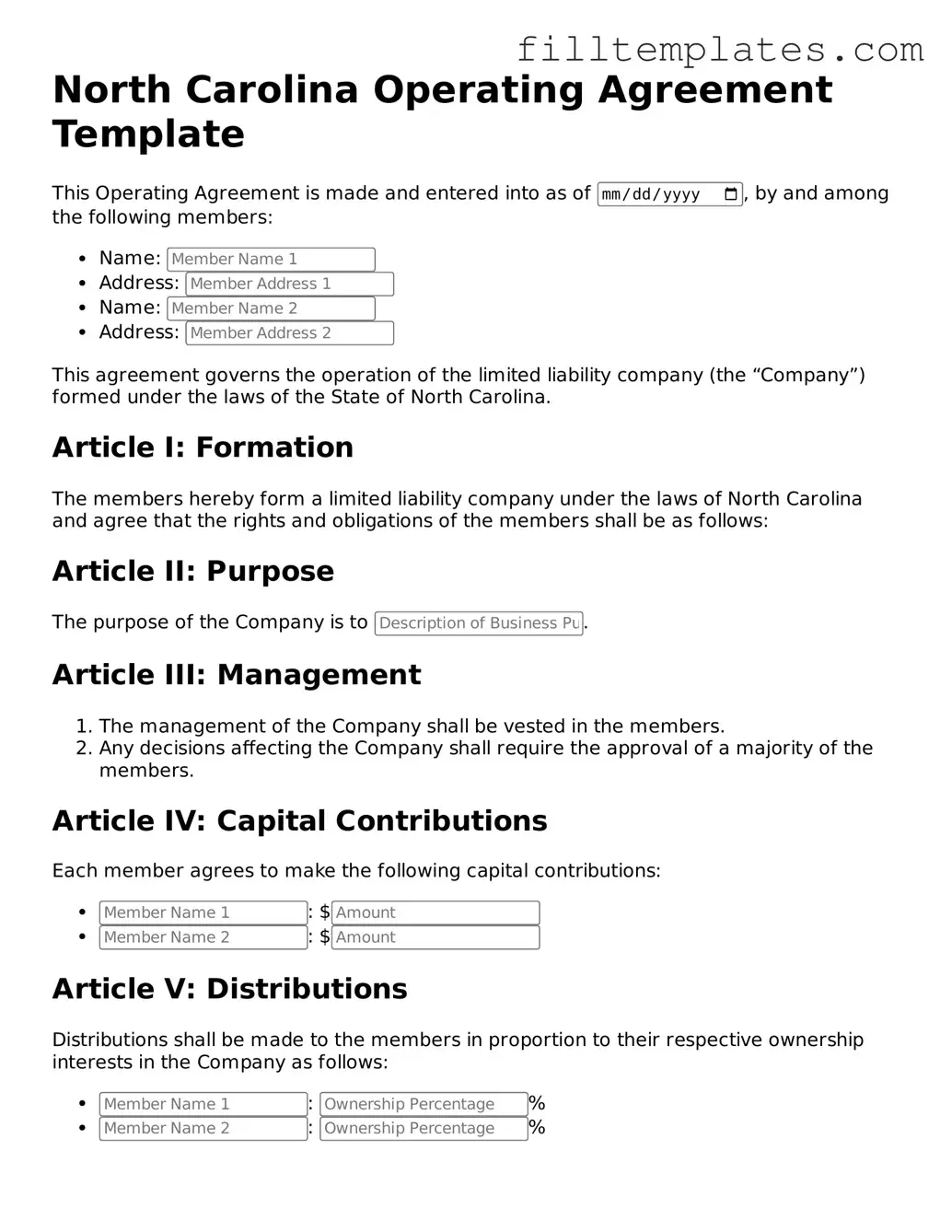

North Carolina Operating Agreement Template

This Operating Agreement is made and entered into as of , by and among the following members:

- Name:

- Address:

- Name:

- Address:

This agreement governs the operation of the limited liability company (the “Company”) formed under the laws of the State of North Carolina.

Article I: Formation

The members hereby form a limited liability company under the laws of North Carolina and agree that the rights and obligations of the members shall be as follows:

Article II: Purpose

The purpose of the Company is to .

Article III: Management

- The management of the Company shall be vested in the members.

- Any decisions affecting the Company shall require the approval of a majority of the members.

Article IV: Capital Contributions

Each member agrees to make the following capital contributions:

- : $

- : $

Article V: Distributions

Distributions shall be made to the members in proportion to their respective ownership interests in the Company as follows:

- : %

- : %

Article VI: Indemnification

The Company shall indemnify any member or former member to the fullest extent permitted by North Carolina law against any and all expenses and liabilities incurred.

Article VII: Amendments

This Operating Agreement may be amended only in writing and signed by all members.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the date first written above.

__________________________

__________________________

Documents used along the form

When forming a limited liability company (LLC) in North Carolina, it is essential to consider several documents that work in conjunction with the Operating Agreement. Each of these documents serves a specific purpose and helps ensure that the LLC operates smoothly and in compliance with state regulations. Below is a list of commonly used forms and documents that you may encounter during this process.

- Articles of Organization: This document is filed with the North Carolina Secretary of State to officially create the LLC. It includes basic information such as the LLC's name, address, and the names of its members.

- Bylaws: While not required for LLCs, bylaws can outline the internal rules and procedures for the organization. They may cover topics such as meetings, voting rights, and the roles of members and managers.

- Member Consent Forms: These forms document the agreement of members to certain decisions or actions taken by the LLC. They serve as a record of member approval and can be useful for maintaining transparency.

- Operating Procedures: This document can detail the day-to-day operations of the LLC, including how decisions are made, how profits are distributed, and the responsibilities of each member.

- Tax Forms: Depending on the nature of the LLC, specific tax forms may need to be filed with the IRS or state tax authorities. These forms help ensure compliance with tax obligations.

- Business Licenses and Permits: Depending on the type of business and its location, various licenses and permits may be required to operate legally. These documents help ensure that the business complies with local regulations.

- Mobile Home Bill of Sale: For those completing mobile home transactions, our essential Mobile Home Bill of Sale template provides a clear and legally binding documentation of ownership transfer.

- Membership Certificates: These certificates serve as proof of ownership for each member of the LLC. They can be issued to members to signify their stake in the company.

- Non-Disclosure Agreements (NDAs): If the LLC will be sharing sensitive information with employees, contractors, or partners, NDAs can protect that information from being disclosed without permission.

Each of these documents plays a vital role in the establishment and ongoing management of an LLC in North Carolina. Properly preparing and maintaining these forms can help protect the interests of the members and ensure that the business operates within the legal framework set by the state. It is always advisable to seek guidance when preparing these documents to ensure compliance and to address any specific needs of the LLC.